-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN - Focus On US CPI And ECB On Thursday

MNI ASIA OPEN - Focus On US CPI And ECB On Thursday

HIGHLIGHTS:

- BOC Sees Strong Rebound, Keeps QE Taper and Rate Guidance (MNI)

- ECB To Reaffirm Bond Buying Vow (MNI)

- EU Letter Lambasts German Court Ruling On ECB PSPP (MNI)

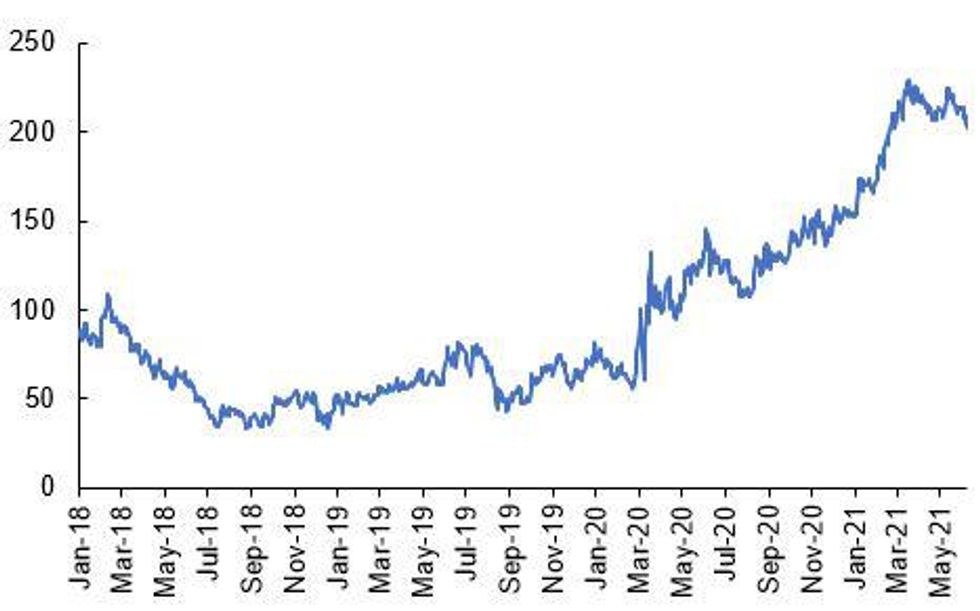

Source: MNI, Bloomberg

AMERICAS

Canada (MNI): BOC Sees Strong Rebound, Keeps QE Taper and Rate Guidance

The Bank of Canada on Wednesday signaled it may keep tapering QE and predicted a strong economic rebound that could present conditions for a rate increase in the second half of next year, while holding its 0.25% rate and CAD3 billion of weekly asset purchases.

BOC Optimism Keeps Focus on July QE Taper

The Bank of Canada's emphasis on a strong rebound from a third wave of Covid shutdowns keeps market expectations focused on Governor Tiff Macklem tapering QE again at the next meeting in July, widening a lead over other major central banks in exiting emergency policies.

EUROPE

ECB (MNI): EU Letter Lambasts German Court Ruling On ECB PSPP

A letter from the European Commission gives the German Constitutional Court two months to reply to Brussels on concerns that it has breached the principle of the primacy of EU law by declaring the ECB's Public Sector Purchase Programme outside of its competence in a May 2020 judgement, and not referring the matter back to the European Court of Justice for further consideration.

EU (MNI): EU Should Allow Debt Of 120% Of GDP - Philippon

The European Union should revamp its debt rules to allow economies to borrow twice as much in order to take advantage of low interest rates and to boost growth potential which has fallen behind that of the United States, former French finance ministry and New York Fed advisor Thomas Philippon told MNI.

ECB (MNI): ECB To Reaffirm Bond Buying Vow

With an economic rebound and rising inflation emboldening hawks, the European Central Bank could reaffirm its intention to buy bonds at a pace necessary to maintain easy financing conditions after its meeting on Thursday, but steer shy of promising to maintain its current EUR80 billion a month throughout the summer.

ASIA-PAC

AUSTRALIA (MNI): Housing Boom Good For Recovery - RBA's Harper

Higher asset prices demonstrate that the Reserve Bank of Australia's monetary policy is being effectively transmitted to the economy and helping to underpin recovery from the pandemic, RBA Board member Ian Harper told MNI, stressing that he was speaking in a private capacity rather than on behalf of the central bank.

DATA

US APR WHOLESALE INV 0.8%; SALES 0.8%

US MBA: UNADJ PURCHASE INDEX -24% VS YEAR-EARLIER LEVEL

MARKET COMPOSITE -3.1% SA THRU JUN 04 WK

REFIS -5% SA; PURCH INDEX +0.3% SA THRU JUN 4 WK

30-YR CONFORMING MORTGAGE RATE 3.15% VS 3.17% PREV

US TSY SUMMARY: Long-End Outperforms As Market Awaits CPI Report

USTs have rallied through the session and the curve has bull flattened with the market eagerly awaiting tomorrow's inflation report.

- Cash yields are broadly 1-5bp lower on the day with the curve 4-5bp flatter. Last yields: 2-year 0.1508%, 5-year 0.7452%, 10-year 1.4891%, 2.1705%.

- TYU1 trades at 132-24, towards the top end of the day's range (L: 132-11+ / H: 1329).

- USD38bn of the 1.625% May-31 note was sold at auction with median yield of 1.497% and bid-to-cover of 2.58x.

- Looking ahead, focus tomorrow will be on the CPI report, as well as earnings and claims data. Tomorrow's ECB meeting will also be key to watch with markets paying paticular attention to the wording around PEPP purchases over the coming quarter.

FOREX: Late Greenback Squeeze As Markets Await US CPI

- Initial dollar weakness was largely attributed to the move lower in US yields throughout the European session. Moves advanced following 10yr yields closing at their lowest level since March on Tuesday.

- A small extension of dollar supply was evident as we broke Monday lows in the DXY, however, markets quickly ran out of steam and a consistent squeeze ensued during US trade. The Late resurgence leaves dollar indices almost exactly unchanged on the week as markets await significant US inflation data due on Thursday.

- GBPUSD weakness appeared to almost front run the move in the dollar amid souring sentiment with the E.U. Negative comments emerged from EU Commission VP Maros Sefcovic following his meeting with UK Cabinet Office minister Lord Frost earlier today. He said the EU will react "swiftly, firmly and resolutely" if grace period on chilled meat trade from GB to NI is extended unilaterally.

- Sterling retreated from 1.4170 against the dollar and never recovered, currently settled around the lows of the week ~1.4115.

- CAD had been the initial outperformer in G10, in anticipation of the Bank of Canada decision and aided by buoyant oil prices. The statement was broadly alongside expectations, reiterating slack expected to be absorbed sometime in H2 2022, in line with median sell-side forecasts. USDCAD held a very tight range but the path of least resistance caused a consistent squeeze for the pair from 1.2059 back to the highs of the day at 1.2118.

- Focus turns to Thursday's release of US CPI and the ECB's monetary policy decision and press conference.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.