-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI ASIA OPEN: SF Fed Daly Downplays Stagflation

EXECUTIVE SUMMARY

- MNI INTERVIEW: Job Mkt Tighter Than Last Boom-Chicago Fed Econ

- MNI BRIEF: Fed's Daly Downplays Stagflation Risk As Rates Rise

- FED: Daly On "Marching Up To Neutral"

- MNI Poland Pushes To Exclude Russia From G20

- ECB'S LAGARDE SAYS CRPYTO ASSETS ARE BEING USED TO CIRCUMVENT RUSSIA SANCTIONS, Bbg

US

FED: America’s labor market is tighter now than it was before the pandemic -- when unemployment dipped to half-century lows -- as Covid deters some from returning to more casual jobs, Chicago Fed economist Jason Faberman told MNI.

- Reduced desired hours of work combined with pay rises demanded by people quitting for better jobs are boosting wage and price pressures, he said. “Wage growth is also going to be inflationary, most likely, and as a result, we should probably expect to see inflation to persist as well because firms are going to continue to compete to attract these workers from wherever they currently are,” Faberman said.

- Using New York Fed survey data, Faberman helped create a measure of the total hours people want to work versus their actual hours. That “aggregate hours gap” shows labor-market tightness even beyond today's 'Great Resignation' is more severe than what top Fed officials have been tracking through the participation rate or the unemployment rate, which has already tumbled to 3.8%. For more see MNI Policy main wire at 1132ET.

- Sustaining trend growth is "quite remarkable" given headwinds and disruptions such as the war in Ukraine, she said, and noted private forecasters continue to see U.S. growth around 2%.

- The main risk is stronger inflation pressures and "we have inflation that's already too high," Daly said. Inflation will remain above 2% through this year, and interest rates may need "marching up" to neutral or even beyond to bring it in line, she said.

Poland Pushes To Exclude Russia From G20

Poland has suggested to US officials that steps should be made to exclude Russia from the G20.

- The proposal comes as Poland has emerged as the most hawkish NATO, and EU member on Russia. Poland announced plans on the weekend to use the NATO summit on Thursday to request a NATO peacekeeping force for Ukraine. This plan was swiftly nixed by US and NATO officials as a dangerous escalation of NATO's role in the conflict.

- Polish Minister of Economic Development and Technology Piotr Nowak said: 'During the meetings with, among others, [US Commerce Secretary] Gina Raimondo, we made a proposal to exclude Russia from the G20, which was met with a positive response and approval, and the matter is to be handed over to President Biden.'

- Raimondo issued a statement saying: 'The Secretary had a good meeting with the Polish Minister Nowak. She welcomed hearing Poland’s views on a number of topics, including the operation of the G20, but did not express a position on behalf of the U.S. Government with respect to the Polish G20 proposal.'

- The G20 is a broad group that includes India, China, Brazil. Any move to exclude Russia would struggle to find unanimity but unlikely event that Russia is excluded from the G20 it is likely that Poland would be the country to take its place.

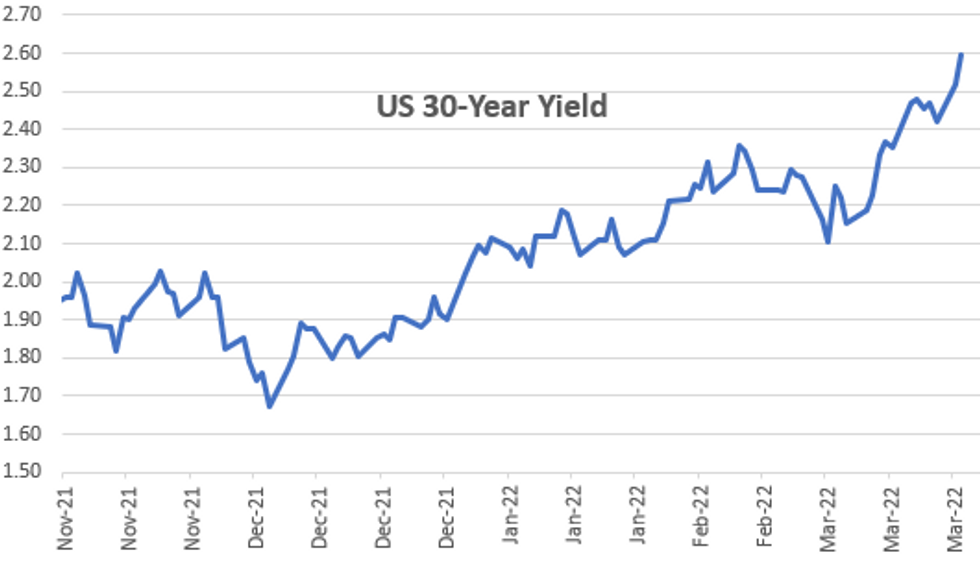

US Tsys: Fed Taking Inflation Seriously

Rates finish broadly weaker yet again, 30YY climbs to late session high of 2.6153% +0.0988, highest lvl since July 2019. Markets less whippy than Monday opener, better volumes, market depth w/Japan back from extended holiday weekend.

- Tsy sell-off accelerated early after StL Fed Pres Bullard comments on Bbg TV urged Fed to "move aggressively to curb inflation .. faster is better" to get "policy back to neutral", adding 50bp hike "would definitely be in the mix."

- Slight delayed reaction to hawkish StL Fed Bullard comments, lead quarterly Eurodollar futures reversed after going bid on lower 3M LIBOR settle (-0.00386 to 0.95371%, +0.01971/wk). Balance of Whites-Reds (EDU2-EDH4) weaker but off lows as markets priced in increased chances for 50bps hike in May and/or June.

- Trading desks report moderate domestic real$ buying in 3s around comment from SF Fed Pres Daly re: inflation expectations "well anchored". U.S. economy can probably escape a 1970s-style bout of stagflation Daly explained because America has emerged as an oil exporter since then and because economic growth will likely remain around its long-run trend rate.

- More Fed-speak on tap Wednesday, limited data:

- 0800ET: Fed Chair Powell, BIS Innovation panel event, moderated Q&A

- 1000ET: New Home Sales (801k, 810k); MoM (-4.5%, +1.1%)

- 1145ET: SF Fed Daly, moderated discussion Bbg equality summit

- 1300ET: US Tsy $16B 20Y Bond auction re-open (912810TF5)

- 1500ET: StL Fed Bullard economic outlook, no text, moderated Q&A

- 2105ET: StL Fed Bullard pre-recorded economic outlook, Credit Suisse conf

OVERNIGHT DATA

- Richmond Fed Mfg. Index, 13 vs. 2 estimate

- US REDBOOK: MAR STORE SALES +12.7% V YR AGO MO

- US REDBOOK: STORE SALES +12.4% WK ENDED MAR 19 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 239.18 points (0.69%) at 34790

- S&P E-Mini Future up 50.75 points (1.14%) at 4502.5

- Nasdaq up 277.5 points (2%) at 14113.69

- US 10-Yr yield is up 8.2 bps at 2.3715%

- US Jun 10Y are down 15/32 at 122-23

- EURUSD up 0.0013 (0.12%) at 1.1029

- USDJPY up 1.26 (1.05%) at 120.73

- WTI Crude Oil (front-month) down $0.36 (-0.32%) at $111.76

- Gold is down $13.37 (-0.69%) at $1922.55

- EuroStoxx 50 up 44.32 points (1.14%) at 3926.12

- FTSE 100 up 34.33 points (0.46%) at 7476.72

- German DAX up 146.23 points (1.02%) at 14473.2

- French CAC 40 up 77.08 points (1.17%) at 6659.41

US TSY FUTURES CLOSE

- 3M10Y +1.579, 182.509 (L: 176.214 / H: 186.869)

- 2Y10Y +4.143, 21.133 (L: 13.487 / H: 22.254)

- 2Y30Y +3.698, 43.271 (L: 35.419 / H: 44.545)

- 5Y30Y +1.141, 20.273 (L: 17.309 / H: 21.772)

- Current futures levels:

- Jun 2Y down 1.75/32 at 106-3.25 (L: 106-01 / H: 106-06.25)

- Jun 5Y down 8.25/32 at 114-27.5 (L: 114-25.75 / H: 115-07.25)

- Jun 10Y down 16/32 at 122-22 (L: 122-20.5 / H: 123-11.5)

- Jun 30Y down 1-08/32 at 148-12 (L: 148-05 / H: 150-03)

- Jun Ultra 30Y down 2-7/32 at 172-14 (L: 172-13 / H: 175-11)

US 10Y FUTURES TECH: (M2) Trend Needle Points South

- RES 4: 126-04 High Mar 14

- RES 3: 125-23+ 20-day EMA

- RES 2: 125-14+ Low Feb 10 and a recent breakout level

- RES 1: 124-25+ High Mar 18

- PRICE: 122-25 @ 1300ET Mar 22

- SUP 1: 122-20+ 176.4% retracement of the Feb 10 - Mar 7 climb

- SUP 2: 122-12 Low Mar 12 2019 (cont)

- SUP 3: 122-00 Round number support

- SUP 4: 121-15+ Low Mar 4 2019 (cont)

The Treasury bias remains lower following yesterday’s strong sell-off that confirmed a resumption of the primary downtrend. The move lower also maintains the bearish price sequence of lower lows and low highs, reinforcing the current bear cycle. The focus is on 122-20, the 176.4% retracement of the Feb 10 - Mar 7 climb and 122-00 further out. On the upside, firm resistance is seen at 125-23+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.005 at 98.440

- Sep 22 -0.025 at 97.860

- Dec 22 -0.025 at 97.425

- Mar 23 -0.025 at 97.170

- Red Pack (Jun 23-Mar 24) -0.03 to -0.01

- Green Pack (Jun 24-Mar 25) -0.065 to -0.045

- Blue Pack (Jun 25-Mar 26) -0.07 to -0.065

- Gold Pack (Jun 26-Mar 27) -0.065 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00271 at 0.32743% (-0.00128/wk)

- 1 Month +0.01086 to 0.45486% (+0.00829/wk)

- 3 Month -0.00386 to 0.95371% (+0.01971/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.04843 to 1.38457% (+0.09700/wk)

- 1 Year +0.14443 to 2.01257% (+0.22614/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $76B

- Daily Overnight Bank Funding Rate: 0.32% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $989B

- Broad General Collateral Rate (BGCR): 0.30%, $381B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $371B

- (rate, volume levels reflect prior session)

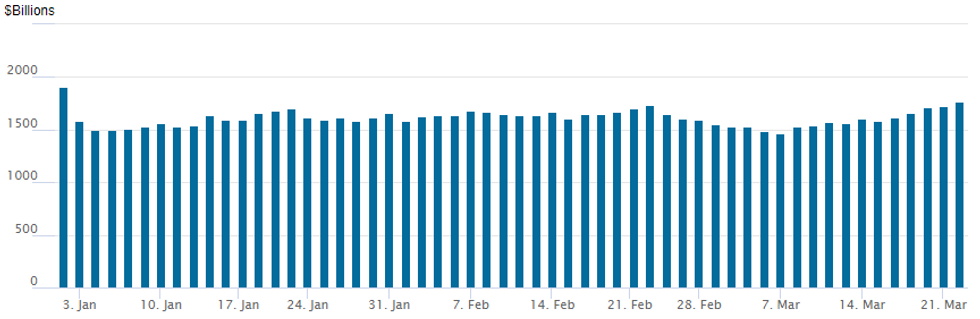

FED Reverse Repo Operation, Second Highest on Record

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to second highest on record at $1,763.183B w/ 88 counterparties vs. $1,728.893B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $5B Lowe's 4Pt Outsizes World Bank

- Date $MM Issuer (Priced *, Launch #)

- 03/22 $5B #Lowe's $750M 5Y +97, $1.5B 10Y +138, $1.5B 30Y +163, $1.25B 40Y +183

- 03/22 $4B *IBRD (World Bank) $1B WNG 2Y +12, $3B 10Y SOFR+40

- 03/22 $2B *HSBC 11NC10 +240

- 03/22 $1.25B *Kommunalbanken 2.5Y SOFR+26

- 03/22 $750M *Brunswick $450M +10Y +205, $300M 30Y +255

- 03/22 $Benchmark Indonesia 10Y 3.95%a, 30Y 4.6%a

EGBs-GILTS CASH CLOSE: Bear Flattening

The German and UK curves bear flattened as the short-end sold off sharply once again.

- The increasingly hawkish shift by the Federal Reserve drove most of the move, but there has also been an element of risk appetite returning (BTP spreads lower, equities higher).

- 10Y Bund and Gilt yields hit fresh post-2018 highs, but the 2Y segment underperformed on both curves as central bank hike pricing ticked higher.

- UK in focus Weds, with CPI data and Spring budget statement (our preview is on the MNI website).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.9bps at -0.235%, 5-Yr is up 4.7bps at 0.223%, 10-Yr is up 3.5bps at 0.505%, and 30-Yr is up 1.4bps at 0.672%.

- UK: The 2-Yr yield is up 9.3bps at 1.415%, 5-Yr is up 8.4bps at 1.462%, 10-Yr is up 7bps at 1.708%, and 30-Yr is up 5.6bps at 1.922%.

- Italian BTP spread down 2.2bps at 151.7bps / Greek up 2.1bps at 224.1bps

FOREX: USD/JPY Most Technically Overbought In Six Years

- The USD/JPY rally drew plenty of attention Tuesday, with the pair clearing the psychological 120 handle and briefly tipping above the Y121 level. The move coincided with a sizeable move in 5Y breakevens, which increased back to highs of 3.68%. This comes despite oil moving lower and the tighter rates pricing, with an additional 193bps of hikes priced across 2022.

- Market focus turns to the longevity of recent strength, with the USD/JPY RSI now tipped to its highest level since late-2016. The Japanese finance minister commented after the Asia-Pac market close, noting that sudden moves in currency markets aren't desirable, and stability remains important. Markets will be on watch for any strengthening of this rhetoric.

- Elsewhere, GBP/USD underwent a sizeable intraday rally, topping the Monday high in short order and making headway north of both 1.3250 as well as key resistance at 1.3231 20-day EMA. Moves came despite the more hawkish Fed tones evident in FOMC appearances this week, with markets repricing a BoE hiking to see close to five 25bps by year-end.

- Antipodean currencies outperformed throughout, with AUD and NZD at the top of the G10 pile, pushing AUD/USD through early March's 0.7441 and to the best levels since mid-November.

- Focus Wednesday turns to the UK's Spring Statement (preview here: https://marketnews.com/mni-research/global-issuanc...) and inflation data, as well as US new homes sales. Speeches are due from BoE's Bailey, Fed's Powell and ECB's Visco - among others.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1200/0800 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.