-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Curves Trades Bull Flatter Post-ADP, Quarterly Refunding

Highlights:

- US curve trades bull flatter following ADP, quarterly refunding

- USD weaker, chewing through post-FOMC gains

- EUR/USD retakes 1.13 ahead of ECB meeting

US TSYS SUMMARY: Bull Flattening Amongst Large Swings

- Treasuries have bull flattened on a day of whipsawing following a large ADP miss, the Treasury Refunding announcement and geopolitical swings.

- ADP was almost 500k below consensus in January and further dampened expectations ahead of payrolls on Fri. Even though the initial reaction was largely unwound, it appeared to set the stage for the subsequent rally after Treasury Refunding that was largely but not completely as expected along with the US announcing the deployment of troops to Eastern Europe.

- 2Y yields are -0.8bps at 1.158%, 5Y -1.6bps at 1.601%, 10Y -1.8bps at 1.770% and 30Y -1.2bps at 2.097%. Lower breakeven inflation had been largely behind earlier rallies but has since largely reversed.

- TYH2 stands towards the middle of the session’s range at 128-03 having earlier got close to testing resistance of 128-11+ (20-day EMA). Volumes remain low, approximately 80% of the average for the time of day.

- Important data releases tomorrow with ULC/productivity for Q4 along with ISM Services for Jan before Friday’s payrolls.

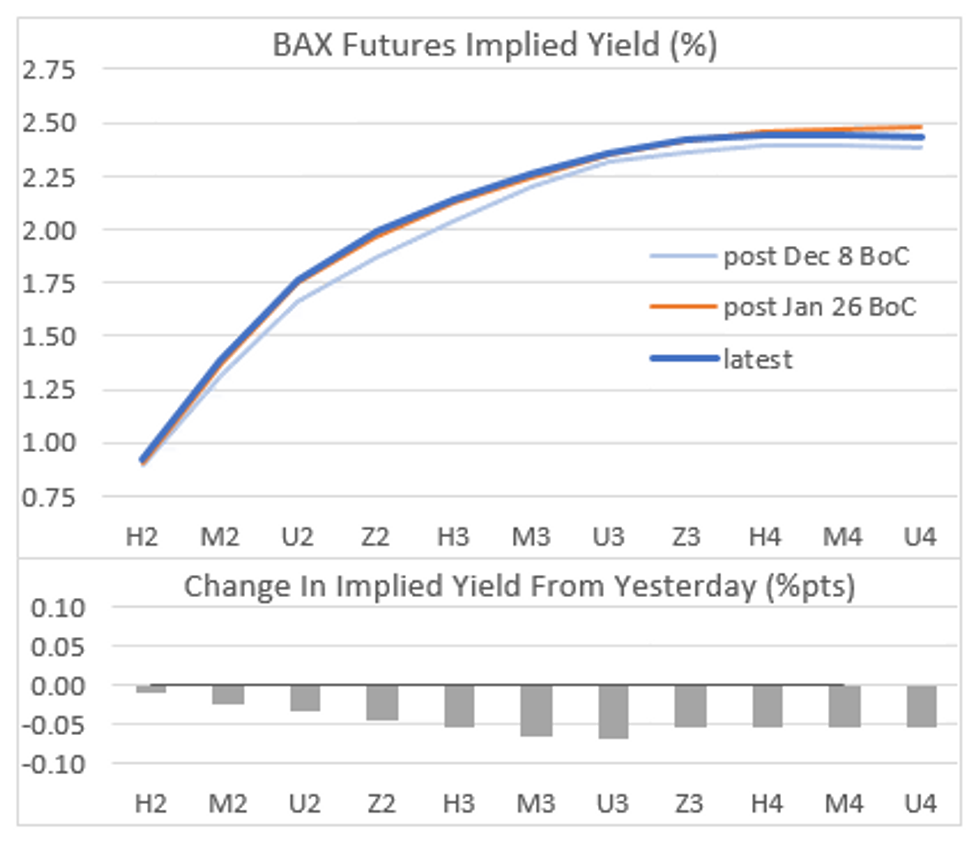

CANADA FIXED INCOME: Sizeable Rally in GoCs

- Today’s sizeable rally in GoCs, outperforming Tsys across the curve, has pulled 2YY down 5bps from yesterday’s post-BOC/FOMC highs to 1.231%.

- This is in part on lower rate expectations, with BAX futures up as much as 4.5 ticks in the whites and 7 ticks in the reds, taking the curve back to where it was last week after hawkish holds from both.

- There have been few obvious domestic factors behind the move, although upcoming BoC speak from Macklem and Rogers could have an impact in just under 30mins. Macklem's opening statement will be published at 1500ET.

EGBs-GILTS CASH CLOSE: Gilts Easily Outperform Pre-BoE/ECB

Gilts outperformed in a bull flattening motion with the German curve bear flattening Wednesday, ahead of key central bank meetings.

- Higher-than-expected Eurozone and Italian Jan inflation sent Bunds to session lows, and after a brief bounce, resumed heading lower until mid-afternoon.

- German 5s30s closed at flattest since March 2020.

- Bunds and Gilts rallied in the final few hours of cash trade on very weak US ADP private payrolls data and news that the US was deploying more troops in eastern Europe.

- Gilts easily outperformed though. Some degree of position squaring ahead of highly-anticipated BoE and ECB decisions Thursday as well - see our website or contact us for our previews.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.458%, 5-Yr is up 2.2bps at -0.18%, 10-Yr is up 0.3bps at 0.04%, and 30-Yr is down 2.6bps at 0.289%.

- UK: The 2-Yr yield is down 3.2bps at 1.029%, 5-Yr is down 2.8bps at 1.108%, 10-Yr is down 4.3bps at 1.257%, and 30-Yr is down 6.6bps at 1.361%.

- Italian BTP spread up 1.4bps at 139bps / Spanish up 0.4bps at 74.4bps

EGB OPTIONS: Bund Combo; Put Spread

- RXJ2 163.50/169.50 combo vs RXH2 166.00/174.00 combo bought for 22 in 2.5k (bought April put)

- RXH2 168.50/168.00 put spread trades 22 in 3.5k

FOREX: USD Index Extends Decline, Eroding Post-FOMC Gains

- Greenback weakness extended on Wednesday as the US Dollar Index registered a third straight session of declines, eroding the entirety of last week’s post-FOMC advance. While not prompting any extension of the moves, US ADP underwhelmed, missing expectations by nearly half-a-million jobs.

- Despite the overall dollar retreat, a brief bout of equity weakness from the highs kept price action in G10 FX muted throughout the US trading session. On the day, GBP, SEK and NOK led gains, whereas NZD (Unch) was the clear relative underperformer.

- EURUSD was underpinned by notably stronger CPI flash estimates and returns to December’s familiar territory around the 1.1300 mark ahead of tomorrow’s ECB decision.

- With the European central bank’s baseline assumption facing increased pressure the ECB could opt to retain some optionality, at Thursday’s meeting, by stressing that inflation forecasts carry a high degree of uncertainty and that there are upside risks to inflation (perhaps citing the risk of persistent energy price pressures).

- Bank of England also in focus tomorrow, where analysts appear unanimous in expecting a 25bp hike. GBPUSD has further recovered off its recent low of 1.3358 on Jan 27 and has topped resistance at 1.3525, Jan 26 high. A continuation higher would suggest scope for a climb towards 1.3662 next, the Jan 20 high.

- Looking at EURGBP, the broader trend remains down, and a resumption of weakness would open 0.8282/77, the Feb'20 and Dec'19 lows and the multi-year range base at 0.8300.

- After the major European central bank decisions, markets will await US ISM Services PMI data, before Friday’s US Non-Farm payroll takes centre stage.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E1.9bln), $1.1195-00(E654mln), $1.1220-25(E720mln) $1.1275-00(E1.9bln), $1.1310-25(E1.2bln), $1.1335-40(E542mln)

- USD/JPY: Y112.35-50($965mln), Y113.00-20($657mln), Y113.80-00($606mln), Y114.90-00($1.9bln)

- GBP/USD: $1.3300(Gbp593mln), $1.3400(Gbp779mln), $1.3500-05(Gbp635mln)

- AUD/USD: $0.7100-20(A$1.1bln), $0.7130-50(A$1.4bln), $0.7200-08(A$755mln)

- NZD/USD: $0.6750-60(N$532mln)

EQUITIES: Stocks Settle Higher, With Earnings a Key Driver

- After a mixed open, all three major US equity indices settled higher on Wednesday, with the S&P 500 outperforming despite a more solid start for the NASDAQ.

- Alphabet (Google) is a particularly source of strength, opening at fresh alltime highs after their report following the Tuesday close. This puts the Communication Services at the top of the pile in the S&P500, with real estate and consumer staples not far behind.

- Energy and financials are the laggards of the day, with a reversal off the highs in the crude price the primary driver. For bank names, a sharp flattening of the US sovereign curve has sapped margins for financials, prompting underperformance among the likes of Wells Fargo, Bank of America and JPMorgan.

- Earnings remain a key driver at this stage, with Meta Platforms (Facebook)and Qualcomm both due after market. Full schedule with timings, EPS and revenue expectations here: https://marketnews.com/mni-us-earnings-schedule-sp...

- Gains in the e-mini S&P are still considered corrective. Price action in January resulted in a reversal of the moving average condition to bearish that suggests short-term gains are corrective. 4576.53, the 50-day EMA has been probed. A decisive break of this resistance would suggest scope for a stronger reversal.

PRECIOUS METALS: Survey Averages Indicate Analysts Bearish On Silver, Platinum

- Yesterday, the London Bullion Market Association released the results of its annual forecast survey. Among the 34 analysts who participated in this year's survey, expectations appear for gold prices to remain relatively stable. (Kitco)

- Analysts, however, appear more bearish on silver as average estimates reside at $23.54/oz, down 6% from the 2021 average price of $25.14.

- The most bullish forecaster (Sharps Pixley) predicts prices rising to around $30/oz:

- "We consider the silver price to be undervalued relative to most asset classes, particularly compared to other commodities," he said. "We expect the investment appetite to shift more and more towards silver this year to the detriment of gold investments."

- On the other hand, precious metals analysts at Bank of China, sit on the most bearish end of the spectrum, with a price target of $17.20, citing the macro-environment as a clear headwind for Silver with the upcoming Fed tightening cycle.

- Furthermore, analysts appear equally downbeat on the potential for platinum with an average price forecast of $1,063.40/oz, down 2.5% from the 2021 average of $1,090.20.

COMMODITIES: Oil Prices Edge Up On Continued Supply Fears

- Crude oil prices have edged up today amidst geopolitical tension with the US deploying troops to Eastern Europe and OPEC+ announcing a planned output rise in line with expectations.

- OPEC+ agreed to raise production another 400kbpd in March. Supply side fears remain though, with spare capacity seen now largely confined to Saudi Arabia, the UAE, Iraq and Kuwait.

- JPM’s Head of Commodities Strategy said oil could hit $120/bbl if geopolitical risks escalate.

- WTI is up +0.1% at $88.30, having earlier cleared resistance at $88.87 (Jan 28 high) before retracing.

- On a busy day, the most active strikes in the H2 contract have been $81/bbl puts.

- Brent is +0.4% at $89.55, with a similar move clearing the Jan 28 high of $90.27 and getting close to second resistance at $90.69 (2.00 proj of the Dec 2-9-20 price swing).

- Gold meanwhile continued to edge up 0.3% to $1806.4, remaining comfortably between resistance of $1822.2 (Jan 27 high) and support of $1780.4 (Jan 28 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/02/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/02/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 03/02/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/02/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1230/1230 |  | UK | BOE post-MPC Press Conference | |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1330/1430 |  | EU | ECB post-policy meeting presser | |

| 03/02/2022 | 1345/0845 |  | US | Senate hearing on Federal Reserve nominees | |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/02/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 04/02/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/02/2022 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 07/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 07/02/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 07/02/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/02/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/02/2022 | 1545/1645 |  | EU | ECB Lagarde Intro at EU Parliament | |

| 07/02/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/02/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2022 | 0745/0845 | * |  | FR | current account |

| 08/02/2022 | 0745/0845 | * |  | FR | foreign trade |

| 08/02/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/02/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/02/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/02/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/02/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/02/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 08/02/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 09/02/2022 | 0700/0800 | ** |  | DE | trade balance |

| 09/02/2022 | 0900/1000 | * |  | IT | industrial production |

| 09/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/02/2022 | 1310/1310 |  | UK | BOE Pill at UK Monetary Policy outlook conference | |

| 09/02/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 09/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/02/2022 | 1700/1200 |  | CA | BOC Governor Macklem speaks to Chamber of Commerce | |

| 09/02/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 09/02/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.