-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Ylds Recede Ahead Week's Key Employ Data

EXECUTIVE SUMMARY

- MNI INTERVIEW: Higher Pay for US Job Switchers Likely to Last

- MNI INTERVIEW: Scarcity Fear is Creating Artificial Demand-ISM

- US Tsys: Yields Could Rise Much Further In Debt Ceiling Standoff

- USTR TO SAY CHINA NOT IN COMPLIANCE WITH PHASE 1 DEAL: CNBC, Bbg

- USTR EVALUATING ACTIONS OVER CHINA'S NON-COMPLIANCE: CNBC, Bbg

US

FED: Higher wages for U.S. workers moving to new jobs are here to stay, Atlanta Fed economist John Robertson told MNI, with companies desperate to find staff and the supply of available employees held back by childcare shortages and fears of contracting Covid at work.

- "When job openings are high, the rate of vacancies are high, and you'll see pretty strong wage growth amongst people who change jobs," he said.

- Hourly wages for job switchers rose 4.1% in August from a year earlier, according to the Atlanta Fed's wage tracker, which uses microdata from the Bureau of Labor Statistics' monthly jobs report. Year-over-year earnings for job stayers trailed by a full percentage point. The more recent trend is even more pronounced, with wage gains for job switchers averaging 4.8% over the last three months, the highest since 2007.

- "I've heard some ugly stories. Chip delay times are out to a year now, steel is out to four to five months, and so some are placing orders today for steel that you want to have delivered to you in February," he said. "Do you really know what your demand is going to be in February?"

- "That's the risk of those extended lead times. It drives up new order levels, and there is essentially artificial demand out there that is pretty much disconnected from what what may happen six, seven, eight months out." For more see MNI Policy main wire at 1425ET.

- Yields could rise much further: in the 2013 debt ceiling crisis for instance, bill yields jumped 40-50bp ahead of a potential default.

- The Oct 17, 2013 bill yield is charted below: it took until Oct 16 to pass a debt ceiling increase (1 day ahead of the assumed drop-dead date). The yield started the month at 2.5bp, and went above 50bp.

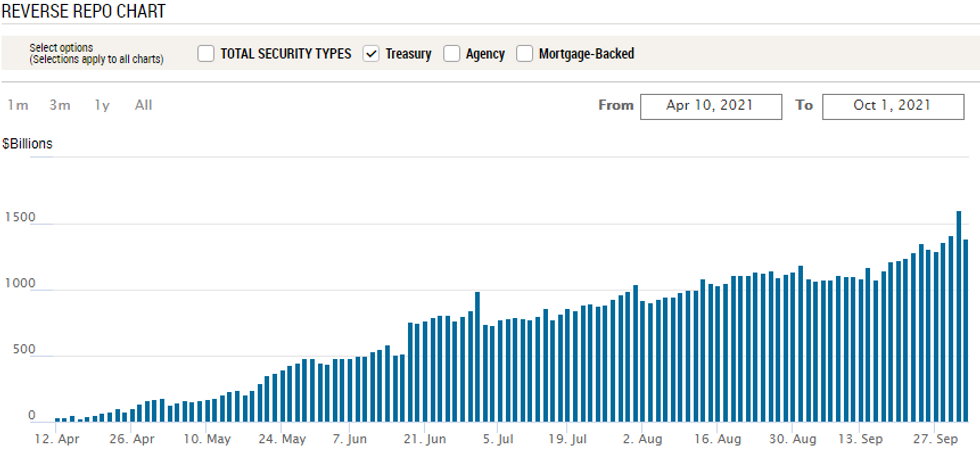

- One big difference this time is that money market funds which usually park money in short-term bills now have the option of using the Fed's reverse repo facility, which is probably going to see strong inflows going into mid-October.

- That's probably positive for market stability ahead of the perceived default date (as investors don't feel compelled to pull their cash from MMFs, causing a knock-on effect into the broader funding space). But it also means there is less incentive to buy those bills - meaning yields could rise much further.

OVERNIGHT DATA

- US SEP PERSONAL INCOME +0.2%; NOM PCE +0.8%

- US SEP PCE PRICE INDEX +0.4%; +4.3% Y/Y

- US SEP CORE PCE PRICE INDEX +0.3%; +3.6% Y/Y

- US SEP UNROUNDED PCE PRICE INDEX +0.401%; CORE +0.335%

- US AUG CONSTRUCT SPENDING +0.0%

- US AUG PRIVATE CONSTRUCT SPENDING -0.1%

- US AUG PUBLIC CONSTRUCT SPENDING +0.5%

- US ISM Sep Manufacturing PMI Rises To 61.1 vs Aug 59.9

- US ISM NEW ORDERS INDEX 66.7 SEP VS 66.7 AUG

- US ISM EMPLOYMENT INDEX 50.2 SEP VS 49.0 AUG

- US ISM PRODUCTION INDEX 59.4 SEP VS 60.0 AUG

- US ISM SUPPLIER DELIVERY INDEX 73.4 SEP VS 69.5 AUG

- US ISM PRICES PAID INDEX 81.2 SEP VS 79.4 AUG (NSA)

- The ISM Mfg PMI +1.2pt in Sep to 61.1, continuing recovery from July lowest lvl since Jan, beat 59.5 est

- Aug uptick led by increase of Employment (+1.2pt) and supplier deliveries (+3.9pt). Prices also rose (+1.8pt).

- Production edged lower after two consecutive gains that followed three months of declines

- CANADA JUL GROSS DOMESTIC PRODUCT -0.1% MOM

- CANADA JUL GOODS INDUSTRY GDP -1.4%, SERVICES +0.4%

- CANADA REVISED JUN GROSS DOMESTIC PRODUCT +0.6% MOM

- CANADIAN AUG FLASH GDP +0.7% MOM

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 539.5 points (1.59%) at 34381.69

- S&P E-Mini Future up 56 points (1.3%) at 4354.25

- Nasdaq up 128.2 points (0.9%) at 14577.41

- US 10-Yr yield is down 2.4 bps at 1.4633%

- US Dec 10Y are up 18.5/32 at 132-6

- EURUSD up 0.0018 (0.16%) at 1.1599

- USDJPY down 0.24 (-0.22%) at 111.05

- WTI Crude Oil (front-month) up $0.71 (0.95%) at $75.74

- Gold is up $2.2 (0.13%) at $1759.15

- EuroStoxx 50 down 12.78 points (-0.32%) at 4035.3

- FTSE 100 down 59.35 points (-0.84%) at 7027.07

- German DAX down 104.25 points (-0.68%) at 15156.44

- French CAC 40 down 2.32 points (-0.04%) at 6517.69

US TSYS: Late Bond Surge Extends Session Highs, Pricing in Employ Miss?

Long end 30Y Bond futures surged to new session highs heading into the close, 30YY slipped to 2.0329% low, before retracing slightly. No specific driver or headline for the move. White House officials say Pres Biden to "meet with the House Democratic caucus about his legislative agenda at 1530ET.- Rather muted start to new month/quarter -- end to the week as interest in next week Friday's Sep employment report heats up. Current mean estimate holding around +500k job gains, from a dozen economists polled by Bbg.

- Stark contrast to potential for a huge tail event miss of as much as -818k MNI reported as estimated by StL Fed economist Max Dvorkin late Thursday. Excerpt:

- U.S. hiring in September "could be weak or even negative" in September, according to a St. Louis Fed analysis of real-time employment data from the scheduling software company Homebase, showing a seasonally-adjusted decline of 818,000 jobs, a St. Louis Fed economist told MNI.

- The model forecasts changes in employment as measured by the BLS's household survey, which tracks closely the headline payrolls figures from the BLS's establishment survey. A smaller drop of 500,000 jobs was forecast by the model without seasonal adjustment, the worst since January.

- Exercising caution, decent amount of position squaring well ahead the data. If a huge miss occurs, rates will retrace higher as tapering expectations are priced out of the curve. A large upside beat -- tapering remains in play and perhaps accelerates timing of rate hikes. By the bell, 2-Yr yield is down 1.2bps at 0.2638%, 5-Yr is down 3.4bps at 0.9312%, 10-Yr is down 2.4bps at 1.4633%, and 30-Yr is down 0.9bps at 2.0357%.

US TSY FUTURES CLOSE

- 3M10Y -1.203, 143.472 (L: 142.609 / H: 146.517)

- 2Y10Y -0.342, 120.445 (L: 119.406 / H: 122.943)

- 2Y30Y +0.945, 177.487 (L: 175.473 / H: 180.564)

- 5Y30Y +2.945, 110.62 (L: 106.947 / H: 113.006)

- Current futures levels:

- Dec 2Y up 1.625/32 at 110-2.5 (L: 110-01.375 / H: 110-02.75)

- Dec 5Y up 10/32 at 123-1.75 (L: 122-25.75 / H: 123-02.25)

- Dec 10Y up 17/32 at 132-4.5 (L: 131-24 / H: 132-06)

- Dec 30Y up 1-01/32 at 160-7 (L: 159-18 / H: 160-14)

- Dec Ultra 30Y up 1-26/32 at 192-28 (L: 191-19 / H: 193-05)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.005 at 99.825

- Mar 22 steady00 at 99.855

- Jun 22 +0.005 at 99.80

- Sep 22 +0.015 at 99.70

- Red Pack (Dec 22-Sep 23) +0.020 to +0.055

- Green Pack (Dec 23-Sep 24) +0.055 to +0.080

- Blue Pack (Dec 24-Sep 25) +0.080 to +0.085

- Gold Pack (Dec 25-Sep 26) +0.080 to +0.085

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N -0.00025 at 0.07438% (-0.00238/wk)

- 1 Month -0.00500 to 0.07525% (-0.00988/wk)

- 3 Month +0.00300 to 0.13313% (+0.00088/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00150 to 0.15700% (+0.00162/wk)

- 1 Year -0.00175 to 0.23488% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $52B

- Daily Overnight Bank Funding Rate: 0.06% volume: $137B

- Secured Overnight Financing Rate (SOFR): 0.05%, $939B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $322B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $14.378B submission

- Next scheduled purchases

- Mon 10/04 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 10/05 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Wed 10/06 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/07 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

Fed: Reverse Repo Operation Usage Decline As New Month Gets Underway

NY Fed reverse repo usage declines to $1,385.991B from 75 counterparties vs. Thursday's record high $1,604.881B.

EGBs-GILTS CASH CLOSE: Gilts Underperform Again To Close The Week

Gilts were stronger Friday but underperformed Bunds yet again, with periphery EGB spreads tighter to end the week.

- Price action came on strong volumes and was dictated largely by weaker equities setting a risk-off tone, with largely in-line PMI and inflation data not moving the needle much in the morning. That said, a strong US ISM number saw core FI weaken in the European afternoon.

- The 10Y segment on both the German and UK curves outperformed, with the Gilt/Bund spread widening to a fresh 5-yr high (124bp at one point).

- After hours Friday, S&P rates France. The ESM, Austria, Germany, Spain, France and Belgium are all due to issue bonds next week, while Industrial Production data takes centre stage.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.5bps at -0.704%, 5-Yr is down 2.3bps at -0.579%, 10-Yr is down 2.3bps at -0.222%, and 30-Yr is down 1.7bps at 0.259%.

- UK: The 2-Yr yield is down 0.6bps at 0.404%, 5-Yr is down 0.9bps at 0.629%, 10-Yr is down 1.4bps at 1.008%, and 30-Yr is down 0.2bps at 1.372%.

- Italian BTP spread down 1.9bps at 103.8bps / Spanish down 1bps at 64.8bps

FOREX: USD Secures Fourth Weekly Gain

- Despite a pullback into the Friday close, the greenback secured a fourth consecutive weekly gain, with the USD Index holding above the 94 handle well into the close. Friday's modest pullback put the greenback at the bottom of the G10 pile amid mild profit-taking, shrugging off better-than-expected PCE and ISM Manufacturing figures.

- Currencies among the hardest hit this week managed to bounce smartly into the Friday close, with NOK and GBP among the strongest performers Friday, but among the weakest performers on the week.

- Equity markets were mixed Friday, with a slip lower in headline European indices helping support JPY for much of the session, a trend which cemented itself further with the show back below Y111.00.

- Focus in the coming week turns to the nonfarm payrolls release for September, which could seal the Fed's intentions to taper asset purchases ahead of the end of 2021. Rate decisions from the Australian and Indian central banks are also due.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.