-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Decent 2Y Sale Acceptance of Two Hikes in 2022

EXECUTIVE SUMMARY

- MNI INTERVIEW: Markets Overestimating Future Rate Hikes-Boivin

- MNI: EU Said Heading For Compromise On UK Euro Clearing

- SEN MANCHIN SAYS SAYS HE THINKS $1.5 TRILLION FOR SPENDING BILL IS "MORE THAN FAIR", Bbg

US

CENTRAL BANKS: Investors betting on rate hikes by the Fed and other major central banks are misreading officials who enshrined greater inflation tolerance even before the pandemic and want to support rebuilding supply networks rather than use the traditional playbook of cooling overheated demand, BlackRock Investment Institute head and former Bank of Canada deputy Jean Boivin told MNI.

- "Central banks at the end of the day will be providing a much more muted response to inflation," Boivin said in an interview. "If central banks were to move with what the market's suggesting now, this is literally like saying we're going to kind of like stop the restart." For more see MNI Policy main wire at 1100ET.

EUROPE

EU: The EU seems to be heading towards a solution for its dispute with London-based clearing houses and banks that would allow for an extension of an equivalence agreement as it seeks a balanced share of euro-denominated clearing between UK and eurozone centres, EU officials and industry sources told MNI.

- The European Commission, charged with negotiating a solution with the big London-based clearing banks, initially took a heavy-handed approach towards encouraging the migration of euro derivative transactions to the single currency bloc. But EU officials now stress that it will be enough if an undefined "critical mass" of cleared positions move to centres in the EU-27. For more see MNI Policy main wire at 1236ET.

US TSYS: Decent 2Y Note Sale Acceptance of Two Rate Hikes in 2022

Yield curves continued to flatten Tuesday, short end underperforming though rate futures finished mixed near late session highs.- Tsys extended session lows after better than expected New Home sales for August surged +14% to 800k; Consumer confidence climbed 113.8 vs. 109.8 in Sep.

- Weakness short lived as rates climbed steadily off post-data lows to session highs midway through the second half. Contributing factors for bounce and renewed curve flattening: Block/buy 7.5k FVZ1 at 121-21.5; Block 2s10s flattener: -13,573 TUZ1 109-21.25 vs. +6,977 TYZ1 130-16.5.

- Tsy futures holding near top of session range/mixed with 2s and 5s still mildly weaker after $60B 2Y note auction's (91282CDD0) small stop with 0.481% high yield vs. 0.482% WI; 2.69x bid-to-cover bounce vs Sep's 2.28x (lowest since 2008) well over five auction avg: 2.54x. Decent performance a sign of acceptance of two rate hikes next year one desk posited.

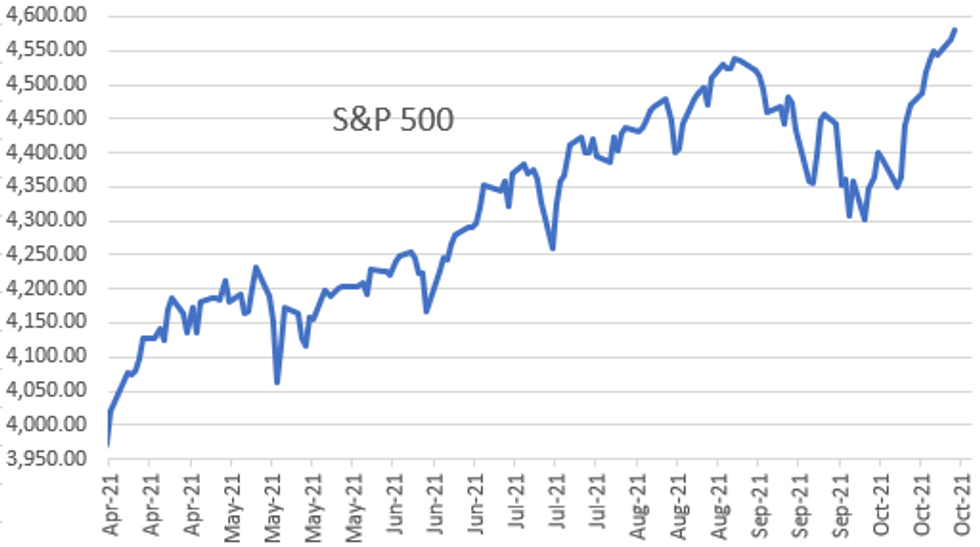

- Equities made new all-time highs (ESZ1 4590.0) after headlines made the rounds the global chip shortage may have crested. US$ posted strong gain as well, DXY +.136 to 93.949 late.

- By the bell, 2-Yr yield is up 1.3bps at 0.4478%, 5-Yr is up 0.8bps at 1.1795%, 10-Yr is down 1.4bps at 1.6167%, and 30-Yr is down 3.2bps at 2.0492%.

OVERNIGHT DATA

- US SEP NEW HOME SALES +14% TO 0.800M SAAR

- US AUG NEW HOME SALES REVISED TO 0.702M SAAR

- US CONF BOARD CONSUMER CONFIDENCE 113.8 IN OCT V SEP 109.8

- US REDBOOK: OCT STORE SALES +15.3% V YR AGO MO

- US REDBOOK: STORE SALES +15.6% WK ENDED OCT 23 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US AUG FHFA HPI SA +1.0% V +1.4% JUL; +18.5% Y/Y

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 68.37 points (0.19%) at 35810.8

- S&P E-Mini Future up 14.25 points (0.31%) at 4572

- Nasdaq up 21.8 points (0.1%) at 15247.79

- US 10-Yr yield is down 1.6 bps at 1.615%

- US Dec 10Y are up 2/32 at 130-20

- EURUSD down 0.0011 (-0.09%) at 1.1597

- USDJPY up 0.42 (0.37%) at 114.13

- WTI Crude Oil (front-month) up $0.79 (0.94%) at $84.57

- Gold is down $14.53 (-0.8%) at $1793.26

- EuroStoxx 50 up 35.66 points (0.85%) at 4223.97

- FTSE 100 up 54.8 points (0.76%) at 7277.62

- German DAX up 157.83 points (1.01%) at 15757.06

- French CAC 40 up 53.64 points (0.8%) at 6766.51

US TSY FUTURES CLOSE

- 3M10Y -1.147, 155.843 (L: 154.906 / H: 159.881)

- 2Y10Y -2.654, 116.688 (L: 116.335 / H: 120.346)

- 2Y30Y -4.452, 159.931 (L: 159.648 / H: 165.395)

- 5Y30Y -3.875, 86.803 (L: 86.567 / H: 91.321)

- Current futures levels:

- Dec 2Y down 0.5/32 at 109-21.625 (L: 109-20.875 / H: 109-22.375)

- Dec 5Y down 1/32 at 121-24.5 (L: 121-20.25 / H: 121-27.25)

- Dec 10Y up 1.5/32 at 130-19.5 (L: 130-11.5 / H: 130-22.5)

- Dec 30Y up 15/32 at 159-0 (L: 158-08 / H: 159-03)

- Dec Ultra 30Y up 1-8/32 at 192-16 (L: 190-28 / H: 192-19)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.010 at 99.805

- Mar 22 steady at 99.780

- Jun 22 steady at 99.625

- Sep 22 -0.010 at 99.445

- Red Pack (Dec 22-Sep 23) -0.02 to -0.01

- Green Pack (Dec 23-Sep 24) -0.01 to steady

- Blue Pack (Dec 24-Sep 25) -0.005 to steady

- Gold Pack (Dec 25-Sep 26) steady to +0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00013 at 0.07163% (-0.00188/wk)

- 1 Month -0.00075 to 0.08700% (-0.00088/wk)

- 3 Month +0.00138 to 0.13588% (+0.01100/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00163 to 0.17625% (+0.00425/wk)

- 1 Year -0.00663 to 0.32275% (+0.00588/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $286B

- Secured Overnight Financing Rate (SOFR): 0.04%, $858B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.691B submission

- Next scheduled purchases

- Wed 10/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 10/29 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

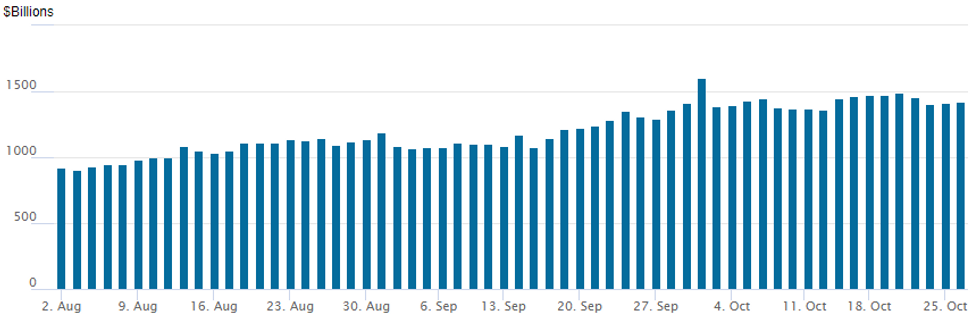

FED Reverse Repo Operation, Inching Higher

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,423.198B from 84 counterparties from $1,413.188B on Monday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Corporate Debt Recap, World Bank Exp Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 10/26 $1.5B #Royal Bank of Canada 10Y +70

- 10/26 $1B Roblox 8.5NC3

- 10/26 $1B *EAA 3Y SOFR+17

- 10/26 $800M #Kinder Morgan $500M 5Y +60, $300M 2051 Tap +150

- 10/26 $750M #Ally Financial 7Y +95

- 10/26 $500M #New York Life 2024 FA backed +18

- Reverse Yankees priced earlier (both upsized slightly since initial guidance):

- 10/26 E1.75B *Morgan Stanley, 11.5NC10.5 +82

- 10/26 E1.1B *Proctor & Gamble, E500M 8.5Y +17, E600M 20Y +40

- Expected to launch Wednesday:

- 10/27 $Benchmark World Bank (IBRD) 10Y +9a

EGBs-GILTS CASH CLOSE: BTPs Reverse

The UK and German curves flattened Tuesday with modest UK outperformance, while periphery spreads widened across the board.

- BTPs underperformed, reversing Tuesday's gains.

- Portugal 10Y spreads also widened amid risks of early elections should the 2022 budget be voted down Wednesday, but the short end rallied on the IGCP announcing a bond exchange tomorrow.

- Little data out today; Spanish factory gate inflation came in at the highest since 1977, while last week, the ECB made the most net asset purchases since mid-July.

- Focus remains on the ECB meeting Thursday (our preview went out Monday), and the BoE next week. UK Budget also of note Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at -0.658%, 5-Yr is up 1.1bps at -0.441%, 10-Yr is down 0.3bps at -0.117%, and 30-Yr is down 2.5bps at 0.244%.

- UK: The 2-Yr yield is down 2.1bps at 0.626%, 5-Yr is down 2bps at 0.8%, 10-Yr is down 3bps at 1.11%, and 30-Yr is down 4.2bps at 1.316%.

- Italian BTP spread up 3.4bps at 111.3bps / Portuguese up 2.9bps at 53.3bps

FORES: USDJPY Creeps Back Above 114.00 As Greenback Holds Narrow Range

- Weakness in the Japanese Yen was the main feature of Tuesday's trading session, comfortably the weakest currency among its G10 counterparts.

- USDJPY edged higher throughout Tuesday, regaining the 114 handle with recent price dips continuing to be considered as corrective and a bullish trend remaining intact. Strong overall sentiment helped AUDJPY lead the way, rising 0.55%.

- GBP had a fairly volatile session following EURGBP breaking to the lowest levels since February 2020 at 0.8403. This coincided with supportive price action in cable, reaching 1.3830 before a strong bid in the dollar prompted a sharp reversal back to unchanged on the day around 1.3765.

- The strong bid in the greenback throughout the US session will likely mean a second consecutive day of gains for the dollar index, albeit with limited ranges overall.

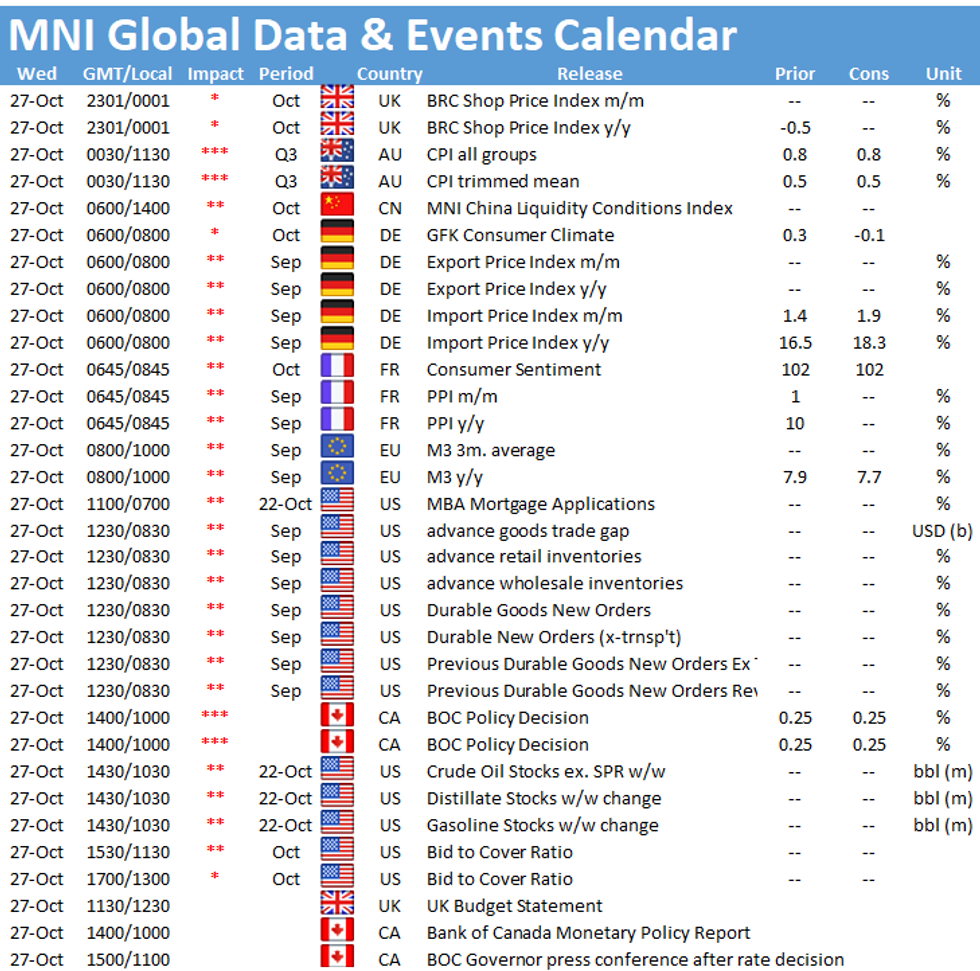

- Australian CPI will be released overnight before the US reports Durable Goods data. The Bank of Canada headlines the latter half of Wednesday's docket. The ECB will meet on Thursday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.