-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: June FOMC Minutes Fizzle

EXECUTIVE SUMMARY

- MNI: Fed Officials Debated Taper, MBS Buys -- June Minutes

- Former Fed VC Blinder on Bbg TV:

- BLINDER SAYS HE WOULD ADVISE BIDEN TO OFFER POWELL SECOND TERM, Bbg

- BLINDER SEES U.S. GROWTH MOMENTUM FROM 2021 CARRYING INTO 2022, Bbg

- ECB chatter ahead Thursday strategy review:

- ECB IS SAID TO AGREE TO SET NEW INFLATION GOAL AT 2%

- ECB IS SAID TO ALLOW FOR SOME OVERSHOOT OF NEW INFLATION GOAL

- ECB IS SAID TO AGREE TO SET NEW INFLATION GOAL AT 2%

US

FED: Federal Reserve officials did not yet agree on the timing and nature of reducing the pace of QE in their June meeting but said they should be in a position to taper asset buys earlier than expected if economic conditions warranted, according to minutes of the central bank's last meeting published Wednesday.

- "The Committee's standard of 'substantial further progress' was generally seen as not having yet been met, though participants expected progress to continue," the minutes said.

- "Participants generally judged that, as a matter of prudent planning, it was important to be well positioned to reduce the pace of asset purchases, if appropriate, in response to unexpected economic developments, including faster-than-anticipated progress toward the Committee's goals or the emergence of risks that could impede the attainment of the Committee's goals." the report said.

EUROPE

ECB: The European Central Bank will publish the 'core decisions' from the Governing Council's strategy review on Thursday the central bank said late Wednesday.

- The outcome will be released at 1300CET, followed by a press conference hosted by President Christine Lagarde and Vice President Luis de Guindos at 1430CET.

- The ECB also note the accounts of the June Governing Council meeting will be released on Friday, 24 hours later than previously scheduled.

OVERNIGHT DATA

- US MBA: REFIS -2% SA; PURCH INDEX -1% SA THRU JUL 2 WK

- US MBA: UNADJ PURCHASE INDEX -14% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.15% VS 3.20% PREV

- US MBA: MARKET COMPOSITE -1.8% SA THRU JUL 02 W

- US REDBOOK: JUL STORE SALES +17.2% V YR AGO MO

- US REDBOOK: STORE SALES +19.4% WK ENDED JUL 03 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US BLS: JOLTS OPENINGS RATE 9.209M IN MAY

- US BLS: JOLTS QUITS RATE 2.5% IN MAY

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 83.35 points (0.24%) at 34660.85

- S&P E-Mini Future up 16.25 points (0.37%) at 4350

- Nasdaq up 7.4 points (0.1%) at 14671.73

- US 10-Yr yield is down 2.9 bps at 1.3196%

- US Sep 10Y are up 10.5/32 at 133-17.5

- EURUSD down 0.0018 (-0.15%) at 1.1806

- USDJPY down 0.01 (-0.01%) at 110.62

- WTI Crude Oil (front-month) down $1.36 (-1.85%) at $72.00

- Gold is up $7.06 (0.39%) at $1803.98

European bourses closing levels:

- EuroStoxx 50 up 25.86 points (0.64%) at 4078.53

- FTSE 100 up 50.14 points (0.71%) at 7151.02

- German DAX up 181.33 points (1.17%) at 15692.71

- French CAC 40 up 20.24 points (0.31%) at 6527.72

US TSY SUMMARY: June FOMC Minutes Shed Little Light on Taper Timing

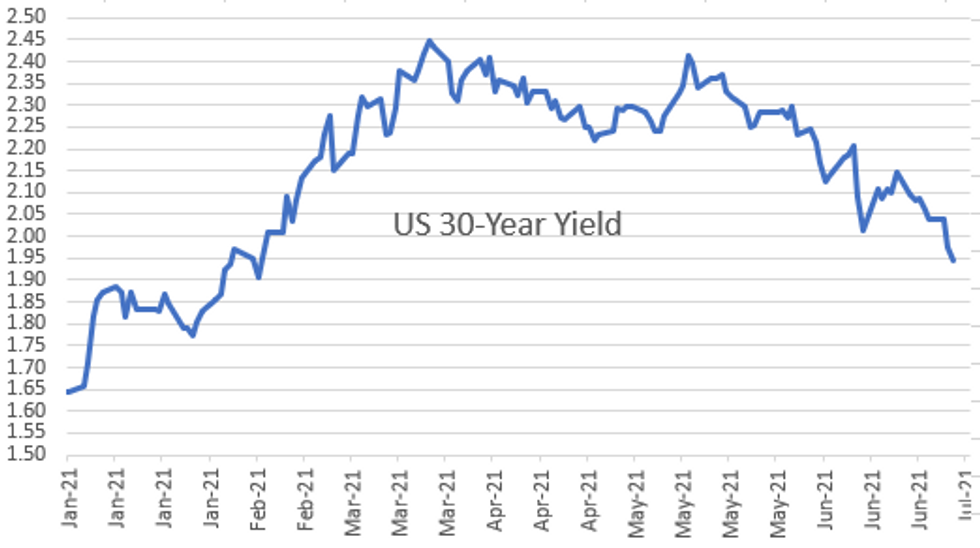

Another session for declining Tsy ylds last seen mid February: 10YY 1.2946% low; 30YY 1.9169% low, and no single driver to pin it on. Sources suggested several factors including stimulus tailwinds starting to fade, Covid Delta variant angst, short squeeze weaker oil, "bland" employment and ISM metrics in addition to slow-down in Asian markets creating more pain for large short positions.- No significant data on the day, rates held narrow range off late morning highs ahead the June FOMC minutes that shed little extra light on timing of tapering. Gist: voting members debated the debate over when it would be appropriate to begin tapering. It feels like it could be a long, hot summer.

- Decent Tsy and Eurodollar option volumes reported: some carry-over upside call buying early followed by better low delta put buying and conditional bear curve flatteners on the day.

- Near $14B in swappable corporate issuance generated some hedging volume in the second half.

- The 2-Yr yield is down 0.4bps at 0.2141%, 5-Yr is down 1.5bps at 0.782%, 10-Yr is down 2.9bps at 1.3196%, and 30-Yr is down 3.2bps at 1.9423%.

US TSY FUTURES CLOSE

- 3M10Y -3.352, 126.389 (L: 124.388 / H: 131.579)

- 2Y10Y -3.167, 109.654 (L: 107.454 / H: 114.05)

- 2Y30Y -3.622, 171.774 (L: 169.689 / H: 176.915)

- 5Y30Y -2.362, 115.219 (L: 113.561 / H: 118.688)

- Current futures levels:

- Sep 2Y up 0.5/32 at 110-7.75 (L: 110-06.625 / H: 110-07.875)

- Sep 5Y up 4/32 at 123-28.75 (L: 123-23.25 / H: 123-29.75)

- Sep 10Y up 10.5/32 at 133-17.5 (L: 133-06.5 / H: 133-22.5)

- Sep 30Y up 1-10/32 at 163-13 (L: 162-07 / H: 163-26)

- Sep Ultra 30Y up 2-17/32 at 197-22 (L: 195-16 / H: 198-13)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.875

- Dec 21 steady at 99.810

- Mar 22 steady at 99.820

- Jun 22 steady at 99.760

- Red Pack (Sep 22-Jun 23) steady to +0.005

- Green Pack (Sep 23-Jun 24) +0.015 to +0.030

- Blue Pack (Sep 24-Jun 25) +0.035 to +0.050

- Gold Pack (Sep 25-Jun 26) +0.055 to +0.060

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00350 at 0.08513% (+0.00463/wk)

- 1 Month +0.00075 to 0.10288% (+0.00000/wk)

- 3 Month -0.01100 to 0.12388% (-0.01400/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00413 to 0.16225% (-0.00075/wk)

- 1 Year -0.00187 to 0.24038% (-0.00413/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $76B

- Daily Overnight Bank Funding Rate: 0.08% volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.05%, $934B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $324B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.566B submission

- Next scheduled purchases:

- Thu 7/8 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Fri 7/9 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

NY Fed reverse repo usage climbs to $785.720B from 65 counterparties vs. $772.581B on Tuesday. Compares to record high of $991.939B on June 30

PIPELINE: $4B Enel Finance 4Pt Launched

Decent $13.45B total high-grade debt to price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 07/07 $5B *KFW 3Y -3

- 07/07 $4B #Enel Finance $1.25B 5Y +70, $1B 7Y +85, $1B 10Y +100, $750M 20Y +110

- 07/07 $1.2B #Xiaomi $800M 10Y +165, $400M 30Y +220

- 07/07 $1B #PacifiCorp 31Y Green +98

- 07/07 $1B *Gazprom 10Y 3.5%

- 07/07 $750M #Royal Bank of Canada 5Y Green +38

- 07/07 $500M *EIB 7Y FRN/SOFR+25

- Expected latter half of week:

- 07/07 $1B Dexia no-grow 3Y +9a

EGBs-GILTS CASH CLOSE: Another Long-End Rally

The German and UK long-ends saw another impressive rally Wednesday, with yields hitting multi-month lows, though periphery spreads widened.

- For the 2nd consecutive session, the impressive rally had no single catalyst. Concerns over weaker growth on the Delta COVID variant appeared to weigh, and the USD strengthened, but with equities rallying, it once again wasn't a risk-off session.

- An FT report that the ECB could issue conclusions on its Strategy Review as soon as tomorrow garnered attention; MNI cited sources that no announcement will be made today.

- Today saw the UK have a strong sale of linkers (GBP0.6bln), with Germany allotting E3.9bln of Bobl. Thursday sees Ireland sell up to E1.5bln of IGB.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.676%, 5-Yr is up 2.7bps at -0.594%, 10-Yr is down 3bps at -0.298%, and 30-Yr is down 3.7bps at 0.187%.

- UK: The 2-Yr yield is up 1.1bps at 0.062%, 5-Yr is down 2.3bps at 0.255%, 10-Yr is down 3.4bps at 0.6%, and 30-Yr is down 4.4bps at 1.121%.

- Italian BTP spread up 2.7bps at 103.9bps / Spanish spread up 1.6bps at 62.8bps

FOREX: Dollar Indices Consolidate Gains

- G10FX remains in fairly close proximity to the prior day's closes. Following Tuesday's strong dollar rally, gains have been consolidated with the DXY up 0.05%.

- EURUSD continued its downward trajectory, breaking 1.18 and confirming bearish technical conditions for the pair and making a new low at 1.1782.

- The clear break of 1.1808 confirms a resumption of the downtrend and maintains the current bearish price sequence of lower lows and lower highs. Price also fell through 1.1795, the Apr 6 low, potentially turning focus to key support at 1.1704, Mar 31 low.

- Small dollar weakness was exhibited during European hours, however, risk-off mode resumed as the US sat down. This weighed heavily on the likes of GBP, AUD, NZD and CAD prompting close to 1% selloffs before recovering slightly heading into the minutes.

- Small negative reaction in the dollar following the release of the minutes, unwinding some of the strength seen within the US session as members reiterated the standard of 'substantial further progress' was generally seen as not having yet been met.

- Overall NZD (+0.33%) outperformed, following the bounce in equities, while weaker oil prices continued to weigh on NOK.

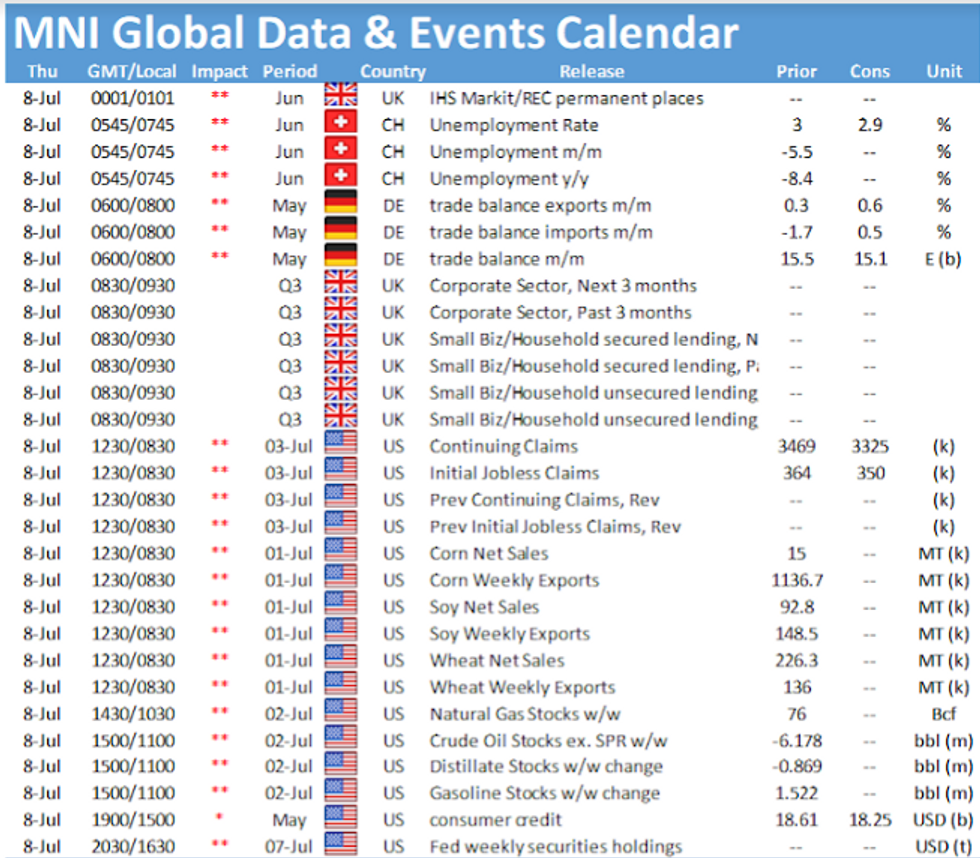

- RBA Gov Lowe is due to speak early on Thursday morning. Later in the day, weekly jobless claims and crude oil inventories headline the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.