-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI ASIA OPEN: 10Y Technicals on Fire

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Treasury Buffer To Ease Reverse Repo Takeup

- MNI BRIEF: Car Prices To Fall As Bottlenecks Resolve -Cleveland Fed

- MNI BRIEF: ECB Sets 2% Symmetrical Inflation Target

- SENATE BANKING CHAIR BROWN SAYS QUARLES WON'T BE REAPPOINTED, Bbg

US TSYS: Approaching The Bull Channel Top

Markets

Markets- US Treasury futures are rallying today as the current bull run extends.

- Futures are approaching the top of a bull channel that intersects at 134-03.The channel is drawn off the May 30 low.

- This represents a key near-term resistance.

- A clear break would strengthen the current bullish argument and would open 134-06, a Fibonacci projection and 134-12, the Feb 26 high (cont).

US

US TSY: The U.S. Treasury may keep its cash balance at a considerably higher level than previously forecast by the end of July so as to build a larger buffer for potentially dragged out debt-ceiling negotiations in Congress, putting less downward pressure on money market rates, former New York Fed economist Christopher Russo told MNI.

- Treasury is likely to try to smooth the bumpy ride past the Aug. 1 debt ceiling deadline by keeping borrowing on a steadier path and only drawing down its cash balance to around USD600 billion at month-end from USD734 billion now, some USD150 billion higher than it previously forecast, he said.

- That means in the near-term there could be less downward pressure on money market rates and potentially less take-up at the Fed's reverse repurchase facility than there would otherwise have been, he said.

- "If the Treasury General Account needs to be elevated going into July 31, the Treasury won't take extreme action to cut down to USD450 billion," Russo said. For more see MNI Policy main wire at 0713ET.

- New and used vehicle prices have accelerated since mid-2020 as factory shutdowns, insufficient materials, and global supply chain disruptions tied to the pandemic hampered production while demand for vehicles spiked.

EUROPE

ECB: The European Central Bank will target inflation at 2% symmetrically over the medium term, the Governing Council said Thursday as it released the outcome of its near 18-month strategy review.

- The symmetric target will see negative and positive deviations of inflation from the target as equally undesirable. "When the economy is operating close to the lower bound on nominal interest rates, it requires especially forceful or persistent monetary policy action to avoid negative deviations from the inflation target becoming entrenched," a statement accompanying the decision said.

- This may also imply a transitory period in which inflation is moderately above target, the ECB added.

OVERNIGHT DATA

- US JOBLESS CLAIMS +2K TO 373K IN JUL 03 WK

- US PREV JOBLESS CLAIMS REVISED TO 371K IN JUN 26 WK

- US CONTINUING CLAIMS -0.145M to 3.339M IN JUN 26 WK

- Langer Weekly Consumer Comfort index fell to 53.3 in week ending July 4 from 55.1 prior

- US MAY CONSUMER CREDIT +$35.3B

- US MAY REVOLVING CREDIT +$9.2B

- US MAY NONREVOLVING CREDIT +$26.1BB

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 343.78 points (-0.99%) at 34343.59

- S&P E-Mini Future down 42.25 points (-0.97%) at 4307

- Nasdaq down 107.9 points (-0.7%) at 14556.66

- US 10-Yr yield is down 3 bps at 1.2862%

- US Sep 10Y are up 10.5/32 at 133-28

- EURUSD up 0.0049 (0.42%) at 1.1842

- USDJPY down 0.85 (-0.77%) at 109.81

- WTI Crude Oil (front-month) up $0.86 (1.19%) at $73.05

- Gold is down $3.3 (-0.18%) at $1800.29

European bourses closing levels:

- EuroStoxx 50 down 86.87 points (-2.13%) at 3991.66

- FTSE 100 down 120.36 points (-1.68%) at 7030.66

- German DAX down 272.07 points (-1.73%) at 15420.64

- French CAC 40 down 130.99 points (-2.01%) at 6396.73

US TSY SUMMARY: More Pain Trade for Rate Bears

Another day of pain for staunch shorts willing or able to hold onto positions. Yields receded to levels not seen since early Feb, 30YY fell to 1.8551% low, 1.8852% last; 10YY 1.2479% low and testing 200DMA before paring back midday.

- Coincidentally, Tsys peaked/started to recede around time ECB strategy review released (in-line: adopting symmetric 2% inflation target expected).

- No immediate reaction to weekly claims climbing 2k to 373k -- higher than est of +350k, while continuing claims recedes slightly (-.145M to 3.339M vs. 3.35M exp).

- Both rates and equities are traded back near the middle of their respective ranges after the rates closing bell: Tsys but well off highs (5s30s yield curve actually a little steeper on day at 117.129 (+1.395) while equities were weaker ESU1 -43.0 at 4306.75 vs. 4279.25 low.

- Heavy volumes traded on day with lions share of TYU1 1.75M occurring before midday. Heavy option volumes with call skew outpacing puts for first time in over a year. Nevertheless, willing put buyers and existing long put positions continued to fade the underlying rally.

- The 2-Yr yield is down 2.4bps at 0.1904%, 5-Yr is down 4.3bps at 0.7356%, 10-Yr is down 3bps at 1.2862%, and 30-Yr is down 2.9bps at 1.9091%.

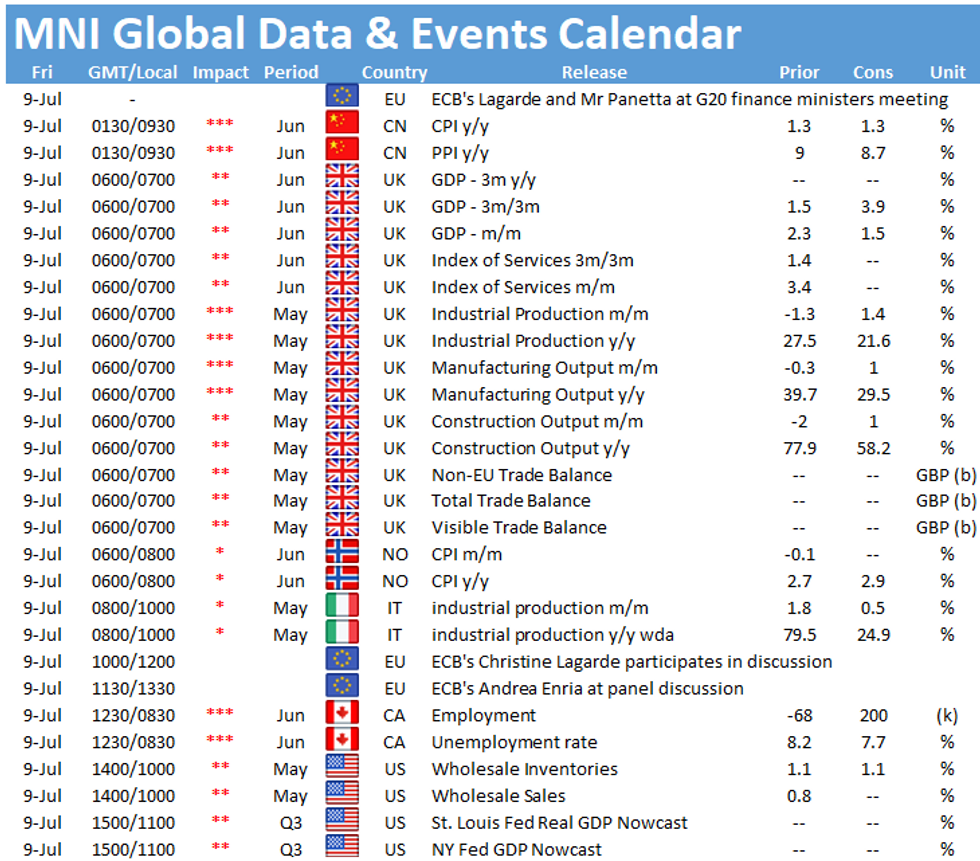

- Friday focus on Wholesale Inventories/sales. No data Monday with June CPI data not until next week Tuesday: MoM (0.6%, 0.5% est); Ex Food and Energy MoM (0.7%, 0.4% est).

US TSY FUTURES CLOSE

- 3M10Y -3.343, 123.213 (L: 119.469 / H: 126.383)

- 2Y10Y -1.173, 108.846 (L: 104.364 / H: 110.647)

- 2Y30Y -0.888, 171.28 (L: 165.277 / H: 173.159)

- 5Y30Y +1.101, 116.835 (L: 111.978 / H: 118.18)

- Current futures levels:

- Sep 2Y up 1.375/32 at 110-9.125 (L: 110-07.5 / H: 110-09.5)

- Sep 5Y up 8/32 at 124-5.25 (L: 123-27.75 / H: 124-07.5)

- Sep 10Y up 10.5/32 at 133-28 (L: 133-16.5 / H: 134-03)

- Sep 30Y up 23/32 at 164-0 (L: 163-09 / H: 164-30)

- Sep Ultra 30Y up 1-8/32 at 198-22 (L: 197-14 / H: 200-23)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.875

- Dec 21 -0.005 at 99.805

- Mar 22 +0.005 at 99.825

- Jun 22 +0.010 at 99.770

- Red Pack (Sep 22-Jun 23) +0.015 to +0.080

- Green Pack (Sep 23-Jun 24) +0.080 to +0.085

- Blue Pack (Sep 24-Jun 25) +0.050 to +0.080

- Gold Pack (Sep 25-Jun 26) +0.020 to +0.040

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00100 at 0.08613% (+0.00563/wk)

- 1 Month -0.00250 to 0.10038% (-0.00250/wk)

- 3 Month -0.00488 to 0.11900% (-0.01888/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00525 to 0.15700% (-0.00600/wk)

- 1 Year -0.00150 to 0.23888% (-0.00563/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $77B

- Daily Overnight Bank Funding Rate: 0.08% volume: $247B

- Secured Overnight Financing Rate (SOFR): 0.05%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $26.791B submission

- Next scheduled purchases:

- Fri 7/9 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

NY Fed reverse repo usage climbs to $793.399B from 72 counterparties vs. $785.720B on Wednesday. Remains well shy of record high of $991.939B on June 30.

PIPELINE: Dexia, Mitsubishi Issued

- Date $MM Issuer (Priced *, Launch #)

- 07/08 $1B *Dexia no-grow 3Y +8

- 07/08 $500M #Mitsubishi Corp 5Y +75a

- $13.45B Priced Wednesday

- 07/07 $5B *KFW 3Y -3

- 07/07 $4B *Enel Fin $1.25B 5Y+70, $1B 7Y+85, $1B 10Y+100, $750M 20Y+110

- 07/07 $1.2B *Xiaomi $800M 10Y +165, $400M 30Y +220

- 07/07 $1B *PacifiCorp 31Y Green +98

- 07/07 $1B *Gazprom 10Y 3.5%

- 07/07 $750M *Royal Bank of Canada 5Y Green +38

- 07/07 $500M *EIB 7Y FRN/SOFR+25

EGBs-GILTS CASH CLOSE: Morning Rally Reverses

Bunds and Gilts staged a huge reversal over the course of the afternoon session, with yields coming off multi-month lows and bull flattening reversing.

- Periphery spreads widened over the entire session though, which was very much risk-off with several European equity indices dropping 2+% on global growth concerns.

- The ECB unveiled the conclusions of its strategy review, which says in part that the central bank will adopt a symmetric 2% inflation target (implying overshoots will be allowed). However this was not seen as market-moving, as the conclusions were largely anticipated well in advance.

- Ireland sold E1.5bln of IGBs, concluding European bond supply this week.

- We'll get multiple ECB speakers Friday, plus the delayed publication of the June meeting accounts. UK GDP is Friday's data focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.683%, 5-Yr is down 0.9bps at -0.603%, 10-Yr is down 0.9bps at -0.307%, and 30-Yr is down 0.4bps at 0.183%.

- UK: The 2-Yr yield is up 2.3bps at 0.085%, 5-Yr is up 0.9bps at 0.264%, 10-Yr is up 1.2bps at 0.612%, and 30-Yr is up 0.7bps at 1.128%.

- Italian BTP spread up 3.1bps at 107bps / Spanish spread up 2.7bps at 65.5bps

FOREX: Souring Sentiment Prompts Further Haven Demand

- A volatile Thursday for G10 currencies where safe haven demand continued to dominate the price action.

- In particular, JPY and CHF were favoured, with some significant intraday moves in the crosses.

- USDJPY had a large 117 pip range after breaking the most recent lows through 110.40 during European hours. A quick acceleration down to 109.80 was briefly consolidated before extending throughout the US session to print fresh lows at 109.53. A small recovery after the WMR fix, sees the pair around 109.85 heading into the close. USDCHF remains 1.04% lower.

- With the move very much tied to risk sentiment waning, AUD, NZD and CAD all suffered.

- NZDJPY has had the most significant move, down 1.69%, closely followed by AUDJPY, down 1.37% amid the pressure in equities.

- EURUSD performed well, rising back above the 1.18 mark and gradually climbing around half a percent on the day to near 1.1850. Once again strong demand for EUR crosses, particularly against NZD and AUD, explain the outperformance.

- Despite oil snapping its losing streak, EURNOK gained a further 1.25% to trade above 10.40 for the first time since early March.

- On Friday, markets will await the rescheduled ECB Monetary Policy Meeting Accounts, however, Canadian Employment will headline the data docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.