-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 1 Million Mean Estimate April Job Gain

EXECUTIVE SUMMARY

- MNI REALITY CHECK: A Million US Jobs Seen Added In April Surge

- MNI:US Employers Offer Hiring Bonuses to Combat Labor Shortage

- MNI BRIEF: Fed Warns Little Visibility On Hedge Fund Leverage

- MNI BRIEF: Fed's Bostic Predicts About 1 Million Jobs Print

US

US: U.S. job growth surged in April as widely available vaccines and stimulus money fueled business confidence, recruiters and industry experts told MNI, though a significant labor shortage threatens to slow the market's recovery.

- After months of practicing some caution in hiring, employers in April were "just optimistic," said Tom Gimbel, president and CEO of the LaSalle Network, with caution "out the window."

- "People are very bullish about the next 18 months," he added, driven by widespread vaccine availability for U.S. adults and stimulus from the government that has injected more certainty into the economy. For more see MNI Policy main wire at 1324ET

US: A labor shortage threatening to derail the job market recovery is driving employers to offer greater benefits like hiring bonuses to coax workers back to the market, industry experts told MNI.

- "There are some instances where employers are using signing bonuses as a way to get people in the door," said Nick Bunker, an economist at employment website Indeed, and using the one-time payments as a way to attract workers without having to raise wages altogether. That allows smaller firms that are less well-positioned to stay competitive for now. For more see MNI Policy main wire at 1601ET

"I'm just going to keep my head down," he said, adding that any number tomorrow short of 6 million jobs would not be enough. Bostic spoke to reporters after giving remarks at a Consumer Financial Protection Bureau research conference.

- The failure of Archegos Capital Management and the associated losses at big banks "illustrates the limited visibility into hedge fund exposures and serves as a reminder that available measures of hedge fund leverage may not be capturing important risks," Fed Governor Lael Brainard said in a statement. "The potential for material distress at hedge funds to affect broader financial conditions underscores the importance of more granular, higher-frequency disclosures." For more see MNI Policy main wire at 1604ET

- FED: SAYS ASSET PRICES MAY BE VULNERABLE IF RISK APPETITE FALLS, Bbg

- FED: SOME ASSET VALUATIONS HIGH BASED ON HISTORICAL STANDARDS, Bbg

- FED: BUSINESS DEBT REMAINS HIGH BUT ABILITY TO SERVICE IMPROVED, Bbg

- FED: HEDGE-FUND LEVERAGE SOMEWHAT ABOVE HISTORICAL AVERAGES, Bbg

OVERNIGHT DATA

US JOBLESS CLAIMS -92K TO 498K IN MAY 01 WK

US PREV JOBLESS CLAIMS REVISED TO 590K IN APR 24 WK

US CONTINUING CLAIMS +0.037M to 3.690M IN APR 24 WK

US Q1 PREL UNIT LABOR COSTS -0.3% VS Q4 +5.6%; Y/Y +1.6%

US Q1 PREL NONFARM PRODUCTIVITY +5.4% VS Q4 -3.8%; Y/Y +4.1%

U.S. WEEKLY LANGER CONSUMER COMFORT INDEX AT 54.4 VS 55.0

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 123.54 points (0.36%) at 34354.79

- S&P E-Mini Future up 4.75 points (0.11%) at 4164.25

- Nasdaq down 81.4 points (-0.6%) at 13500.94

- US 10-Yr yield is down 0.9 bps at 1.5572%

- US Jun 10Y are up 4.5/32 at 132-22

- EURUSD up 0.005 (0.42%) at 1.2055

- USDJPY down 0.16 (-0.15%) at 109.05

- WTI Crude Oil (front-month) down $0.81 (-1.23%) at $64.82

- Gold is up $26.77 (1.5%) at $1813.89

- EuroStoxx 50 down 3.35 points (-0.08%) at 3999.44

- FTSE 100 up 36.87 points (0.52%) at 7076.17

- German DAX up 25.96 points (0.17%) at 15196.74

- French CAC 40 up 17.62 points (0.28%) at 6357.09

US TSY SUMMARY: Exogenous Factors Upset Calm Ahead April Jobs Report

Choppy day for US FI rates, several exogenous events at play early in the session, while anticipation over whether Fri's April employment report will turn out to be a "monster" or not. First, the exogenous factors:- Pre-open chop after the BoE anncd steady rate, slowed the pace of QE but no tapering. Bonds surged to pre-open highs and quickly evaporated with futures gradually extended session lows by midmorning.

- Rates surged again on of all things .. headlines over fishing rights around Jersey Island with both UK and France briefly sending navy vessels to the region (much more to the story including Brexit differences, threats of cutting off power to the island etc).

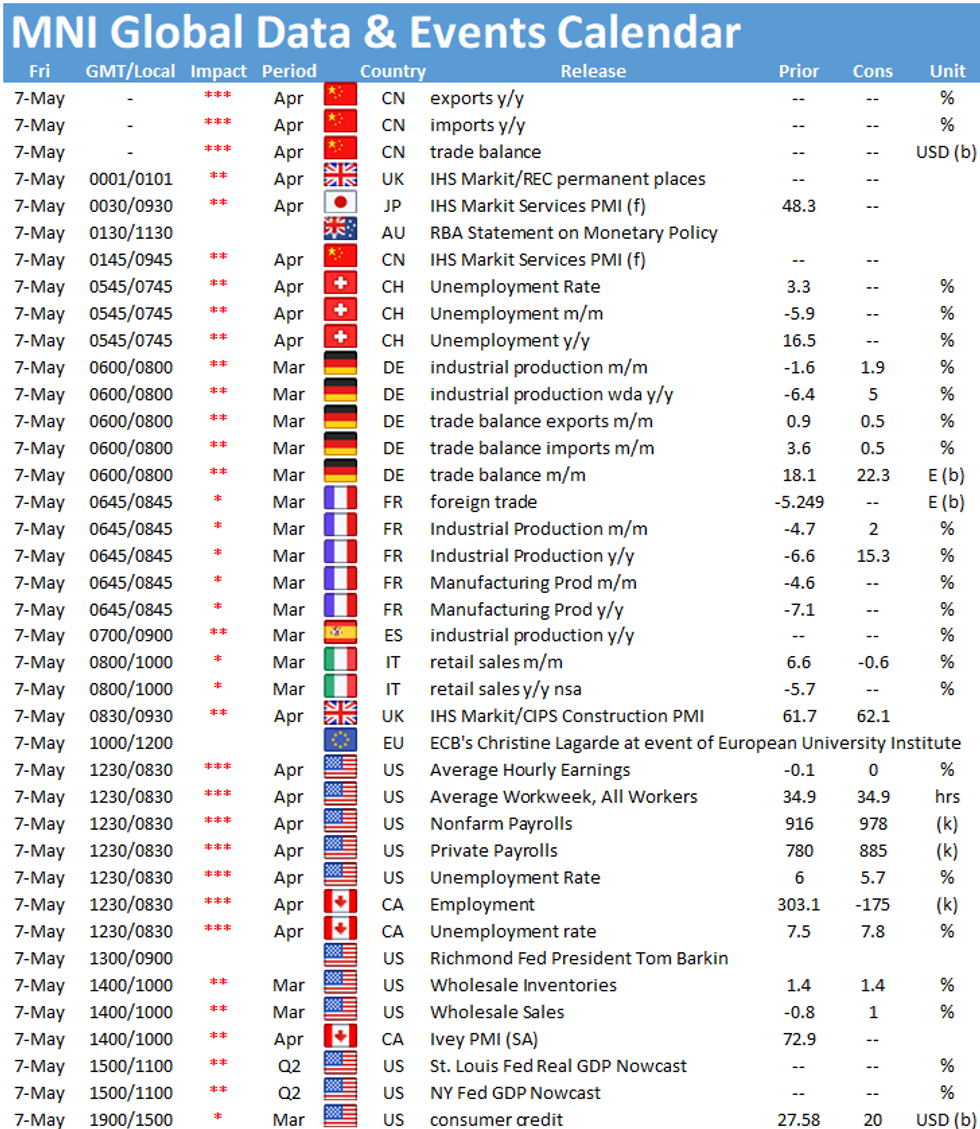

- Tsys see-sawed near top end of range as the Jersey dust-up settled and focus turned to Fri's employ data: mean estimate now +1.0M jobs (73 estimates from +700k low to +2.1M high. Atl Fed Bostic est's +1M job gains for April -- good, but not enough to get him to green-light tapering bond buying, unlike Dallas Fed Kaplan.

- Couple highlights in Eurodollars: lead quarterly EDM1 +0.010 to 99.83 after 3M LIBOR set's new all-time low: -0.00788 to 0.16200% (-0.01438/wk). Massive put position build: over +145,000 Blue Sep 80 puts 6-6.5 (if NOT a rate hike play, traders think paper hedging taper bets ahead Jackson Hole in August.

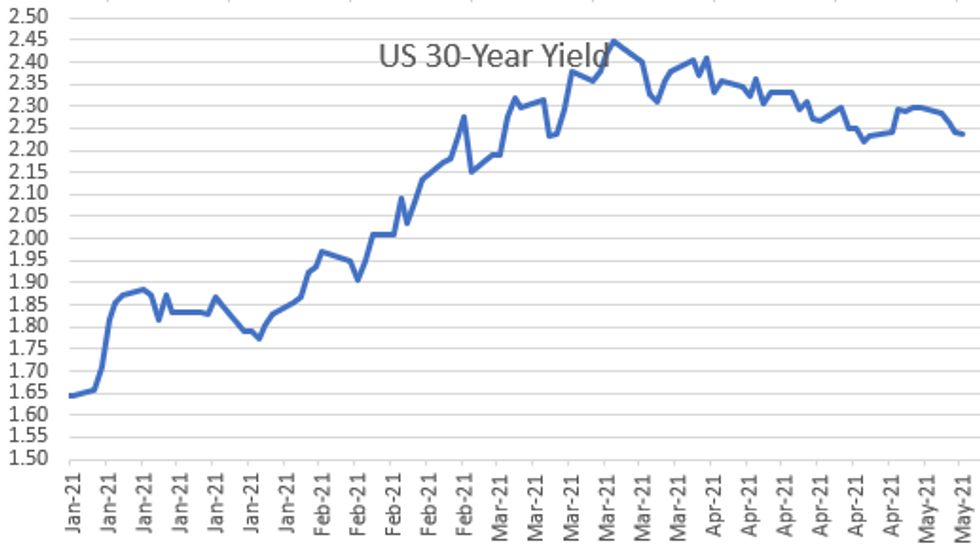

- The 2-Yr yield is up 0.4bps at 0.1546%, 5-Yr is up 0bps at 0.7933%, 10-Yr is down 0.9bps at 1.5572%, and 30-Yr is down 1.1bps at 2.2319%.

US TSY FUTURES CLOSE:

- 3M10Y -0.949, 154.38 (L: 153.95 / H: 157.389)

- 2Y10Y -1.094, 140.24 (L: 139.887 / H: 143.249)

- 2Y30Y -1.109, 207.877 (L: 207.452 / H: 211.378)

- 5Y30Y -1.07, 143.853 (L: 143.608 / H: 146.872)

- Current futures levels:

- Jun 2Y up 0.125/32 at 110-12.75 (L: 110-12.375 / H: 110-13)

- Jun 5Y up 1.5/32 at 124-8 (L: 124-06.25 / H: 124-09.75)

- Jun 10Y up 4.5/32 at 132-22 (L: 132-16.5 / H: 132-24)

- Jun 30Y up 16/32 at 158-20 (L: 157-29 / H: 158-23)

- Jun Ultra 30Y up 25/32 at 188-14 (L: 187-07 / H: 188-17)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.010 at 99.830 after 3 Month set' -0.00788 to 0.16200% (-0.01438/wk) ** (NEW Record Low)

- Sep 21 +0.010 at 99.820

- Dec 21 +0.005 at 99.760

- Mar 22 +0.005 at 99.785

- Red Pack (Jun 22-Mar 23) +0.005 to +0.010

- Green Pack (Jun 23-Mar 24) steady

- Blue Pack (Jun 24-Mar 25) +0.005 to +0.015

- Gold Pack (Jun 25-Mar 26) +0.020 to +0.025

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00363 at 0.06425% (-0.00700/wk)

- 1 Month -0.01050 to 0.09513% (-0.01212/wk)

- 3 Month -0.00788 to 0.16200% (-0.01438/wk) ** (NEW Record Low)

- 6 Month -0.00050 to 0.20013% (-0.00475/wk)

- 1 Year -0.00550 to 0.27350% (-0.00763/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $73B

- Daily Overnight Bank Funding Rate: 0.05% volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.01%, $841B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $343B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.677B submission

- Next week's schedule

- Mon 5/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 5/11 1010-1030ET: TIPS 1-7.5Y, appr $2.425B

- Wed 5/12 1500ET Update NY Fed Operational Purchase Schedule

PIPELINE: $1.25B NatWest Markets Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/06 $1.5B *EIB 10Y +10

- 05/06 $1.25B #NatWest Markets $950M 3Y +55, $300M 3Y FRN SOFR+53

- 05/06 $1B Banco Santander Perp NC6 4.75%

- 05/06 $1B #Broadbridge Fncl 10Y +105

- 05/06 $800M *ENN Natural Gas 5NC3 +265

- 05/06 $800M #Weir Group 5Y +145

- 05/06 $700M *NIB 5Y FRN SOFR+19

- 05/06 $Benchmark ORBIA 5Y +115a, 10Y +150a

- 05/06 $Benchmark SVB Fncl 7Y +110a

FOREX: BOE Sparks Volatile Session For Cable, CAD firmer Once More

- Unchanged policy from the BOE sparked a very brief GBP selloff to 1.3858 amid outside expectations the MPC might look to trim purchases. As the dust settled Cable reversed and USD weakness prompted a sharp reversal to intraday highs of 1.3940, before retreating once again.

- USDCAD downtrend remains intact Thursday, with the pair hitting new cycle lows, breaking the January 2018 lows below 1.2250. This keeps the pair solidly in bear mode after recent weakness.

- MA studies also highlight a downside bias, reinforcing current trend conditions. 1.2239, a Fibonacci projection, gave way, opening vol band support at 1.2143. On the upside, initial resistance is at 1.2365/2419.

- Broad dollar indices weakened by around 0.35% in line with EURUSD firming back to 1.2050. Our analyst notes a bearish theme remains with key resistance being defined at 1.2150, Apr 29 high. A firm support is at 1.2013/1989, the 20 and 50-day EMAs. This zone has been probed, a breach would trigger a stronger sell-off.

- EMFX led gains on Thursday against the dollar with MXN, TRY, BRL and RUB all strengthening between 0.75-1.5%.

EGBs-GILTS CASH CLOSE: Price Swings Both Ways As Markets Digest BoE

Gilts swung in both directions following the BoE's decision to slow asset purchases while downplaying it as an active policy shift. After initially dropping sharply, Gilt yields rose to session highs, before eventually moving lower again later in the afternoon as equities bounced.

- EGBs saw a bit of selling interest in the afternoon (possibly ahead of Friday's U.S. payrolls data), but again, recovered later in the session.

- Notably BTP yields / spreads rose, with both Bloomberg and Reuters separately citing speculation from market sources over a potential new 30-Yr bond syndication (no confirmation as yet).

- German Mar factory orders beat expectations.

- Supply was from France (OATs, EUR10.4bn) and Spain (Bono/Oblis/ObliEi, EUR5.4bn).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.691%, 5-Yr is up 0.4bps at -0.599%, 10-Yr is up 0.3bps at -0.225%, and 30-Yr is up 1bps at 0.341%.

- UK: The 2-Yr yield is down 1.5bps at 0.039%, 5-Yr is down 2.5bps at 0.334%, 10-Yr is down 2.7bps at 0.792%, and 30-Yr is down 0.8bps at 1.318%.

- Italian BTP spread up 1.6bps at 114.2bps/ Spanish spread up 0.3bps at 68.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.