-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Ylds Recede Ahead Wednesday's FOMC

EXECUTIVE SUMMARY

- MNI: Fed To Phase In QT From Mid-Year - Ex-Officials

- MNI INTERVIEW: Canada Faces Permanent Deficit, Risks Inflation

- U.S. WEIGHS EVACUATING DIPLOMATS’ FAMILY MEMBERS FROM UKRAINE, Bbg

US

FED: The Fed is likely to launch quantitative tightening around mid-year, setting progressively higher caps for the value of maturing debt allowed to run off each month and maxing out at a monthly pace above the peak QT rate of USD50 billion in 2018, former Fed officials told MNI.

- The more aggressive approach to shrinking its balance sheet is part of the Fed's overall effort to pick up the pace of policy tightening as the risk recedes that the economic recovery will reverse or money markets undergo the same turmoil as in September 2019 when bank reserves became scarce, the ex-officials said.

- "It looks like they will move faster in time and somewhat faster in terms of the level of short-term rates when they start, and the amounts of run-off will likely be higher," former New York Fed president Bill Dudley said. "The program will be similar to last time, with caps that increase over time."

World Economic Forum: Davos Rescheduled & In Person: The World Economic Forum has rescheduled it's annual meeting in Davos-Klosters, Switzerland, to Sunday 22 to Thursday 26 May.

- Working Together, Restoring Trust, the Annual Meeting 2022 will be the first global in-person leadership event since the start of the pandemic.

- Topics on the agenda will include the pandemic recovery, tackling climate change, building a better future for work, accelerating stakeholder capitalism, and harnessing the technologies of the Fourth Industrial Revolution.

- Klaus Schwab, Founder and Executive Chairman, World Economic Forum, said: “After all the virtual meetings taking place in the last two years, leaders from politics, business and civil society have to convene finally in person again. We need to establish the atmosphere of trust that is truly needed to accelerate collaborative action and to address the multiple challenges we face.”

- https://www.weforum.org/press/2022/01/media-adviso...

CANADA

BOC: Canada runs the risk of a “permanent” budget deficit, potentially fueling inflation, as lawmakers from across the political spectrum move away from previous commitments to fiscal balance, the country's independent Parliamentary Budget Officer told MNI.

- "The balanced budgets come hell or high water that we heard in the late 1990s have not been heard in a long time. So there seems to be increasing comfort with a permanent deficit," said Yves Giroux, who reported earlier this week that that tens of billions of dollars of government spending commitments aimed at restoring the job market from the pandemic are unnecessary.

- With employment and hours worked rebounding, more spending could prop up inflation instead, he said.

- "If you have an economy that's already running at a healthy pace and you provide additional government spending, then there's a risk," said Giroux, who before leading the budget office directed the finance department's social policy division. "There's a clear risk that it will either create inflationary pressures, or it will result in increased imports." For more see MNI Policy main wire at 1117ET.

Tsy/Eurodollar Roundup: Appetite for Risk Evaporates

After robust midday trade, Tsy futures bounced back near early session/week highs, TYH2 tapped 128-16 -- shy of Jan 13 high/20D EMA resistance at 128-27. Equities under heavy pressure after FI close: SPX emini: 4393.0 -83.75.

- Heavy volumes (TYH2>1.8M) by the close as risk-off tone gained momentum (Russia/Ukraine and China/S China Sea flashpoints). Aside from exogenous geopolitical risk-off support/bounce, underlying positioning continues to price in tighter Fed policy for 2022 ahead next week's FOMC: four .25bp quarterly rate hikes to start in March.

- After some chunky Block buys in 2s and 5s earlier, buy-stops triggered on the rally while trading desks report better leveraged$ acct selling in 10s and 30s, prop acct steepener unwinds in shorts to intermediates.

- No corporate supply today, but hear reports of selling ahead next week's 2s, 5s and 7Y Tsy supply; Corp debt issuance expected to resume after $188.31B issued on Month so far.

- Feb serial ops expire today. Decent amount of options coming off the sheets for a serial expiry. Though accts have been active unwinding/rolling to avoid pin risk, today's rally have exposed larger positions in higher strikes, namely TYG 128 and FVG 119.25

- Option trade appears more mixed with two-way puts and larger unwinds of tactical longs (-25k TYH 127 puts, 18-21 after heavy buying this week), large 5Y call sale/exit going short (total over 83,000 FVH 120 calls from 15-19).

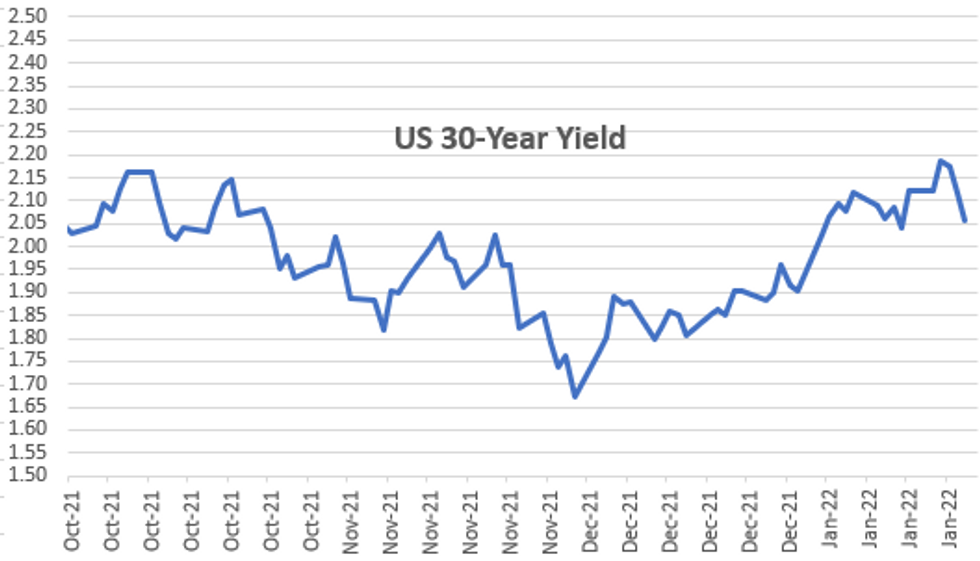

- The 2-Yr yield is down 3.4bps at 0.9912%, 5-Yr is down 4.1bps at 1.5454%, 10-Yr is down 5.7bps at 1.7474%, and 30-Yr is down 5.3bps at 2.0638%.

OVERNIGHT DATA

- CANADA NEW HOME PRICES ROSE 10% IN 2021, MOST SINCE 1989

- STATSCAN SEES PRICES CLIMBING FURTHER THIS YEAR AMID LOW RATES

- CANADA DEC FLASH RETAIL SALES -2.1%

- CANADIAN NOV RETAIL SALES +0.7%; SALES EX-AUTOS/PARTS +1.1%

- CANADA NOV RETAIL SALES EX-AUTOS/PARTS-GASOLINE +0.5%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 337.36 points (-0.97%) at 35058.57

- S&P E-Mini Future down 65 points (-1.45%) at 4522

- Nasdaq down 285.3 points (-2%) at 14324.92

- US 10-Yr yield is down 5.5 bps at 1.7492%

- US Mar 10Y are up 19/32 at 128-9.5

- EURUSD up 0.003 (0.27%) at 1.1318

- USDJPY down 0.43 (-0.38%) at 114.13

- Gold is down $7.78 (-0.42%) at $1839.69

- EuroStoxx 50 down 70.05 points (-1.63%) at 4299.61

- FTSE 100 down 90.88 points (-1.2%) at 7585.01

- German DAX down 308.45 points (-1.94%) at 15912.33

- French CAC 40 down 125.57 points (-1.75%) at 7194.16

US TSY FUTURES CLOSE

- 3M10Y -5.251, 157.398 (L: 155.651 / H: 162.223)

- 2Y10Y -2.642, 74.858 (L: 74 / H: 77.282)

- 2Y30Y -2.302, 106.484 (L: 105.687 / H: 109.555)

- 5Y30Y -1.396, 51.471 (L: 50.696 / H: 54.458)

- Current futures levels:

- Mar 2Y up 4.125/32 at 108-19.375 (L: 108-16.5 / H: 108-19.75)

- Mar 5Y up 12.25/32 at 119-18 (L: 119-09.5 / H: 119-20.5)

- Mar 10Y up 20/32 at 128-10.5 (L: 127-28 / H: 128-16)

- Mar 30Y up 1-18/32 at 156-1 (L: 154-25 / H: 156-08)

- Mar Ultra 30Y up 2-24/32 at 190-11 (L: 187-31 / H: 190-26)

US 10YR FUTURE TECHS: (H2) Corrective Bounce

- RES 4: 129-21 50-day EMA

- RES 3: 129.14 High Jan 5

- RES 2: 128-27 High Jan 13 and 20-day EMA

- RES 1: 128-16 High Jan 21

- PRICE: 128-07+ @ 16:57 GMT Jan 21

- SUP 1: 127-02 Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

The downtrend in Treasuries remains intact and short-term gains are considered corrective. The contract has cleared support at 127-30, Jan 10 low, confirming a resumption of the underlying downtrend and an extension of the bearish price sequence of lower lows and lower highs. Moving average studies are in a bear mode too. The focus is on 127-00. Firm resistance is at 128-27, Jan 13 high. A break is required to alter the picture.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.015 at 99.565

- Jun 22 +0.035 at 99.240

- Sep 22 +0.055 at 98.980

- Dec 22 +0.065 at 98.715

- Red Pack (Mar 23-Dec 23) +0.075 to +0.095

- Green Pack (Mar 24-Dec 24) +0.080 to +0.095

- Blue Pack (Mar 25-Dec 25) +0.070 to +0.080

- Gold Pack (Mar 26-Dec 26) +0.070 to +0.075

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00372 at 0.07471% (+0.00071/wk)

- 1 Month -0.00158 to 0.10771% (+0.00442/wk)

- 3 Month -0.00115 to 0.25771% (+0.01642/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00186 to 0.44443% (+0.04943/wk)

- 1 Year +0.00014 to 0.79857% (+0.07286/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07% volume: $265B

- Secured Overnight Financing Rate (SOFR): 0.04%, $927B

- Broad General Collateral Rate (BGCR): 0.05%, $346B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $42.943B submission

- Next scheduled purchases:

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

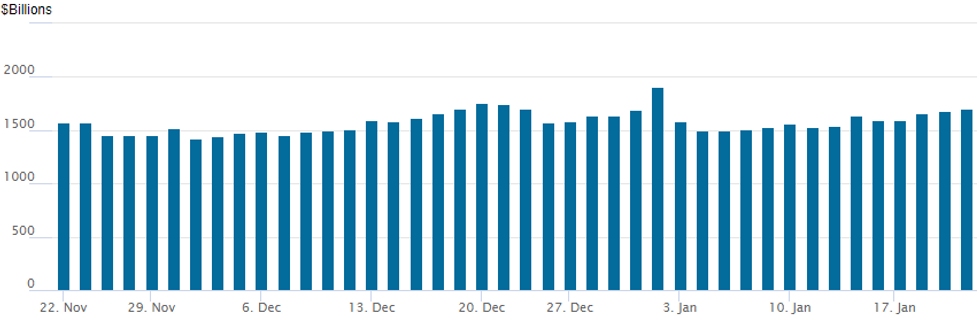

FED Reverse Repo Operation, Usage Hits New High for 2022

NY Federal Reserve/MNI

Third consecutive new high for 2022: NY Fed reverse repo usage climbs to $1,706.127B w/81 counterparties today vs. $1,678.931B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Corporate Debt Issuance Nears $200B

No new issuance expected Friday after heavy $46.26B domestic/foreign high-grade debt issuance priced Tue-Thu this week, total for month at $188.31B already compares to $227.55B in 2021. Likely see total for Jan over $200B with pause around next week's FOMC. Pace of issuance may start to slow as Fed starts to to hike rates (March expected 25bp hike)

- CDX IG 5Y credit spds holding near highs for the week after gaining latter half Thursday, currently 57.12 (+3.99 on day) vs. 53.42 late last Friday. CDX HY 5Y at 107.60 (-0.63 on day) vs. 108.39 late last Friday.

- Date $MM Issuer (Priced *, Launch #)

- 01/20 $1.5B *Bank of New Zealand (BNZ) $750M 5Y +68, $400M 5Y SOFR+81, $350M 10Y +105

- 01/20 $2.1B *US Bancorp $1.25B 6NC5 +60, $850M 11NC10 +85 (6NC5 SOFR dropped)

- 01/20 $1.75B *Bank of America PerpNC5 4.375%

EGBs-GILTS CASH CLOSE: Strong End To The Week

European core FI enjoyed a strong end to the week, with Germany outperforming at the short end sand the UK impressing further down the curve.

- A few factors set a bullish tone early in the session: a broad sell-off in equities, weakness in commodities prices, and poor UK data (Dec retail sales missed badly).

- Bund and Gilt yields ended off their lows, as equities bounced a little in the afternoon.

- Volumes on the lighter side however, with an eye on next week's Fed decision.

- More immediately, some focus on the Italian presidential election Monday.

- BTPs and GGBs underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.1bps at -0.618%, 5-Yr is down 3.7bps at -0.333%, 10-Yr is down 4.1bps at -0.065%, and 30-Yr is down 4.1bps at 0.231%.

- UK: The 2-Yr yield is down 1.7bps at 0.882%, 5-Yr is down 4.6bps at 0.997%, 10-Yr is down 5.4bps at 1.171%, and 30-Yr is down 4.9bps at 1.298%.

- Italian BTP spread up 2.7bps at 135.3bps / Greek up 3.4bps at 176.5bps

FOREX: Safe Havens In Favour Amid Continued Slide In Equities

- Global equity indices remained under pressure with Russia/Ukraine tensions the driving factor behind the waning global risk appetite. While currency markets continue to play second fiddle to the volatility experienced in equity markets, the Swiss Franc and the Japanese Yen did outperform in the G10 space with risk-tied FX broadly on the retreat.

- USDJPY fell 0.37% to 113.70, however, much more significant moves were seen in the crosses with the likes of AUDJPY, NZDJPY and CADJPY all falling just shy of 1%.

- In similar vein, the EUR was underpinned by solid demand for EUR crosses and it is worth noting a strong bounce for EURGBP after being unable to break significant technical support at the 0.8300 mark.

- The dollar index is slightly in the red for Friday although the DXY looks likely to post 0.5% gains for the week.

- Notably, USDRUB did break to the highest levels for the year, rising 1% on the day to 77.50. This represents the highest levels for the pair since April 2021.

- Ongoing developments on the Ukrainian border will likely dominate the early price action next week, however, the release of manufacturing and services flash pmis will provide the markets with their first set of data for the week.

- In focus will be both the Federal Reserve and the Bank of Canada due to release their monetary policy decisions/statements on Wednesday.

DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.