-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Alphabet Underscores Late Risk Appetite

EXECUTIVE SUMMARY

- Alphabet Shares Surge 6% After 4Q Earnings Beat $30.09 vs. $27.32

- MNI: Fed's Reticence To Hike Rates Raises Risk of Hard Landing

- MNI INTERVIEW: US Mfg Growth To Stay Solid Despite Omicron-ISM

- ATL Fed Bostic: "Real Danger" Of Inflation Expectations Rising To 4+%

- StL Fed Bullard: DOESN’T THINK RAISING 50 BPS HELPS FED, Bbg

- MANCHIN ON BIDEN'S ECONOMIC BUILD BACK BETTER PLAN: IT'S DEAD, Bbg

US

FED: The Federal Reserve’s slow march toward eventually raising interest rates in the face of surging inflation puts them further behind in the fight to combat price pressures, and may well force officials to overcorrect later by tightening policy too quickly, former Fed staffers told MNI after last week’s FOMC meeting.

- “I am disappointed that the Fed did not get more aggressive,” said Dean Cruoshore, a former Philadelphia Fed economist now at the University of Richmond.

- “With a long lag between monetary policy actions and its impact, they are very far behind where they should be. As inflation continues to grow in 2022, they will be forced to raise rates faster and by more than would have been the case if they had acted more quickly.

- Cruoshore said he expects PCE inflation to average 5% in the fourth quarter compared with the same period in 2021, “with wide error bands, especially on the high side.” For more see MNI Policy main wire at 1152ET.

FED: In comments published on the Atlanta Fed website today, Pres Bostic suggests US inflation expectations could potentially become "untethered" and "unanchored", with a "real danger" of rising from around 2% to "say, 4 percent or higher"

- Those comments don't appear to be aimed at implied market expectations but rather Bostic advertising the Atlanta Fed's Business Inflation expectations survey: "longer-run inflation expectations among businesses and consumers in fact have climbed, but not enough to suggest that expectations are dangerously unanchored. Still, the mostly pandemic-induced episodic price pressures could grind on long enough to fundamentally alter expectations. I definitely worry about that."

- It's straightforward to see what he's talking about in this chart (also available on the Atlanta Fed site: https://www.atlantafed.org/research/inflationproje...).

- "I don't think this knocks us off the path at all," he said about omicron. "This is just a little bit of a blip but I do think we're really not looking at much over 60 anymore [in the PMI]. I think we're gonna run strong right into 2023."

- The headline for the ISM survey has now declined in three straight months to 57.6 in January, the lowest reading since November 2020, but remained in solid expansion territory. The prices index jumped again, up 7.9ppts to 76.1, reversing some of the drop reported over the prior couple of months and likely delaying improvements in new order levels, he said. For more see MNI Policy main wire at 1334ET.

Eurodollar/Treasury Roundup, Risk-On Ahead Wed's ADP

Risk appetite gradually improved Late Tuesday, after StL Fed Bullard continued to downplay chances of a 50Bp hike in March.

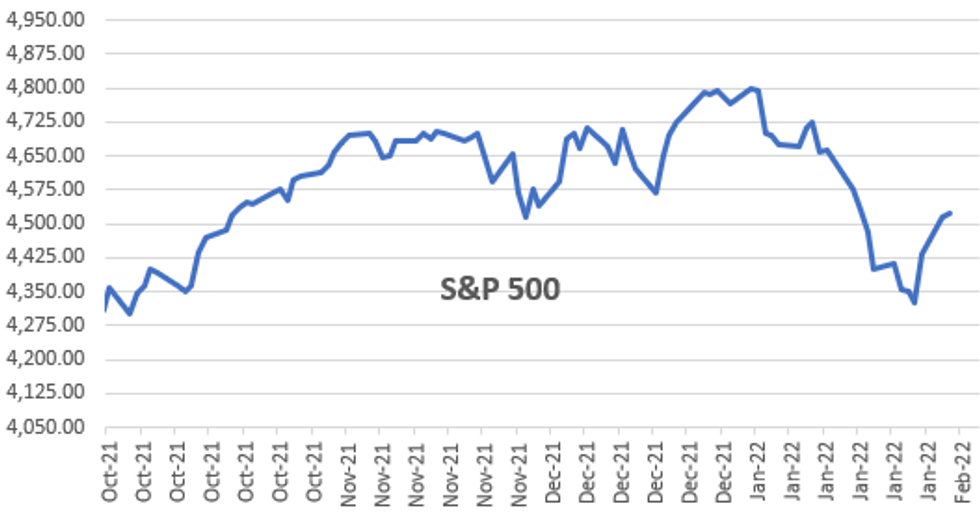

- Stocks made decent gains after FI close, SPX eminis on highs and through 20D EMA at 4540.0 (+45.25) high. Top sectors leading Energy (+3.4%), Materials (1.65%) and Financials (+1.52%).

- Tsys finished weaker, after paring early session gains, yield curves rebounding from early flattening amid decent buying in short end including +15k TYH2 Block at 108-09.8. Trading desks reported foreign real$ buying in 3s, two-way in 5s from central banks and leveraged$, short end steepeners in 2s vs. 3s and 5s.

- Large flattener blocks in the long end eary in the session included 10s and 30s vs. 30Y ultra-bonds.

- Eurodollar and Treasury options saw decent unwinds in crowded March rate-hike trades as active spec accounts looked for better opportunities in longer expiries. Salient trades: paper sold over -80,000 short Mar 98.50/98.62 put spds at 8.5 vs. 98.42/0.12%; in Treasury options: -16,000 TYH 127/129 put over risk reversals, 1 vs. 128-00.5/0.49%.

- Data highlight for Wednesday: ADP private employment figures ahead the NY open, potential insight ahead Fri's Jan NFP (+150k est vs. +199k in Dec).

- The 2-Yr yield is down 1.4bps at 1.1651%, 5-Yr is up 1.3bps at 1.6226%, 10-Yr is up 2.2bps at 1.7982%, and 30-Yr is up 1.7bps at 2.1244%.

OVERNIGHT DATA

- US FINAL JAN MFG PMI 55.5r; DEC 57.7

- US JAN MFG PMI REVISED UP FROM 55.0

- US REDBOOK: JAN STORE SALES +15.2% V YR AGO MO

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US REDBOOK: STORE SALES +15.8% WK ENDED JAN 29 V YR AGO WK

- US DEC CONSTRUCT SPENDING +0.2%

- US DEC PRIVATE CONSTRUCT SPENDING +0.7%

- US DEC PUBLIC CONSTRUCT SPENDING -1.6%

- US ISM PURCHASING MANAGERS MANUF INDEX 57.6 JAN VS 58.7 DEC

- US ISM PRICES PAID INDEX 76.1 JAN VS 68.2 DEC (NSA)

- US ISM NEW ORDERS INDEX 57.9 JAN VS 60.4 DEC

- US ISM EMPLOYMENT INDEX 54.5 JAN VS 54.2 DEC

- US ISM PRODUCTION INDEX 57.8 JAN VS 59.2 DEC

- US ISM SUPPLIER DELIVERY INDEX 64.6 JAN VS 64.9 DEC

- US ISM ORDER BACKLOG INDEX 56.4 JAN VS 62.8 DEC (NSA)

- US ISM INVENTORIES INDEX 53.2 JAN VS 54.7 DEC

- US ISM CUSTOMER INV INDEX 33.0 JAN VS 31.7 DEC (NSA)

- US ISM EXPORTS INDEX 53.7 JAN VS 53.6 DEC (NSA)

- US ISM IMPORTS INDEX 55.1 JAN VS 53.8 DEC (NSA)

- US BLS: JOLTS OPENINGS RATE 10.925M IN DEC

- US BLS: JOLTS QUITS RATE 2.9% IN DEC

- CANADA DEC GROSS DOMESTIC PRODUCT +0.6% MOM

- CANADA DEC GOODS INDUSTRY GDP +0.5%, SERVICES +0.6%

- CANADA REVISED NOV GROSS DOMESTIC PRODUCT +0.8% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 100.48 points (0.29%) at 35231.39

- S&P E-Mini Future up 9.5 points (0.21%) at 4514

- Nasdaq up 5.3 points (0%) at 14245.3

- US 10-Yr yield is up 2.2 bps at 1.7982%

- US Mar 10Y are down 3.5/32 at 127-27.5

- EURUSD up 0.0019 (0.17%) at 1.1253

- USDJPY down 0.4 (-0.35%) at 114.71

- WTI Crude Oil (front-month) down $0.26 (-0.3%) at $87.88

- Gold is up $2.18 (0.12%) at $1799.42

- EuroStoxx 50 up 49.85 points (1.19%) at 4224.45

- FTSE 100 up 71.41 points (0.96%) at 7535.78

- German DAX up 148.19 points (0.96%) at 15619.39

- French CAC 40 up 100.29 points (1.43%) at 7099.49

US TSYS FUTURES CLOSE

- 3M10Y +1.823, 160.218 (L: 148.908 / H: 160.218)

- 2Y10Y +3.287, 62.89 (L: 58.142 / H: 63.33)

- 2Y30Y +2.424, 95.11 (L: 90.31 / H: 96.657)

- 5Y30Y -0.341, 49.303 (L: 48.439 / H: 51.834)

- Current futures levels:

- Mar 2Y down 0.5/32 at 108-10 (L: 108-07.625 / H: 108-12.625)

- Mar 5Y down 2.5/32 at 119-4 (L: 119-00 / H: 119-14)

- Mar 10Y down 4/32 at 127-27 (L: 127-22 / H: 128-11.5)

- Mar 30Y down 12/32 at 155-8 (L: 154-25 / H: 156-10)

- Mar Ultra 30Y down 29/32 at 188-1 (L: 187-01 / H: 190-00)

US 10Y FUTURES TECHS: (H2) Returning Lower

- RES 4: 129-31 Low Dec 8

- RES 3: 129-08 50-day EMA

- RES 2: 129.14 High Jan 5

- RES 1: 128-13/27 20-day EMA / High Jan 13

- PRICE: 127-27+ @ 16:41 GMT Feb 1

- SUP 1: 127-06+/02 Low Jan 26 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

Treasuries returned lower through the London close, but remain above 127-02, the Jan 19 low. The bearish theme remains intact - this follows the break on Jan 18 of support at 127-30, Jan 10 low. The move lower maintains the price sequence of lower lows and lower highs. Furthermore, moving average studies remain in a bear mode. 127-02, Jan 19 low, is the trigger for a resumption of the downtrend. Key short-term resistance is unchanged at 128-27, Jan 13 high.

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady at 99.490

- Jun 22 +0.010 at 99.105

- Sep 22 +0.015 at 98.805

- Dec 22 steady at 98.535

- Red Pack (Mar 23-Dec 23) -0.015 to -0.01

- Green Pack (Mar 24-Dec 24) -0.015 to -0.005

- Blue Pack (Mar 25-Dec 25) -0.005

- Gold Pack (Mar 26-Dec 26) -0.01 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00043 at 0.07743% (-0.00157/wk)

- 1 Month +0.00614 to 0.11300% (+0.00671/wk)

- 3 Month -0.00615 to 0.30271% (-0.01386/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01443 to 0.52597% (-0.00486/wk)

- 1 Year -0.02772 to 0.93457% (-0.01329/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.019T

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.551B submitted

- Next scheduled purchases:

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

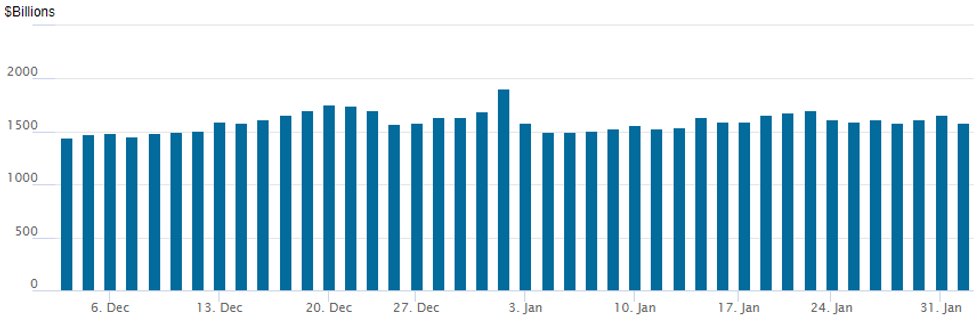

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,584.109B w/78 counterparties vs. $1,654.850B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

$9B Bank of America 5Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/01 $9B Bank of America $1.75B 3NC2 +67, $750M 3NC2 SOFR+66, $2.25B 6NC5 +92, $500M 6NC5 SOFR+105, $3.75B 11NC10 +117

- 02/01 $1B *Kommuninvest +2Y SOFR+15

- 02/01 $650M *CAF 5Y SOFR+85

- 02/01 $600M #Tyco Electronics Group 10Y +93

- On tap for Wednesday:

- 02/02 $Benchmark Development Bank of Japan 3Y

- Note on prior Bank of America issuance, last year BOA issued a total of $15B on April 16 ( $2.25B 4NC3 +65, $600M 4NC3 FRN SOFR+69, $3.75B 6.25NC5.25 +90, $400M 6.25NC5.25 FRN SOFR+97, $4.5B 11NC10 +110, $3.5B 21NC20 +115.

- The month prior, BoA issued $5.5B last month on March 8: $2.5B 6NC5 +80, $2B 11NC10 +105, $1B 31NC30 +115. Compares to total of $9.5B debt issued by BoA for all of 2020.

- Note on prior Bank of America issuance, last year BOA issued a total of $15B on April 16 ( $2.25B 4NC3 +65, $600M 4NC3 FRN SOFR+69, $3.75B 6.25NC5.25 +90, $400M 6.25NC5.25 FRN SOFR+97, $4.5B 11NC10 +110, $3.5B 21NC20 +115.

EGBs-GILTS CASH CLOSE: Yields Reverse Higher In The Afternoon

European yields rose Tuesday as equities held their ground and markets continued to reprice central bank outlooks in a more hawkish direction.

- That's of course ahead of the ECB and BoE decisions Thursday and marked a reversal in the afternoon, as morning yield drops dissipated.

- Stronger-than-expected US ISM prices paid data and job openings contributed to a negative tone.

- This time, the German short-end underperformed (vs UK weakness Monday).

- BTPs rallied briefly on a BTPei syndication announcement which was seen as reducing potential for a nominal mandate in February.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.8bps at -0.47%, 5-Yr is up 1.8bps at -0.202%, 10-Yr is up 2.6bps at 0.037%, and 30-Yr is up 3.8bps at 0.315%.

- UK: The 2-Yr yield is up 1.6bps at 1.061%, 5-Yr is up 0.3bps at 1.136%, 10-Yr is down 0.2bps at 1.3%, and 30-Yr is down 2.1bps at 1.427%.

FOREX: Greenback Weakness Extends, NZD Squeezes Ahead Of Jobs Data

- The USD index sits marginally in the red on Tuesday, extending yesterday’s strong sell-off. A light calendar and broadly in-line US ISM Manufacturing PMI data did little to stoke any G10 currency volatility as markets await more major central bank meetings later in the week.

- Particular beneficiaries were once again AUD (+0.67%) and NZD (+0.93%), boosted by equity benchmarks consolidating at better levels, an advance for metals and higher commodity indices in general.

- AUDUSD failed to gather any downward momentum following the post-RBA downtick and continued to grind higher throughout both the European and US trading sessions. Furthermore, Friday’s false break of 0.6993/91, the Dec 3 2021 and Nov 2, 2020 lows has contributed to the squeeze/recovery with firm short-term resistance now in focus at 0.7130, the Jan 7 low.

- NZD’s outperformance comes ahead of quarterly employment data due overnight. Further gains may target the December lows of 0.6702, the most notable short term resistance point.

- The Pound also caught a bid, with cable rising 0.48% as well as the pressure on the cross which has been edging back towards the 0.8300 as we approach Thursday’s BoE meeting. The MPC looks set to raise Bank Rate by 25 basis points for a second meeting in a row taking it to the 0.5% threshold for it to begin reducing the size of its balance sheet, and to open the door to another hike in May.

- Yesterday’s daily close for EURUSD highlights a 3-day Japanese candle reversal known as a morning star. This suggested scope for a stronger short-term corrective which did play out throughout Tuesday. EURUSD came within 14 pips of the next firm resistance at 1.1293, the 20-day EMA, before settling around 1.1250.

- Overnight, RBA Governor Lowe is due to speak at the National Press Club, in Sydney with a Q&A expected. In Europe, HICP inflation data will be published before Thursday’s ECB meeting.

Data Calendar for Wednesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/02/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/02/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/02/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/02/2022 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2022 | 1500/1000 | ** |  | US | housing vacancies |

| 02/02/2022 | 1500/1000 |  | CA | BOC Deputy Gravelle speaks on swaps panel | |

| 02/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/02/2022 | 2000/1500 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 03/02/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.