-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: NATO Summit and More Fed Speak

EXECUTIVE SUMMARY

- MNI: Fed Rate Hikes Must Be Cautious, Evans Says

- MNI BRIEF: Evans Supports Quick Move to Slim Fed Balance Sheet

- MNI BRIEF: Fed Hike Must Account For Soft Landing Risk-Kashkari

- MNI NATO: Stoltenberg: No NATO Peacekeeping Mission To Ukraine

- MNI: Trade Kinks Put Price Surge On Longer Path-Supply Experts

- US Pres Biden: 'China Understands Its Future Is With The West, Not Russia'

US

FED: Chicago Federal Reserve President Charles Evans said Thursday that interest-rate hikes must remain cautious and be done on a meeting-by-meeting basis, while saying his views on tightening are in line with the median FOMC's dot plot projection.

- The Ukraine conflict and new waves of Covid being seen abroad are upside inflation risks that officials will monitor closely, Evans said, and "our recent 25 basis point rate hike was the first of what appears to be many this year." The latest dot plot called for the equivalent of seven quarter-point moves this year and three next year.

- "Policymakers need to be cautious, humble, and nimble as we navigate the course ahead. Monetary policy is not on a preset course: Each meeting's decision will be based on an assessment of economic and financial conditions at the time, as well as the risks to the outlook," Evans said. His prepared text didn't mention much about how to slim down the balance sheet or about hiking by 50bps, an option recently signaled by Fed Chair Jerome Powell.

- “It’s clearly going to be faster than what we did” the last time, he said on a call with reporters after a speech in Detroit, because markets are strong enough and it's beneficial to reset.

- Asset sales aren't a pressing question and wouldn't come into play as an option until the Fed is "well into it," he said. Sales could clean up the composition of the balance sheet between securities such as Treasuries and MBS, he said.

- Earlier he said his rate-hike view mirrors the FOMC consensus for the equivalent of seven hikes this year and he's more comfortable with those kinds of moves though he's open to a 50bp increase.

- "There's a danger to overdoing it" and "I hope we can engineer a soft landing," he said during an online talk. "I've penciled in in my forecast we'd have seven this year, but it's really going to depend on the economic data," he said, and the pace depends on worker shortages and the Fed's unanimous view inflation must return to target.

- Strong job growth hasn't been enough to rebuild supply chains and keep inflation in check and "we have to respond" to price gains that have been more persistent than expected, he said. Still, low 10-year Treasury yields signal expectations are in check and long-term growth prospects are modest, he said.

- Jonathan Gold, vice president of supply chain and customs policy at the National Retail Federation, said he's expecting supply chain disruptions throughout 2022.

- "There are a lot of factors that go into that - ongoing strong consumer demand certainly continues to put stress on the supply chain as retailers but there are now shutdowns in China and the Ukraine situation now too," he said. "The system has been stressed for the better part of 18-plus months and that stress is going to continue." For more see MNI Policy main wire at 1526ET.

- Biden says: 'NATO has never ever been more united than it is today. Putin is getting the exact opposite of what he wanted.'

- Biden refuses to give 'intelligence data' about whether or not Russia is planning to use chemical or biological weapons.

- Biden on China: I had a very straight forward conversation with Xi [earlier this month]. I made it clear to him that he understood the consequences for dealing with Russia. I made no threats but indicated that Western companies have left Russia. I indicated that he would be putting Chinese economic growth in jeopardy if he supported Russia.'

- Biden: 'China understands that its economic future is far more connected with the West than it is with Russia.'

- Biden confirms that discussions took place today on food shortages. He says that Russia and Ukraine have long been the bread basket of Europe and there will be significant costs to many countries from sanctions on Russia.

- Biden says he wants Russia excluded from the G20 and he wants Ukraine to be admitted to the group as an observer.

EUROPE

NATO: Stoltenberg: 'We are resetting NATO's deterrence and defense for the long term. We have already increased our presence in the East and we've decided on four new battlegroups...in the eastern part of the alliance and across the whole alliance.'

- On the Polish proposal for a NATO peacekeeping mission Stoltenberg said: 'We have a responsibility to stop this conflict becoming a fully fledged war between NATO and Russia. For this reason NATO will not be deploying troops to Ukraine.'

US TSYS: Late Risk-On, SPX Nears Key Resistance

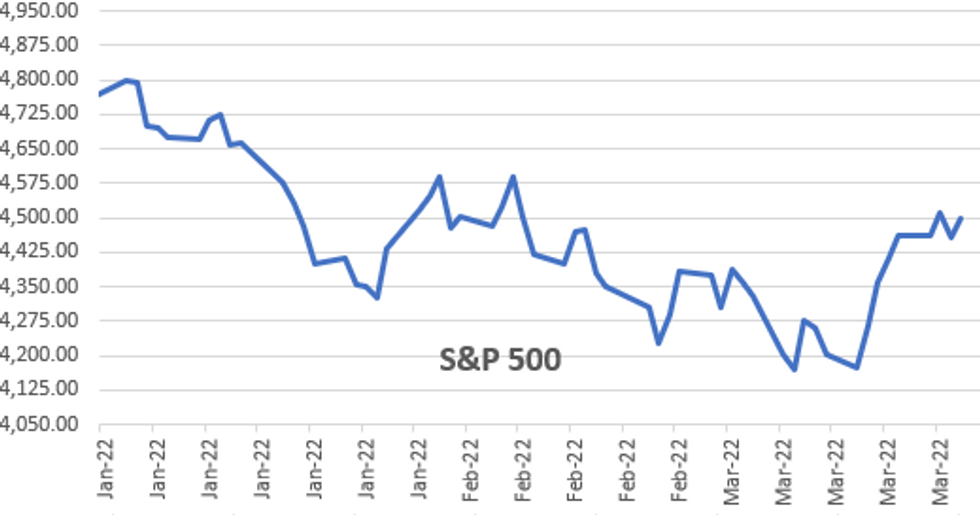

After holding near midday highs through the second half, US FI markets inching lower after the bell as equity indexes extend session highs: SPX eminis +66.0 at 4413.50 -- resistance of 4514.75 (Mar 22 high), a breach of which viewed as an important short-term bullish development and an extension would open 4578.50, the Feb 9 high.- Tsy 30YY back of 2.5 late: 2.5189% (+.0347), yield curves mixed 5s10s still well inverted -3.294 (-.328). Translation: uncertainty over pricing in forward policy (or confidence in Fed managing a soft landing) that is also inducing inversion in Eurodollar futures from EDM3 through EDM6.

- Tsys had see-sawed off morning lows to midday highs, trading desks reporting two-way trade across the board ahead the $14B 10Y TIPS auction that drew -0.540% high-yield back on Jan 20.

- Short end remains under pressure, trading desks reported domestic real$ selling in 2s earlier (various dealers starting to support 50bp hikes at May 4 FOMC). Two-way option-tied flow ahead serial April options expiring Friday, deal-tied selling across the curve.

- US Data/Speaker Calendar (prior, estimate) at 1000ET:

- Pending Home Sales MoM (-5.7%, 1.0%); YoY (-9.1%, -2.2%)

- U. of Mich. Sentiment (59.7, 59.7); Current Conditions (67.8, 67.6)

- Fed Speakers on tap Friday

- SF Fed Daly opening remarks at annual mon-pol conference, time TBA

- Fed Gov Waller discusses digital currency at 0910ET

- NY Fed Williams mon-pol outlook, BIS panel event w/Bank of Peru, 1000ET

- Richmond Fed Barkin on containing inflatio, Citadel event, 1130ET

OVERNIGHT DATA

- US JOBLESS CLAIMS -28K TO 187K IN MAR 19 WK

- US PREV JOBLESS CLAIMS REVISED TO 215K IN MAR 12 WK

- US CONTINUING CLAIMS -0.067M to 1.350M IN MAR 12 WK

- US FEB DURABLE NEW ORDERS -2.2%; EX-TRANSPORTATION -0.6%

- US JAN DURABLE GDS NEW ORDERS REV TO +1.6%

- US FEB NONDEF CAP GDS ORDERS EX-AIR -0.3% VS JAN +1.3%

- US Q4 CURRENT ACCOUNT GAP -$217.9

- US Q3 CURRENT ACCOUNT REVISED TO -$219.9

- US FLASH MAR SERVICES PMI 58.9 (FOREC 56.0); FEB 56.5

- US FLASH MAR MANUF PMI 58.5 (FORECAST 56.6); FEB 57.3

- US FLASH MAR COMPOSITE PMI 58.5 (FORECAST 54.7); FEB 55.9

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 230.03 points (0.67%) at 34583.87

- S&P E-Mini Future up 43 points (0.97%) at 4490

- Nasdaq up 178.2 points (1.3%) at 14099.05

- US 10-Yr yield is up 5.3 bps at 2.3444%

- US Jun 10Y are down 8/32 at 122-28.5

- EURUSD down 0.0007 (-0.06%) at 1.0997

- USDJPY up 1.1 (0.91%) at 122.25

- Gold is up $18.48 (0.95%) at $1962.29

- EuroStoxx 50 down 5.83 points (-0.15%) at 3863.39

- FTSE 100 up 6.75 points (0.09%) at 7467.38

- German DAX down 9.86 points (-0.07%) at 14273.79

- French CAC 40 down 25.66 points (-0.39%) at 6555.77

US TSY FUTURES CLOSE

- 3M10Y +6.663, 184.308 (L: 178.58 / H: 188.857)

- 2Y10Y +4.327, 23.253 (L: 17.236 / H: 24.425)

- 2Y30Y +1.967, 40.145 (L: 34.059 / H: 43.134)

- 5Y30Y -2.224, 14.062 (L: 12.13 / H: 17.746)

- Current futures levels:

- Jun 2Y down 2/32 at 106-4.625 (L: 106-02.5 / H: 106-07.375)

- Jun 5Y down 7.5/32 at 114-28.75 (L: 114-23.75 / H: 115-07.75)

- Jun 10Y down 12/32 at 122-24.5 (L: 122-16.5 / H: 123-10)

- Jun 30Y down 18/32 at 148-31 (L: 148-07 / H: 150-01)

- Jun Ultra 30Y down 10/32 at 174-26 (L: 173-11 / H: 176-08)

US 10Y FUTURES TECH: (M2) Trend Remains Down

- RES 4: 126-26+ High Mar 10

- RES 3: 126-04 High Mar 14

- RES 2: 125-07+ 20-day EMA

- RES 1: 123-25+ Low Mar 16 and a recent breakout level

- PRICE: 122-29 @ 1145ET Mar 24

- SUP 1: 122-12 Low Mar 23

- SUP 2: 122-00 Round number support

- SUP 3: 121-15+ Low Mar 4 2019 (cont)

- SUP 4: 121-02 Low Jan 18 2019 (cont)

Treasuries are trading lower today. Attention is on yesterday’s 122-12 low where a break would again confirm a resumption of the downtrend. This would also maintain the bearish price sequence of lower lows and low highs that clearly highlights current sentiment and would open 122-00. Firm resistance is seen at 125-07+, the 20-day EMA. Initial resistance is seen at 123-25+, the Mar 16 low and this week’s breakout level.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.020 at 98.440

- Sep 22 -0.055 at 97.845

- Dec 22 -0.060 at 97.415

- Mar 23 -0.050 at 97.175

- Red Pack (Jun 23-Mar 24) -0.035 to -0.02

- Green Pack (Jun 24-Mar 25) -0.045 to -0.03

- Blue Pack (Jun 25-Mar 26) -0.045

- Gold Pack (Jun 26-Mar 27) -0.04 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00085 at 0.32786% (-0.00085/wk)

- 1 Month -0.00943 to 0.44714% (+0.00057/wk)

- 3 Month -0.00014 to 0.96557% (+0.03157/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03615 to 1.42586% (+0.13829/wk)

- 1 Year +0.04700 to 2.05786% (+0.27143/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $908B

- Broad General Collateral Rate (BGCR): 0.30%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $344B

- (rate, volume levels reflect prior session)

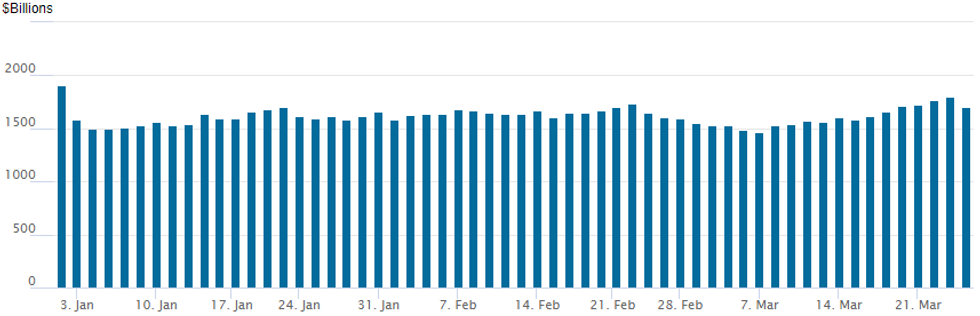

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,707.655B w/ 88 counterparties vs. Wednesday's $1,803.186B "22 high -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $4B Home Depot 4Pt Launched

Home Depot dropped the 3Y FRN tranche, still leads w/$4B issuance:

- Date $MM Issuer (Priced *, Launch #)

- 03/24 $4B #Home Depot $500M 3Y +40, $750M 5Y +60, $1.25B 10Y +95, $1.5B 30Y +120

- 03/24 $1.25B #DNB Bank $650M 3NC2 +85, $600M 3NC2 SOFR+83

- 03/24 $1B *FHLBanks 2Y +4.5

EGBs-GILTS CASH CLOSE: Yields Touch Fresh Multi-Year Highs Post-PMIs

Largely strong PMIs (particularly on the inflation side) set a bearish tone for the European FI space Thursday, with German instruments underperforming UK counterparts.

- With Eurozone PMI data looking stagflationary, German Schatz and Bobl yields reached the highest levels in 7-8 years.

- UK services PMI impressed; 10Y Gilt yields reached the highest levels since 2018.

- Periphery spreads were mixed (much as equity performance was mixed), with Italian spreads very slightly wider.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.4bps at -0.199%, 5-Yr is up 7.8bps at 0.27%, 10-Yr is up 6.6bps at 0.532%, and 30-Yr is up 4.6bps at 0.665%.

- UK: The 2-Yr yield is down 0.2bps at 1.348%, 5-Yr is up 1.3bps at 1.415%, 10-Yr is up 1.9bps at 1.646%, and 30-Yr is down 0.7bps at 1.841%.

- Italian BTP spread up 0.3bps at 152.1bps / Spanish down 2.3bps at 88.1bps

FOREX: JPY Breaks Another Key Level

- JPY extended the downleg into the Thursday close, with both USD/JPY and EUR/JPY moving through a number of notable technical levels. USDJPY marked a sixth consecutive session of higher highs, meaning this week, the pair has cleared the psychological 120.00, 121.00 and now 122.00 handles, strengthening bullish conditions.

- In the EURJPY cross, prices cleared major resistance at the 2021 highs of 134.13, tilting the RSI higher. This technical measure is now tilting toward flagged overbought conditions for the first time since early February - when it presaged a corrective dip lower from 133.00 to below 126.00.

- Scandi currencies traded well, with NOK and SEK higher against most others. The Norges Bank raised rates and steepened their rate path projection, indicating rates could be as high as 2.50% at end-2023 - a notable upgrade from their last look in December. A moderation in the oil price worked against NOK into the close, with Brent and WTI shedding 3% apiece.

- A recovery in Wall Street equities and weight in oil followed a report from Axios, citing the chief of staff to the Ukrainian President as saying that progress had been made in ceasefire negotiations with Russia, expressing "careful optimism".

- Focus Friday turns to UK retail sales numbers, the German March IFO release and US pending home sales data. Fedspeak continues to filter through, with Daly, Waller, Barkin and Williams on the docket. BoC's Kozicki also makes an appearance.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/03/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 25/03/2022 | 0800/0900 | *** |  | ES | GDP (f) |

| 25/03/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/03/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/03/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/03/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/03/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 25/03/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/03/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/03/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 25/03/2022 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 25/03/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/03/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 25/03/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 25/03/2022 | 1645/1245 |  | CA | BOC Deputy Kozicki speaks at SF Fed conference on "A world of difference: households, the pandemic and monetary policy" |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.