-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: NY Fed QE Retires; $30B ATT/Discovery Debt

EXECUTIVE SUMMARY

- MNI: War Makes Fed More Cautious On Tightening –Ex-Officials

- MNI INTERVIEW: War Means ECB Must Clarify Greek Support-Scope

- Ukraine "Won't Trade `Single Inch' Of Territories"

- KIRBY RULES OUT POLAND SENDING MIG FIGHTERS FOR U.S. DELIVERY, Bbg

- IRAQ OIL MINISTER: OPEC+ INCREASES ARE ENOUGH, Bbg

- IRAQ OIL MINISTER: EXTRA OUTPUT HIKES COULD HARM MARKET, Bbg

US

FED: Federal Reserve officials are likely to tighten monetary policy more cautiously than previously intended despite high inflation as they assess the hit to growth from surging energy prices in the wake of Russia’s invasion of Ukraine, former top policymakers and staffers told MNI.

- “The base case has to be a 25-basis-point move next week,” citing continued economic momentum and upside inflation risk, said Dennis Lockhart, former president of the Federal Reserve Bank of Atlanta.

- But the FOMC may shy away from hints at future moves, emphasizing that decisions are being made on a meeting-by-meeting basis, although the dot plot in the Summary of Economic Projections will still offer some clue into officials' expected tightening path.

- “I doubt there will be signaling of the next move or a series of moves,” Lockhart said. “The committee can't ignore the ambiguity of the current policy-making circumstances and the uncertainty about how the war evolves. Compared to a few weeks ago, I expect a circumspect and measured tone coming out of this meeting.” For more see MNI Policy main wire at 1403ET.

EUROPE

ECB: The Russian invasion of Ukraine makes it necessary for the European Central Bank to clarify how it will support Greece should inflation and market uncertainty continue to rise, Dennis Shen, lead country analyst at Scope Ratings in Berlin told MNI.

- “ECB policy over the forthcoming period and degree of central-bank support for Greek financial markets is another area we require further visibility around – critical for ensuring maintenance of an 'ECB put' to arrest market pressure on Greek government bonds should risk sentiment worsen owing to the Russia-Ukraine conflict and as inflation rises further,” Shen wrote in response to emailed questions.

- The Governing Council said last December that it would purchase Greek bonds over and above rollovers of redemptions from the Pandemic Emergency Purchase Programme if needed to avoid market fragmentation. for more see MNI Policy main wire at 0625ET.

US TSYS: Give Peace a Chance, Say Bye to QE, Hello to $30B ATT/Discovery Debt

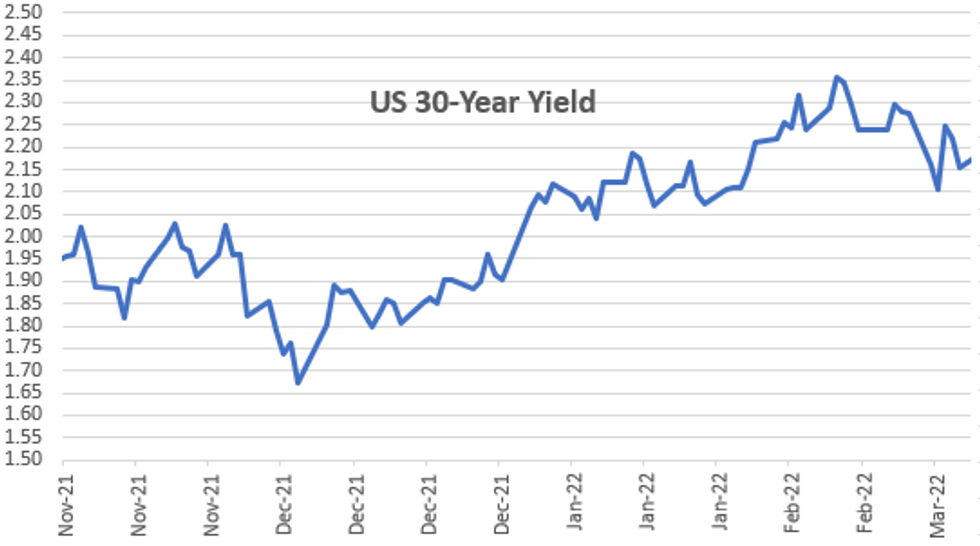

Tsys holding weaker levels after the bell, 30YY hitting 2.3014% high, risk-on (risk-off unwind) gained momentum as markets clung to hopes of a diplomatic solution to Russia war in Ukraine.- FI markets opened weaker, Tsys following Gilts lower in early London trade. De-escalation hopes tied to Russia officials claims no intention of toppling the Ukrainian government, preferring to achieve goals via talks.

- Mood carried through midday US trade on headlines Ukraine ready for diplomatic solution to strife, according to Pres Zelensky aide. Move tempered after aide added security guarantees are required while Ukraine "Won't Trade `Single Inch' Of Territories".

- Tsy futures gaps lower/bounces slightly after $34B 10Y note auction re-open (91282CDY4) tails slightly: 1.920% high yield vs. 1.915% WI; 2.47x bid-to-cover off last month's 2.68x.

- Aside from the Tsy 10Y re-open, markets absorbed $30B in the forth largest corporate debt issue on record: ATT/Discovery deal main focus in corporate spheres this week. In early February, ATT announced early they would spin off WarnerMedia in a $43 billion transaction to merge media properties with Discovery. Today's 11-part mega-deal: Magallanes, Inc (aka Spinco -- wholly owned T sub under a registration statement filed last Nov) will converts automatically after the divestiture to WarnerMedia Business.

- Final NY Fed purchase operation: After 1,780 operations and nearly $6T in securities bought, NY Fed's last purchase operation of Tsy 2.25Y-4.5Y, accepts $4.0001B vs. $17.398B submission. MBS buy-backs to continue through the end of the week.

OVERNIGHT DATA

- US BLS: JOLTS OPENINGS RATE 11.263M IN JAN

- US BLS: JOLTS QUITS RATE 2.8% IN JAN

- US MBA: REFIS +9% SA; PURCH INDEX +9% SA THRU MARCH 4 WK

- US MBA: UNADJ PURCHASE INDEX -7% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 4.09% VS 4.15% PREV

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 669 points (2.05%) at 33356.05

- S&P E-Mini Future up 108.5 points (2.6%) at 4283.75

- Nasdaq up 445.4 points (3.5%) at 13259.08

- US 10-Yr yield is up 10.2 bps at 1.9479%

- US Jun 10Y are down 20.5/32 at 126-16.5

- EURUSD up 0.0176 (1.61%) at 1.1077

- USDJPY up 0.18 (0.16%) at 115.83

- WTI Crude Oil (front-month) down $14.92 (-12.06%) at $108.41

- Gold is down $63.86 (-3.11%) at $1985.70

- EuroStoxx 50 up 260.73 points (7.44%) at 3766.02

- FTSE 100 up 226.61 points (3.25%) at 7190.72

- German DAX up 1016.42 points (7.92%) at 13847.93

- French CAC 40 up 424.87 points (7.13%) at 6387.83

US TSY FUTURES CLOSE

- 3M10Y +8.107, 155.623 (L: 145.638 / H: 155.718)

- 2Y10Y +2.383, 26.663 (L: 22.895 / H: 27.963)

- 2Y30Y -0.202, 62.22 (L: 58.256 / H: 63.403)

- 5Y30Y -2.587, 42.173 (L: 39.347 / H: 46.096)

- Current futures levels:

- Jun 2Y down 3.375/32 at 107-4.375 (L: 107-04.25 / H: 107-10.625)

- Jun 5Y down 11.75/32 at 117-16.25 (L: 117-15.25 / H: 118-03)

- Jun 10Y down 19/32 at 126-18 (L: 126-16.5 / H: 127-14.5)

- Jun 30Y down 1-11/32 at 155-23 (L: 155-20 / H: 157-21)

- Jun Ultra 30Y down 2-3/32 at 182-10 (L: 182-07 / H: 185-06)

US 10Y FUTURES TECH: (M2) Extends This Week’s Retracement

- RES 4: 129-31 Low Dec 8 (cont)

- RES 3: 129-13 3.00 proj of the Feb 10 - 14 - 15 price swing

- RES 2: 129-04/07+ High Mar 7 / Trendline off Aug 4 ‘21 high (cont)

- RES 1: 128-04 High Mar 8

- PRICE: 126-19.5 @ 1400ET Mar 9

- SUP 1: 126-19+ Low Mar 9

- SUP 2: 126-10 76.4% retracement of the Feb 10 - Mar 7 rally

- SUP 3: 125-29/14+ Low Feb 25 / Low Feb 10 and the bear trigger

- SUP 4: 125-06+ Low May 30 2019 (cont)

Treasuries are lower again today as the pullback from Monday’s high of 129-04 extends. The contract has breached support at 127-00, Mar 2 low and a continuation lower would open 126-10, a Fibonacci retracement. At this stage, the move lower appears corrective and 126-10 is seen as a key near-term support. A rebound would refocus attention on 129-04, the bull trigger.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.010 at 99.158

- Jun 22 -0.010 at 98.645

- Sep 22 -0.005 at 98.340

- Dec 22 -0.030 at 98.015

- Red Pack (Mar 23-Dec 23) -0.09 to -0.055

- Green Pack (Mar 24-Dec 24) -0.095 to -0.09

- Blue Pack (Mar 25-Dec 25) -0.095

- Gold Pack (Mar 26-Dec 26) -0.095 to -0.09

Short Term Rates

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00043 at 0.07843% (+0.00029/wk)

- 1 Month +0.03057 to 0.35171% (+0.04157/wk)

- 3 Month +0.04200 to 0.74500% (+0.13486/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02115 to 1.04486% (+0.10543/wk)

- 1 Year +0.03971 to 1.48657% (+0.13371/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $948B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $358B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: After 1,780 operations and nearly $6T in securities bought, NY Fed's last purchase operation of Tsy 2.25Y-4.5Y, accepts $4.0001B vs. $17.398B submission. MBS buy-backs to continue through the end of the week.

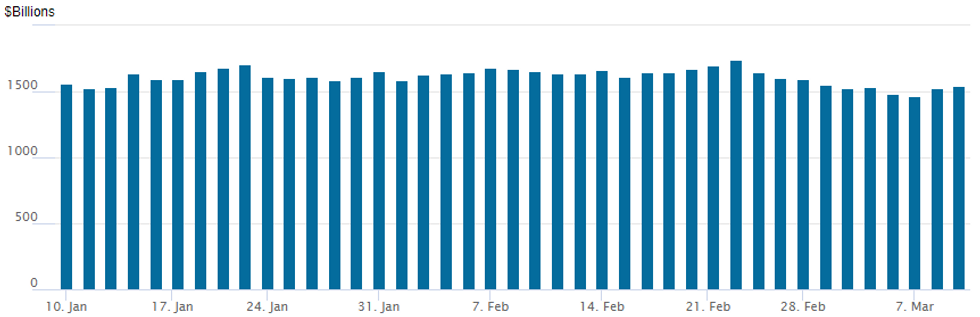

FED Reverse Repo Operation, Inching higher

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,542.504B w/ 81 counterparties vs. $1,525.099B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

$30B ATT/Discovery 11-Pt Mega-Deal Launched, Weighing on Tsys

Size of deal -- while estimated around $30B earlier (see 1158ET bullet), size of mega-deal weighing on Tsys -- new session lows.

- Date $MM Issuer (Priced *, Launch #)

- 03/09 $30B Magallanes, Inc* 11Pt Jumbo:

- $1.75B 2Y +175,

- $500M 2Y NC1 +185,

- $500M 2Y FRN/SOFR+178,

- $1.75B 3Y +180,

- $500M 3Y NC1 +195,

- $4B 5Y +190,

- $1.75B 7Y +215,

- $5B 10Y +235,

- $4.5B 20Y +265,

- $7B 30Y +280,

- $3B 40Y +305

- 03/09 $500M #Public Service Electric & Gas 10Y +120

* Magallanes, Inc related to ATT/Discovery deal main focus in corporate spheres today. In early February, ATT announced early they would spin off WarnerMedia in a $43 billion transaction to merge media properties with Discovery. Today's 11-part mega-deal: Magallanes, Inc (aka Spinco -- wholly owned T sub under a registration statement filed last Nov) will converts automatically after the divestiture to WarnerMedia Business.

Wednesday's $30B ATT/Discovery 11pt debt issuance via Magallanes Inc (see 1347ET bullet for details) ties it with AbbVie for fourth largest issuance deal on record:

- Record Size Issuance

- 8/11/13 $49B Verizon

- 1/13/16 $46B AB InBev

- 9/04/18 $40B CVS over 9 tranches

- 11/12/19 $30B AbbVie jumbo 10-part

- 4/30/20 $25B Boeing 7pt

EGBs-GILTS CASH CLOSE: Risk-On Bear Flattening Ahead Of ECB

Bunds and Gilts continued to sell off Wednesday, in what was a more clearly risk-positive session compared with Tuesday's core FI weakness.

- In a combination of dip-buying and nascent optimism that the Ukraine-Russia situation won't worsen further, European stocks rallied strongly (DAX posted its best gains since March 2020), oil and gold fell sharply, and periphery spreads compressed, led by GGBs.

- Both the German and UK curves bear flattened, as attention turned to the ECB decision Thursday, and the Lagarde press conference which will come alongside US inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 12.3bps at -0.487%, 5-Yr is up 9.8bps at -0.111%, 10-Yr is up 10.4bps at 0.216%, and 30-Yr is up 10.7bps at 0.427%.

- UK: The 2-Yr yield is up 9bps at 1.416%, 5-Yr is up 8.6bps at 1.325%, 10-Yr is up 8bps at 1.526%, and 30-Yr is up 6.5bps at 1.685%.

- Italian BTP spread down 2.2bps at 146.2bps / Greek down 5.3bps at 217.2bps

FOREX: Renewed Optimism Prompts Euro Relief Rally, DXY Retraces Lower

- A significant recovery in European equities amid renewed hopes for a diplomatic solution to the Ukraine conflict, triggered a strong relief rally for the Euro. Additionally, the surge in sentiment weighed on the greenback with the dollar index falling over 1%, back to Friday’s lowest levels.

- EURUSD broke through short-term resistance of Monday's intraday high of 1.0961 and was steadily supported throughout the trading day. The price action was stubborn and unrelenting as the pair registered a high print of 1.1095, marking a substantial 205-pip range. Resistance now resides at 1.1121, the low from Jan 28 and the recent breakdown level and comes into focus ahead of tomorrow’s ECB meeting and US inflation data.

- Single currency strength was broad based, with Euro registering +1% gains against AUD, CAD, NZD, CHF and GBP and EURJPY posted a very decent intra-day advance of +1.7%.

- Another notable upswing on Wednesday was seen for the Swedish Krona. The currency is set to register its best day against the greenback since at least 2011 and in turn, USDSEK has now retraced over half the war-induced rally, retreating back to 9.68 and the Feb 24 highs.

- Aussie MI Inflation Expectations will be released overnight ahead of a vacant European data docket before the ECB statement and press conference. President Lagarde is scheduled to start talking as the US release their February CPI data, with the headline annual rate expected to jump to 7.9%. Eight surveyed analysts are expecting the figure to reach 8%.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 10/03/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/03/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 10/03/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/03/2022 | 1330/0830 | *** |  | US | CPI |

| 10/03/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/03/2022 | 1330/0830 | * |  | CA | Intl Investment Position |

| 10/03/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/03/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 10/03/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/03/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/03/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/03/2022 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.