-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Record Reverse Repo, Strong 7Y Auction

EXECUTIVE SUMMARY

- MNI DATA BRIEF: US Apr PCE Seen Higher, Above Fed Comfort Zone

- MNI:US May Job Growth Seen Slowing Further- St Louis Fed Model

- FED: 50 COUNTERPARTIES TAKE RECORD $485.3B AT FIXED-RATE REVERSE REPO

- BIPARTISAN CHINA COMPETITION BILL CLEARS U.S. SENATE HURDLE, Bbg

- BIDEN TO OFFER $6 TRILLION BUDGET TO BOOST INFRASTRUCTURE: NYT, Bbg

- REPUBLICANS SEEK ABOUT $928B IN INFRASTRUCTURE SPENDING .. FOCUSES ON ROADS, BRIDGES, BROADBAND, AIRPORTS, Bbg

US

US: The total PCE price index and core PCE price index -- a pair closely watched by Fed officials -- should both tick up to 0.6% in April, while a year earlier, the PCE price index should increase to 3.5% from 2.3% in March, while the y/y core PCE price index should jump to 2.9% from 1.8% in March, to record the highest level since 1993. Both sets of data will raise eyebrows at the Fed, but are unlikely to lead to any snap policy shifts.

- U.S. personal income is set to fall sharply in April as the effects of stimulus checks sent earlier in the spring fade, with markets expecting a decline of more than 14% following March's outsized 21.1% gain. For more see MNI Policy main wire at 1055ET.

US: U.S. employers added between 19,000 and 865,000 jobs in May, according to a St. Louis Fed model using high frequency data from scheduling software companies Kronos and Homebase, far lower than the 618,000 to 1.3 million range forecast last month.

- Job gains through May are likely better represented by the lower end of the Fed model's forecast. Data from Homebase, which reflects the forecast's upper end, has a larger concentration of small businesses, particularly in retail and leisure and hospitality, St. Louis Fed economist Max Dvorkin told MNI in an email.

- "It may be that these sectors are leading in the employment gains, but that should not be extrapolated to the whole economy," he said. Payroll employment rose by just 266,000 in April. Sources have told MNI the Fed may need to bring the job market just halfway back before saying it's made substantial progress.

US: Highlights of Biden's budget proposals:

- Largest Federal Spending since WWII

- Would imply deficits of over $1.3trillion for the next decade

- Total spending would rise to $8.2 trillion by 2031

- Would be funded by higher corporate and taxes on higher earners

- Implies no major additional policies for this budget

- Budget sees growth of just under 2% per year for most of the next decade after accounting for inflation. That's similar to post-crisis and 20-year average.

- Unemployment seen falling to 4.1% by 2022 and would remain below 4% across the forecast horizon.

- Senior Senate Republicans are currently presenting their counteroffer to the Biden administration's multi-trillion dollar infrastructure bill (the 'American Jobs Plan')

US TSY SUMMARY: Rates Weaker/Off Lows

Tsys finished the session weaker but off midday lows. Rates followed Bunds, Gilts lower in early trade after BoE Vlieghe commented early rate hikes possible if there is a smooth furlough transition. Sideways trade after first significant data of wk: Durable goods weaker than expected, though higher revisions. Initial jobless claims slightly better than expected, while GDP unch in latest reading (vs expectations of 0.1pp revision higher).

- Bonds lead a gradual move lower, yld curves bear steepening in late morning trade. TYM1 -9.5/32, 132-19.5 last, still well above April 13/29 key support of 131-18.5. Trading desks noted two-way positioning w/better selling from props and real$ accts, central bank buying in 10s earlier. Curve-wise, trading desks report real- and fast$ doing 5s30s steepeners. No deal-tied flows with corporate issuers sidelined ahead shortened Friday/extended holiday weekend. Some pre-auction short-sets ahead final leg week's Tsy supply: $62B 7Y note.

- Decent auction results w/ high yield of 1.285% vs. 1.292% WI. Tsys holding off session lows. Bid-to-cover: 2.41x well over 2.24x 5 month avg, and highest since Sep '20. Indirect take-up of 59.57 well over the 5 month average of 55.35% but well shy of Jan's 64.09%. Primary dealer take-up 19.73% well below 25.83% 5 month avg (compares to February's >1Y high of 39.80%.) Direct take-up picks up of 20.70 vs. 18.79% 5M avg.

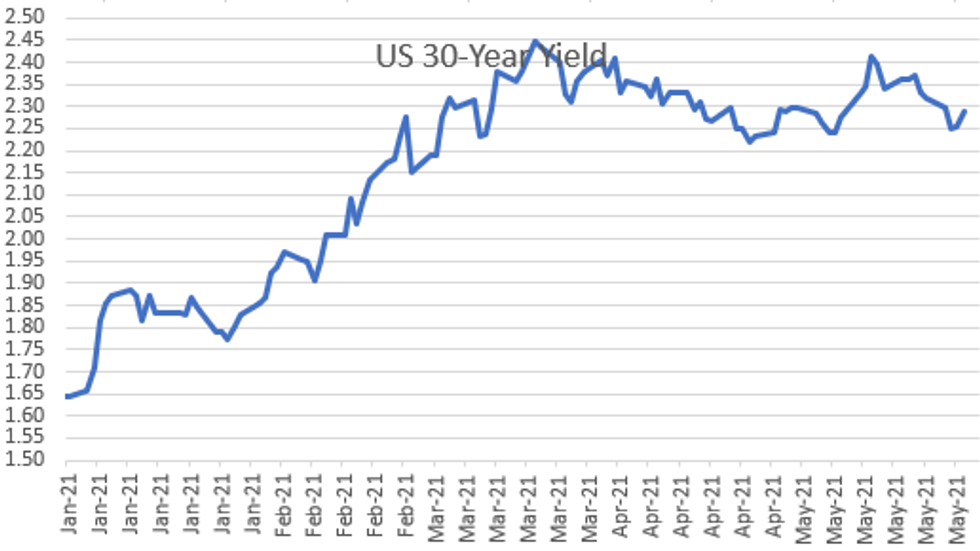

- The 2-Yr yield is down 0.4bps at 0.1446%, 5-Yr is up 3.2bps at 0.8139%, 10-Yr is up 3.2bps at 1.6079%, and 30-Yr is up 3.2bps at 2.2882%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -38K TO 406K IN MAY 22 WK

- US PREV JOBLESS CLAIMS REVISED TO 444K IN MAY 15 WK

- US CONTINUING CLAIMS -0.096M to 3.642M IN MAY 15 WK

- US APR DURABLE NEW ORDERS -1.3%; EX-TRANSPORTATION +1.0%

- US MAR DURABLE GDS NEW ORDERS REV TO +1.3%

- US APR NONDEF CAP GDS ORDERS EX-AIR +2.3% V MAR +1.6%

- US NAR APR PENDING HOME SALES INDEX 106.2 V 111.1 IN MAR

MONTH-END EXTENSIONS: Barclays/Bbg Extension Estimates for US

UPDATED forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.03Y. Note: MBS extension est surged to 0.22 from 0.13 prelim estimate.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.12 | 0.08 | 0.11 |

| Agencies | 0.04 | 0.11 | 0.01 |

| Credit | 0.11 | 0.08 | 0.08 |

| Govt/Credit | 0.11 | 0.08 | 0.10 |

| MBS | 0.22 | 0.06 | 0.05 |

| Aggregate | 0.13 | 0.08 | 0.09 |

| Long Gov/Cr | 0.11 | 0.09 | 0.10 |

| Iterm Credit | 0.08 | 0.07 | 0.08 |

| Interm Gov | 0.11 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.08 |

| High Yield | 0.11 | 0.06 | 0.04 |

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 122.29 points (0.36%) at 34442.7

- S&P E-Mini Future up 6.75 points (0.16%) at 4199.75

- Nasdaq up 13.5 points (0.1%) at 13750.31

- US 10-Yr yield is up 3.4 bps at 1.6096%

- US Jun 10Y are down 7.5/32 at 132-21.5

- EURUSD up 0.0008 (0.07%) at 1.22

- USDJPY up 0.64 (0.59%) at 109.78

- WTI Crude Oil (front-month) up $0.64 (0.97%) at $66.86

- Gold is up $0.61 (0.03%) at $1897.39

European bourses closing levels:

- EuroStoxx 50 up 7.54 points (0.19%) at 4039.21

- FTSE 100 down 7.26 points (-0.1%) at 7019.67

- German DAX down 43.99 points (-0.28%) at 15406.73

- French CAC 40 up 44.11 points (0.69%) at 6435.71

US TSY FUTURES CLOSE:

- 3M10Y +3.48, 159.527 (L: 155.212 / H: 161.313)

- 2Y10Y +3.619, 146.139 (L: 142.206 / H: 147.109)

- 2Y30Y +3.452, 214.02 (L: 210.55 / H: 215.49)

- 5Y30Y -0.094, 147.121 (L: 145.571 / H: 148.072)

- Current futures levels:

- Jun 2Y down 0.125/32 at 110-13.75 (L: 110-13.25 / H: 110-13.875)

- Jun 5Y down 2.75/32 at 124-11 (L: 124-08.75 / H: 124-14.25)

- Jun 10Y down 7.5/32 at 132-21.5 (L: 132-18 / H: 132-30)

- Jun 30Y down 25/32 at 157-24 (L: 157-16 / H: 158-18)

- Jun Ultra 30Y down 1-4/32 at 186-6 (L: 185-20 / H: 187-14)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.075 at 99.880

- Sep 21 +0.010 at 99.880

- Dec 21 +0.010 at 99.835

- Mar 22 steady at 99.840

- Red Pack (Jun 22-Mar 23) -0.02 to steady

- Green Pack (Jun 23-Mar 24) -0.03 to -0.02

- Blue Pack (Jun 24-Mar 25) -0.04 to -0.03

- Gold Pack (Jun 25-Mar 26) -0.05 to -0.04

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00188 at 0.05700% (-0.00275/wk)

- 1 Month -0.00037 to 0.09213% (+0.00050/wk)

- 3 Month -0.00037 to 0.13463% (-0.01237/wk) ** (Record Low)

- 6 Month -0.00062 to 0.17113% (-0.00762/wk)

- 1 Year -0.00313 to 0.24875% (-0.01088/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $64B

- Daily Overnight Bank Funding Rate: 0.04% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.01%, $869B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsys 22.5Y-30Y, $2.001B accepted vs. $6.713B submission

- Next scheduled purchases:

- Fri 5/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

PIPELINE: Limited Issuance Ahead Extended Holiday Weekend

- Date $MM Issuer (Priced *, Launch #)

- 05/27 $1.5B Mamoura 10Y +95, 30Y Formosa 3.4%

- $6.1B Priced Wednesday

- 05/26 $3B *Morgan Stanley 4NC3 fix to FRN +48

- 05/26 $2B *UniCredit $1B 6NC5 +120, $1B 11NV10 +155

- 05/26 $1.1B *Triton Container Int $500M 3Y +88, $600M 10Y +158

EGBs-GILTS CASH CLOSE: BoE's Vlieghe Puts Pressure On Gilts

Thursday saw a weak session for the space, with the Bund and Gilt curves bear steepening.

- Biggest headline reaction of the day came from BoE Vlieghe, who commented at midday UK time that early rate hikes are possible if there is a smooth furlough transition.

- This sent Gilts lower, with Bunds following suit.

- ECB's Weidmann in contrast didn't add to the conversation on tapering.

- BTPs were sold across the curve at various points in the day, but the weakness in Bunds meant spreads compressed over the course of the session.

- We get French prelim May inflation and Eurozone confidence data on Friday, as well as an appearance by ECB Villeroy; Italy sells up to E8.5bln of BTP/CCTeu.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.656%, 5-Yr is up 2.3bps at -0.554%, 10-Yr is up 3.4bps at -0.172%, and 30-Yr is up 4bps at 0.389%.

- UK: The 2-Yr yield is up 2.9bps at 0.052%, 5-Yr is up 4.7bps at 0.349%, 10-Yr is up 5.8bps at 0.81%, and 30-Yr is up 3.7bps at 1.319%.

- Italian BTP spread down 1.9bps at 110.8bps / Spanish spread down 0.2bps at 65.6bps

FOREX: GBP/JPY Nears Highest Level Since 2016

- After a particularly muted morning, currency markets picked up as outgoing BoE MPC member Vlieghe spoke on the future of the bank rate as the UK economy rolls off the pandemic-era furlough scheme.

- Vlieghe stated that an earlier-than-expected rate hike is possible should the transition from furlough to a post-pandemic labour market take place smoothly. In response, the Gilt curve steepened as the 10y yield rose, helping boost GBP across the board. GBP/JPY responded by narrowing the gap with 2018's 156.61. A break above here would mark the highest rate since 2016.

- Early month-end flow worked against the JPY Thursday, which fell against all others in G10. USD/JPY eyes 110.15 Fib resistance ahead of any test on the year's best level at 110.97.

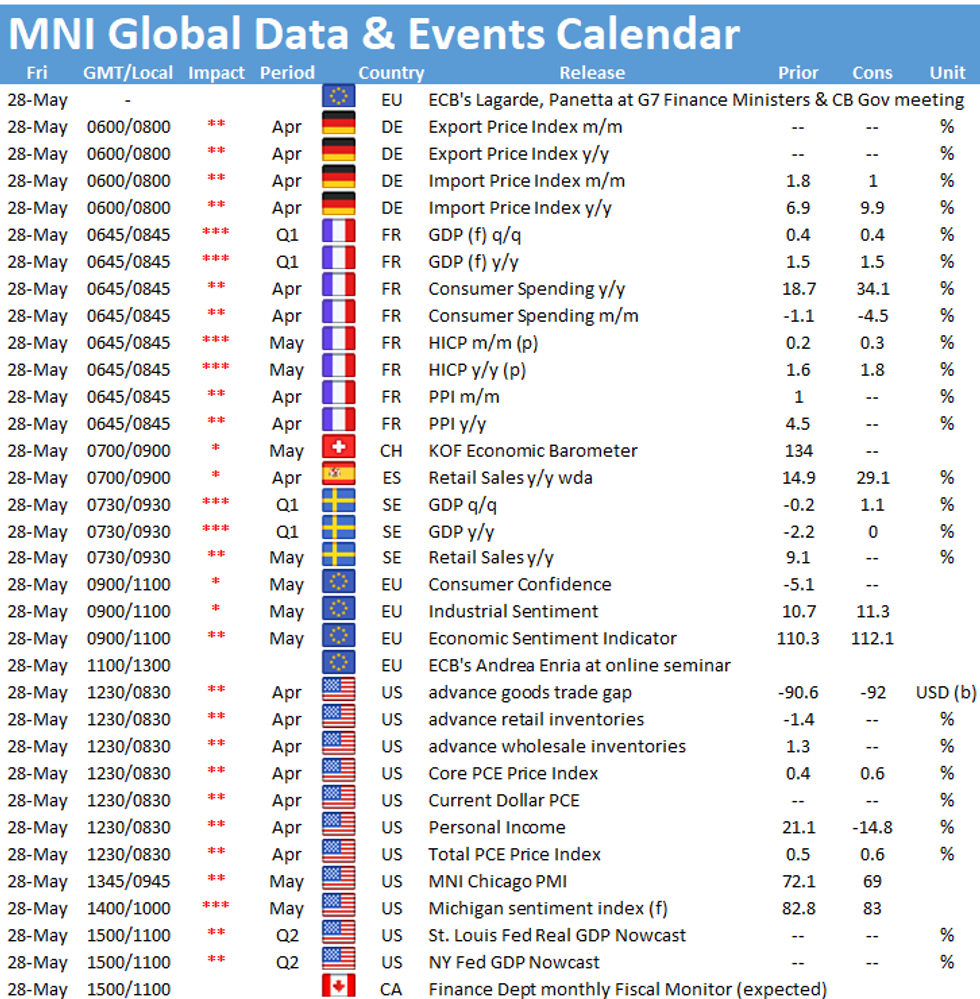

- Focus Friday turns to Japanese jobless rate data, French prelim inflation, US trade balance, PCE data for April and the MNI Chicago PMI. G7 finance ministers also meet to discuss China's place in global trade, while ECB's Villeroy is due to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.