-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Two Sessions in One, Risk Appetite Returns Late

EXECUTIVE SUMMARY

- MNI INTERVIEW: Virus and Jobs May Restrain Prices-Fed's Wright

- MNI BRIEF: Fed Edged Closer to Taper Talk in April Minutes

- MNI BRIEF: Quarles Says Fed Trying to Avoid Inflation Headfake

- MNI: Fed Could Tighten Policy Sooner if Price Pressures Surge

- FED BULLARD: U.S. HAS `BIG ECONOMIC BOOM GOING ON', Bbg

- FED BULLARD: WOULDN'T BE SURPRISED IF 2021 GDP EST. OF 6.5% RAISED, Bbg

- FED BOSTIC: ECONOMY IS TRANSITIONING TO RECOVERY, OUT OF PANDEMIC, Bbg

- FED BOSTIC: EXPECTS A LOT OF VOLATILITY OVER NEXT SEVERAL MONTHS, Bbg

US TSY SUMMARY: Thinking About Thinking of Tapering

An active midweek session with a lot to unpack with several Fed speakers leading up to the April FOMC minutes release, a weak 20Y auction and a meltdown in crypto-fx that weighed heavily on tech stocks in the first half. Heavy overall volumes even without the pick-up in Jun/Sep quarterly rolling, TYM1 near 1.9M after the bell.- No data aside from the April minutes event risk, Tsys kicked off with a risk-off tone as sharp declines in crypto currencies (various reasons, but some pointed to early headlines China expressing negative opinion on digital tokens, Bitcoin ->20% last 24 hours, Ether -42% from highs), that spilled over to tech stocks and global equities in general.

- Upbeat Fed speakers tempered the bid in rates (BULLARD: U.S. HAS `BIG ECONOMIC BOOM GOING ON', Bbg) while a weak $27B 20Y Bond auction (2.286% high yld vs. 2.275% WI) spurred additional selling. Tsys extended sell-off after April FOMC minutes as it became apparent Fed is thinking about thinking of tapering as economic recovery continues.

- "Some participants mentioned upside risks around the inflation outlook that could arise if temporary factors influencing inflation turned out to be more persistent than expected."

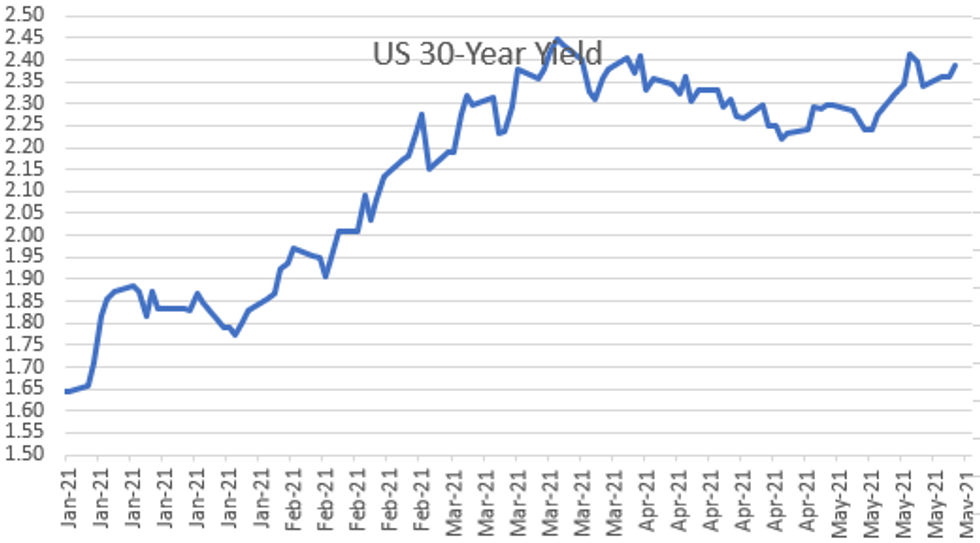

- The 2-Yr yield is up 1bps at 0.1592%, 5-Yr is up 5bps at 0.868%, 10-Yr is up 5bps at 1.6864%, and 30-Yr is up 3.1bps at 2.3911%.

US

FED: Minneapolis Fed Research Director Mark Wright told an MNI webinar Wednesday a recent jump in inflation is likely temporary and the major risks facing the U.S. economy come instead from the failure to reach herd immunity or generate enough employment to accommodate some 10 million workers still out of a job.

- "We have to trade off little misses on the upside of inflation because of the fact that we are still a long long way from full employment, and a little bit of higher inflation is not a huge price to pay for getting those people back to work," Wright said. "Given we are so far away from full employment I think it's still going to be a tendency to want to see the labor market improve." For more see MNI Policy main wire at 1500ET.

FED: Simmering price pressures could force Federal Reserve officials to speed up their QE exit and interest-rate liftoff timeline as they reassess how hot the economy can run without sparking undue inflation, current and former policymakers told MNI.

- While some still see room for medium-term inflation expectations to rise after a decade of downside misses, supply chain bottlenecks and economic reopening could push them too high, leaving the Fed in the difficult position of needing to pare back monetary support before the string of million-plus increases in payrolls Fed Chair Jerome Powell has signaled might be needed, MNI was told. For more see MNI Policy main wire at 0909ET.

- "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the minutes showed.

- "Some participants mentioned upside risks around the inflation outlook that could arise if temporary factors influencing inflation turned out to be more persistent than expected."

- "I don't think actually that it would be good for the industries that we want to see thriving as the recovery continues for us to close off that recovery prematurely, trying to stay ahead of inflation when again our best estimate is that we are not behind," said Quarles in a question-and-and-answer session. "Our experience over the course of the last decade coming out of the financial crisis is that a couple of times we thought we saw [inflation] -- wanted to stay ahead of inflationary pressures, and we increased interest rates. It was premature."

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE +1.2% SA THRU MAY 14 WK

- US MBA: REFIS +4% SA; PURCH INDEX -4% SA THRU MAY 14 WK

- US MBA: UNADJ PURCHASE INDEX +2% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.15% VS 3.11% PREV

- CANADIAN APR CONSUMER PRICE INDEX INFLATION +3.4% YOY

- CANADA MOM CPI INFLATION WAS +0.5% IN APR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 381.21 points (-1.12%) at 33678.48

- S&P E-Mini Future down 37.25 points (-0.9%) at 4086.25

- Nasdaq down 82.6 points (-0.6%) at 13220.12

- US 10-Yr yield is up 4.8 bps at 1.6847%

- US Jun 10Y are down 13/32 at 131-31.5

- EURUSD down 0.0058 (-0.47%) at 1.2166

- USDJPY up 0.37 (0.34%) at 109.26

- WTI Crude Oil (front-month) down $2.32 (-3.54%) at $63.17

- Gold is down $6.35 (-0.34%) at $1863.90

- EuroStoxx 50 down 68.6 points (-1.71%) at 3936.74

- FTSE 100 down 84.04 points (-1.19%) at 6950.2

- German DAX down 273.02 points (-1.77%) at 15113.56

- French CAC 40 down 91.12 points (-1.43%) at 6262.55

US TSY FUTURES CLOSE:

- 3M10Y +4.439, 166.862 (L: 160.551 / H: 167.718)

- 2Y10Y +3.831, 152.21 (L: 147.106 / H: 153.066)

- 2Y30Y +1.95, 222.605 (L: 218.713 / H: 223.982)

- 5Y30Y -1.982, 152.045 (L: 151.956 / H: 155.405)

- Current futures levels:

- Jun 2Y down 0.5/32 at 110-12.625 (L: 110-12.375 / H: 110-13.625)

- Jun 5Y down 6.5/32 at 123-31.5 (L: 123-30 / H: 124-09.5)

- Jun 10Y down 12/32 at 132-0.5 (L: 131-30 / H: 132-18.5)

- Jun 30Y down 21/32 at 156-1 (L: 155-25 / H: 157-08)

- Jun Ultra 30Y down 28/32 at 182-28 (L: 182-15 / H: 184-25)

US EURODOLLAR FUTURES CLOSE

- Jun 21 -0.0025 at 99.8475

- Sep 21 -0.005 at 99.840

- Dec 21 -0.005 at 99.795

- Mar 22 -0.010 at 99.805

- Red Pack (Jun 22-Mar 23) -0.035 to -0.005

- Green Pack (Jun 23-Mar 24) -0.065 to -0.045

- Blue Pack (Jun 24-Mar 25) -0.07

- Gold Pack (Jun 25-Mar 26) -0.07 to -0.055

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00125 at 0.06163% (-0.00038/wk)

- 1 Month -0.00275 to 0.09650% (-0.00100/wk)

- 3 Month -0.00600 to 0.14925% (-0.00588/wk) ** (NEW Record Low vs. 0.14963% on 5/17)

- 6 Month -0.00012 to 0.18363% (-0.00400/wk)

- 1 Year +0.00075 to 0.26350% (-0.00238/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.01%, $888B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $15.686B submission

- Next scheduled purchases:

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: $1B Kommuninvest 2Y Priced

Otherwise limited issuance on day after $34B in first two days of week

- Date $MM Issuer (Priced *, Launch #)

- 05/19 $1B *Kommuninvest WNG 2Y +1

- 05/18 $2.8B *Charter Communications $1.4B 30Y +177, $1.4B 40Y +202

- 05/18 $2.5B *World Bank 5Y +2

- 05/18 $2B *Square $1B 5Y 2.75%, $1B 10Y 3.5%

- 05/18 $1.5B *Cox Communications $800M 10Y +100, $700M 30Y +125

- 05/18 $1.4B *Tenet 8NC3 4.25%

- 05/18 $1.25B *Federation des Caisses Desjardins du Quebec (CCDJ) $750M 3Y +38, $500M 3Y FRN SOFR+43

- 05/18 $1B *Caisse de depot et placement du Québec (CDPQ) 5Y +10

- 05/18 $1B *Societe Generale PNC5 4.75%

- 05/18 $1B *Microchip WNG 3Y +65

- 05/18 $1B *DNB Bank 6NC5 +72

EGBs-GILTS CASH CLOSE: Core FI Yields Succumb To Safe Haven Gravity

Bund and Gilt yields succumbed to the gravity of weakening equities as Wednesday's session progressed, with yields closing well off session highs. Meanwhile periphery spreads traded in a fairly wide range, settling higher.

- In some ways it was a case of simple risk-off (with equities sharply lower amid a cryptocurrency meltdown), but short cover/profit taking helped core FI, and EGB supply ahead potentially weighed on peripheries too: Thursday sees Spain sell up to E6bln nominal and France up to E13.5bln of nominal and linkers.

- Germany allotted E3.4bln of Bund (weakest 10-year auction in terms of bid-to-cover and bid-to-offer since Mar 2020), Finland sold E3bln of 2031 RFGB via syndication. UK sold Gilts (GBP2.5bn), Portugal BTs (E1.75bn) and the EFSF (E1bln).

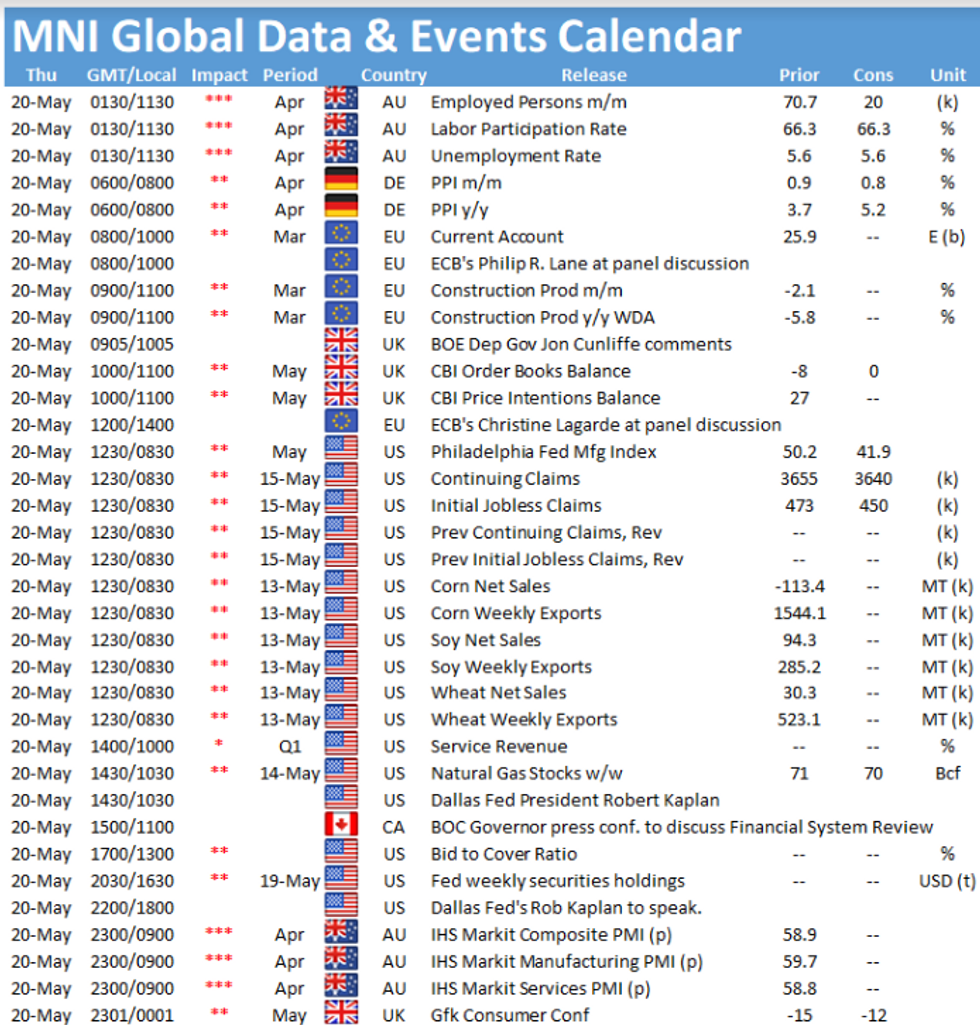

- Apart from EGB supply, main items on Thursday's calendar are ECB speakers (incl Lane, Lagarde, and Villeroy).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.647%, 5-Yr is down 0.1bps at -0.506%, 10-Yr is down 0.7bps at -0.11%, and 30-Yr is down 1.7bps at 0.447%.

- UK: The 2-Yr yield is down 1.3bps at 0.075%, 5-Yr is down 1.1bps at 0.374%, 10-Yr is down 2bps at 0.848%, and 30-Yr is down 1.9bps at 1.398%.

- Italian BTP spread up 1.7bps at 122.8bps/ Spanish spread up 1.3bps at 71.8bps

FOREX SUMMARY: FOMC Taper Mention Prompts Greenback Strength

- The US Dollar surged as the FOMC minutes suggested officials noted more recovery progress would open door to taper debate.

- Before the release of the minutes, the cryptocurrency rout had kept the USD in marginal positive territory, however, with US yields surging back close to the May highs, the dollar is extending its reprieve following 3 consecutive days of declines.

- The greenback strengthened across the board with EURUSD initially moving roughly 35 pips plumbing fresh session lows through 1.2190 to 1.2174. New highs for the USD against AUD, JPY, GBP, NZD, CAD, CNH and CHF.

- Initial weakness in equities particularly made antipodeans suffer and the extension of US yields has enhanced the move lower. AUD and NZD are the biggest losers against the dollar, shedding 1% and 1.32% respectively.

- On the downside for EURUSD, key short-term support is being approached at 1.2052, May 13 low. The outlook remains technically bullish following last week's recovery.

- The focus overnight turns to Australian employment data as well as the Annual NZ budget release. Tomorrow in the US, markets will await Philly Fed and Jobless Claims, before the Bank of Canada's Macklem is due to give a press conference.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.