-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Strong Existing Home Sales Temper Weak PMIs

EXECUTIVE SUMMARY

- MNI BRIEF: Hot US Housing Market 'Settling' as Inventories Rise

- Exclusive | China-US tension: Xi-Biden meet may be further delayed as Beijing considers a virtual G20 seat, SCMP

- FDA HAS GRANTED FULL APPROVAL TO PFIZER'S COVID VACCINE, Bbg, Washington Post

- DOE OFFERS UP TO 20M BBL CRUDE OIL FROM U.S. SPR, Bbg

Source: Bbg, MNI

US

US: Sales of existing homes hit the highest annualized pace since March in July, the National Association of Realtors said Monday, though the housing market still appears to be settling down after months of elevated activity as some inventory tightness is alleviated and prices moderate. Existing home sales climbed to a seasonally adjusted annual rate of 5.99 million from a revised 5.87 million pace in June.

- There were 1.32 million homes available for sale at the end of July, up 7.3% from last month but still down 12% from one year ago. That's still an improvement over previous months, when inventory levels were down more than 20% y/y, NAR chief economist Lawrence Yun said Monday. "We should have more inventory in the coming months," he said on a call with reporters. "I definitely expect that by the end of the year we will have turned the corner on inventory."

- If they fail to meet in Rome in October, it would be the longest delay before a newly inaugurated US president met his Chinese counterpart since 1997.

- Politburo Standing Committee members have not taken any overseas trips since the pandemic and Xi has not hosted a foreign state leader since March 2020.

CANADA

CANADA: ELECTION WATCH

- Liberal chance of winning a majority government 31% vs prior 41% according to CBC Poll Tracker, chance of minority 54% vs prior 48%

- Conservatives have 14% chance of winning most seats vs prior 10%

- Subdued campaigning over summer weekend, leading newspaper columnist calls campaign "shapeless."

- Liberal PM Justin Trudeau Monday morning made pledges on healthcare, said he would seek sanctions on Taliban

- Finance Minister Chrystia Freeland had Twitter post about Conservative health care position flagged as "manipulated media," one of the first such cases in Canada for a prominent figure

- Liberal PM Trudeau Fri announced paid sick leave days for federal workers

- Conservative leader Erin O'Toole on Fri again attacked Trudeau's comment that monetary policy isn't a big part of govt plan to boost economy, said high inflation is a key worry for families

OVERNIGHT DATA

- US FLASH AUG MFG PMI 61.2; JUL 63.4, SURVEY 62.0

- US FLASH AUG SERVICES PMI 55.2; JUL 59.9, SURVEY 59.2

- US FLASH AUG COMPOSITE PMI 55.4; JUL 59.9

- US JULY EXISTING HOME SALES +2.0% TO 5.99M SAAR, ABOVE EXP

- NAR: JUNE EXISTING HOME SALES REVISED UP TO 5.87M

- NAR'S YUN: RENTAL MARKET 'SOARING' DUE TO INABILITY TO BUY

- NAR'S YUN: INVENTORY EASING FOR HOMES WORTH MORE THAN $500K

- July reading of the Chicago Fed National Activity Index is 0.53

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 264.81 points (0.75%) at 35385.26

- S&P E-Mini Future up 45.5 points (1.03%) at 4482.5

- Nasdaq up 242 points (1.6%) at 14956.61

- US 10-Yr yield is unchanged 0 bps at 1.255%

- US Sep 10Y are up 2/32 at 134-6

- EURUSD up 0.0049 (0.42%) at 1.1747

- USDJPY down 0.08 (-0.07%) at 109.7

- WTI Crude Oil (front-month) up $3.47 (5.58%) at $65.61

- Gold is up $23.6 (1.33%) at $1804.67

- EuroStoxx 50 up 28.92 points (0.7%) at 4176.42

- FTSE 100 up 21.12 points (0.3%) at 7109.02

- German DAX up 44.75 points (0.28%) at 15852.79

- French CAC 40 up 56.99 points (0.86%) at 6683.1

US TSYS: Supported as Equities Make New All-Time Highs

Back to/near midmorning highs after the bell. Take away the quarterly roll volume in Tsys and volumes were pretty light for the late summer session (TYU<950k; >172k TYU/TYZ volume). Meanwhile , equities made new all-time highs: ESU1 tapped 4485.75 in early noon trade; Crude bounced back to last Wed' levels (WTI +3.4 at 65.54) and Gold surged over 1,806.0.

- Little/no react from rates to weaker than estimated Markit US PMIs (Mfg 61.2 vs. 62.0 est; Srvc 55.2 vs. 59.2 est) tempered by better than expected Existing home sales (+2.0% TO 5.99M SAAR).

- Focus on Friday's now remote economic symposium hosted by KC Fed in Jackson Hole Wyoming.

- Cross-asset positioning, no deal-tied flow but some early pre-auction short sets ahead first leg Tsy supply w/$60B 2Y note auction Tuesday reported.

- Reminder, Sep Tsy options expire Friday while Dec underlying futures takes lead quarterly position from Sep on Aug 31 (first notice).

- The 2-Yr yield is up 0bps at 0.2242%, 5-Yr is down 1bps at 0.7721%, 10-Yr is unchanged at 1.255%, and 30-Yr is up 0.5bps at 1.8735%.

US TSY FUTURES CLOSE

- 3M10Y -0.167, 120.263 (L: 119.837 / H: 122.606)

- 2Y10Y +0.021, 102.711 (L: 102.377 / H: 104.983)

- 2Y30Y +0.322, 164.394 (L: 163.851 / H: 166.481)

- 5Y30Y +1.491, 109.807 (L: 107.611 / H: 110.206)

- Current futures levels:

- Sep 2Y up 0.125/32 at 110-8.25 (L: 110-07.5 / H: 110-08.375)

- Sep 5Y up 2.25/32 at 124-3 (L: 123-29.75 / H: 124-03)

- Sep 10Y up 2.5/32 at 134-6.5 (L: 133-30 / H: 134-07.5)

- Sep 30Y up 1/32 at 165-25 (L: 165-08 / H: 165-28)

- Sep Ultra 30Y up 5/32 at 201-5 (L: 200-04 / H: 201-07)

US TSY FUTURES: Quarterly Futures Roll Update

Late session roll volume update: strong pick-up with 5s taking the lead, better selling in 5s, 10s and 30s, buying in Ultras. Current roll markets:

- TUU/TUZ 103,724 from 5.25 to 5.5, 5.38 last

- FVU/FVZ 229,478 from 14.5-15.25, 14.5 last

- TYU/TYZ 166,388 from 18.25 to 19.25, 18.25 last

- UXYU/UXYZ 114,274, 1-28 last

- USU/USZ 87,200 from 1-17.25 to 1-17.75, 1-17.25 last

- WNU/WNZ 32,053, 1-23.25 last

US EURODOLLAR FUTURES CLOSE

- Sep 21 -0.002 at 99.870

- Dec 21 -0.005 at 99.805

- Mar 22 -0.005 at 99.840

- Jun 22 -0.005 at 99.80

- Red Pack (Sep 22-Jun 23) steady to +0.015

- Green Pack (Sep 23-Jun 24) +0.015 to +0.020

- Blue Pack (Sep 24-Jun 25) +0.010 to +0.015

- Gold Pack (Sep 25-Jun 26) +0.010 to +0.015

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00037 at 0.07775% (-0.00025 total last wk)

- 1 Month -0.00150 to 0.08438% (-0.00588 total last wk)

- 3 Month +0.00087 to 0.12925% (+0.00413 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00037 to 0.15300% (-0.00400 total last wk)

- 1 Year +0.00037 to 0.23700% (-0.00212 total last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $902B

- Broad General Collateral Rate (BGCR): 0.05%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $354B

- (rate, volume levels reflect prior session)

- TSY 7Y-10Y, $3.201B accepted vs. $8.131B submission

- Next scheduled purchases

- Tue 8/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 8/25 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 8/26 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 8/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to new record high of 1,135.697B from 76 counter-parties vs. $1,111.908B on Friday. Prior record high of $1,115.656B set Wednesday, Aug 18.

PIPELINE: $3B EIB 5Y Expected Tuesday

Issuance volume has slowed significantly since the decent start for August, appr $5B total estimate for week after $10B last week and just over $40B prior.- Date $MM Issuer (Priced *, Launch #)

- 08/23 $600M Black Hills 3NC6 +80a

- Rolled to Tuesday:

- 08/24 $3B EIB WNG +5Y +1a

EGBs-GILTS CASH CLOSE: BTPs Underperform Amid Broader Weakness

Bunds and Gilts weakened modestly in Monday trade, with yields coming off late-morning highs to leave curves mixed (UK bear flatter, Germany bear steeper).

- Weakness mirrored a rebound in equities and oil from Friday's lows. And Core FI appeared to shrug off weaker-than-expected but still solid Aug flash PMI readings.

- Notably though, periphery spreads widened, led by Italy (10Y spread above 107bp to Bunds for first time since the start of the month). No particular trigger and slightly at odds with broader risk-on sentiment.

- In issuance, Germany sells 7Y Bund and UK 5Y Gilt tomorrow; Finland also expected to sell E3bln 5Y RFGB via syndication.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at -0.747%, 5-Yr is up 0.6bps at -0.742%, 10-Yr is up 1.5bps at -0.48%, and 30-Yr is up 2bps at -0.031%.

- UK: The 2-Yr yield is up 1.4bps at 0.115%, 5-Yr is up 1.9bps at 0.261%, 10-Yr is up 1.3bps at 0.536%, and 30-Yr is up 0.6bps at 0.946%.

- Italian BTP spread up 2bps at 106.1bps / Spanish up 0.5bps at 71.1bps

FOREX: Dollar Retreats From Multi-Month Highs, Commodity-Tied FX Lead Charge

- Broad dollar indices suffered to start the week as a strong bounce in the commodity space helped risk-tied currencies lead global gains.

- Lingering concerns around Covid and the economic recovery have potentially propelled expectations for a slightly more dovish Powell at Jackson Hole, also lending support to risk assets on Monday.

- The >5.5% rally in crude futures exacerbated the relief rally in CAD and NOK, both firming ~1.3% against the greenback. Not far behind were Antipodean-FX with AUSUSD and NZDUSD both snapping 5-day losing streaks and rising between 0.9-1.15%.

- Important to note for USDCAD, Friday's price pattern is a bearish shooting star candle and is a concern for bulls. Should the oil price recovery continue, markets will monitor this pattern as it is a reversal threat.

- European Flash PMIs were mixed but both the Euro and Sterling took their cues from the dollar. EURUSD (+0.40%) rose above 1.17 and gradually climbed towards 1.1750. Pound Sterling, despite a particularly weak UK services PMI figure, was also on a steady grind that saw GBPUSD 0.8% better off, trading around 1.3730 as of writing.

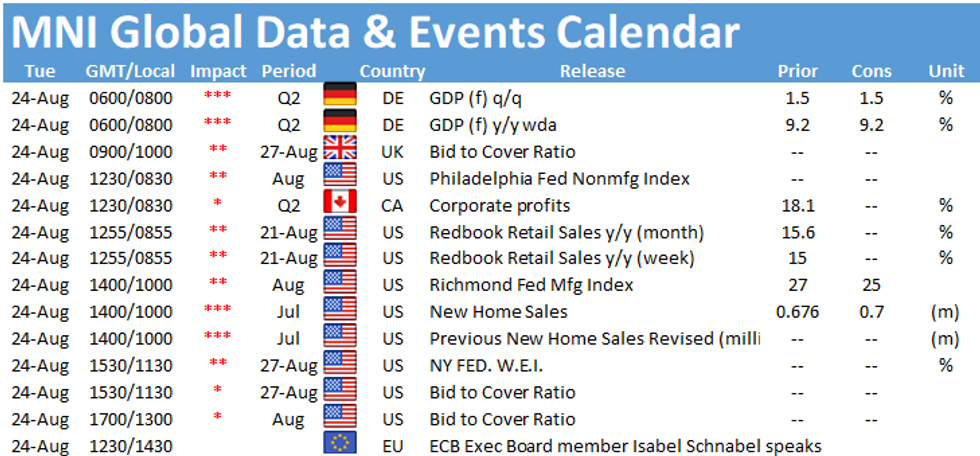

- Final reading of German GDP early on Tuesday before US New Home Sales and Richmond Manufacturing Index headline the US docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.