-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Persistence of Higher Price Expectations

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: ECB Adopts Flexible Wording On Rates Timing

- MNI BRIEF: US Treasury Saw USD217B Deficit in February

- MNI RUSSIA: IMF No Longer Sees Russian Debt Default as an Improbable Event

- MNI SECURITY: GR Scholz To Continue Engagement With Putin

- GOLDMAN TO EXIT RUSSIA IN WALL STREET’S FIRST PULLOUT, Bbg

- ICE LIFTS BRENT CRUDE OIL FUTURES MARGIN BY 32%, Bbg

US

US: The U.S. government budget again slipped into the red in February with a USD217 billion deficit, while racking up a USD476 billion deficit in the first five months of the fiscal year, the Treasury Department said Thursday.

- After the first monthly surplus in January going back to September 2019, February's deficit came as outlays jumped to USD506 billion from USD346 billion the previous month, and receipts fell to USD290 billion from USD465 billion.

- The USD476 billion budget gap for the first five months of fiscal 2022 was down USD571 billion, or 55%, from the prior fiscal year at the same time. The Biden administration has shifted its stance in recent weeks to emphasize plans to cut budget deficits as inflation has pushed higher.

EUROPE

ECB: The European Central Bank accelerated the expected end of its asset purchases programme at its meeting on Thursday but gave itself room to delay any subsequent rate hikes as the war in Ukraine both raised the prospect of a near-term spike in inflation and posed downside risks to the eurozone economy.

- After what ECB President Christine Lagarde described as a meeting seeing differing opinions amid high levels of uncertainty, the Governing Council opted to set its Asset Purchase Programme at EUR40 billion in April, but then to reduce it by EUR10 billion a month with a view to ending bond buys in the third quarter if data permits. This was faster than the pace anticipated in December, when it said purchases would continue at EUR40 billion a month throughout the second quarter, and at EUR30 billion in Q3.

RUSSIA: The IMF joined a growing chorus that's warning of a risk that Russia will default on debt obligations following its invasion of Ukraine.

- A Russian default is no longer "an improbable event," IMF Managing Director Kristalina Georgieva told reporters Thursday. "It's not that Russia doesn't have money, Russia cannot use this money," she said. (BBG)

- Additionally, the IMF indicated unprecedented sanctions against the nation will make it difficult for the country to convert its IMF reserve assets, known as special drawing rights, into currency.

- After the call Macron said that Scholz will speak with Putin again within 48 hours to continue to push for a ceasefire between Russia and Ukraine. Macron and Scholz told the Russian president that any resolution to the war needed to come through negotiations between Ukraine and Russia. This reflects an understanding amongst European leaders that Russia may seek a resolution to the war which bypasses Kyiv to satisfy Russian 'security concerns'.

- Macron conceded that he is 'worried and pessimistic' and 'Europe must prepare itself for all scenarios.'

- The three-way call came as the former German Chancellor Gerhard Schrder was reportedly in Moscow meeting Russian President Vladimir Putin. When pressed on the meeting Scholz replied: 'I do not wish to comment on that.'

- The next high-level meeting will take place between Putin and Finnish President Sauli Niinist tomorrow.

US TSYS: Rates Off Lows, Equities Stage Late Rebound as Brent Crude Sours

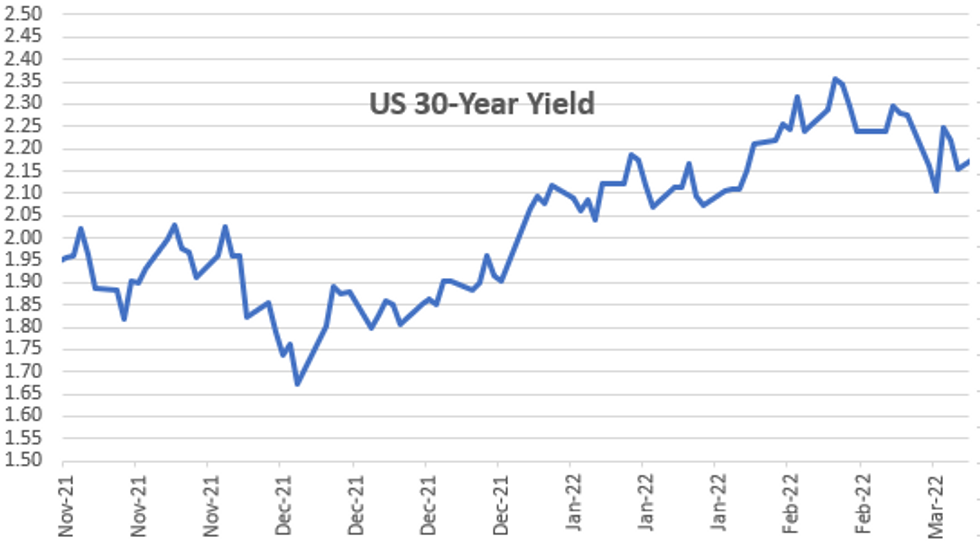

Rates held weaker levels after Thursday's close -- but off lows -- a variety of factors in play after 30YY tapped 2.4006% high while 10YY tapped 2.0179%, yield curves bounced off flatter levels.

- FI markets reversed gains during early London trade, extended lows across the curve into late morning after ECB policy annc kept rates steady but accelerated asset purchase wind down. The "hawkish hold" message looks to conclude QE in third quarter "If the incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of our net asset purchases."

- ECB presser w/Pres Lagarde helped yields take another leg higher on comments such as "persistence of higher price expectations uncertain" and of course "war is a substantial upside risk to inflation". Cold comfort(?): money markets not seeing "sever strain" as a result of sanctions on Russia.

- Relatively muted react to hot CPI coming out as expected +0.8% MoM, 7.9% YoY, core YoY +6.4%, highest inflation levels since the early '80s.

- While inflation metrics remain worrying, uncertainty due to Russia's war in Ukraine is starting to cool down more hawkish forward policy views with Fed eager to address rising inflation -- but not wanting to paint themselves into a corner.

- Tys pare losses after strong $20B 30Y auction re-open (912810TD0), Bond sale trades through 2.5bp on 2.375% high yield vs. 2.400% WI; 2.46x bid-to-cover vs. 2.30x last month.

- Cross assets: Still weaker, stocks quietly bounced back near midmorning highs in SPX eminis: 4251.5 (-15.25) -- traders citied renewed selling in oil as Brent extends session to 111.04, WTI to 105.82.

- After the bell, 2-Yr yield is up 3.5bps at 1.7145%, 5-Yr is up 5.3bps at 1.9313%, 10-Yr is up 4.4bps at 1.9969%, and 30-Yr is up 4.5bps at 2.3797%.

OVERNIGHT DATA

- US FEB CPI 0.8%, CORE 0.5%; CPI Y/Y 7.9%, CORE Y/Y 6.4%

- US FEB ENERGY PRICES 3.5%

- US FEB OWNERS' EQUIVALENT RENT PRICES 0.4%

- US JOBLESS CLAIMS +11K TO 227K IN MAR 05 WK

- US PREV JOBLESS CLAIMS REVISED TO 216K IN FEB 26 WK

- US CONTINUING CLAIMS +0.025M to 1.494M IN FEB 26 WK

MARKETS SNAPSHOT

Key late session market- DJIA down 147.14 points (-0.44%) at 33143.47

- S&P E-Mini Future down 21 points (-0.49%) at 4247.25

- Nasdaq down 127.2 points (-1%) at 13133.16

- US 10-Yr yield is up 4.4 bps at 1.9969%

- US Jun 10Y are down 15/32 at 126-2.5

- EURUSD down 0.0089 (-0.8%) at 1.0987

- USDJPY up 0.26 (0.22%) at 116.09

- WTI Crude Oil (front-month) down $2.49 (-2.29%) at $106.17

- Gold is up $5.08 (0.26%) at $1997.00

- EuroStoxx 50 down 114.63 points (-3.04%) at 3651.39

- FTSE 100 down 91.63 points (-1.27%) at 7099.09

- German DAX down 405.83 points (-2.93%) at 13442.1

US TSY FUTURES CLOSE

- 3M10Y +5.644, 160.361 (L: 148.644 / H: 162.799)

- 2Y10Y +1.306, 28.233 (L: 23.983 / H: 29.35)

- 2Y30Y +1.752, 66.884 (L: 60.699 / H: 67.921)

- 5Y30Y -0.314, 45.048 (L: 41.628 / H: 46.097)

- Current futures levels:

- Jun 2Y down 2.75/32 at 107-1.625 (L: 107-00 / H: 107-06.25)

- Jun 5Y down 9/32 at 117-7 (L: 117-03.75 / H: 117-22.25)

- Jun 10Y down 14.5/32 at 126-3 (L: 125-29.5 / H: 126-26.5)

- Jun 30Y down 24/32 at 154-30 (L: 154-13 / H: 156-03)

- Jun Ultra 30Y down 2-20/32 at 179-21 (L: 179-03 / H: 182-25)

US 10Y FUTURES TECH: (M2) Approaching Key Support

- RES 4: 129-31 Low Dec 8 (cont)

- RES 3: 129-13 3.00 proj of the Feb 10 - 14 - 15 price swing

- RES 2: 129-04/06 High Mar 7 / Trendline off Aug 4 ‘21 high (cont)

- RES 1: 127-05+/128-04 20-day EMA / High Mar 8

- PRICE: 126-02+ @ 1640 GMT Mar 10

- SUP 1: 125-29 Low Feb 25

- SUP 2: 125-14+ Low Feb 10 and the bear trigger

- SUP 3: 125-06+ Low May 30 2019 (cont)

- SUP 4: 124-27 Low May 24 2019 (cont)

Treasuries have extended this week’s bear leg today. The contract has breached 126-10, 76.4% of the Feb 10 - Mar 7 rally. The break of this level strengthens a bearish threat and while the pullback is considered corrective, there is potential for a deeper pullback. The next support to watch is 125-29, the Feb 25 low ahead of the key support and bear trigger at 125-14+. A break of 125-14+ would confirm a resumption of the broader downtrend.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.025 at 99.133

- Jun 22 -0.055 at 98.590

- Sep 22 -0.040 at 98.295

- Dec 22 -0.035 at 97.980

- Red Pack (Mar 23-Dec 23) -0.045 to -0.035

- Green Pack (Mar 24-Dec 24) -0.07 to -0.045

- Blue Pack (Mar 25-Dec 25) -0.075 to -0.065

- Gold Pack (Mar 26-Dec 26) -0.065 to -0.06

Short Term Rates

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 at 0.07929% (+0.00115/wk)

- 1 Month +0.03529 to 0.38700% (+0.07686/wk)

- 3 Month +0.05786 to 0.80286% (+0.19272/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.05800 to 1.10286% (+0.16343/wk)

- 1 Year +0.04829 to 1.53486% (+0.18200/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $246B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $952B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $357B

- (rate, volume levels reflect prior session)

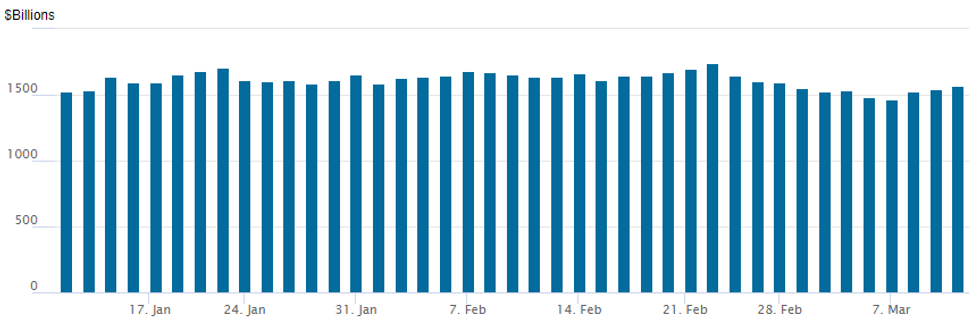

FED Reverse Repo Operation

NY Federal REserve/MNI

Tys pare losses after strong $20B 30Y auction re-open (912810TD0), Bond sale trades through 2.5bp on 2.375% high yield vs. 2.400% WI; 2.46x bid-to-cover vs. 2.30x last month.

- Indirect take-up climbs to 71.25% vs. 67.95% in Feb; direct bidder take-up recedes to 16.42% vs. 17.75% prior, primary dealer take-up falls to 12.06% vs. 14.30%.

- The next 30Y auction (re-open) is tentatively scheduled for April 13

PIPELINE: $5.25B Citigroup 3Pt, $3.5B Charter Comm 3Pt Launched

Still waiting for Goldman Sachs and DBC Bank, updated guidance- Date $MM Issuer (Priced *, Launch #)

- 03/10 $Benchmark Goldman Sachs 2Y +135, 2Y FRN/SOFR, 6NC5 +170, 6NC5 FRN/SOFR

- 03/10 $5.25B #Citigroup $1.75B 4NC3 +140, $500M 4NC3 FRN/SOFR, $3B 11NC10 +180

- 03/10 $3.5B #Charter Comm $1B 11Y +245, $1.5B 31Y +290, $1B 41Y +315

- 03/10 $Benchmark DBS Bank 5Y +68a

- 03/10 $1.5B #MPLX 30Y +260

EGBs-GILTS CASH CLOSE: ECB Hawkish Surprise

Thursday's ECB decision to accelerate its exit from asset purchases earlier than expected - with Pres Lagarde calling the Ukraine-Russia war a "substantial upside risk" to inflation.

- EGB curves bear flattened as rate hike expectations were brought forward: 2Y-5Y German bonds underperformed.

- Real yields rose sharply as breakeven inflation expectations slipped.

- BTPs underperformed, with 10Y spreads out over 16bps.

- Conversely, UK short-end yields headed lower.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.6bps at -0.381%, 5-Yr is up 10.9bps at -0.002%, 10-Yr is up 5.8bps at 0.274%, and 30-Yr is up 2.4bps at 0.451%.

- UK: The 2-Yr yield is down 6.5bps at 1.351%, 5-Yr is down 2.3bps at 1.303%, 10-Yr is down 0.3bps at 1.523%, and 30-Yr is up 0.9bps at 1.695%.

- Italian BTP spread up 16.6bps at 162.9bps / Spanish up 6.6bps at 99.3bps

FOREX: Greenback Regains Poise As ECB-Induced EUR Spike Meets Tough Resistance

- The ECB’s Governing Council made the decision to slow its net asset purchases at a marginally quicker pace than they had previously assessed. This prompted a substantial wave of single currency demand, which saw EURUSD rip from around 1.1040 to highs of 1.1121 prior to President Lagarde addressing the press.

- Matching perfectly with the January 28 low and breakdown point, the pair met firm touted resistance as markets awaited further details within the press conference.

- As the session developed markets began to analyse the ECB’s choice of language around rate hikes. Market participants interpreted the phrase "some time after the end of the net purchases and will be gradual", as a dovish balancing act, with Lagarde confirming this provides the ECB with optionality amid the obvious lingering uncertainties.

- Indeed, the Euro began to gradually unwind the notable spike and eventually made fresh session lows, with EURUSD extending back below 1.10 and hovering just above session lows of 1.0980 as of writing and the likes of EURAUD, EURCAD and EURNZD all down well over 1%.

- Given EURUSD’s path of least resistance throughout the second half of Thursday, the USD index sits 0.55% higher, erasing around half of yesterday’s losses.

- Growth data from the UK is the highlight of Friday’s European data calendar before Canadian February employment and US Michigan sentiment data round off the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/03/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 11/03/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/03/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/03/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/03/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/03/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 11/03/2022 | 1330/0830 | ** |  | CA | Capacity Utilization |

| 11/03/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 11/03/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 11/03/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/03/2022 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.