-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jobs Data Disappoints, Mkts Resilient

EXECUTIVE SUMMARY

- US Tsy Announces Additional $21.6B in Emergency Rental Assistance Allocation

- HOUSE REP. SPEAKER PELOSI: THE NEED TO PASS BIDEN'S AMERICAN JOBS AND FAMILIES PLANS IS HIGHLIGHTED BY THE DISAPPOINTING EMPLOYMENT RESULTS., Rtrs

- U.S. CHAMBER CALLS FOR ENDING $300 WEEKLY UNEMPLOYMENT SUPPL

- CNN: South Carolina and Montana to end all pandemic unemployment benefits for jobless residents

US TSY SUMMARY: April Jobs Surprise

Not your typical NFP jobs Friday: gap bid in Tsys after April employment report came out much weaker than expected with +266k job gains vs. +1 million mean estimate. Heavy volumes on two-way flow post-data (TYM1 appr 850k 20minutes after the release; 2.6m by the close), as futures scaled back appr half the move on lower than expected April jobs

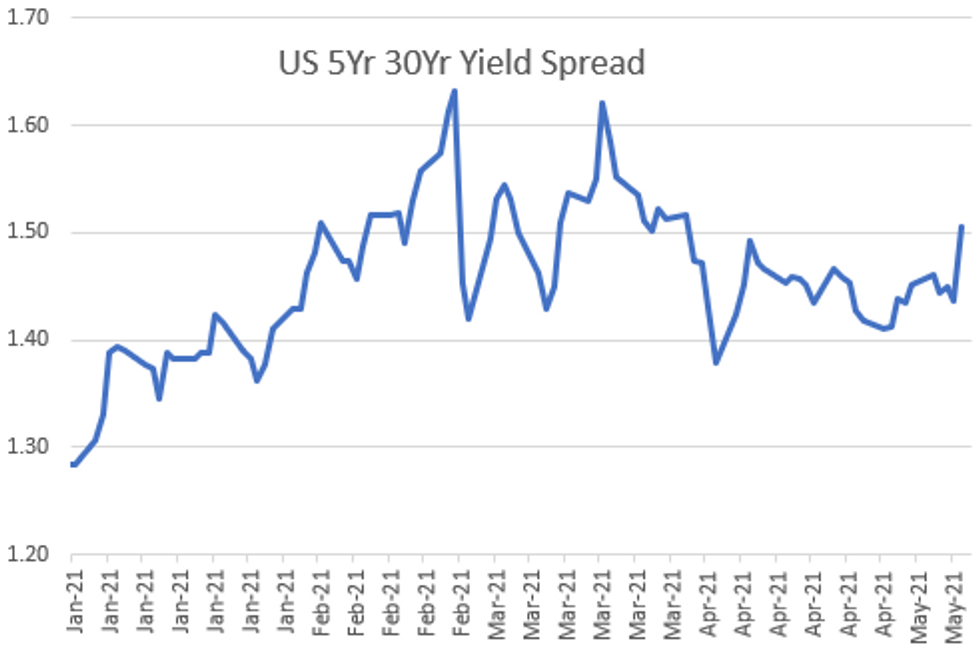

- April Jobs-Miss Debate: whether due to seasonal adjustments or employable people staying at home (either due to safety concerns or collecting very generous jobless benefits), some feel it's not the health of the recovery, but the pace that is being impeded by supply constraints. The Fed will continue to be very patient. That said, Tsy futures have reversed early gains, curves bending steeper with Bonds broadly weaker into midday (5s30s topped 150.8).

- Not a noticeable reaction in rates as Pres Biden discusses April jobs report and American Rescue Plan. Tsys continue to inch lower in long end 2s-10s paring gains. Bonds continue to trade weaker -- TYM1 nearly back to steady on day -- comments from Tsy Sec Yellen on jobs data notwithstanding.

- Note 10Y breakeven hits 2.4993% Highest since early April 2013 while equities made new all-time high of 4232.25. The 2-Yr yield is down 1bps at 0.1429%, 5-Yr is down 3.4bps at 0.7708%, 10-Yr is up 0.8bps at 1.5771%, and 30-Yr is up 3.4bps at 2.2761%.

US

DATA REACT: Jobs Data Assures No Taper Talk At June FOMC. With the +266k April nonfarm payrolls print, vs expectations of 1mn+, Fed Chair Powell's "string" of strong jobs reports ends with one (March)... And maybe not even that as March was revised down to +770k from +916k.

- This highly-anticipated but ultimately extremely disappointing report all but assures there will be no taper discussion at the June FOMC; we'll get the May employment report on Jun 4 before the June 17 FOMC decision/dot plot but that would have to make up for this miss and then some before there was any talking about talking about slowing asset purchases.

- Notably unemp rate higher (first deterioration since Apr 2020); manufacturing payrolls contracted unexpectedly as well. Not an unambiguously bad report, though tough to find a big enough silver lining to offset the dreadful headline miss. Average hourly earnings +0.7%, a big beat vs flat expected; Y/Y rising too (+0.3%) and ave weekly hours rose. Participation rate rising too (61.5% to 61.7%), and U6 fell to 10.4% from 10.7%.

US OUTLOOK/OPINION: Seasonal Adjustment Issues = Second Thoughts On Jobs Miss. Seeing a lot of discussion about seasonal adjustment issues being a big factor behind the April nonfarms miss. Almost all of the NFP previews we saw pointed this out beforehand, as a caveat in case there was a big 'miss' in either direction.

- Non-adjusted, the US added 1.089mn jobs in April. That's very typical for a 'normal' April (the average for 2016-2019 in April was +1.04mn), and also in line with the 1.1-1.2mn jobs created in each of Feb and Mar. If the BLS is using the typical April +1mn as a benchmark (the avg 2016-2019 seasonally adjusted payroll rises in April were around +200k vs +1.04mn after adjustment), hard to say how much of the 2021 figure was accounted for with the BLS making its adjustments.

- Would point out that some of the sectors you'd expect would be roaring back DID roar back in NSA terms - Leisure and Hospitality added 575k jobs NSA in April which looks like the biggest non-pandemic total ever (apart from the May-Jun rehiring in 2020). Not sure whether a downward seasonal adjustment is warranted for those areas.

- You can't discount the seasonal adjustment as a big factor here, in other words. Most 'circumstantial' evidence from the labor market suggests that the April figure is something of an aberration.

OVERNIGHT DATA

- US APR NONFARM PAYROLLS +266K; PRIVATE +218K, GOVT +48K

- US PRIOR MONTHS PAYROLLS REVISED: MAR +770K; FEB +536K

- US APR UNEMPLOYMENT RATE 6.1%

- US APR AVERAGE HOURLY EARNINGS +0.7% Vs MAR -0.1%; +0.3% YOY

- US APR AVERAGE WEEKLY HOURS 35.0 HRS

- US MAR WHOLESALE INV 1.3%; SALES 4.6%

- CANADA APRIL SA IVEY PURCHASING INDEX 60.6 VS MARCH 72.9

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 210.86 points (0.61%) at 34759.75

- S&P E-Mini Future up 31 points (0.74%) at 4225.5

- Nasdaq up 123.2 points (0.9%) at 13756.27

- US 10-Yr yield is up 0.8 bps at 1.5771%

- US Jun 10Y are up 1.5/32 at 132-23

- EURUSD up 0.01 (0.83%) at 1.2165

- USDJPY down 0.46 (-0.42%) at 108.62

- WTI Crude Oil (front-month) up $0.05 (0.08%) at $64.77

- Gold is up $15.44 (0.85%) at $1830.77

European bourses closing levels:

- EuroStoxx 50 up 34.81 points (0.87%) at 4034.25

- FTSE 100 up 53.54 points (0.76%) at 7129.71

- German DAX up 202.91 points (1.34%) at 15399.65

- French CAC 40 up 28.42 points (0.45%) at 6385.51

US TSY FUTURES CLOSE:

- 3M10Y +0.567, 156.008 (L: 145.259 / H: 156.793)

- 2Y10Y +1.943, 143.046 (L: 132.471 / H: 143.4)

- 2Y30Y +4.585, 212.825 (L: 201.142 / H: 213.285)

- 5Y30Y +6.661, 150.224 (L: 142.718 / H: 150.819)

- Current futures levels:

- Jun 2Y up 0.75/32 at 110-13.5 (L: 110-12.375 / H: 110-14.25)

- Jun 5Y up 5/32 at 124-12.75 (L: 124-05.75 / H: 124-20.75)

- Jun 10Y up 3/32 at 132-24.5 (L: 132-17.5 / H: 133-16.5)

- Jun 30Y down 21/32 at 157-31 (L: 157-26 / H: 160-15)

- Jun Ultra 30Y down 1-12/32 at 187-0 (L: 186-26 / H: 191-10)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.835

- Sep 21 -0.005 at 99.815

- Dec 21 +0.010 at 99.775

- Mar 22 +0.010 at 99.80

- Red Pack (Jun 22-Mar 23) +0.020 to +0.050

- Green Pack (Jun 23-Mar 24) +0.055 to +0.070

- Blue Pack (Jun 24-Mar 25) +0.040 to +0.060

- Gold Pack (Jun 25-Mar 26) +0.005 to +0.025

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00 012 at 0.06413% (-0.00712/wk)

- 1 Month +0.00625 to 0.10138% (-0.00588/wk)

- 3 Month -0.00212 to 0.15988% (-0.01650/wk) ** (NEW Record Low)

- 6 Month -0.00738 to 0.19275% (-0.01212/wk)

- 1 Year -0.00250 to 0.27100% (-0.01012/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $72B

- Daily Overnight Bank Funding Rate: 0.05% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.01%, $883B

- Broad General Collateral Rate (BGCR): 0.01%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- No buy-op Friday

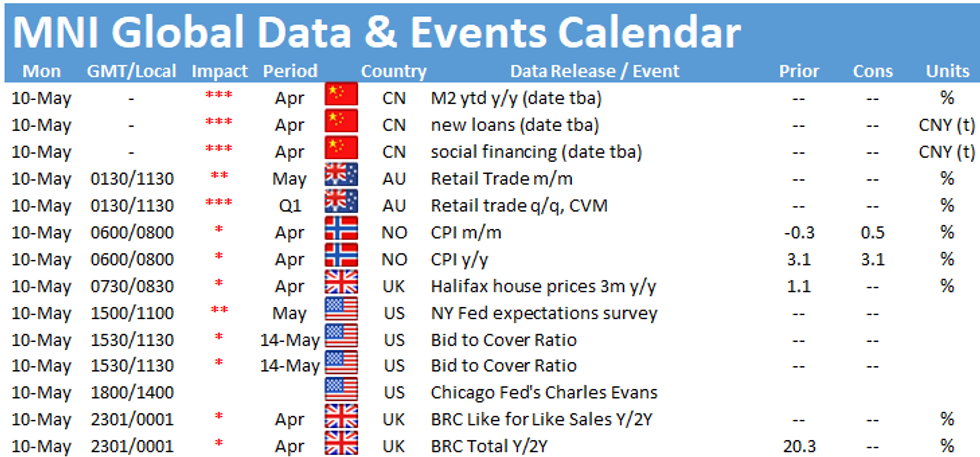

- Next week's schedule

- Mon 5/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 5/11 1010-1030ET: TIPS 1-7.5Y, appr $2.425B

- Wed 5/12 1500ET Update NY Fed Operational Purchase Schedule

PIPELINE: High-Grade Corporate Debt Issuance

- $8.65B Priced Thursday, $27.775B/wk, no new issuance for Friday yet

- Date $MM Issuer (Priced *, Launch #)

- 05/06 $1.5B *EIB 10Y +10

- 05/06 $1.25B *NatWest Markets $950M 3Y +55, $300M 3Y FRN SOFR+53

- 05/06 $1.1B *ORBIA $600M 5Y +110, $500M 10Y +145

- 05/06 $1B *Banco Santander Perp NC6 4.75%

- 05/06 $1B *Broadbridge Fncl 10Y +105

- 05/06 $800M *ENN Natural Gas 5NC3 +265

- 05/06 $800M *Weir Group 5Y +145

- 05/06 $700M *NIB 5Y FRN SOFR+19

- 05/06 $500M *SVB Fncl 7Y +87

FOREX: US Dollar Index Closing At Lowest Level For 11 Weeks

- A weak US employment report prompted a strong selloff in the US dollar, with the DXY weakening by around 0.5% following the data.

- Despite a reversal in US treasuries, the dollar was unable to fully retrace and then extended its weakness throughout the session into the close. The weakness was felt evenly against G10 counterparts and EM currencies alike, with the only notable underperformer the Canadian Dollar where a similarly poor domestic jobs report was to blame.

- Fresh recent highs for GBPUSD at 1.40. Worth highlighting the cluster off daily highs just above the 1.40 mark, dating back to mid-February. The pair has consistently failed to close above this psychological level and looks likely to be in play next week. Clearing resistance at 1.4009 would reinstate a technically bullish theme.

- The strength has been underpinned by what Prime Minister Johnson is celebrating as "very encouraging" early results in a crucial set of British elections – following the ruling Tory party winning the high-profile town of Hartlepool.

- Labour party head Keir Starmer has described the election results as `bitterly disappointing'.

- Additionally, reports circulated that two-thirds of U.K. adults have had first covid-19 vaccine dose.

- Notable longer term dynamics in USDCAD that has been in a clear downtrend since the reversal off 1.4668 on Mar 19, 2020. The rejection at 1.4668 meant that the major resistance at 1.4690, the Jan 2016 high remained intact. The USD remains in a clear downtrend. However, the pair is approaching a major support at 1.2062 that will potentially either reinforce the current medium-term bear leg if breached or lead to a reversal if the support manages to contain CAD strength.

EGBs-GILTS CASH CLOSE: BTPs Get Kazak-ed

A busy back-and-forth session ended with Gilt and Bund cash trading cheaper/more expensive to end the week.

- The space was hit early in the session when in a BBG interview, ECB's Kazaks floated the possibility of a slowdown in PEPP purchases in June. Periphery spreads widened.

- Then the afternoon brought a shocking downside miss in US employment gains in April, pushing core global FI much higher. Then, in another twist, talk of of seasonal adjustment factors unduly impacting the reading led to a bearish reversal.

- In the end, yields were little changed on the session, with Gilts outperforming.

- In supply, Belgium sold E0.5bln of OLOs via ORI auction.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.5bps at -0.686%, 5-Yr is up 1.2bps at -0.587%, 10-Yr is up 1bps at -0.215%, and 30-Yr is up 1bps at 0.351%.

- UK: The 2-Yr yield is down 0.6bps at 0.033%, 5-Yr is down 2.1bps at 0.313%, 10-Yr is down 1.7bps at 0.775%, and 30-Yr is down 0.4bps at 1.314%.

- Italian BTP spread up 3.8bps at 118bps / Spanish spread up 2bps at 70.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.