-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Hawkish Fed Speak Resumes

EXECUTIVE SUMMARY

- MNI FED: Waller: Looking For 225+bp of Hikes In 2022, 50bp Hikes Possible

- MNI FED: Waller Unconcerned About Inflation Expectations...Or Recession

- MNI FED: Bullard Dissent: 300bp 2022 Hikes, QT Now Appropriate

- MNI FED: Barkin Sees Gradual Unwind Of Fed's Extraordinary Support

- US: US Pres Biden to Europe Next Week: Expected to speak at European council summit on Thursday, followed by G7 meeting. No set times, TBA.

US

FED: Fed Gov Waller (voter), interviewed on CNBC just now, was characteristically hawkish.

- We know now that Waller's 2022 "dot" was one of the 4 that saw either 225bp or 250bp of hiking this year based on his comments and the Dot Plot. Bullard was the 5th to see over 2.25% end-2022, but he said earlier he's looking for 3.00-3.25%.

- Re supporting a 25bp hike at the March meeting: "The data is screaming at us to go 50 but the geopolitical events were telling us to move with caution. Those two factors combined pushed me off" of a 50bp hike. Going forward, could move in 50bp increments at coming meetings.

- Geopolitics will be an issue in that regard. Other than oil prices, will have to see if Russia-Ukraine create other problems down the line for the US economy. Europe will feel this a lot more.

- "I really favor front-loading our rate hikes", need to do more now if we want to have impact on inflation this year / next, with aggressive rate hikes. Strategy of "just doing it" on rate hikes rather than just promising. If we need to keep going, we will.

- Would like Fed to be much closer to neutral by end-year or sooner; much higher than they are right now. Personal forecast for neutral is 2-2.25%, Waller's projection is to be above that by the end of the year.

- Would start balance sheet runoff in the next meeting or so; Fed has room to go sooner and faster than last time with runoff. Re moving quickly on rates: As long as we're clear in communications, markets adjust quickly; hasn't been a lot of market turmoil since our November hawkish pivot.

- Getting to neutral or slightly above shouldn't be a concern re causing a recession. You can pull back demand and put downward pressure on prices/wages while only having a minor effect on quantities. Fed can't produce any more houses, but we can reduce demand.

- Regarding the inflation outlook: Supply chain issues will start to resolve themselves end of this year / beginning of next year + reduction of fiscal stimulus taking pressure off inflation.

- Regarding expectations: Would be more concerned if 2-yr out infl expectations became unanchored; currently they're not that high.

FED: In an explanation of his dissent to March's FOMC decision (in favor of a 50bp hike rather than 25bp), St Louis Fed Pres Bullard writes that he was in favor of 300bp of total Fed funds increases in 2022.

- That puts to rest who had the highest 2022 "dot" in the hiking plot of the Summary of Economic Projections and not a huge surprise given he's considered the biggest current "hawk" on the Committee, but he's been at the vanguard of the FOMC's hawkish shift so his comments are worthy of consideration.

- In addition to the 50bp dissent (and not mentioned in the Statement), he writes that "implementing a plan for reducing the size of the Fed’s balance sheet" would have been appropriate at the meeting.

- He says the FOMC is missing its target "by 410 basis points on the headline measure and 320 basis points on the core measure", placing a "particularly heavy burden" on many Americans.

- With inflation rising, real rates are falling and the Fed's policy "has been unwittingly easing further". "The Committee will have to move quickly to address this situation or risk losing credibility on its inflation target."

- Expressing confidence that market-based and long-term consumer inflation expectations have remained anchored, Barkin said the Fed is reducing "support gradually so that we can get back to a more normal position as the economic situation evolves. At that time, we can decide if we need to put the brakes on the economy or not," he said.

- "Prior to our meeting, there was much debate about whether the Fed should move faster. We have moved at a 50-basis point clip in the past, and we certainly could do so again if we start to believe that is necessary to prevent inflation expectations from unanchoring," he said.

US TSYS: Short End Under Pressure On Hawkish Fed Speak

Bonds finished strong Friday, but off early highs to near middle of session range, short end weaker as market digested hawkish comments from Fed Gov Waller on CNBC, StL Fed Bullard dissenter essay and Richmond Fed Barkin in the first half.

- Barkin said the central bank's "gradual" interest rate path shown in forecasts this week depicting seven interest rate increases will not drive an economic decline, while the normalization of the balance sheet can work in the background and will begin soon.

- Yield curves bull flattened with 3s, 5s and 7s inverting vs. 10s in the first half on continued heavy short end selling and strong buying in long end (30YY falling to 2.4014% low. Note: late 2s10s Block steepener:

- +20,000 TUM2 106-17.25, post-time bid vs.

- -10,750 TYM2 124-17.5, well through 124-21 post-time bid

- US Biden/China Xi call headlines filtering through -- Xi sounding dovish Russia war in Ukraine: "confrontation not beneficial to anyone .. conflicts, confrontation not beneficial to anyone".

- Not much substance from Russia Pres Putin address at Luzhniki stadium in Moscow: 'The concert is dedicated to the eighth anniversary of Crimea's reunification with Russia" Tass, before video of event cut out.

- Pres Biden will travel to Brussels, Belgium on Wednesday next week, expected to speak at European council summit on Thursday, followed by G7 meeting. No set times, TBA.

OVERNIGHT DATA

- U.S. FEB. INDEX OF LEADING ECONOMIC INDICATORS UP 0.3% TO 119.9

- US NAR: FEB EXISTING HOME SALES -7.2% TO 6.02M SAAR; -2.4% YOY

- U.S. existing home sales fell by more than expected to a seasonally adjusted annual rate of 6.02 million in February, sinking 7.2% from a month earlier and down 2.4% from a year earlier, the National Association of Realtors said Friday.

- Rising mortgage rates and sustained high inflation have prevented many consumers from purchasing a home, NAR chief economist Lawrence Yun told reporters. The median existing home price was $357,300 last month, up 15.0% from a year ago.

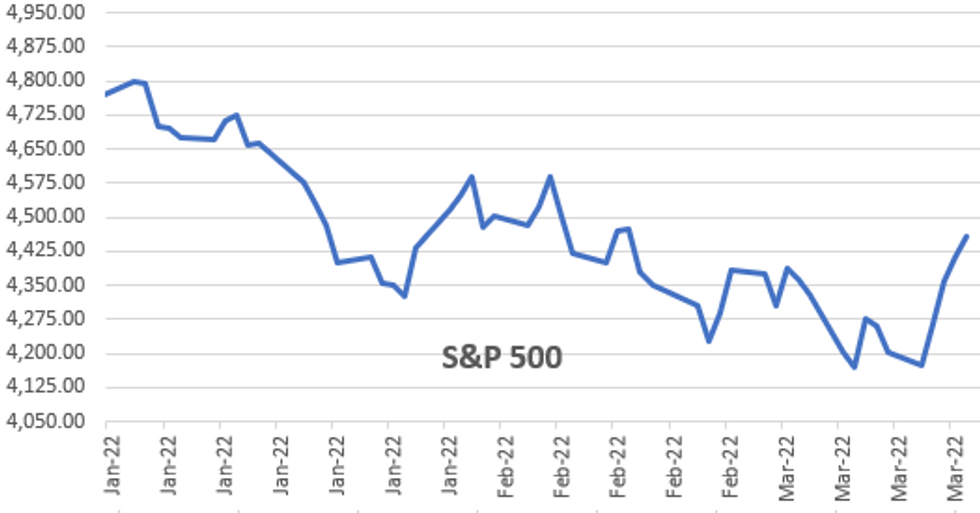

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 222.61 points (0.65%) at 34705.95

- S&P E-Mini Future up 50.5 points (1.15%) at 4452.75

- Nasdaq up 263.5 points (1.9%) at 13879.38

- US 10-Yr yield is down 2.8 bps at 2.1423%

- US Jun 10Y are up 10.5/32 at 124-21

- EURUSD down 0.0041 (-0.37%) at 1.105

- USDJPY up 0.5 (0.42%) at 119.1

- WTI Crude Oil (front-month) up $1.76 (1.71%) at $104.74

- Gold is down $23.05 (-1.19%) at $1919.88

- EuroStoxx 50 up 17.12 points (0.44%) at 3902.44

- FTSE 100 up 19.39 points (0.26%) at 7404.73

- German DAX up 25.03 points (0.17%) at 14413.09

- French CAC 40 up 7.72 points (0.12%) at 6620.24

US TSY FUTURES CLOSE

- 3M10Y -4.076, 173.152 (L: 170.737 / H: 178.583)

- 2Y10Y -4.539, 20.527 (L: 17.801 / H: 25.645)

- 2Y30Y -7.471, 47.411 (L: 44.739 / H: 55.153)

- 5Y30Y -4.767, 27.54 (L: 26.076 / H: 32.922)

- Current futures levels:

- Jun 2Y up 0.375/32 at 106-18 (L: 106-16 / H: 106-21)

- Jun 5Y up 3.75/32 at 116-4.25 (L: 115-31.25 / H: 116-10)

- Jun 10Y up 9.5/32 at 124-20 (L: 124-10.5 / H: 124-25.5)

- Jun 30Y up 1-01/32 at 152-15 (L: 151-14 / H: 152-27)

- Jun Ultra 30Y up 2-09/32 at 178-13 (L: 176-03 / H: 178-26)

US 10Y FUTURES TECH: (M2) Trend Condition Remains Bearish

- RES 4: 128-04 High Mar 8

- RES 3: 127-14+ High Mar 9

- RES 2: 126-04+ 20-day EMA

- RES 1: 125-14+ Low Feb 10 and a recent breakout level

- PRICE: 124-24+ @ 11:13 GMT Mar 18

- SUP 1: 123-25+ Low Mar 16

- SUP 2: 123-19+ 150.0% retracement of the Feb 10 - Mar 7 climb

- SUP 3: 123-06 161.8% retracement of the Feb 10 - Mar 7 climb

- SUP 4: 122-29+ 76.4% of the Oct ‘18 - Mar ‘20 upleg (cont)

Treasuries remain above Wednesday’s low. Current trend conditions remain bearish though. Monday’s strong sell-off resulted in a break of key support at 125-14+, the Feb 10 low and a bear trigger. This confirmed a resumption of the primary downtrend and marks an extension of the bearish price sequence of lower lows and lower highs. The move lower opens 123-19+ next. Initial firm resistance is seen at 126-04+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.005 at 98.560

- Sep 22 -0.025 at 98.105

- Dec 22 -0.030 at 97.680

- Mar 23 -0.045 at 97.415

- Red Pack (Jun 23-Mar 24) -0.03 to +0.010

- Green Pack (Jun 24-Mar 25) +0.010 to +0.030

- Blue Pack (Jun 25-Mar 26) +0.035 to +0.055

- Gold Pack (Jun 26-Mar 27) +0.055 to +0.070

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00271 at 0.32871% (+0.24942/wk)

- 1 Month -0.00200 to 0.44657% (+0.05000/wk)

- 3 Month +0.00614 to 0.93400% (+0.10800/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01314 to 1.28757% (+0.15700/wk)

- 1 Year +0.01072 to 1.78643% (+0.19043/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $73B

- Daily Overnight Bank Funding Rate: 0.32% volume: $266B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $1.003T

- Broad General Collateral Rate (BGCR): 0.30%, $374B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $365B

- (rate, volume levels reflect prior session)

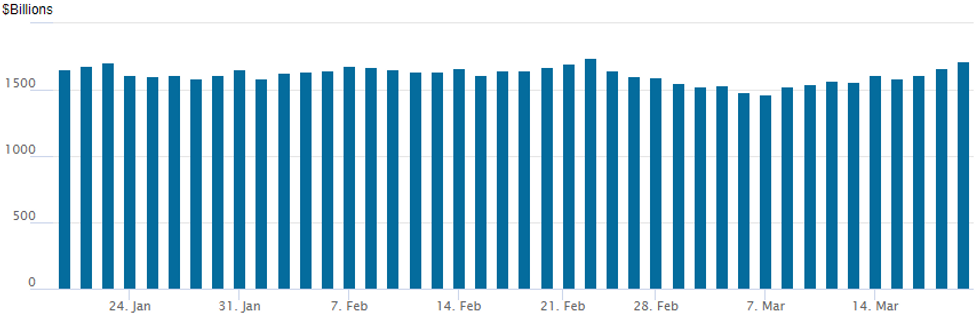

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to highest since Feb 23 at $1,715.148B w/ 84 counterparties vs. $1,659.977B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $36.55B Total Issuance on Week

No new issuance Friday after $36.55B total high-grade debt priced on the week:- Date $MM Issuer (Priced *, Launch #)

- $22.5B Priced Thursday

- 03/17 $4B *Wells Fargo 6NC5 +137.5

- 03/17 $3.5B *Bank of America $3B 4NC3 +123, 4NC3 SOFR +133

- 03/17 $3B *Toyota Motor $1.2B 2Y +60, $400M 2Y SOFR+62, $1.4B 5Y +90

- 03/17 $2.75B *Banco Santander $1.25B 3Y +135, $1.75B 6NC5 +200

- 03/17 $2B Turkey 5.5Y around 8.625%

- 03/17 $1.5B *NextEra Energy $1.1B 2NC.5 +100, $400M 2NC.5 SOFR+102

- 03/17 $1.5B *Royal Bank of Canada 5Y SOFR+65

- 03/17 $1.5B *NatWest 3Y +135a, 3Y SOFR

- 03/17 $1.25B *Nigeria 7Y around 8.375%

- 03/17 $900M *Blackstone Private Cr Fund 3Y +260

- 03/17 $600M *Southwest Gas 10Y +190

EGBs-GILTS CASH CLOSE: Front-End UK Rates Continue To Fall Post-BoE

The standout move to end a volatile week was a rally in the UK short-end, as BoE rate hikes continued to be priced out following a more dovish-than-expected meeting Thursday.

- Amid a bull flattening move on the Gilt curve, 2Y UK yields fell sharply, and are now off around 25bp vs pre-BoE. MNI's BoE Review explains some of the reasons why the BoE may hike less than markets are pricing.

- Equities were fairly flat on the day, and periphery spreads likewise.

- The German curve was fairly flat, Bobl modestly outperformed - fairly light volumes overall, especially by comparison to recent sessions.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.338%, 5-Yr is down 1.3bps at 0.09%, 10-Yr is down 1.2bps at 0.373%, and 30-Yr is unchanged at 0.561%.

- UK: The 2-Yr yield is down 8.9bps at 1.209%, 5-Yr is down 7.9bps at 1.244%, 10-Yr is down 6.8bps at 1.497%, and 30-Yr is down 4.3bps at 1.743%.

- Italian BTP spread up 0.1bps at 151.9bps / Spanish up 0.1bps at 94.4bps

FOREX: USDJPY Set For Highest Weekly Close Since Jan 2016

- Another firm session for major equity indices continued to underpin USDJPY strength on Friday. The pair remains on an upward trajectory following last week’s significant break of 116.35 and impressive three big figure extension in just over a week.

- This week’s important technical break was the move through resistance at 118.60/66, the Jan 3 ‘17 and Dec 15 ‘16 highs, strengthening current bullish technical conditions. USDJPY looks set to post its highest weekly close since January 2016.

- The CHF has outperformed, rising 0.85% against the Euro back to 1.0300. EURUSD retraces a part of recent impressive gains, but the bias remains for further corrective rallies.

- Meanwhile the greenback trades more mixed with the ICE dollar index residing 0.3% in the green to finish the week. Despite the overall greenback retreat this week, Friday’s boost comes amid hawkish commentary from both Fed’s Waller and Kashkari, emphasising the latest set of projections from Wednesday’s FOMC meeting.

- Looking ahead, Fed Chair Powell is due to speak on Monday about the economic outlook at the National Association for Business Economics Annual Economic Policy Conference. Japan will be out for a local holiday.

- On the data calendar, UK inflation data precedes the UK budget release on Wednesday. European Flash PMIs are scheduled for Thursday. On the central bank front, SNB and Norges Bank decisions are risk events of note.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2022 | 0300/1100 |  | CN | PBOC LPR decision | |

| 21/03/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/03/2022 | 0730/0830 |  | EU | ECB Lagarde at Institut Montaigne Event | |

| 21/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2022 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/03/2022 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 21/03/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.