-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: $6.5B Apple Debt Issuance Saps Early Tsy Bid

EXECUTIVE SUMMARY

- MNI BRIEF: Geithner Calls For Fed Standing Repo Facility

- FED: Goldman Sachs: Still "Some Ground to Cover"

- MNI INTERVIEW: BOC Seen Having Smooth Shift From Taper to Hike

- BANK OF CANADA GOVERNOR MACKLEM COMMITTED TO KEEP INFLATION LOW, STABLE AND PREDICTABLE; MACKLEM SAYS CANADIANS CAN BE CONFIDENT COST OF LIVING WILL BE KEPT UNDER CONTROL AS ECONOMY REOPENS, Rtrs

US

FED: Goldman saw the July FOMC meeting as offering "little new information".

- They saw a "few reasons" not to make much of the updated statement language: "First, this language likely arose as a compromise intended to satisfy more hawkish participants without saying anything that isn't obvious. Second, it was balanced by language noting that the FOMC 'will continue to assess progress in coming meetings,' which seems to rule out a formal taper announcement in September. Third, Powell used similar language in his June press conference."

- However, the statement "expressed somewhat less concern about the impact of the virus on the economy, which was somewhat surprising... Powell balanced this in his press conference, though".

- Powell's comments on taper composition were consistent with $15B taper pace ($10B Tsy,$5B MBS), with 2nd most likely being $20B ($10B Tsy, $10B MBS). * This would "provide an implicit option to maintain the $20bn total pace of tapering by doubling the pace of UST tapering after the MBS purchases end, which would shorten the taper period from eight meetings to six. This might be useful if inflation surprised to the upside and the FOMC wanted the option to hike sooner."

- Future action: First taper warning at Sep FOMC, formal announcement in Dec. 20% probability of Nov announcement, 55% December, 25% later.

- The two led a report for the G30 that is one of the most influential calls yet for reform after the March 2020 squeeze that pushed the Federal Reserve into uncharted areas of liquidity provision. Stein backed a broad repo facility and said restrictive bank leverage ratios have discouraged some firms from supporting Treasury market trading and backing repo trades.

- Fed officials are still studying last year's market squeeze, with a standing repo mechanism, under discussion even before the pandemic, one possible outcome -- although, as MNI has reported, there is acknowledgement of the stigma that could be attached to its use.

CANADA

BOC: The Bank of Canada will have a smooth transition out of asset purchases later this year while facing more risks around the timing of an interest-rate rise in 2022, former central bank researcher and CIBC Senior Economist Royce Mendes told MNI.

- Governor Tiff Macklem will likely taper government bond buying again in October to CAD1 billion a week from the current CAD2 billion, a pace that will simply match maturing assets and may even lead the BOC to drop the QE label, he said. Asset purchases began last year at CAD5 billion and shifting to a net neutral stance would be far ahead of the Fed and ECB, though other peers in the U.K. and New Zealand are also looking to scale back. For more see MNI Policy main wire at 1404ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -24K TO 400K IN JUL 24 WK

- US PREV JOBLESS CLAIMS REVISED TO 424K IN JUL 17 WK

- US CONTINUING CLAIMS +0.007M to 3.269M IN JUL 17 WK

- US Q2 GDP +6.5%

- PCE Price Index +6.4% Rate In 2Q, DJ

- Core PCE Price Index +6.1% Rate In 2Q, DJ

- Pending Home Sales -1.9% vs. 0.1% exp

- U.S. WEEKLY LANGER CONSUMER COMFORT INDEX AT 53.2 VS 51.5

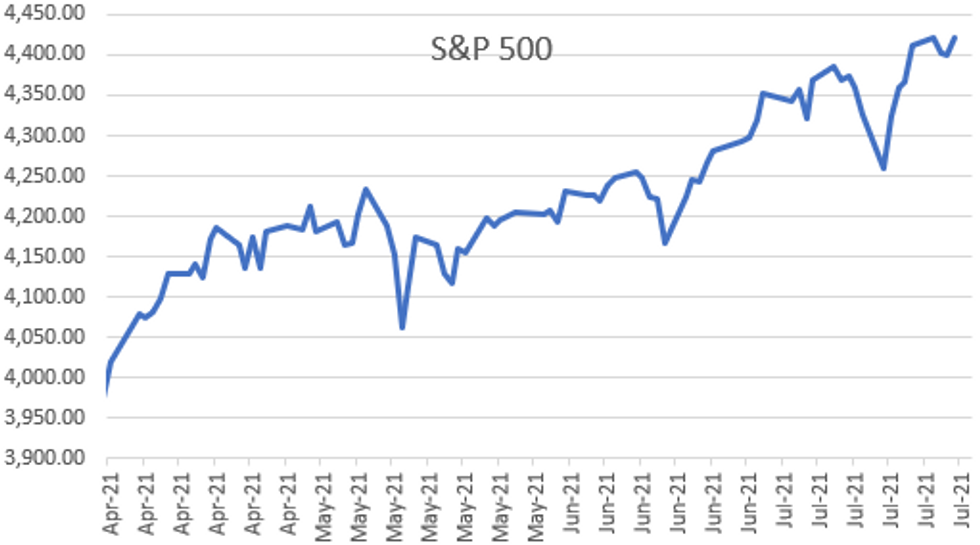

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 180.43 points (0.52%) at 35111.34

- S&P E-Mini Future up 21.5 points (0.49%) at 4415

- Nasdaq up 30.9 points (0.2%) at 14793.15

- US 10-Yr yield is up 3.5 bps at 1.2676%

- US Sep 10Y are down 1.5/32 at 134-7

- EURUSD up 0.0047 (0.4%) at 1.1892

- USDJPY down 0.48 (-0.44%) at 109.43

- WTI Crude Oil (front-month) up $1.19 (1.64%) at $73.57

- Gold is up $23.92 (1.32%) at $1831.04

- EuroStoxx 50 up 13.74 points (0.33%) at 4116.77

- FTSE 100 up 61.79 points (0.88%) at 7078.42

- German DAX up 70.11 points (0.45%) at 15640.47

- French CAC 40 up 24.46 points (0.37%) at 6633.77

US TSY SUMMARY: Risk Appetite Resumes

Risk appetite gradually returned day after steady FOMC rate annc, markets leaning into the more hawkish message from policy makers despite not receiving specific details on speed or timing of tapering QE.

- Early bond support evaporated after the annc of Apple 4pt issuance ($8.5b issued May'20 -- lead to speculative rate-locks), not to mention other issuers. $6.5B Apple launched later in second half -- lion's share of $15B total high-grade issuance.

- Stronger equities helped risk appetite (ESU1 +20.0 after FI close) after China continues to quell investor concerns overnight.

- Tsys had gapped higher post data, some desks initially citing GDP miss. Others said GDP was misleading as "as all inventory drawdown" related.

- FI markets also absorbed $62B 7Y note (91282CCR0) auction: Tsys inched lower after 1.03bp tail with high yield of 1.050% vs. 1.037% WI. Bid-to-cover: 2.23x vs. 2.27x 5m avg, Indirect take-up: 58.37 vs. 59.97 in June, still well over 5M avg of 55.19%. Primary dealer take-up 22.18% vs. 18.69% last month remains below 25.06% 5 month avg. Direct take-up slips to 19.45 vs. 19.53% 5M avg.

- The 2-Yr yield is down 0.2bps at 0.1996%, 5-Yr is up 1.8bps at 0.7287%, 10-Yr is up 3.3bps at 1.2659%, and 30-Yr is up 3.2bps at 1.9124%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

US TSY FUTURES CLOSE

- 3M10Y +3.834, 122.03 (L: 117.356 / H: 123.028)

- 2Y10Y +3.523, 106.436 (L: 102.746 / H: 107.155)

- 2Y30Y +3.426, 171.08 (L: 167.847 / H: 172.052)

- 5Y30Y +1.631, 118.206 (L: 116.164 / H: 118.636)

- Current futures levels:

- Sep 2Y up 0.625/32 at 110-9.75 (L: 110-08.75 / H: 110-10)

- Sep 5Y up 1.75/32 at 124-10.25 (L: 124-07.25 / H: 124-13.5)

- Sep 10Y down 1/32 at 134-7.5 (L: 134-03 / H: 134-16)

- Sep 30Y down 5/32 at 164-7 (L: 163-27 / H: 164-31)

- Sep Ultra 30Y down 3/32 at 198-24 (L: 198-02 / H: 199-30)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.010 at 99.875

- Dec 21 +0.015 at 99.825

- Mar 22 +0.010 at 99.840

- Jun 22 +0.015 at 99.795

- Red Pack (Sep 22-Jun 23) +0.015 to +0.025

- Green Pack (Sep 23-Jun 24) +0.015 to +0.020

- Blue Pack (Sep 24-Jun 25) -0.01 to +0.010

- Gold Pack (Sep 25-Jun 26) -0.025 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.07938% (-0.00075/wk)

- 1 Month +0.00375 to 0.09575% (+0.00963/wk)

- 3 Month -0.00275 to 0.12575% (-0.00313/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00012 to 0.15388% (-0.00462/wk)

- 1 Year -0.00013 to 0.23700% (-0.00438/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08% volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.05%, $862B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $345B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $5.653B submission

- Next scheduled purchase

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations -- Nearing Record High

NY Fed reverse repo usage climbs to $987.283B from 76 counterparties vs. $965.189B on Wednesday -- just off June 30 record high of $991.939B.

PIPELINE: $6.5B Apple 4Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/29 $6.5B #Apple 4pt jumbo: $2.3B 7Y +40, $1B 10Y +47, $1.8B 30Y +77, $1.4B 40Y +92 (adds to $8.5B issued back on May 4, 2020: $2B 3Y +60, $2.25B 5Y +80, $1.75B 10Y +110, $2.5B 30Y +145)

- 07/29 $3B #Humana $1.5B 2NC.5 +50, $750M 5Y +65, $750M 10Y +90

- 07/29 $2.5B Synnex $700M 3NC1 +90, $700M 5Y +110, $600M 7Y +135, $500M 10Y +145

- 07/29 $2B #Blackstone $650M 7Y +65, $850M 10.5Y +85a, 30Y +95a

- 07/29 $500M #New York Life 10Y +58

- 07/29 $500M DR Horton Inc 5Y +65a

FOREX: USD Weakness Across The Board Amid Risk Rally

- The greenback extended on post-FOMC losses on Thursday. Persistent weakness saw the dollar index retreat another 0.5%, with no immediate signs of any bounce.

- The dollar sell-off was emboldened by buoyant risk sentiment, evident by both firm equities and a strong performance in the commodity space.

- As such, Antipodean currencies performed well with Kiwi the notable performer rallying 0.94% and topping the G10 pile. Closely behind was the Norwegian Krone, extending on yesterday's rally, supported by stronger oil prices. EMFX baskets also took advantage of the benign conditions with sizeable gains in high beta ccys such as TRY, ZAR and BRL, all up over 1%.

- Price action in the major pairs was lacklustre, with EURUSD (+0.35%) and GBPUSD (0.48%) moving higher in a slow grind, with the latter hovering just below 1.3990, a Fibonacci retracement and initial resistance.

- USDCNH (0.53%)pulled lower, extending the rejection following the latest breach of touted resistance at 6.50.

- An underwhelming second quarter GDP reading out of the U.S. as well as slightly higher than expected initial jobless claims kept the USD under pressure throughout the session.

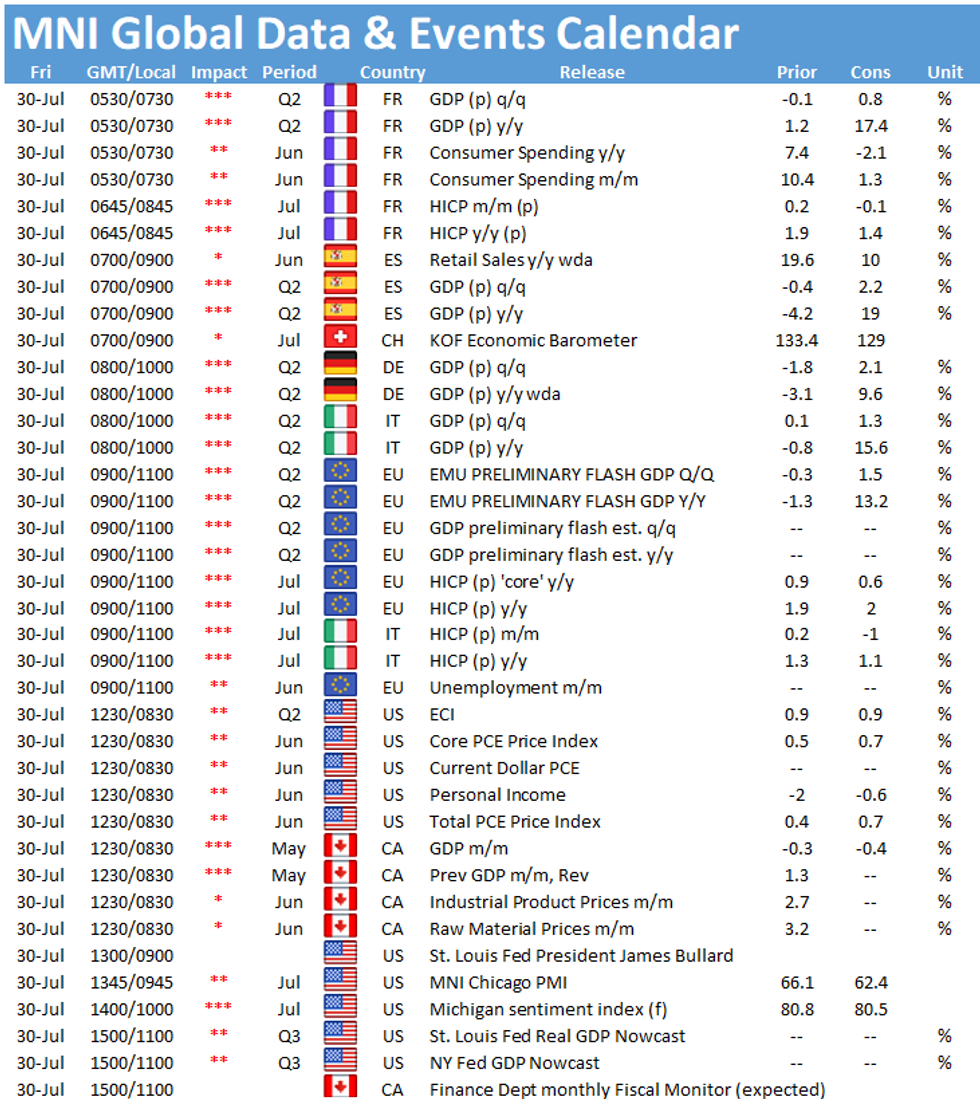

- Tomorrow's data calendar is fairly packed with European flash GDP prints to kick off before the Eurozone CPI flash estimate. The US session will be headlined by US Core PCE price index, with Canadian GDP and the MNI Chicago Business Barometer also on the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.