-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI ASIA OPEN - Focus Shifts To Payrolls On Friday

MNI ASIA OPEN - - Focus Shifts To Payrolls On Friday

EXECUTIVE SUMMARY:

- MNI: US Hiring Capped, Wages Up on Labor Shortage

- MNI: Fed Sees Trimmed Mean Inflation At 2.4% Next Year

- MNI: BOE Bailey: Inflation Rise Should Be Temporary

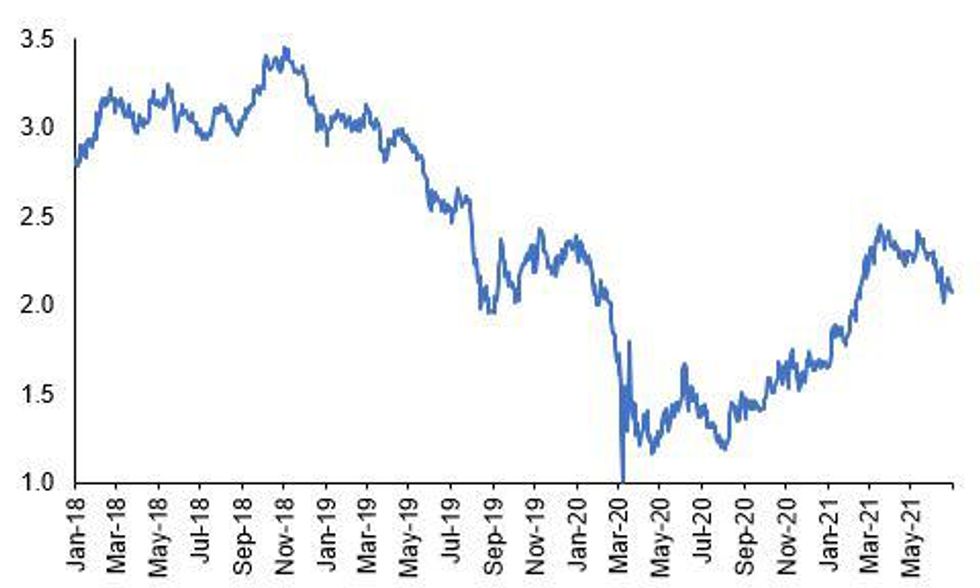

Fig 1. UST 30-Year Yield, %

Source: MNI, Bloomberg

NORTH AMERICA

US (MNI): US Hiring Capped, Wages Up on Labor Shortage

U.S. hiring accelerated in June as vaccine uptake fueled further business re-openings and increased mobility, but a limited labor pool is still holding back even stronger job gains, industry experts told MNI, forcing many employers to raise hourly wages and salaries in an attempt to bring back workers that are still sitting out.

US (MNI): Fed Sees Trimmed Mean Inflation At 2.4% Next Year

Trimmed Mean PCE inflation, a favored internal measure of underlying inflation for Federal Reserve officials, is likely to rise to 2.4% by the end of next year as price pressures stemming from supply bottlenecks broaden out, the Dallas Fed said in a blog post Thursday.

FED (MNI): Fed Hikes Won't Wait for Social Equality -Meyer

Federal Reserve officials will likely be satisfied with reaching traditional goals of full employment and stable prices in order to lift interest rates by mid-2023 and won't take too many risks seeking a more inclusive job market recovery amid overheating fears, former Fed Governor Larry Meyer said in an interview.

EUROPE

ITALY (MNI): Italy's Draghi Faces Hot Summer As Coalition Demands Build

Members of Italy's governing coalition are readying a shopping list of demands in return for backing key economic legislation in what could be a politically turbulent summer, as a potential split by the largest party in parliament adds to worries for Prime Minister Mario Draghi, government and parliamentary sources told MNI.

SWEDEN (MNI): Riksbank Sticks With Zero Rate Forecast

Sweden's Riksbank left its key policy rate at zero percent following its June meeting and is still projecting rates to stay at that level for the whole of its 3-year forecast horizon. The Monetary Policy Report, published Thursday, projected unchanged rates despite an increased inflation profile. Prices are expected to rise temporarily before receding and then move back just above the 2.0% target on the CPIF fixed-income rate measure as the global recovery strengthens.

ECB (MNI): ECB Policymakers To Step Up Talks Ahead Review End

Eurosystem officials are set for a host of meetings in coming weeks, a spokesperson for the European Central Bank told MNI Thursday, although there was no confirmation of what topics would be discussed.

BOE (MNI): BOE Bailey: Inflation Rise Should Be Temporary

While UK inflation has risen faster than expected the increase was likely to be temporary, Bank of England Governor Andrew Bailey said Thursday. Base effects, a slower recovery in supply than demand and distortedly strong demands for goods as opposed to services, with the latter still hampered by social restrictions, were all cited by Bailey as reasons why inflation is likely to continue to pick-up near term but then decline again.

DATA

U.S. Jobless Claims Fall to 364,000

U.S. jobless claims dropped by 51,000 in the latest week to 364,000, a sign of gradually improving labor market conditions as the economy recovers from the Covid recession, the Bureau of Labor Statistics said Thursday.

ISM Jun Manufacturing PMI Slipped To 60.6 vs May 61.2

US ISM NEW ORDERS INDEX 66.0 JUN VS 67.0 MAY

US ISM EMPLOYMENT INDEX 49.9 JUN VS 50.9 MAY

US ISM PRODUCTION INDEX 60.8 JUN VS 58.5 MAY

US ISM SUPPLIER DELIVERY INDEX 75.1 JUN VS 78.8 MAY

US ISM INVENTORIES INDEX 51.5 JUN VS 50.8 MAY

The ISM Mfg PMI dropped 0.6pt in Jun to 60.6, hitting a 5-month low and coming in slightly weaker than market forecasts (BBG: 61.0).

June's downtick was led by an decrease of Supplier Deliveries (-3.7pt), Employment and New Orders (both -1.0), with Employment shifting back to contraction territory for the first time since Nov 2020.

Meanwhile, Production edged up 2.3pt in June, while Inventories gained 0.3ptand rose to the highest level since Oct 2020.

Among the other categories, Order Backlogs saw the largest fall, down 6.1ptto 64.5, its lowest level since Feb.

On the other hand, imports recorded the biggest gain, up 7.0pt to the highest level since Dec 2006 at 61.0, while Prices rose by 4.1pt to a record high of 92.1.

While Customer's inventory ticked up 2.8pt to 30.8, Exports edged up 0.8pt to 56.2 in Jun.

US TSYS SUMMARY: Marginal UST Curve Flattening; Focus Tomorrow Shifts To Payrolls

The UST curve has flattened slightly on the day as a result of the short end trading a touch weaker and long-end yields inching lower. Following a brief rally around the time of the initial claims data, USTs are now back to the middle of the day's range.

- Last yields: 2-year 0.2527%, 5-year 0.8926%. 10-year 1.4663%, 30-year 2.0728%

- TYU1 trades at 132-10+, having sat inside a relatively tight range during the day (L: 132-06 / H: 132-15).

- Initial jobless claims came in at 364k vs 388k consensus, while the ISM manufacturing print was a touch below expectations at 60.6 vs 60.9 while pointing to still solid expansion.

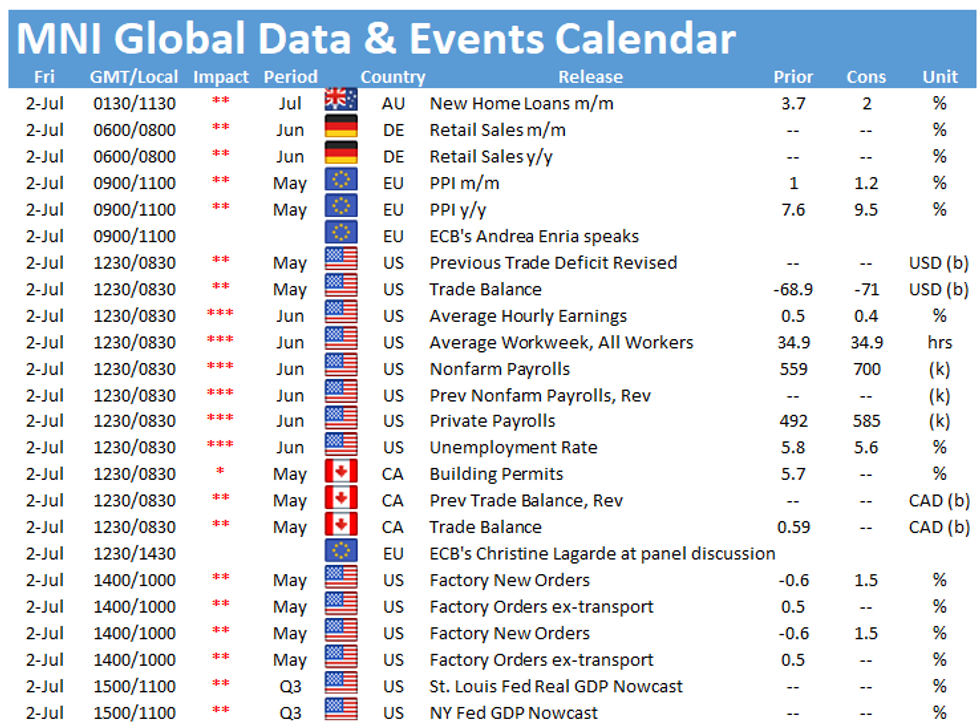

- Focus tomorrow shifts to payrolls with consensus looking for a print of 716k.

FOREX: Dollar Strength Prevails, JPY Out Of Favour

- The dollar index (+0.16%) is likely to post a 5-day winning streak as markets appear optimistic regarding the upcoming June non-farm payrolls data, with the whisper number at a slightly more bullish 800k, vs. 720k estimates.

- USDJPY broke some strong technical resistance through 111.12 overnight and very supportive action throughout Thursday ensued. Approaching the close, USDJPY is on the highs around 1.1165, up 0.5% on the day.

- Interest has been building in topside USD strikes, most notably at Y111.75 in USD/JPY, at which over $2bln in call options are due to expire at the post-NFP NY cut. This would narrow the gap with key resistance at the 112.23 Feb 20, 2020 high.

- Initially, EURUSD bounced from noted Fibonacci retracement support at 1.1837 with a fairly swift rally back to 1.1884, showing relative outperformance. However, with dollar momentum growing throughout the US session, the lows are being approached once more. A positive surprise from tomorrow's data may prompt a sustained break that would open 1.1704, Mar 31 low and a key support.

- Elsewhere both GBP and AUD retreated by 0.5%, with slightly smaller losses seen for CAD (-0.35) and NZD (-0.26%). Emerging market currencies bore the brunt of the dollar strength with both ZAR and BRL down well over 1%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.