-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: FOMC, Debt Ceiling Vote, Year-End

EXECUTIVE SUMMARY

- US: Democrats Target a Debt Ceiling Increase of $2.5 Trillion

- ECB PROJECTIONS SHOW INFLATION BELOW 2% GOAL IN 2023, 2024, Bbg

US

FOMC EXECUTIVE SUMMARY:

- The FOMC will shift in a hawkish direction at the December meeting as it eyes rising inflation risks.

- This shift will include a doubling of the pace of the asset purchase taper, a more aggressive rate “dot plot”, and an adjustment in the Statement language (including eliminating the word “transitory” to describe inflation).

- The FOMC signaling more than 2 hikes in 2022, or a hiking pace faster than 3 hikes per year, would be hawkish vs expectations.

DATA REACT: US PPI Shows Further Strength

- PPI final demand inflation was stronger than expected in Nov, with headline up +0.8% M/M (cons 0.5%) and core +0.7% M/M (cons 0.4%).

- This pushed Y/Y rates up to 9.6% and 7.7% respectively. That's the highest since Nov'10 for headline and a new series high for the core series first calculated in Aug'14.

- The re-acceleration in sequential core PPI inflation appears relatively broad-based, with the main three categories of core goods (0.8% M/M), transportation & warehousing (1.9% M/M) and other services (0.6% M/M) all accelerating on the month.

- Whilst further evidence of underlying inflationary pressures, it does little to change market expectations for Wed's FOMC.

EUROPE

Re: ECB PROJECTIONS SHOW INFLATION BELOW 2% GOAL IN 2023, 2024, Bbg

Headline not particularly surprising (although a leak two days ahead of the meeting is quite a surprise!) and was the base case expectation - this is our summary of the GC's views on inflation headed into the December decision - in-line with this BBG piece:

- The surge in inflation has been driven by temporary factors which will subside, with inflation still projected to be below target over the medium term.

- For the time being, there are limited signs of wage pressure and second-round effects.

US TSYS: Pre-FOMC Pressure in Rates, Accelerated Taper Expected

Tsys finish weaker -- near the middle of the month's range on light volume (TYH2<950 after the bell) in the lead up to the final FOMC policy annc for 2021 on Wednesday. FOMC expected to shift in a hawkish direction at the December meeting as it eyes rising inflation risks.- This shift will include a doubling of the pace of the asset purchase taper, a more aggressive rate “dot plot”, and an adjustment in the Statement language (including eliminating the word “transitory” to describe inflation).

- FOMC signaling more than 2 hikes in 2022, or a hiking pace faster than 3 hikes per year, would be hawkish vs expectations.

- Early session: post-PPI react, Tsys pared losses: Already bouncing off lows ahead the release, Tsy futures extended the bounce even after Nov PPI +0.8% vs. +0.5 est, equities traded weaker in mild risk-off/risk-on unwind start to the session.

- Delayed sell-off, Tsys eventually receded: PPI's further evidence of underlying inflationary pressures, it does little to change market expectations for Wed's FOMC

- The 2-Yr yield is up 2.8bps at 0.6608%, 5-Yr is up 3.1bps at 1.2353%, 10-Yr is up 2.2bps at 1.4377%, and 30-Yr is up 1.9bps at 1.8186%.

OVERNIGHT DATA

US DATA: US PPI Data Comes in Ahead of Forecast

- US PPI Final Demand (Nov) M/M 0.8% vs. Exp. 0.5% (Prev. 0.6%)

- Final Demand (Nov) Y/Y 9.6% vs. Exp. 9.2% (Prev. 8.6%, Rev. 8.8%)

- Ex Food and Energy (Nov) M/M 0.7% vs. Exp. 0.4% (Prev. 0.4%)

- Ex Food and Energy (Nov) Y/Y 7.7% vs. Exp. 7.2% (Prev. 6.8%)

- US REDBOOK: DEC STORE SALES +15.7% V YR AGO MO

- US REDBOOK: STORE SALES +16.0% WK ENDED DEC 11 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 116.08 points (-0.33%) at 35561.13

- S&P E-Mini Future down 36.25 points (-0.78%) at 4626.25

- Nasdaq down 178.3 points (-1.2%) at 15241.18

- US 10-Yr yield is up 2.4 bps at 1.4394%

- US Mar 10Y are down 7/32 at 130-20

- EURUSD down 0.0028 (-0.25%) at 1.1256

- USDJPY up 0.2 (0.18%) at 113.74

- WTI Crude Oil (front-month) down $0.91 (-1.28%) at $70.41

- Gold is down $15.73 (-0.88%) at $1770.99

- EuroStoxx 50 down 38.53 points (-0.92%) at 4144.51

- FTSE 100 down 12.8 points (-0.18%) at 7218.64

- German DAX down 168.16 points (-1.08%) at 15453.56

- French CAC 40 down 47.6 points (-0.69%) at 6895.31

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00850 at 0.06863% (-0.00363/wk)

- 1 Month -0.00225 to 0.10750% (-0.00113/wk)

- 3 Month +0.00813 to 0.21088% (+0.01263/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00400 to 0.29113% (+0.00288/wk)

- 1 Year -0.00712 to 0.49788% (-0.01150/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $936B

- Broad General Collateral Rate (BGCR): 0.05%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $341B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $9.301B accepted vs. $31.951B submission

- Next schedule purchases:

- Thu 12/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B vs. $1.425B prior

- Thu 12/16 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B vs. $1.775B prior

- Fri 12/17 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B vs. $1.600B prior

- Note, while the size of buy-operations in 10-30Y actually increased slightly to account for the drop in number of operations from 4 to 3, combined purchases still reduced.

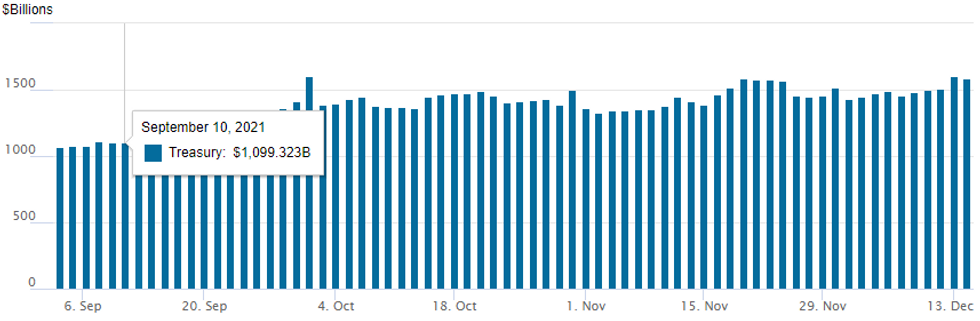

FED Reverse Repo Operation

NY Federal Reserve/MNI

After Monday's surge to second highest usage on record, NY Fed reverse repo usage recedes slightly to $1,584.488B from 79 counterparties vs. $1,599.768B on Monday. Record high still 1,604.881B from Thursday, September 30.

FOREX: Greenback Completes V Shape Intra-Day Recovery

- Broad risk-off in equity and commodity markets filtered through into a stronger US dollar on Tuesday, after the greenback had been under initial pressure to start the trading day.

- Lows of the 96.10 in the dollar index were short-lived as Omicron fears sapped risk optimism in global markets and prompted a flight to quality in G10 FX. The DXY rallied to the best levels of the week and the index currently hovers just below the December highs of 96.59.

- EURUSD moved in line with the broader dollar, continuing to pivot off the 1.13 mark and currently pressing recent lows around 1.1260. The recent consolidation appears to be a triangle formation. This is a continuation pattern and reinforces the current bear trend. The bear trigger is 1.1186/85. Clearance of this support would resume the trend and open 1.1128, a Fibonacci projection.

- With risk under pressure, the usual suspects AUD(-0.3%), CAD(-0.3%) an NZD(-0.15%) have all drifted lower, albeit in fairly narrow ranges.

- The risk-off tone may struggle to build too much momentum as markets turn their focus to the upcoming slew of major central bank decisions over the next 48 hours, including the FOMC and the ECB.

- Higher US yields and lower equities have weighed on emerging market currencies, with the JPMorgan Emerging market currency index currently down 0.65%. Ongoing troubles for Turkey saw the Lira plunge another 4% and in LatAm, the Mexican peso fell over 1% back to 21.20.

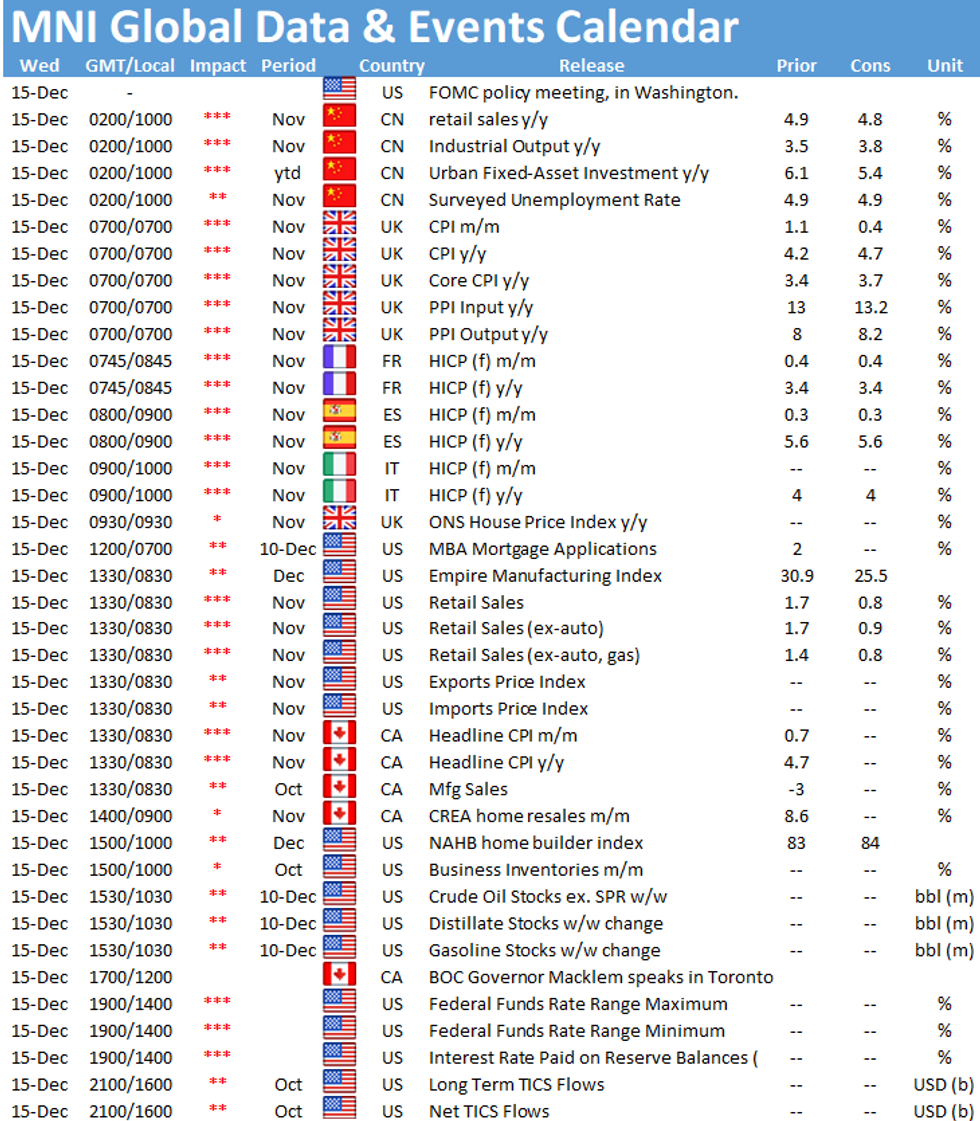

- Despite the build up to the Fed, we have a busy data schedule with Chinese retail sales overnight and US retail sales headlining the early US docket. Additionally, CPI data from both the UK and Canada will be published. The FOMC decision/statement takes place at 1400ET/1900GMT.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.