-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA OPEN: Taper Annc Still Expected This Fall

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Seen Aiding Healthy Wage Inflation

- MNI INTERVIEW: Housing to Drive Up U.S. Inflation For Years

- MNI INTERVIEW: US Service Hiring Capped by Delta--ISM

- MNI BRIEF: BOC Turning 'Report Card' Speech Into QE Outlook

- MNI INTERVIEW: BOJ To Hold Course As Japanese PM Suga Goes

- MNI: US August Service PMI Backs Off From July All-Time High

- MNI: US AUG NONFARM PAYROLLS +235K; PRIVATE +243K, GOVT -8K

- US Pres Biden: "No question" Delta variant is to blame for poor jobs report, Axios

US

FED: Continued Fed stimulus is needed to underpin the job recovery with wage inflation that entices more workers into industries that are growing through the pandemic, Jackson Hole presenter Veronica Guerrieri told MNI.

- "Tolerating a little higher level of inflation has some advantages in this context, because increasing inflation may come with a change in relative prices that may help to smooth labor differences across sectors," said Guerrieri, a consultant at the Chicago Fed since 2014.

- Guerrieri presented a paper at the Jackson Hole conference just after Chair Jerome Powell's speech and expects the FOMC to remain expansionary. "Powell didn't seem too worried about inflation at Jackson Hole and that is consistent with our paper and our message," she said. Her talk on "Monetary Policy in Times of Structural Reallocation" was based on research with coauthors Guido Lorenzoni, Ludwig Straub, and Ivan Werning. For more see MNI Policy main wire at 1015ET.

- "Some people are still afraid to go back to work," he said, particularly in customer-facing industries where the risk of exposure is high. "There's a big strain on accommodation and food services."

- Unemployed workers in those industries are likely still sitting out as the spread of the Delta variant of Covid-19 remains unchecked, he added. For more see MNI Policy main wire at 1217ET.

FED: Surging home prices will put upward pressure on U.S. inflation for years to come as they trickle into rental and owners'-equivalent rent measures used in key consumer price indices, two economists from the Federal Reserve Bank of Dallas told MNI.

- "Over the long haul, rents and housing prices do tend to move together, but there is a significant lag in movements in house prices finally translating into rents and feeding into our measures of inflation," said Jim Dolmas, Dallas Fed economic policy advisor and senior economist, in an interview.

- Dolmas and Xiaoqing Zhou, also a senior economist, have modeled the lag between home price spikes and effects on rent and OER, determining it to be about a year and a half. For more see MNI Policy main wire at 0902ET.

CANADA

BOC: Bank of Canada Governor Tiff Macklem's traditional "report card" speech next Thursday following the Wednesday interest-rate decision will also deliver an outlook for quantitative easing, according to a media notice posted Friday.

- The speech is now titled "Economic progress report: QE and the reinvestment phase" and will be delivered virtually to a Quebec audience at noon, according to the notice. In keeping with a practice of limiting some communications during an election campaign, there will be audience questions but no press conference. Sources have told MNI the BOC may shift to ending net bond purchases later this year, keeping it far more hawkish than the Fed and ECB.

ASIA

BOJ: The Bank of Japan will keep its monetary policy framework unchanged whoever replaces Prime Minister Yoshihide Suga as president of the ruling Liberal Democratic Party, a former BOJ executive director told MNI on Friday.

- "When the coalition party holds the [legislative] majority, there is no room for the BOJ to change its policy framework," said Kazuo Momma, now executive economist at Mizuho Research and Technologies.

- Japan's next prime minister is likely to continue with "Abenomics"-style policies, combining major fiscal and monetary easing, and only a departure from this path would prompt changes by the BOJ, Momma said. For more see MNI Policy main wire at 0615ET.

OVERNIGHT DATA

- US AUG NONFARM PAYROLLS +235K; PRIVATE +243K, GOVT -8K

- US PRIOR MONTHS PAYROLLS REVISED: JUL +1,053K; JUN +962K

- US AUG UNEMPLOYMENT RATE 5.2%

- US AUG AVERAGE HOURLY EARNINGS +0.6% Vs JUL +0.4%; +4.3% YOY

- US AUG AVERAGE WEEKLY HOURS 34.7 HRS

- U.S. IHS MARKIT AUG. COMPOSITE PMI AT 55.4 VS 59.9 PRIOR

- U.S. IHS MARKIT AUG. SERVICES PMI AT 55.1 VS 59.9 LAST MONTH

- US AUG ISM SERVICES PMI 61.7 VS 64.1 JUL

- US ISM SERVICES PRICES 75.4 AUG VS 82.3 JUL

- US ISM SERVICES EMPLOYMENT INDEX 53.7 AUG VS 53.8 JUL N

- US ISM SERVICES BUSINESS INDEX 60.1 AUG VS 67.0 JUL

- US ISM SERVICES NEW ORDERS 63.2 AUG VS 63.7 JUL

- The ISM Services PMI fell to 61.7 in August, backing off from the record high of 64.1 in Jul, but largely in line with market expectations (BBG: 61.7)

- Employment was little changed, down just 0.1, while Prices fell sharply, down 6.9 points from admittedly elevated levels.

MARKET SNAPSHOT

DJIA down 40.34 points (-0.11%) at 35405.38

- S&P E-Mini Future up 1.5 points (0.03%) at 4536.5

- Nasdaq up 23 points (0.2%) at 15352.56

- US 10-Yr yield is up 3.9 bps at 1.3223%

- US Dec 10Y are down 5.5/32 at 133-11.5

- EURUSD up 0.0015 (0.13%) at 1.189

- USDJPY down 0.29 (-0.26%) at 109.65

- WTI Crude Oil (front-month) down $0.84 (-1.2%) at $69.14

- Gold is up $20.64 (1.14%) at $1830.37

- EuroStoxx 50 down 30.12 points (-0.71%) at 4201.98

- FTSE 100 down 25.55 points (-0.36%) at 7138.35

- German DAX down 59.39 points (-0.37%) at 15781.2

- French CAC 40 down 73.09 points (-1.08%) at 6689.99

US TSYS: Big Jobs Miss Not Big Enough to Forestall Late 2021 Taper

Big miss from forecasters on Aug jobs data (+235k vs.+725k est) and Big initial ranges in the minutes following Friday's early headline data.- Tsys initially gapped higher/broke range on the large data miss (July up-revision to +1.053M vs. +943k did little to temper the move. Tsys completely reverse post-data gap bid and extend session lows w/yld curves bear steepening to new highs shortly after. It took a little while to explain (justify?) moves as rates held to lower range.

- General agreement: on one hand the weaker than expected Aug jobs gain will forestall any taper annc at the Sep FOMC, RBS/NatWest economists said. On the other, it's still a +235k gain -- not small enough for the Fed "to back away from their 'this year' signal either."

- Wrightson economists downplayed any covid-tied lag to low job gains, positing the slowdown more likely due to "resumption of in-person school attendance along with the expiration of emergency unemployment benefits will boost labor supply in the months ahead, resulting in larger payroll gains in future months."

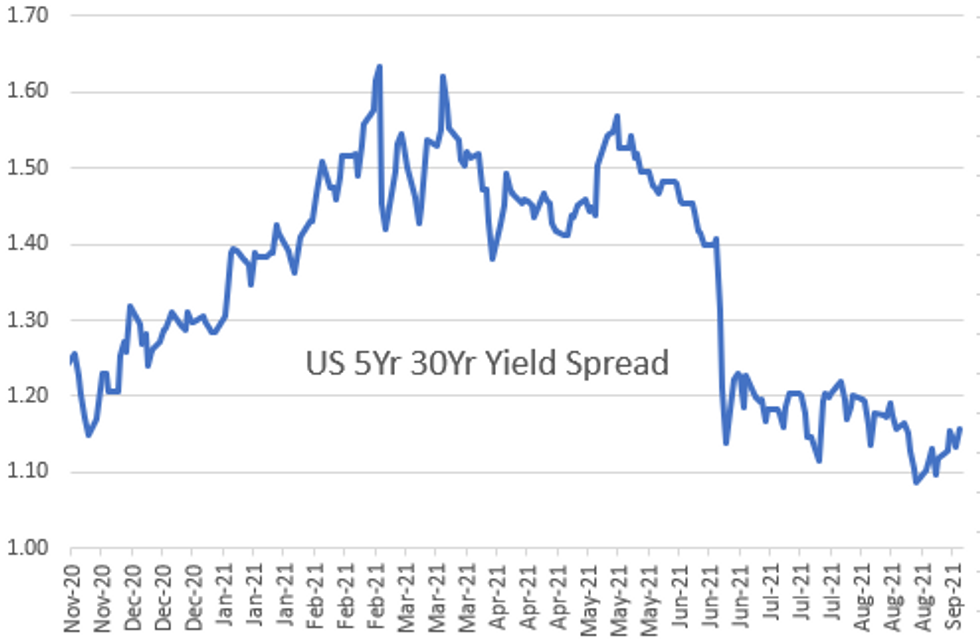

- The 2-Yr yield is up 0.1bps at 0.2061%, 5-Yr is up 2.1bps at 0.7852%, 10-Yr is up 3.9bps at 1.3223%, and 30-Yr is up 4.5bps at 1.942%.

US TSY FUTURES CLOSE

- 3M10Y +3.458, 127.249 (L: 121.356 / H: 128.855)

- 2Y10Y +3.665, 111.261 (L: 106.357 / H: 112.811)

- 2Y30Y +4.506, 173.254 (L: 168.495 / H: 174.55)

- 5Y30Y +2.428, 115.534 (L: 110.871 / H: 117.067)

- Current futures levels:

- Dec 2Y up 0.375/32 at 110-5.375 (L: 110-05 / H: 110-06.25)

- Dec 5Y down 0.75/32 at 123-22 (L: 123-21 / H: 123-30)

- Dec 10Y down 5/32 at 133-12 (L: 133-08 / H: 133-28)

- Dec 30Y down 17/32 at 162-28 (L: 162-17 / H: 164-00)

- Dec Ultra 30Y down 1-8/32 at 196-26 (L: 196-11 / H: 199-08)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.880

- Dec 21 steady at 99.825

- Mar 22 -0.005 at 99.850

- Jun 22 steady at 99.815

- Red Pack (Sep 22-Jun 23) +0.005 to +0.015

- Green Pack (Sep 23-Jun 24) -0.01 to +0.005

- Blue Pack (Sep 24-Jun 25) -0.025 to -0.02

- Gold Pack (Sep 25-Jun 26) -0.045 to -0.03

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N -0.00275 at 0.07075% (-0.00538/wk)

- 1 Month +0.00000 to 0.08288% (-0.00313/wk)

- 3 Month -0.00213 to 0.11550% (-0.00438/wk) ** New Record Low

- 6 Month +0.00075 to 0.14838% (-0.00638/wk)

- 1 Year +0.00000 to 0.22275% (-0.01238/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $952B

- Broad General Collateral Rate (BGCR): 0.05%, $397B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $360B

- (rate, volume levels reflect prior session)

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

- Tue 9/07 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 9/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Thu 9/09 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 09/10 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage climbs to 1,074.707B from 74 counter-parties vs. $1,066.987B Thursday. Record high of $1,189.616B set Tuesday, Aug 31.

PIPELINE: Issuers Sidelined Ahead August NFP

- Date $MM Issuer (Priced *, Launch #)

- 09/03 No new high grade debt issuance scheduled ahead NFP, to resume following extended holiday weekend

- $7.025B to price Thursday

- 09/02 $5B *World Bank 7Y +6

- 09/02 $1.025B *Japan Tobacco $625M 10Y +97.5, $400M 30Y 3.3%

- 09/02 $500M *China Development Bank 3Y Green +23

- 09/02 $500M *Contemporary Amperex Tech 5Y +85

- 09/02 $Benchmark Ahli United Bank 5Y +200a

FOREX: NFP Miss Extends Greenback Losing Streak

- The lower than forecast print for non-farm payrolls of 235k prompted a quick move lower in the greenback. Despite the initial moves reversing quite quickly, the dollar index remained under pressure throughout the US session settling around 0.25% lower for Friday.

- The move lower in the DXY extends its losing streak to 6 days and notably the index has fallen on 10 of the past 11 trading sessions.

- Antipodean FX tops the G10 pile on Friday with both AUD and NZD firming 0.8%. Despite the majority of the gains coming before the US data, the weaker numbers kept both currency pairs on the front foot to close the week.

- EURUSD spiked to noted resistance at 1.1909, matching with the July 30th highs. The single currency traded back down to around 1.1875 ahead of option expiries and the WMR fix, however, broad dollar pressure leaves the pair hovering just under the 1.19 mark ahead of the close.

- USDJPY fell firmly back below 110, with the move lower in equity indices adding some buoyancy to the Japanese Yen.

- CNY, CNH strength this week has put the redback at its strongest levels against the USD since mid-June, infitting with the weaker dollar theme since the Monday open.

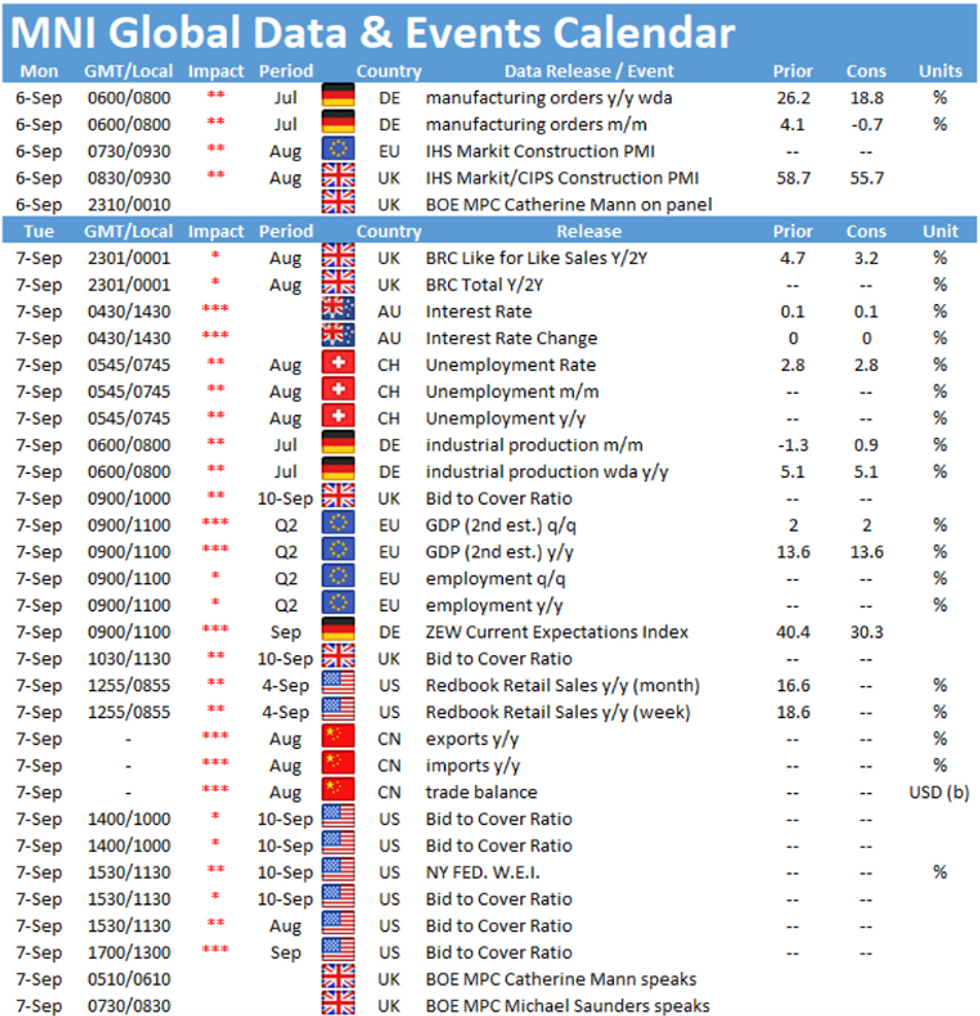

- US and Canadian Labor Day holiday on Monday. Markets will focus on key central bank meetings next week, including the RBA, BOC and Thursday's ECB decision. The week will be capped off by Canadian employment figures and US PPI data.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.