-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Month-End Risk-Off

EXECUTIVE SUMMARY

- MNI: St. Louis Fed Model Sees Loss of 818k Jobs in September

- MNI BRIEF: Fed's Evans Says Underlying Inflation May Lag 2%

- MNI BRIEF: Atlanta Fed Bostic Sees Four Hikes Thru 2023

- US DATA: MNI Chicago Business Barometer Slips in September to 64.7

US

FED: Atlanta Fed President Raphael Bostic said Thursday the conditions needed to begin tapering the central bank's asset purchases have been achieved and he now sees four rate hikes through 2023.

- "We can really begin to pull back some of the emergency policy that we've had and that would be starting the taper soon." Bostic , an FOMC voter this year, told reporters on a call. He continues to see liftoff "later in the year 2022," but has upped his view for 2023, now seeing three additional hikes in 2023.

- "For 2023 I've actually added one more increase so there are three increases in my forecast," he said. "In part this is because in my models are having the economy operating very strong through 2022 and nearing full employment by the end of 2022 such that there won't be impediments to normalization in 2023."

- Bostic, who sees the neutral rate at 2.5%, said he doesn't see rates getting to neutral before the end of 2024. The Atlanta Fed chief also added that while there have been sharp increases in short-term price expectations, signs from long-run expectations suggest expectations remain anchored.

- The model forecasts changes in employment as measured by the BLS's household survey, which tracks closely the headline payrolls figures from the BLS's establishment survey. A smaller drop of 500,000 jobs was forecast by the model without seasonal adjustment, the worst since January. For more see MNI Policy main wire at 1223ET.

- "I still see underlying inflation as below 2% and not enough lift being done with wage and price growth," Evans said during a webinar with Princeton University professor Markus Brunnermeier. Evans reiterated that tapering will be justified around the end of this year and done around the middle of next year, with one rate increase in 2023.

OVERNIGHT DATA

- US JOBLESS CLAIMS +11K TO 362K IN SEP 25 WK

- US PREV JOBLESS CLAIMS REVISED TO 351K IN SEP 18 WK

- US CONTINUING CLAIMS -0.018M to 2.802M IN SEP 18 WK

- US Q2 GDP +6.7%

- MNI CHICAGO BUSINESS BAROMETER 64.7 SEP V 66.8 AUG

- MNI CHICAGO: ORDER BACKLOGS AT 61.1; LOWEST SINCE MARCH

- MNI CHICAGO: EMPLOYMENT AT 52.4; HIGHEST SINCE APRIL

- MNI CHICAGO: PRODUCTION 60.7 SEP V 61 AUG

- Survey respondents told MNI freight difficulties and the available supply of raw materials continue to hamper production, which fell 0.3 points to 60.7, the lowest level since June.

- Order Backlogs saw the largest decline through the month, dropping 20.5 points to a six-month low of 61.1 as supply shortages weighed heavily on production.

- That was followed by Supplier Deliveries, which sank 11.6 points to 81.2, the lowest level since March. Firms reported worsening port congestion and ongoing problems with ocean, rail, trucking, and even air cargo. New Orders were also down in September, falling 3.4 points to a six-month low of 64.4, suggesting demand through the month rose at a much slower pace compared to August.

- Prices paid eased by 3.2 points to a four-month low of 90.7.

- Meanwhile, Employment rose 4.1 points to 52.4, the highest level since April. Companies reported fewer difficulties finding available workers compared to previous months, though those workers weren't always qualified for open positions.

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 323.09 points (-0.94%) at 34133.96

- S&P E-Mini Future down 20.75 points (-0.48%) at 4337.75

- Nasdaq up 31.7 points (0.2%) at 14573.47

- US 10-Yr yield is up 0.4 bps at 1.5202%

- US Dec 10Y are up 7/32 at 131-22

- EURUSD down 0.0015 (-0.13%) at 1.1576

- USDJPY down 0.59 (-0.53%) at 111.43

- WTI Crude Oil (front-month) up $0.25 (0.33%) at $75.23

- Gold is up $31.77 (1.84%) at $1756.18

- EuroStoxx 50 down 32.14 points (-0.79%) at 4048.08

- FTSE 100 down 21.74 points (-0.31%) at 7086.42

- German DAX down 104.58 points (-0.68%) at 15260.69

- French CAC 40 down 40.79 points (-0.62%) at 6520.01

US TSYS: Mnth/Qtr-End Buying Tsys, Equities Weak; Funding Bill Passes Senate

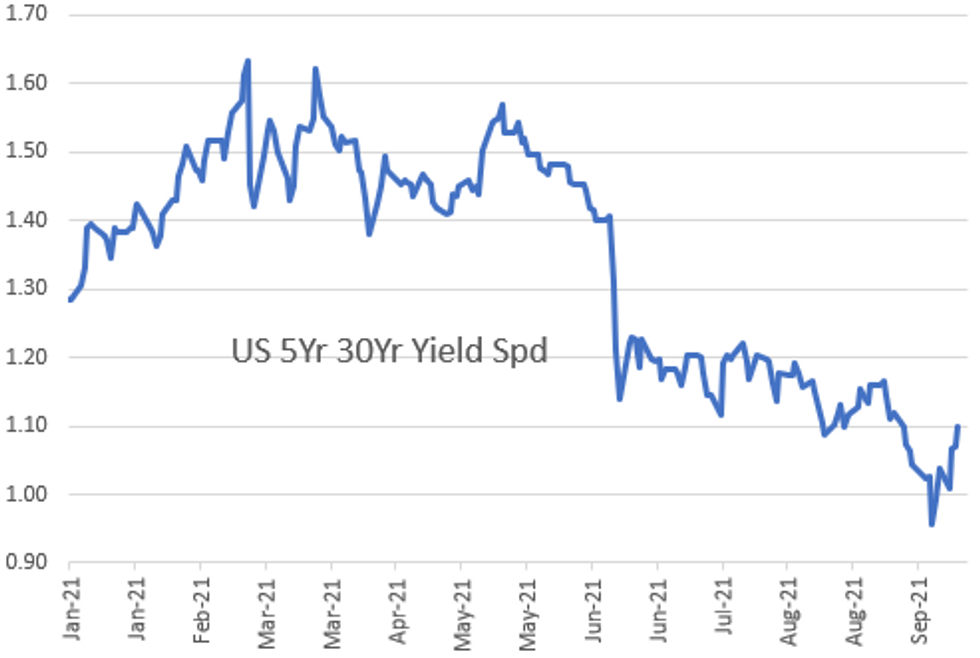

No month/quarter-end fireworks after Thursday's closing bell, Tsy futures mildly higher/near middle session range, equities attempting to pare losses with another hour to go in the session (ESZ1 -15.0). Yield curves managed to steepen, 5s30s +2.8 at 109.5 after the bell.- Not much of a react to weekly claims +11K to 362k. Still expansive: MNI Chicago Business Barometer fell 2.1 points in September to 64.7, the lowest reading February after declining to 66.8 in August. Not much of a react to Fed speakers including Fed Chair Powell and Tsy Sec Yellen as they testified to House panel.

- Though it didn't roil markets, focus on stopgap bill to fund US Govt through Dec 3 had passed in the Senate and was off to the House for another vote.

- Sources reported prop and fast$ buying in intermediates, short term plays to get ahead of month end buying from real$. Though duration estimates were not exceptionally large (US Tsy +0.7Y), TYZ1 saw decent buying from 131-19 to -22.5 after the bell.

- Swap spds widened in shorts to intermediates on decent rate paying in 2s-7s around midmorning. Limited deal-tied hedging while Sep looked to finish month w/just over $215B high-grade corporate debt issued, third largest for the year.

- The 2-Yr yield is down 0.2bps at 0.2873%, 5-Yr is down 0.3bps at 0.9874%, 10-Yr is up 0.4bps at 1.5202%, and 30-Yr is up 2.4bps at 2.0846%.

MONTH-END EXTENSIONS: PRELIMINARY Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y, real extension 0.04Y; US Gov inflation linked 0.01Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.07 | 0.09 | 0.1 |

| Agencies | 0.08 | 0.06 | 0.05 |

| Credit | 0.09 | 0.12 | 0.11 |

| Govt/Credit | 0.07 | 0.1 | 0.09 |

| MBS | 0.09 | 0.07 | 0.09 |

| Aggregate | 0.09 | 0.09 | 0.09 |

| Long Gov/Cr | 0.06 | 0.08 | 0.12 |

| Iterm Credit | 0.07 | 0.1 | 0.1 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.12 | 0.12 |

US TSY FUTURES CLOSE

- 3M10Y +0.353, 148.471 (L: 146.398 / H: 151.771)

- 2Y10Y +0.74, 123.094 (L: 121.142 / H: 125.351)

- 2Y30Y +2.663, 179.463 (L: 175.536 / H: 181.179)

- 5Y30Y +2.753, 109.485 (L: 105.605 / H: 110.164)

- Current futures levels:

- Dec 2Y up 0.75/32 at 110-1 (L: 110-00 / H: 110-01)

- Dec 5Y up 3.75/32 at 122-24.75 (L: 122-18.25 / H: 122-25.25)

- Dec 10Y up 7/32 at 131-22 (L: 131-11 / H: 131-23.5)

- Dec 30Y up 7/32 at 159-10 (L: 158-26 / H: 159-27)

- Dec Ultra 30Y up 3/32 at 191-10 (L: 190-22 / H: 192-18)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.015 at 99.835

- Mar 22 +0.010 at 99.855

- Jun 22 +0.010 at 99.795

- Sep 22 +0.010 at 99.685

- Red Pack (Dec 22-Sep 23) +0.010 to +0.020

- Green Pack (Dec 23-Sep 24) +0.020 to +0.030

- Blue Pack (Dec 24-Sep 25) +0.030

- Gold Pack (Dec 25-Sep 26) +0.025 to +0.030

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00438 at 0.07463% (-0.00213/wk)

- 1 Month -0.00213 to 0.08025% (-0.00488/wk)

- 3 Month -0.00075 to 0.13013% (-0.00212/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00112 to 0.15850% (+0.00312/wk)

- 1 Year -0.00400 to 0.23663% (+0.00700/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $872B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $340B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $8.298B submission

- Next scheduled purchase

- Fri 10/01 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.425B

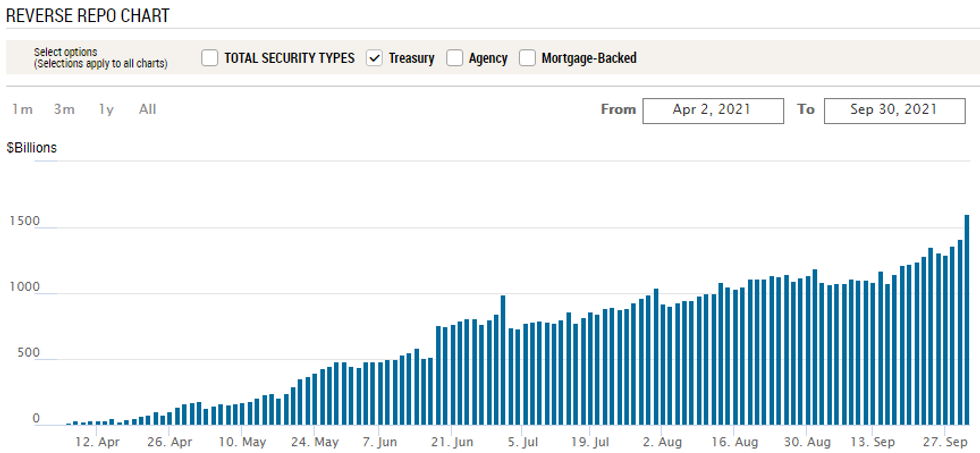

Fed: Record Reverse Repo Operation, Headed to $2T?

NY Federal Reserve

NY Fed reverse repo usage climbs to another new record high: $1,604.881B today while counter-parties jump to 92. Wednesday's prior record was $1,415.840B. At this pace, reverse repo usage will be over $2T by next week!

PIPELINE: Sep Issuance Third Highest for 2021

Sep 2021 total issuance at $215.635B -- could go higher but nothing on tap Thursday as issuers glide into quarter-end. This month's issuance third highest for 2021, behind March with $232.62B and January with $227.55B. Current month surpassed Sep '20 total of $207.82B.

- Date $MM Issuer (Priced *, Launch #)

- 09/30 No new issuance Thursday

- $6.25B Priced Wednesday; $28.6B/wk; $215.635B

- 09/29 $1.5B *Enbridge $500M each: 2Y +30, $5Y +60, 08/01/51 tap +125

- 09/29 $1.25B *SEK (Swedish Export Cr) 3Y SOFR +17

- 09/29 $1.15B *Athene $650M 5Y +73, $500M 5Y FRN/SOFR, 10Y +110

- 09/29 $1B *Everest Reinsurance 31Y +115

- 09/29 $750M *APICORP 5Y Green +40

- 09/29 $600M *Bank of Nova Scotia 60NC5 3.625%

EGBs-GILTS CASH CLOSE: Gilts Underperform Bunds Again

Gilts underperformed Bunds again, with the long end of both the UK and German curves weakening, despite weaker equities, and some anticipation that large month-end extensions would be supportive.

- The spread of 10Y Gilts/Bunds hit a fresh 5-year high, as yields hit fresh multi-month highs.

- Meanwhile periphery EGBs traded mixed, with Italy and Spain spreads widening, and Greece and Portugal tightening.

- Eurozone CPI data (France, Italy, Germany) was largely in line w expectations albeit mostly at multi-year highs, while UK Q2 GDP was revised up 0.7pp to 5.5%.

- Final Eurozone PMIs feature Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.688%, 5-Yr is up 0.1bps at -0.557%, 10-Yr is up 1.2bps at -0.201%, and 30-Yr is up 2.4bps at 0.275%.

- UK: The 2-Yr yield is up 0.4bps at 0.409%, 5-Yr is up 1.1bps at 0.636%, 10-Yr is up 3bps at 1.021%, and 30-Yr is up 3.7bps at 1.372%.

- Italian BTP spread up 1.9bps at 105.6bps / Spanish up 0.8bps at 65.9bps

FOREX: Single Currency Spirals as Month-, Quarter-End Boosts Volatility

- The EUR was comfortably the poorest performer in G10 Thursday, with EUR/USD extending the downtrend into month- and quarter-end despite the pullback in the USD Index. EUR/USD cleared 1.16 with conviction, touching the lowest levels since mid-July.

- GBP saw some very modest reprieve after two consecutive sessions of heavy selling pressure. GBP/USD tested the week's lows of 1.3412 briefly, before recovering off the mat to trade with minor gains following the London fix.

- In early US trade, USD strength was again the theme, helping the USD Index climb to fresh 2021 highs of 94.503. This faded through the Wall Street open, but the there's little sign yet of any bearish reversal. This keeps upside targets intact at 94.469 (the 38.2% Fib for the 2020 - 2021 downtick) and the late September highs of 94.742.

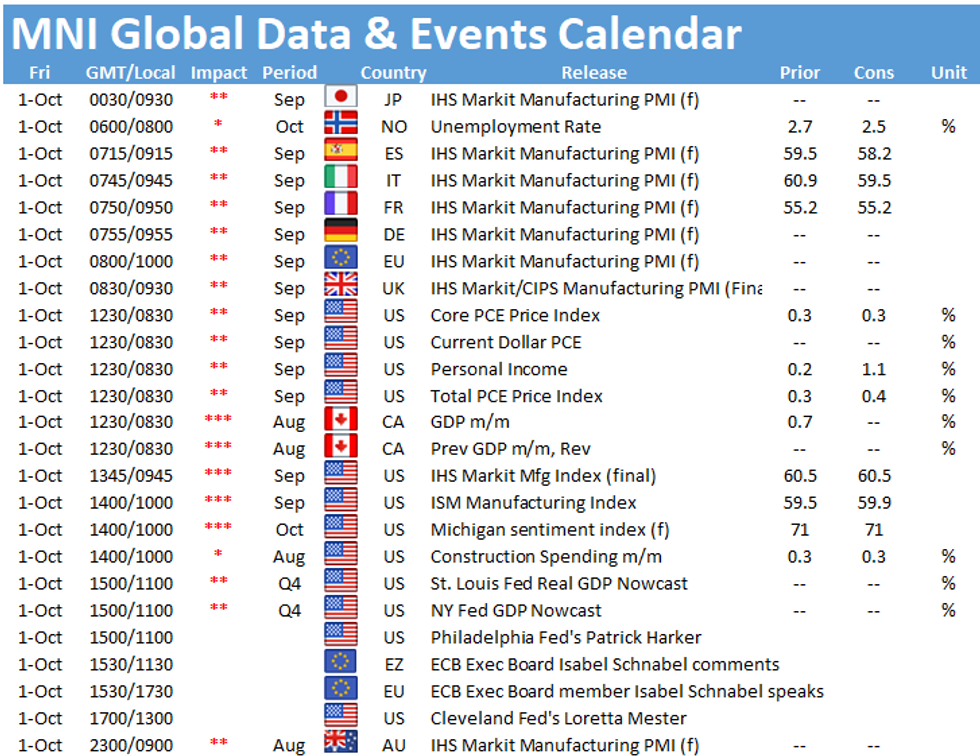

- Focus Friday turns to Japan's Tankan survey, US personal income/spending data and Canadian GDP. Fed's Harker & Mester and ECB's Schnabel are due to speak.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.