-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Early Geopol Risk Roils, Focus Turns To Fed

MNI ASIA MARKETS ANALYSIS: South Korea Rescinds Martial Law

MNI ASIA OPEN: Rates Hammered on Positive Vaccine Headlines

EXECUTIVE SUMMARY

- MNI: Fed Dots To Signal Two Rate Hikes in 2022, Openness To 3rd

- OMICRON NEUTRALIZED BY THREE PFIZER DOSES IN LAB TESTS, Bbg

- BIONTECH: EXPECT SIGNIFICANT PROTECTION WITH 3 VACCINE DOSES, Bbg

- However: BIONTECH: TOO EARLY TO SAY IF OMICRON VARIANT IS LESS DANGEROUS -- and PFIZER WILL HAVE MORE ACCURATE RESULTS IN 1-2 WEEKS: BOURLA, Bbg

- PFIZER WILL HAVE MORE ACCURATE RESULTS IN 1-2 WEEKS: BOURLA, Bbg

- MNI US MARKETS ANALYSIS - Plan B Sends GBP Spiralling: Global risk sentiment taking a hit as reports suggest that UK Govt to announce stricter Covid restrictions

US

FED: The Federal Reserve’s dot plot next week is likely to show policymakers forecasting at least two interest rate increases for 2022 with some even seeing three if inflation pressures fail to abate, former Fed economists and policymakers told MNI.

- “The December 2021 dot-plot will pencil in two rate hikes in 2022, with the potential for a third if the FOMC anticipates that meaningful inflationary pressures are likely to persist across the year stubbornly,” Rick Roberts, a former New York Fed staffer now at Monmouth University, told MNI.

- That will mark a rapid shift from the Fed’s most recent rate estimates in September, which saw policymakers divided between whether to start hiking interest rates in 2022 or 2023. For more see MNI Policy main wire at 1218ET.

US TSYS: Omicron? There's a Vacc For That

Early whipsaw action Wednesday -- Tsys and Bunds reversed late overnight bid (tied to reports suggested that the UK Govt will announce stricter Covid restrictions in face of Omicron variant) promptly sold off on headlines that a third dose Pfizer, Biontech vaccine "neutralized" Omicron variant in lab tests.- Not quite the risk-on move some had hoped for: equities sat this one out, trading only modestly higher late in the day (EDZ1 +10.5 at 4695.5), Gold gained 2.0 and WTI crude held around 72.40.

- Early trade, trading desks reported domestic real$ buying 2-3s, leveraged accts buying 5s after chunky 5Y futures block sales (-16.9k) and sell-stops triggered on first and second downdrafts.

- Yield curves bear steepened/bonds extending session lows after huge JOLTS openings rate of 11.033M -- near record high, quits rate 2.8%. Equities holding near steady (ESZ1 4685.0 last). Trading desks report domestic and foreign real$ selling 10s and 30s. Central bank bought 2s, contributing to bear steepener.

- Tsy had firmed off session lows in lead-up to the Tsy auction, drew modest two-way after $36B 10Y note re-open (91282CDJ7) tailed slightly:1.518% high yield vs. 1.515% WI; 2.43x bid-to-cover better than last month's 2.35x but still shy a 2.51x 5-month average.

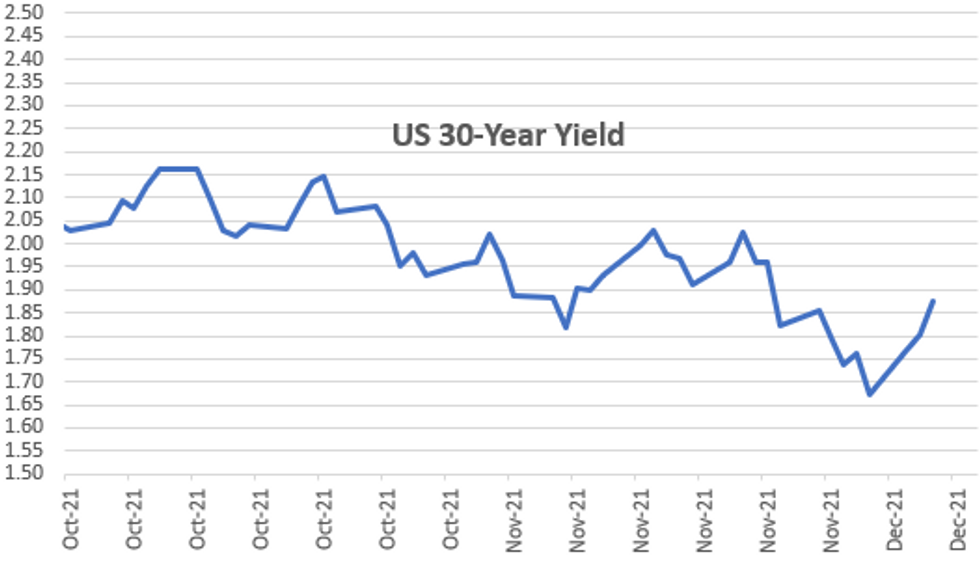

- The 2-Yr yield is down 1.6bps at 0.6735%, 5-Yr is down 0.2bps at 1.2532%, 10-Yr is up 2.9bps at 1.5024%, and 30-Yr is up 6.9bps at 1.8716%.

OVERNIGHT DATA

- US BLS: JOLTS OPENINGS RATE 11.033M IN OCT

- US BLS: JOLTS QUITS RATE 2.8% IN OCT

- BANK OF CANADA HOLDS POLICY INTEREST RATE AT 0.25%

- BOC KEEPS RATE-HIKE GUIDANCE FOR MIDDLE QTRS OF 2022

- BANK OF CANADA MAINTAINS QE IN REINVESTMENT PHASE

- BOC SAYS RECOVERY STILL NEEDS CONSIDERABLE SUPPORT

- BOC SAYS INFLATION TO SLOW TOWARDS 2% IN 2ND HALF OF 2022

- BOC SAYS OMICRON COULD WEIGH ON ECONOMIC GROWTH

- BOC-OMICRON HAS LOWERED GAS PRICES, MAY HIT SUPPLY CHAINS

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 26.51 points (-0.07%) at 35692.46

- S&P E-Mini Future up 5.5 points (0.12%) at 4690.5

- Nasdaq up 71.8 points (0.5%) at 15758.71

- US 10-Yr yield is up 2.9 bps at 1.5024%

- US Mar 10Y are down 2/32 at 130-8.5

- EURUSD up 0.0082 (0.73%) at 1.1349

- USDJPY up 0.04 (0.04%) at 113.64

- WTI Crude Oil (front-month) up $0.42 (0.58%) at $72.49

- Gold is up $1.8 (0.1%) at $1785.93

- EuroStoxx 50 down 43.11 points (-1.01%) at 4233.09

- FTSE 100 down 2.85 points (-0.04%) at 7337.05

- German DAX down 126.85 points (-0.8%) at 15687.09

- French CAC 40 down 50.82 points (-0.72%) at 7014.57

US TSY FUTURES CLOSE

- 3M10Y +3.501, 143.991 (L: 135.476 / H: 146.903)

- 2Y10Y +5.22, 83.035 (L: 75.246 / H: 84.091)

- 2Y30Y +9.154, 119.882 (L: 107.627 / H: 120.162)

- 5Y30Y +7.182, 61.619 (L: 52.571 / H: 61.858)

- Current futures levels:

- Mar 2Y up 1/32 at 109-2.375 (L: 108-31.375 / H: 109-03)

- Mar 5Y down 0.5/32 at 120-25.75 (L: 120-20.5 / H: 121-01)

- Mar 10Y down 3.5/32 at 130-7 (L: 129-31 / H: 130-24.5)

- Mar 30Y down 1-2/32 at 160-27 (L: 160-15 / H: 162-26)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.0075 at 99.790

- Mar 22 +0.015 at 99.685

- Jun 22 +0.030 at 99.495

- Sep 22 +0.045 at 99.270

- Red Pack (Dec 22-Sep 23) +0.030 to +0.055

- Green Pack (Dec 23-Sep 24) -0.01 to +0.015

- Blue Pack (Dec 24-Sep 25) -0.01 to -0.005

- Gold Pack (Dec 25-Sep 26) -0.01 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00550 at 0.07025% (-0.00625/wk)

- 1 Month -0.00063 to 0.10138% (-0.00275/wk)

- 3 Month +0.00225 to 0.20050% (+0.01287/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00475 to 0.28813% (+0.01700/wk)

- 1 Year +0.00625 to 0.48875% (+0.02725/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.05%, $989B

- Broad General Collateral Rate (BGCR): 0.05%, $349B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $338B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $7.351B accepted vs. $19.865B submission

- Next scheduled purchases -- two for Thursday:

- Thu 12/09 1010-1030ET: Tsy 0Y-2.25Y, appr $10.875B

- Thu 12/09 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 12/10 1010-1030ET: Tsy 7Y-10Y, appr $2.825B

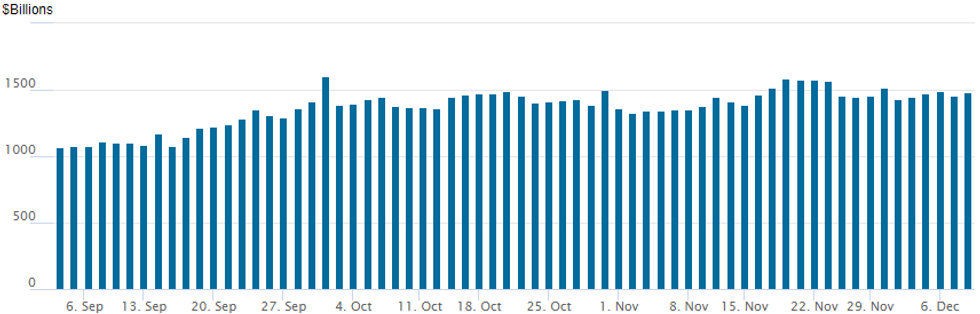

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,484.192B from 71 counterparties vs. $1,455.038B on Monday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: Rabobank Launched

- Date $MM Issuer (Priced *, Launch #)

- 12/08 $2.5B #NextEra Energy Cap $1B 5Y +62, $1B 10Y +92, $500M 30Y +112

- 12/08 $1.25B #Rabobank 6NC5 +73

- 12/08 $500M #Toronto-Dominion Bank (TD) WNG 3Y +33

- 12/08 $500M #Athene +30Y +157

- 12/08 $500M Standard Ind 4.375% 2030 Tap +99a

EGBs-GILTS CASH CLOSE: Gilts Outperform On "Plan B"

Gilts easily underperformed Bunds Wednesday, with periphery spreads also widening.

- UK yields had fallen sharply by late morning following reports that the gov't would move to "Plan B" Covid restrictions, but the move fully reversed and then some after a promising Omicron efficacy report just before midday from vaccine-makers Pfizer/Biontech.

- The latter saw 10Y Bund yields rise nearly 10bp from the low over the afternoon.

- No particular trigger for BTP weakness, but some big cash selling noted in the morning set off spread-widening (and equities weakened over the session, so modestly risk-off).

- ECB's Schnabel noted the bank would not hike before ending net asset purchases (contrasting w Holzmann's comments earlier in the week).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at -0.676%, 5-Yr is up 4.6bps at -0.555%, 10-Yr is up 6.2bps at -0.313%, and 30-Yr is up 7.7bps at -0.016%.

- UK: The 2-Yr yield is unchanged at 0.462%, 5-Yr is up 1bps at 0.582%, 10-Yr is up 4.5bps at 0.775%, and 30-Yr is up 3.4bps at 0.837%.

- Italian BTP spread up 4.3bps at 133.9bps / Greek up 6bps at 169.6bps

FOREX: Greenback Under Pressure As Aussie Extends Gains

- The dollar index fell 0.45% on Wednesday, turning negative on the week, largely resulting from strong performances in CNH, AUD and the Euro.

- Commodity and risk-tied currencies remain optimistic, evident by the near 1% rallies in both AUDJPY and EURJPY.

- With the greenback weakness, AUDUSD has further distanced itself from major noted support below the 0.7000 mark and is now closing in on the 20-day EMA, at 0.7187. A clear breach of this average would strengthen the current bull phase.

- EURUSD has bounced well from the day’s low at 1.1267 and is now trading towards the upper bound of last week’s range. Key short-term resistance is unchanged at 1.1383, Nov 30 high where a break would signal scope for a stronger corrective bounce and open 1.1514, Nov 5 high.

- USDCAD had trended lower ahead of the Bank of Canada rate announcement, however, a marginally dovish-to-expectations statement prompted a 50-pip bounce for the pair, in the face of dollar weakness.

- GBP came under pressure following reports that the Government are set to announce further covid restrictions. ‘Plan B’ is widely expected to have a working from home which spooked GBPUSD to fresh 2021 lows below 1.3200 to a low print of 1.3163. The pair has since bounced amid a weaker dollar, however, remains lower on the day with EURGBP up 0.77%.

- EURGBP’s recent breach of 0.8544, 76.4% of the Nov 5 - 22 sell-off has prompted an extension towards a key short-term resistance at 0.8595, the Nov 5 high.

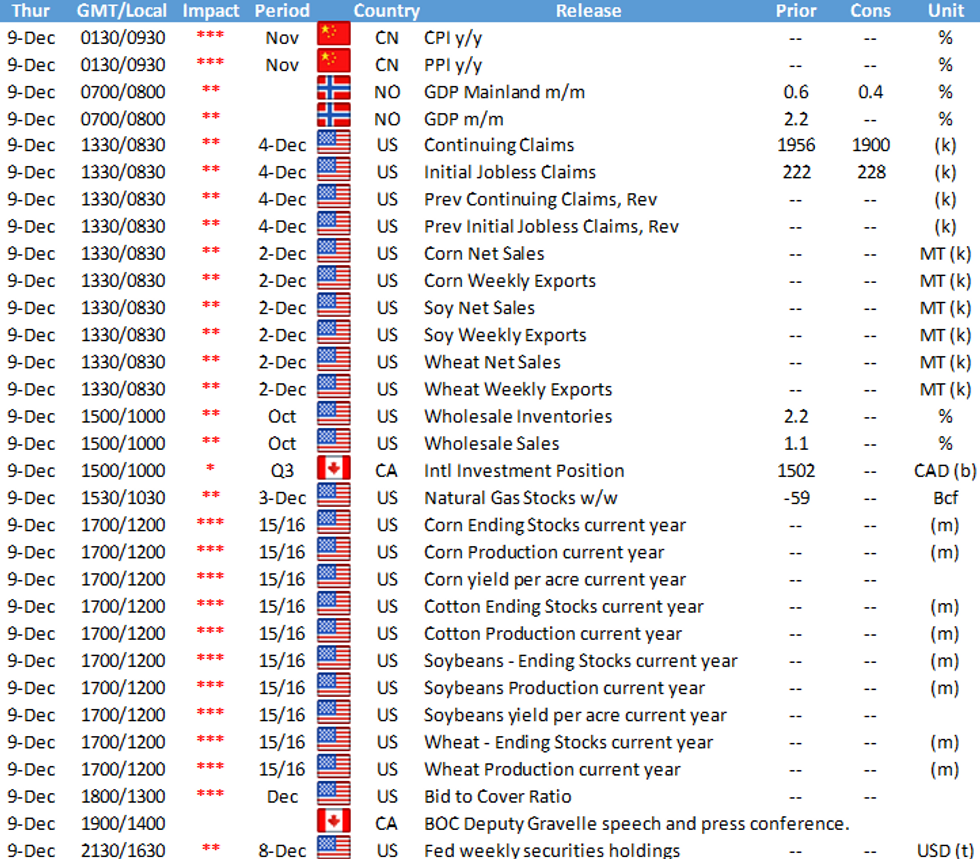

- Chinese CPI/PPI scheduled overnight, before a light European and US calendar ahead of Friday’s US CPI data. BOC’s Gravelle is due to speak about the Economic Progress Report with a Q&A expected.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.