-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Market Vol Continues Ahead FOMC

EXECUTIVE SUMMARY

- MNI FED: Balance Sheet Runoff Expectations Range Widely

- MNI INTERVIEW: U.S. Port Backlog Seen Dragging Into Next Year

- MNI: IMF Cuts Global Growth Call on US, China, Sees Hot Prices

- IMF CUTS 2022 GLOBAL ECONOMIC-GROWTH FORECAST TO 4.4% FROM 4.9%, Bbg

- U.S. Considers ‘Potent’ Export Controls Against Russia, WSJ

US

FED: In looking through dozens of sell-side previews for this week's Fed meeting, it's clear that there is a wide range of expectations for balance sheet runoff plans (or, "QT").

- Chair Powell said this month it would take two-to-four meetings to finalize the details, but that runoff this time will be "sooner and faster" than the 2017-19 experience. The latter included a 2017 start that took a year to "ramp up" to maximum cap rates (above which, maturing principal was reinvested) of $50B/month..

- This time, most analysts expect Fed balance sheet runoff to begin in Q3 2022 (Jul, Aug, Sep), and for the ramp-up period to be relatively brief (around 3-6 months on average).

- The median consensus for FOMC 'peak' balance sheet runoff is about $90-100B/month, with a range of $60-105B. The larger size reflects both the larger size of the balance sheet and the larger overall size of the Tsy and MBS markets.

- Most see a split that favors a quicker runoff in MBS proportional to Tsys (60/40, or 60/30) compared with their accumulation (80/40 in the Pandemic QE program).

US: The IMF clipped its 2022 global growth forecast half a percentage point to 4.4% on stalled U.S. Build Back Better legislation, Fed rate hikes and China's real estate slowdown, while boosting its inflation call for advanced economies 1.6pp to 3.9% on pandemic supply bottlenecks.

- Inflation in emerging and developing nations this year was lifted by a percentage point to 5.9% in Tuesday's World Economic Outlook update. Price gains in richer nations would be the fastest since 1991 according to the WEO database, though the IMF said inflation should slow to 2.1% next year.

- U.S. economic growth was lowered 1.2pp to 4% this year, China's by 0.8pp to 4.8%, and Germany and Canada both by 0.8pp. Risks are to the downside in part because only 4% of low-income countries are fully vaccinated against Covid, the IMF reported.

- “Monetary policy is at a critical juncture in most countries. Where inflation is broad based alongside a strong recovery, like in the U.S., or high inflation runs the risk of becoming entrenched, as in some emerging market and developing economies and advanced economies, extraordinary monetary policy support should be withdrawn,” First Deputy Managing Director Gita Gopinath wrote in a report.

UK PM: In Event Of Russian Invasion UK Will Contribute To NATO Units

UK Prime Minister Boris Johnson has just delivered a statement to the House of Commons on the Ukraine crisis (link to livestream here).

- 'I shudder to contemplate the tragedy that would ensue [from a Russian invasion]...No one would gain from such a catastrophe'

- 'Russia's goal is to keep NATO forces away from her borders. If that is her goal, then invading Ukraine could scarcely be more counter productive.'

- In the event of a Russian invasion the UK would impose sanctions 'heavier than anything we have done before against Russia'. UK would also "look to contribute to any new NATO deployments to protect our allies in Europe"

- UK gov't “can not accept the doctrine implicit in Russia’s proposals that all states are sovereign but some are more sovereign than others.....We must not bargain away the vision of a free Europe".

Eurodollar/Treasury Futures/Options Roundup

Another volatile day for stocks Tue, similar to late Mon's sharp rebound to finish higher, shares staged a second half rally back near steady -- but pared more than half the bounce after the FI close.- Otherwise, Tsy trade was generally subdued trade ahead Wed's FOMC policy annc (no rate change anticipated yet, clearer forward guidance re: liftoff, balance sheet run-off, QT) Main focus on geopolitical risk and headlines re: Russia/Ukraine invasion threat, NATO, US troops on high alert.

- Limited react to data on day: US NOV FHFA HPI SA +1.1% V +1.1% OCT; +17.5% Y/Y; US CONF BOARD CONSUMER CONFIDENCE 113.8 IN JAN V DEC 115.2.

- Tsy futures holding near middle of weaker session range with mild short covering after $55B 5Y note auction (91282CDT5) stops through: 1.533% high yield vs. 1.547% WI; 2.50x bid-to-cover vs. December's 2.41x.

- Indirect take-up: climbs to 68.72% vs. Dec's 2021 year high of 65.66%. Primary dealer take-up: recedes 14.80% vs. 20.02%; Direct take-up 16.48% vs. 14.32%.

- Eurodollar option flow: Liftoff Positioning, 50Bp June hike in addition to 25bps liftoff from Fed in March. EDM2 currently trading 99.265: +5,000 Jun 98.93/99.00/99.06/99.12 put condors, 1.0 vs. 99.29/0.05%

- Elsewhere, targeting five 25bp quarterly hikes starting this March through March 2023, paper adding to bear curve (Whites/Greens) steepener: +15,000 short Mar 98.50/Green Mar 98.00 put spds, 0.25/Greens over

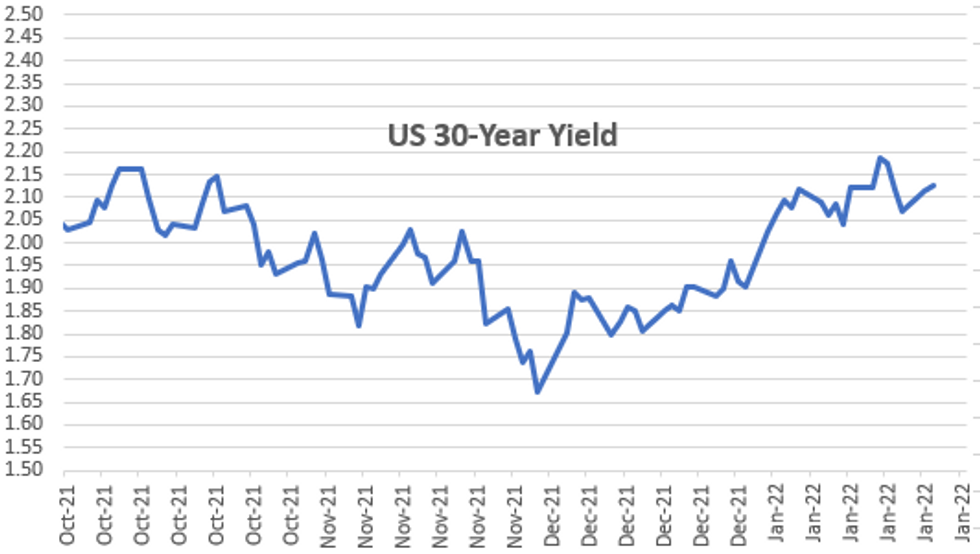

- The 2-Yr yield is up 6.2bps at 1.0333%, 5-Yr is up 2.2bps at 1.5691%, 10-Yr is up 1.1bps at 1.7814%, and 30-Yr is up 1.4bps at 2.1258%.

OVERNIGHT DATA

- US NOV FHFA HPI SA +1.1% V +1.1% OCT; +17.5% Y/Y

- US CONF BOARD CONSUMER CONFIDENCE 113.8 IN JAN V DEC 115.2

- Richmond Fed: Jan Manufacturing Index 8 Vs Dec 16

- Richmond Fed: Jan Mfg Shipments Index 14 Vs Dec 12

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 30.87 points (-0.09%) at 34362.37

- S&P E-Mini Future down 44.25 points (-1%) at 4364

- Nasdaq down 248.4 points (-1.8%) at 13625.09

- US 10-Yr yield is up 1.3 bps at 1.7832%

- US Mar 10Y are down 13/32 at 128-3.5

- EURUSD down 0.0023 (-0.2%) at 1.13

- USDJPY down 0.05 (-0.04%) at 113.92

- WTI Crude Oil (front-month) up $2.07 (2.48%) at $85.38

- Gold is up $4.33 (0.23%) at $1847.35

- EuroStoxx 50 up 23.9 points (0.59%) at 4078.26

- FTSE 100 up 74.31 points (1.02%) at 7371.46

- German DAX up 112.74 points (0.75%) at 15123.87

- French CAC 40 up 50.17 points (0.74%) at 6837.96

US TSY FUTURES CLOSE

- 3M10Y -1.637, 158.18 (L: 153.869 / H: 160.188)

- 2Y10Y -4.916, 74.633 (L: 73.249 / H: 78.974)

- 2Y30Y -4.567, 109.101 (L: 107.032 / H: 113.081)

- 5Y30Y -0.767, 55.521 (L: 54.026 / H: 57.276)

- Current futures levels:

- Mar 2Y down 3/32 at 108-19.25 (L: 108-19 / H: 108-22.375)

- Mar 5Y down 8.5/32 at 119-15.25 (L: 119-14 / H: 119-23.25)

- Mar 10Y down 12.5/32 at 128-4 (L: 128-01 / H: 128-17)

- Mar 30Y down 21/32 at 155-8 (L: 154-27 / H: 156-09)

- Mar Ultra 30Y down 1-13/32 at 188-7 (L: 187-19 / H: 190-10)

US TREASURY TECHNICALS: (H2) Resistance Remains Intact

- RES 4: 129-31 Low Dec 8

- RES 3: 129-18 50-day EMA

- RES 2: 129.14 High Jan 5

- RES 1: 128-24+/27 20-day EMA / High Jan 13

- PRICE: 128-11+ @ 16:18 GMT Jan 25

- SUP 1: 127-28/02 Low Jan 21 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

The downtrend in Treasuries remains intact. For now though, the contract remains in a corrective cycle following the recovery from last week’s low. Key S/T resistance is at 128-27, Jan 13 high and just above the 20-day EMA at 128-24+. A break of these two resistance points would suggest potential for a stronger recovery and open 129-00 and above. A resumption of weakness would refocus attention on the bear trigger at 127-02, Jan 19 low.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.025 at 99.545

- Jun 22 -0.040 at 99.225

- Sep 22 -0.040 at 98.980

- Dec 22 -0.050 at 98.725

- Red Pack (Mar 23-Dec 23) -0.06 to -0.05

- Green Pack (Mar 24-Dec 24) -0.055

- Blue Pack (Mar 25-Dec 25) -0.06 to -0.055

- Gold Pack (Mar 26-Dec 26) -0.06 to -0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00215 at 0.07886% (+0.00415/wk)

- 1 Month -0.00057 to 0.10786% (+0.00015/wk)

- 3 Month +0.00043 to 0.26757% (+0.00986/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00172 to 0.45029% (+0.00586/wk)

- 1 Year -0.00371 to 0.78986% (-0.00871/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $75B

- Daily Overnight Bank Funding Rate: 0.07% volume: $273B

- Secured Overnight Financing Rate (SOFR): 0.04%, $886B

- Broad General Collateral Rate (BGCR): 0.05%, $332B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $322B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $1.999B accepted vs. $2.829B submission

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

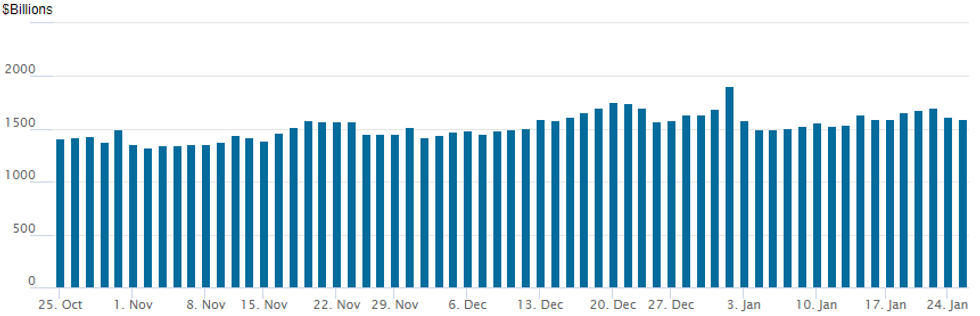

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,599.502B w/81 counterparties vs. $1,614.002B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE:

Corporate supply ebbs ahead Wed's FOMC, Tuesday issuance limited to $1.5B CDP 5Y SOFR after $2.75B priced Monday: China Cinda commercial bank, Hanwha Life Korean insurance and supra-sovereign Pakistan.

- Date $MM Issuer (Priced *, Launch #)

- 01/25 $1.5B *CDP Financial 5Y SOFR+39

- $2.75B Priced Monday

- 01/24 $1B *China Cinda 5Y +175

- 01/24 $1B *Pakistan Sukuk 7Y 7.95%

- 01/24 $750M *Hanwha Life 10NC5 +185

- Investment Grade index on 5Y levels well correlated to stocks as they receded same time equities bounced off session lows (ESH2 currently 4392.0 vs. 9279.75 low).

- CDX HY5 -- high-yield credit index on session highs, currently at 107.392 -0.100.

EGBs-GILTS CASH CLOSE: Yield Bounceback Loses Steam

A bounce-back session for risk saw German and UK yields rise across the curve Tuesday, with periphery EGB spreads tightening.

- But Russia-Ukraine tensions and stock market woes remained prevalent themes, and yields finished off late-morning highs, mirroring a pullback in equities from overnight best levels.

- Duration supply a theme too: Netherlands sold E2bn 30Y DSL, while FInland 20Y mandate helped weigh on semi-core EGBs.

- Italian presidential elections continue; BTP spreads fell 2+bp, GGBs down 3.6bp.

- Some attention on the UK Gov't lockdown party scandal, w headlines that the Gray report would be released tonight. Though most attention on the Federal Reserve decision tomorrow.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at -0.648%, 5-Yr is up 1.9bps at -0.359%, 10-Yr is up 2.8bps at -0.079%, and 30-Yr is up 3.7bps at 0.235%.

- UK: The 2-Yr yield is up 2.5bps at 0.896%, 5-Yr is up 2.9bps at 0.996%, 10-Yr is up 3.8bps at 1.164%, and 30-Yr is up 4.2bps at 1.284%.

- Italian BTP spread down 2.2bps at 136.9bps / Greek down 3.6bps at 173.6bps

FOREX: Greenback Off Highs As Equities Stage Another Late Bounce

- A tale of two halves for the US dollar on Tuesday as markets prepare for the January FOMC meeting tomorrow. Renewed equity index weakness during Europe lent support to the greenback and prompted a near 0.4% higher in the DXY. However, another late bounce for the major benchmarks worked against the dollar throughout the US trading session, which now hovers close to unchanged.

- The Swiss Franc is a standout, notably underperforming its G10 counterparts. The strength in USDCHF (+0.56%) prompted a brief breach of the 0.9200 handle, representing a two-week high for the pair. Some analysts speculated the weakness may be down to potential intervention from the central bank with eyes on next Monday’s sight deposit data for any clarification.

- Elsewhere EURGBP fell 0.45% after finding resistance at the 50-day exponential moving average late on Monday around 0.8420. The pair is currently recovering off a multiyear low of 0.8305, Jan 20 low. Gains had been considered corrective with a bearish technical outlook remaining. Further weakness would refocus attention on the major support and bear triggers at 0.8282/77 from February 2020.

- Overall, ranges/volatility continue to be underwhelming in comparison to those seen in equity markets.

- Tomorrow, the first key central bank meeting will be the bank of Canada where analysts are split between a hold and potential lift-off. Focus then turns to the Fed where the FOMC are expected to continue its hawkish shift at the January meeting, using the Statement to signal that a rate hike is coming in March.

Data Outlook for Wednesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2022 | 0700/0800 | ** |  | SE | PPI |

| 26/01/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 26/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 26/01/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/01/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 26/01/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/01/2022 | 1500/1000 |  | CA | BOC Monetary Policy Report | |

| 26/01/2022 | 1500/1000 | *** |  | US | new home sales |

| 26/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/01/2022 | 1600/1100 |  | CA | BOC Governor press conference after rate decision | |

| 26/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/01/2022 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.