-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: 30Y Tsy Yields Back to Late Friday Lvls

EXECUTIVE SUMMARY

- POWELL: FINANCIAL CONDITIONS HAVE TIGHTENED ON RATE-HIKE TALK, Bbg

- POWELL: RATE INCREASES `HAVE ALREADY HAPPENED IN EFFECT', Bbg

- POWELL: DON’T YET KNOW IF RATES WILL NEED TO GO ABOVE NEUTRAL, Bbg

- MNI INSIGHT: Fed Clings To View That Inflation Spike Will Ebb

- MNI BRIEF: Fed’s Powell Inclined to Back 25BP March Hike

- MNI BRIEF: St. Louis Fed Model Signals 450k Gain For Feb Jobs

- MNI: ECB May Delay Hikes, Face German Wage-Price Spiral-Grimm

US

FED: Many Federal Reserve officials still view the U.S. inflation surge as temporary to a large extent and likely to ease in the second half of the year, despite having moved away from a controversial description of rising prices as “transitory,” MNI understands.

- These policymakers are comforted by contained longer-run inflation expectations, particularly among market measures, although they are vigilant for possible spikes. They are also watching the potential that wage demands seeking to keep up with price spikes could create a worsening price spiral – a danger officials see as contained for now.

- The Fed is set raise interest rates for the first time since the pandemic at its upcoming March meeting, but there is still active and open debate on the extent of eventual rate hikes and the pace needed to contain an inflation rate that surged to 7.5% in the year to January.

- The lingering view that inflation is passing, if more stubborn than initially expected, means the core of the FOMC still favors gradual and predictable moves, even if they are prepared to act more aggressively should their benign predictions fail to materialize. For more, see MNI Policy main wire at 1006ET.

- “I’m inclined to support a 25 basis point rate hike,” Powell told lawmakers. “We will proceed but we will proceed carefully. We’re going to avoid adding uncertainty to what is already an extraordinarily uncertain and challenging moment.”

- MNI reported this week the Fed is keepings its options open, including the possibility of more aggressive hikes later in the year if inflation does not come down as expected.

- Annual revisions to the BLS's population estimates at the start of the year complicate how to read the model's output for February. The St. Louis Fed model had undershot the better-than-expected January jobs report, but the improvement in the household survey at the start of the year largely reflected a 1 million increase in U.S. population and less so the growing share of employed people, Dvorkin said.

- Using January as a base, the model expects a seasonally adjusted increase of 1.5 million employed for February. But with December as a base, the model sees a 184,000 decline in employed. "My personal forecast is in between these two numbers," Dvorkin said.

EUROPE

ECB: Germany faces both a wage-price spiral and a squeeze on growth, a leading government policy adviser told MNI, adding that soaring raw material costs linked to the Russian invasion of Ukraine might delay European Central Bank rate rises and force a rethink of German plans to transition to a green economy.

- Inflation is likely to remain at around 5% in 2022 despite rising natural gas prices being passed on to consumers only gradually, Veronika Grimm, a member of the German Council of Economic Experts, said in emailed responses to questions. At the same time, supply shortages caused by the conflict could affect production, with car and chemical output particularly hard hit.

- “Gas prices are currently at a very high level, and the situation is not expected to ease in the short term,” Grimm said. “However, wholesale price increases will only gradually be passed on to consumers. After all, many have longer-term contracts.” For more, see MNI Policy main wire at 0857ET.

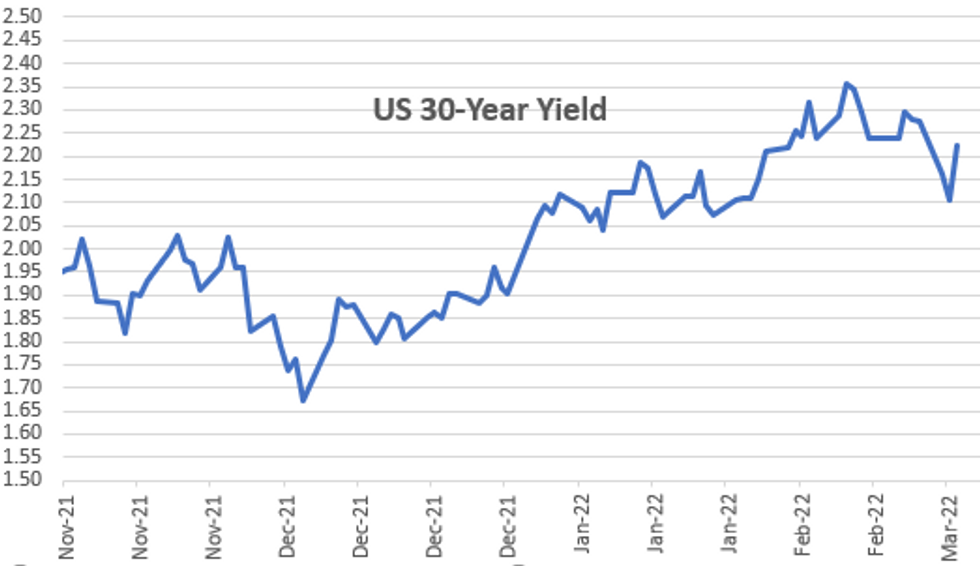

US TSYS: FI Summary, 30YY Back To Late Fri Lvls

Tsy bond yields have surged to highs for the week -- back near late Friday levels before Mon-Tue massive risk-off consolidation saw 30YY fall to 2.066% low Tuesday -- currently at 2.2666% +.1620 after the bell.

- Markets went from a cessation of risk-off following better than expected ADP jobs data (+475k vs. +375k est; huge Jan up-revision from -301k to +509k) to cautious risk-on by noon as Fed Chairman Powell brought a level of normalcy back to markets: expecting March liftoff as appropriate, keeping 50bp hike in reserve if inflation stays hot later in year, gradual/predictable balance sheet runoff soon after.

- High-gear risk-on in second half -- no obvious standout headline driver, but some desks cite short covering in stocks on hopes of some peace accord as Ukraine delegates said to be heading to talks with Russian counterparts. Leading SPX sectors at the moment: Energy, Financials and Materials -- all seeing some relief bounce after punishing sell-off/reaction to global sanctions on Russia.

- Thursday data focus on weekly claims, unit labor costs, durables while Fed Chairman Powell returns to Senate for second monetary policy testimony.

- After the bell, 2-Yr yield is up 16.3bps at 1.504%, 5-Yr is up 14.6bps at 1.7404%, 10-Yr is up 12.9bps at 1.856%, and 30-Yr is up 11.9bps at 2.2234%.

OVERNIGHT DATA

- ADP came out stronger than expected +475k vs + 375k, huge Jan up-revision to +509k from - 301k

- US MBA: REFIS +1% SA; PURCH INDEX -2% SA THRU FEB 25 WK

- US MBA: UNADJ PURCHASE INDEX -9% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 4.15% VS 4.06% PREV

- US MBA: MARKET COMPOSITE -0.7% SA THRU FEB 25 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 608.32 points (1.83%) at 33895

- S&P E-Mini Future up 83.5 points (1.94%) at 4386.75

- Nasdaq up 238.4 points (1.8%) at 13765.68

- US 10-Yr yield is up 12.9 bps at 1.856%

- US Jun 10Y are down 43.5/32 at 127-12

- EURUSD down 0 (0%) at 1.1124

- USDJPY up 0.59 (0.51%) at 115.52

- WTI Crude Oil (front-month) up $8.41 (8.13%) at $111.95

- Gold is down $12.42 (-0.64%) at $1932.06

- EuroStoxx 50 up 54.74 points (1.45%) at 3820.59

- FTSE 100 up 99.36 points (1.36%) at 7429.56

- German DAX up 95.26 points (0.69%) at 14000.11

- French CAC 40 up 101.53 points (1.59%) at 6498.02

US TSY FUTURES CLOSE

- 3M10Y +12.336, 150.923 (L: 134.004 / H: 152.385)

- 2Y10Y -3.286, 35 (L: 31.274 / H: 42.485)

- 2Y30Y -4.246, 71.747 (L: 66.049 / H: 82.109)

- 5Y30Y -3.012, 48.137 (L: 43.661 / H: 56.369)

- Current futures levels:

- Jun 2Y down 14/32 at 107-14.375 (L: 107-14.125 / H: 107-30.625)

- Jun 5Y down 1-2.75/32 at 118-3.25 (L: 118-02.5 / H: 119-09.75)

- Jun 10Y down 1-20/32 at 127-3.5 (L: 127-02.5 / H: 128-29.5)

- Jun 30Y down 3-03/32 at 156-02 (L: 155-31 / H: 159-05)

- Jun Ultra 30Y down 5-09/32 at 183-10 (L: 183-01 / H: 188-28)

(M2) Bullish Focus

- RES 4: 129-31 Low Dec 8 (cont)

- RES 3: 129-13 3.00 proj of the Feb 10 - 14 - 15 price swing

- RES 2: 129-00 Round number resistance

- RES 1: 128-31+ High Mar 1

- PRICE: 128-09 @ 11:44 GMT Mar 2

- SUP 1: 126-30 20-day EMA

- SUP 2: 125-29 Low Feb 25

- SUP 3: 125-14+ Low Feb 10 and the bear trigger

- SUP 4: 125-06+ Low May 30 2019 (cont)

Treasuries traded firmer Tuesday as the contract extended the recovery that started Feb 10 off 125.14+. This week’s gains have resulted in a break of both the 20- and 50-day EMAs and the break of the latter EMA strengthens the current bullish theme. Resistance at 128-17, Jan 24 high was breached yesterday. This signals scope for a climb towards the 129-00 handle next. On the downside, the 20-day EMA is seen as an initial firm support. It intersects at 126-30.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.010 at 99.358

- Jun 22 -0.190 at 98.865

- Sep 22 -0.265 at 98.530

- Dec 22 -0.275 at 98.220

- Red Pack (Mar 23-Dec 23) -0.275 to -0.23

- Green Pack (Mar 24-Dec 24) -0.22 to -0.20

- Blue Pack (Mar 25-Dec 25) -0.20 to -0.185

- Gold Pack (Mar 26-Dec 26) -0.18 to -0.16

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00243 at 0.07943% (+0.00229/wk)

- 1 Month +0.00786 to 0.24243% (+0.01186/wk)

- 3 Month +0.01128 to 0.52214% (-0.00086/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03200 to 0.79586% (-0.03285/wk)

- 1 Year +0.04158 to 1.21829% (-0.11242/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.07% volume: $247B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.062T

- Broad General Collateral Rate (BGCR): 0.05%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $361B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

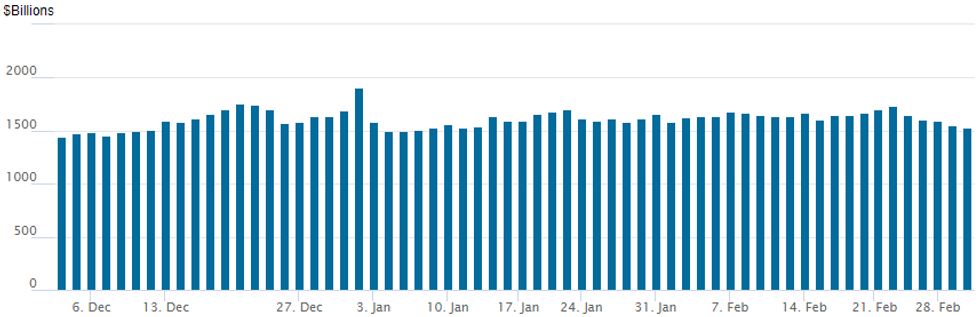

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,526.211B w/ 80 counterparties vs. $1,552.950B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $6B HCA 5Pt Leads Day's Issuance

Still waiting on Bank of Nova Scotia and Athene to launch, otherwise over $16B in high-grade debt looks to price today:

- Date $MM Issuer (Priced *, Launch #)

- 03/02 $6B #HCA Inc $1B 5Y +140, $500M 7Y +160, $2B 10Y +185, $500M 20Y +215, $2B 30Y +235

- 03/02 $2.25B #Bank of Nova Scotia 5Y SOFR+58

- 03/02 $2B #Republic of Chile 20Y +200

- 03/02 $2B #Exelon $650M 5Y +100, $650M 10Y +145, $700M 30Y +180

- 03/02 $1.5B #Progressive $500M each: 5Y +75, 10Y +115, 30Y +145

- 03/02 $1.25B #John Deere $450M 3Y +45, $300M 3Y FRN/SOFR+56, $500M 5Y +60

- 03/02 $1.1B #Nucor $550M 10Y +130, $150M 30Y +165

- 03/02 $1.05B #Athene Global, $550M 2Y +100, $500M 5Y +145

- 03/02 $750M #Crown Castle 5Y +120

- 03/02 $700M #Alabama Power WNG 10Y +120

- 03/02 $550M #Nasdaq WNG 30Y +175

- 03/02 $500M #Waste Connections 10Y +135

- 03/02 $Benchmark Athene Global, 2Y fix/FRN, 5Y fix/FRN

FOREX: USDCAD At 5-Week Lows On Oil/Hawkish BOC, Cross/JPY Strongly Supported

- The Bank of Canada initiated lift-off today by raising the overnight rate by 25bps to 0.5%. While CAD strength had largely been as a result of the prior significant surge in crude futures, a hawkish tilt to the statement provided an additional tailwind for the Canadian dollar, prompting USDCAD (-0.75%) to plumb fresh 5-week lows.

- After briefly testing the key short-term support of 1.2636 (Feb 10 low) that forms the bottom of the post Jan26 BOC/FOMC range, a sustained clearance should open 1.2560 (Jan 26 low).

- The 2% bounce in equity indices and oil price advance of around 8% on Wednesday also lent support to the likes of AUD, NZD and GBP while historical safe havens CHF (-0.26%) and JPY (-0.55%) were weighed upon.

- The divergence in G10 majors was evident with Cross/JPY being extremely well supported throughout the trading day as CAD/JPY rallied over 1.25%.

- EURUSD trades unchanged for the session, however, the single currency experienced some strong volatility after extending yesterday’s downward momentum to trade at 1.1058 amid fresh highs in the dollar index above 97.80. However, as equity markets bounced, EURUSD rose back above the 1.11 mark, looking likely to close just below session highs of 1.1143.

- Thursday will see the ECB Monetary Policy Meeting Accounts, as well as euro area unemployment, German car production and sales, and final services PMI data. BOC Governor, Tiff Macklem is then due to hold an online press conference about the Economic Progress Report with a Q&A scheduled.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 03/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/03/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/03/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 03/03/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/03/2022 | 1000/1100 | ** |  | EU | retail sales |

| 03/03/2022 | 1000/1100 | ** |  | EU | unemployment |

| 03/03/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/03/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/03/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 03/03/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 03/03/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/03/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 03/03/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 |  | CA | BOC Governor Macklem speech, "Economic Progress Report." | |

| 03/03/2022 | 2030/1530 |  | CA | BOC Governor Macklem testifies at House committee. | |

| 03/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2300/1800 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.