-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI ASIA OPEN: Closer To Debt Limit Extension

EXECUTIVE SUMMARY

- MNI: Debt Limit Extension Green Light

- MNI: ECB Floating New Bond Buying Scheme

- PUTIN: RUSSIA READY TO HELP STABILIZE ENERGY MARKETS

- PUTIN: GAZPROM GAS SUPPLIES TO EUROPE MAY REACH NEW RECORD

US

US: Debt Limit Extension Green Light. No market reaction to latest headlines re: extending debt limit. Sen Rep Leader McConnell: WILL ALLOW EMERGENCY DEBT LIMIT EXTENSION INTO DEC .. with the caveat "BIPARTISAN TALKS POSSIBLE IF DEMOCRATS STOP SPENDING" Bbg.

- Secondly, "WE WILL ALLOW THE DEMOCRATS TO USE NORMAL PROCEDURES TO PASS THE EMERGENCY DEBT LIMIT EXTENSION INTO DECEMBER" Rtrs

- On the high-side, Morgan Stanley economists expect a gain of 700,000 in September "after rising by 235k in August. Within this forecast, we expect that private payrolls rose by 540k". On unemployment, MS expects "gains in employment and participation lowered the unemployment rate slightly to 5.1% in September from 5.2% in August."

- While Jefferies economists note a "pickup in high-contact activity .. restaurant bookings, domestic flight activity and hotel occupancy rates .. it's unlikely to be captured in September payrolls." Therefore Jefferies expects "another tepid employment report. We expect only a 300k increase, with outright contractions in leisure & hospitality and retail. This appears to be a delayed response to Delta, and is likely to prove temporary."

ECB Floating New Bond Buying Scheme

Latest Bbg headlines on post-PEPP bond-buying:- ECB IS SAID TO STUDY NEW BOND-BUYING PLAN FOR WHEN PEPP ENDS

- ECB'S NEW BOND-BUYING PROGRAM WOULDN'T BE TIED TO CAPITAL KEY

- ECB HASN'T TAKEN DECISION ON NEW BOND-BUYING PLAN

- ECB'S NEW PROGRAM WOULD COMPLEMENT OLDER ASSET PURCHASE PLAN

- ECB IS SAID TO STUDY NEW PLAN TO PREVENT WIDENING OF SPREADS

OVERNIGHT DATA

- US ADP NATL EMPLOYMENT +568K SEP (+430K EXP, +340K PRIOR REV)

- AUG REV TO +340K FROM +374K

- US MBA: REFIS -10% SA; PURCH INDEX -2% SA THRU OCT 1 WK

- US MBA: UNADJ PURCHASE INDEX -13% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.14% VS 3.10% PREV

- US MBA: MARKET COMPOSITE -6.9% SA THRU OCT 01 WK

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 9.08 points (0.03%) at 34322.01

- S&P E-Mini Future up 7.75 points (0.18%) at 4342

- Nasdaq up 44.3 points (0.3%) at 14477.69

- US 10-Yr yield is down 0.5 bps at 1.5206%

- US Dec 10Y are up 0.5/32 at 131-24

- EURUSD down 0.0047 (-0.41%) at 1.1552

- USDJPY down 0.01 (-0.01%) at 111.46

- WTI Crude Oil (front-month) down $1.69 (-2.14%) at $77.24

- Gold is up $3.53 (0.2%) at $1763.65

- EuroStoxx 50 down 52.78 points (-1.3%) at 4012.65

- FTSE 100 down 81.23 points (-1.15%) at 6995.87

- German DAX down 221.16 points (-1.46%) at 14973.33

- French CAC 40 down 83.16 points (-1.26%) at 6493.12

US TSYS: Strong Private Employ Gain A Precursor to Fri's NFP?

Rates trade mixed after the bell, bonds outperforming for much of the session as yield curves scaled back steepening off multi-yr lows over last couple wks (5s30s -2.8 to 109.1). In-turn, equities reversed modest losses to mildly higher after Tsys closed, a surge in global gas prices traded lower, Gold posted modest gains.- Better than expected Sep ADP job gain of +568k vs. +430k est (Aug down revision by 34k to +340k) spurred additional selling in intermediates to long end. Of note is +466K in services jobs highlighted by +226K figure for Leisure and Hospitality (highest since June), suggests Jul-Aug lull is reversing and perhaps further evidence that the Delta Covid variant is not having a particularly significant lasting impact on hiring.

- However, small business employment growth of just +63K suggests very little traction there, with all of the heavy lifting done by large businesses: +390K was the highest since June 2020.

- No market reaction to late headlines re: extending debt limit. Sen Rep Leader McConnell: WILL ALLOW EMERGENCY DEBT LIMIT EXTENSION INTO DEC .. with the caveat "BIPARTISAN TALKS POSSIBLE IF DEMOCRATS STOP SPENDING" Bbg.

- Futures levels see-sawed higher amid fast$, prop acct buying after initial program selling. Decent pick-up in US$ debt issuance from supra-sovereigns including United Arab Emirates pushed high-grade supply over $12B (>$38B since Mon).

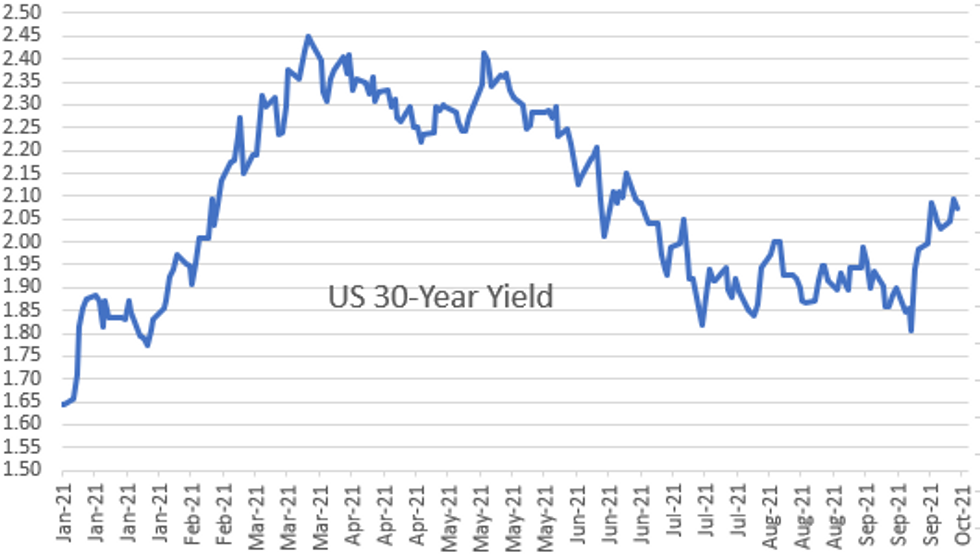

- The 2-Yr yield is up 1bps at 0.2935%, 5-Yr is up 0.8bps at 0.9813%, 10-Yr is down 0.5bps at 1.5206%, and 30-Yr is down 2.1bps at 2.0746%.

US TSY FUTURES CLOSE

- 3M10Y -1.021, 147.499 (L: 145.937 / H: 152.548)

- 2Y10Y -1.312, 122.509 (L: 120.527 / H: 127.952)

- 2Y30Y -2.938, 177.841 (L: 175.614 / H: 185.501)

- 5Y30Y -2.954, 109.1 (L: 107.609 / H: 114.492)

- Current futures levels:

- Dec 2Y down 0.75/32 at 110-0.5 (L: 110-00 / H: 110-01.375)

- Dec 5Y down 1.25/32 at 122-25.75 (L: 122-21 / H: 122-27.25)

- Dec 10Y steady at at 131-23.5 (L: 131-13 / H: 131-27)

- Dec 30Y up 12/32 at 159-17 (L: 158-06 / H: 159-25)

- Dec Ultra 30Y up 28/32 at 191-24 (L: 189-04 / H: 192-09)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.835

- Mar 22 steady at 99.855

- Jun 22 steady at 99.795

- Sep 22 -0.010 at 99.675

- Red Pack (Dec 22-Sep 23) -0.025 to -0.015

- Green Pack (Dec 23-Sep 24) -0.015 to -0.01

- Blue Pack (Dec 24-Sep 25) -0.01 to +0.005

- Gold Pack (Dec 25-Sep 26) +0.010 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00287 at 0.07275% (-0.00162/wk)

- 1 Month +0.00138 to 0.08713% (+0.01188/wk)

- 3 Month +0.00000 to 0.12400% (-0.00913/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00100 to 0.15613% (-0.00088/wk)

- 1 Year +0.00425 to 0.24113% (+0.00625/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.05%, $916B

- Broad General Collateral Rate (BGCR): 0.05%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $344B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.838B submission

- Next scheduled purchases

- Thu 10/07 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

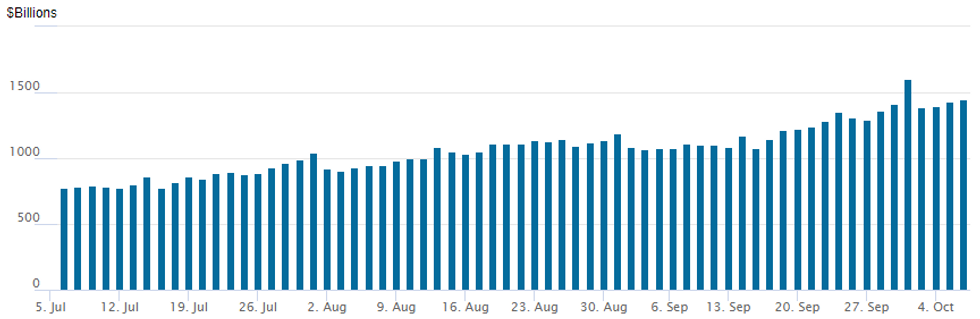

FED Reverse Repo Operation, Climb Continues

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,451.175B from 83 counterparties vs. Tuesday's $1.431.180B. Compares to Thursday, September 30 record high of $1,604.881B.

PIPELINE: $3B Macquarie 4Pt Launched

Pushes total issuance for Wednesday to $12.25B

- Date $MM Issuer (Priced *, Launch #)

- 10/06 $4B #United Arab Emirates $1B 10Y +70, $1B 20Y +105, $2B 40Y Formosa 3.25%

- 10/06 $3B #Macquarie Group $850M 4NC3 +67, $400M 4NC3 FRN/SOFR +71, $500M 6.5NC5.5 +95, $1.25B 11.25NC10.25 +135

- 10/06 $3B #Pepsico 10Y +47, 20Y +62, 30Y +72 (for comparison, Pepsico issued $6.5B on March 17 '21: $1.5B 5Y +160, $500M 7Y +180, $1.5B 10Y +180, $750M 20Y +190, $1.5B 30Y +200, $750M 40Y +230)

- 10/06 $1B *Ontario WNG 10Y +31

- 10/06 $750B #CCDJ (Quebec) 5Y +17

- 10/06 $500M *Korea 10Y +25

EGBs-GILTS CASH CLOSE: Energy Drives Reversal

Wednesday saw a proverbial "story of two sessions" play out in European FI, with sharp weakness at the open giving way to a significant rally by the afternoon.

- The price action largely centred around energy market dynamics: natgas prices soared to records early, weighing on equities and bonds, but soothing comments on supply by Russia's Putin led gas prices lower and equities/bonds to bounce.

- Just as they underperformed on the energy price spike, Gilts outperformed on the reversal.

- Periphery spreads widened, with Greece underperforming.

- Supply came from the UK (GBP2.5bln Gilt) Germany (E4bln Bobl), Slovakia (E1bln via syndication).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.694%, 5-Yr is up 0.4bps at -0.549%, 10-Yr is up 0.6bps at -0.182%, and 30-Yr is up 0.9bps at 0.301%.

- UK: The 2-Yr yield is up 1.7bps at 0.47%, 5-Yr is up 0.8bps at 0.691%, 10-Yr is down 1.3bps at 1.071%, and 30-Yr is down 2.1bps at 1.428%.

- Italian BTP spread up 2.6bps at 107.4bps / Spanish up 0.5bps at 65.2bps

FOREX: Haven Currencies Gain as Stocks Test Recent Lows

- Haven FX outperformed Wednesday, with JPY, USD and CHF among the session's best performers. Currencies took the lead from equities as US futures indices rolled off the late Tuesday high to narrow in on the recent lows.

- NOK reversed early strength as energy prices performed an about-face. Strength across WTI and Brent crude futures initially propped up the currency, but a larger build than expected in crude stockpiles saw the NOK reverse course to be the weakest among G10 FX.

- AUD/NZD extended the rally off the mid-September low on the RBNZ rate decision, with NZD holding the session's underperformance throughout as the RBNZ failed to commit to an extended tightening cycle. AUD/NZD strengthened to touch 1.0518 - new multi-month highs - before fading.

- Focus turns to German industrial production and weekly US jobless claims, while a number of ECB speakers are also due. There are seven different ECB speeches due, as well as appearances from Fed's Mester and PBoC governor Yi Gang.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.