-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: 5s30s Yld Curve Plummets, Near Inversion

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed’s Athreya-Upside Risks To 4% Inflation View

- MNI FED: NY's Williams Open To 50bp Hike, But Runoff Comments Also Of Note

- MNI BRIEF: Williams Says Fed Unwinding Accommodative Policies

- MNI BRIEF: Fed's Williams Says Price Expectations Are Stable

- MNI BRIEF: Fed's Williams Open To 50BP Rate Move

- MNI BRIEF: Fed Paper Dismisses Yield Curve Inversion Signal

- RUSSIAN ARMY TO FOCUS ON TAKING FULL CONTROL OVER DONBAS: IFX

- CHINA HASN'T MOVE FORWARD W/ MILITARY EQUIPMENT TO RUSSIA, Bbg

- Tsy Sec Yellen: NOT APPROPRIATE NOW TO SANCTION CHINA AS RUSSIA PARTNER - RTRS

- Yellen: 'DON'T SEE' WEAKNESS IN U.S. ECONOMY, JOB GAINS STRONG .. NOT SEEING END OF GLOBALIZATION, Bbg

US

FED: The surge in energy prices could mean inflation more than doubles the Fed’s target this year, Richmond Fed Research Director Kartik Athreya told MNI, adding that it would still make sense to await further clarity on the war in Ukraine before tilting towards more aggressive rate hikes.

- “If we look at year-on-year inflation I would expect something around the 4% mark for this year,” he said in an interview, referring to the Fed’s preferred PCE measure. “That’s my baseline. But I think the risks are to the upside at least for the next year.”

- “If the war continues to be protracted and world energy markets are significantly hampered, that is going to show up in U.S. prices,” he said.

FED: New York Fed President John Williams said Friday inflation expectations have been remarkably stable despite the sharp rise in inflation, but the central bank will have to move policy to reinforce those expectations.

- "We are watching inflation expectations and other indicators very closely given the large movements in inflation," he told a BIS conference. "Despite the very high inflation we are seeing, longer-term and medium-term (expectations), whether from markets or from surveys, have stayed remarkably stable," he said.

- "I don't see any reason not to do one or the other. It's just we just need to make the right decisions based on what what we're seeing in the economy and how our policy decisions will affect the outlook."

- The FOMC's updated projections last week showed a median expectation for seven quarter-point rate hikes this year.

- "Across the globe, many central banks - including the Federal Reserve -are moving to unwind the highly accommodative policies they put in place at the start of the pandemic. And we are doing this at a time when the economic implications of COVID-19 and the war in Ukraine remain highly uncertain," said Williams, the vice chair of the FOMC.

- William's remarks were prepared for a Central Reserve Bank of Peru and Bank for International Settlements webinar and he did not comment on the potential for supersizing Fed rate increases or provide a view of the economic outlook.

- Two simple explanations for the recent near-inversion of the 2-10 spread are that markets do not anticipate the FOMC will seek to increase short term interest rates much beyond the next year and a half, or that inflation over the next two years is expected to be higher than during the subsequent eight, the note said. Neither explanation involves a recession.

- "It is not valid to interpret inverted term spreads as independent measures of impending recession. They largely reflect the expectations of market participants," Fed economists Eric Engstrom and Steven Sharpe wrote. "Among various terms spreads to consider, the 2-10 spread offers a particularly muddled view."

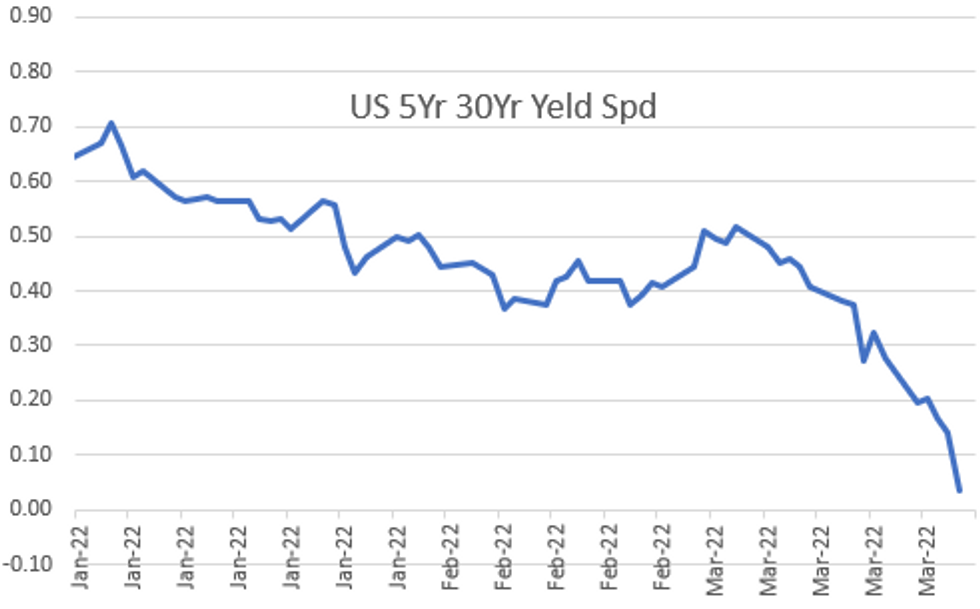

US TSYS: Yield Curves Pancake

Tsy yield curves bear flattened in a hurry Friday as confidence in Fed managing a soft landing wavers. After starting off the session around +12.17, the 5s30s curve slipped below 2.0 recently to 1.317 low -- back near early 2006 levels now when pair inverted from Feb-March to low of -12.669 on Feb 27, 2006.- Meanwhile, 3s, 5s and 7s extending inversion vs. 10s, 5s10s at -8.125 vs. -9.094 low as Tsys held near session lows through the second half. See MNI Policy main wire Brief: Fed Paper Dismisses Yield Curve Inversion Signal at 1100ET. Link to Fed paper: (Don't Fear) The Yield Curve, Reprise.

- US FI markets gapped lower (30YY surged from appr 2.512% to 2.5767% over 20 minute period, making new highs at 2.641%). Timing of rate move occurred around the release of IFX headlines: RUSSIAN ARMY TO FOCUS ON TAKING FULL CONTROL OVER DONBAS, however: Open to interpretation on whether that is a positive development (potential for triggering rate sale) or NOT as equities trimmed gains over same period.

- On tap for next week:

- Advance Goods Trade Balance (-$107.6B, -$106.3B), 0830ET

- Wholesale Inventories MoM (1.0% rev, 0.8%), 0830ET

- Retail Inventories MoM (1.9%, 1.3%), 0830ET

- Dallas Fed Manf. Activity (14, 10), 1030ET

- Treasury auctions Monday:

- US Tsy $57B 13W, $48B 26W bill auctions at 1130ET

- US Tsy $50B 2Y Note auction (91282CEG2), 1130ET

- US Tsy $51B 5Y Note auction (91282CEF4), 1300ET

OVERNIGHT DATA

- US NAR FEB PENDING HOME SALES INDEX 104.9 V 109.4 IN JAN

- US NAR FEB PENDING HOME SALES -4.1% MOM; -5.4% YOY

- MICHIGAN FINAL MARCH CONSUMER SENTIMENT AT 59.4; EST. 59.7

- MICHIGAN MARCH CURRENT CONDITIONS AT 67.2 FROM 68.2

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 62.02 points (0.18%) at 34772.34

- S&P E-Mini Future up 12.25 points (0.27%) at 4525.25Z

- Nasdaq down 57.3 points (-0.4%) at 14135.53

- US 10-Yr yield is up 10.5 bps at 2.4768%

- US Jun 10Y are down 39.5/32 at 121-22

- EURUSD down 0.0008 (-0.07%) at 1.0989

- USDJPY down 0.24 (-0.2%) at 122.11

- Gold is down $2.73 (-0.14%) at $1954.96

- EuroStoxx 50 up 4.34 points (0.11%) at 3867.73

- FTSE 100 up 15.97 points (0.21%) at 7483.35

- German DAX up 31.97 points (0.22%) at 14305.76

- French CAC 40 down 2.09 points (-0.03%) at 6553.68

US TSY FUTURES CLOSE

- 3M10Y +8.705, 193.854 (L: 180.054 / H: 196.281)

- 2Y10Y -3.505, 19.589 (L: 15.559 / H: 22.155)

- 2Y30Y -9.542, 30.282 (L: 26.225 / H: 39.052)

- 5Y30Y -10.906, 2.984 (L: 1.317 / H: 14.546)

- Current futures levels:

- Jun 2Y down 9.125/32 at 105-28 (L: 105-25 / H: 106-05.125)

- Jun 5Y down 29.5/32 at 114-1.75 (L: 113-30 / H: 114-30.75)

- Jun 10Y down 1-09/32 at 121-20.5 (L: 121-16 / H: 122-30)

- Jun 30Y down 2-04/32 at 147-7 (L: 146-20 / H: 149-15)

- Jun Ultra 30Y down 2-30/32 at 172-19 (L: 171-04 / H: 175-29)

US 10Y FUTURES TECH: (M2) Fresh Cycle Low

- RES 4: 126-04 High Mar 14

- RES 3: 125-00+ 20-day EMA

- RES 2: 123-25+ Low Mar 16 and a recent breakout level

- RES 1: 123-12 High Mar 23

- PRICE: 121-25+ @ 15:49 GMT Mar 25

- SUP 1: 121-17+ Intraday low

- SUP 2: 121-15+ Low Mar 4 2019 (cont)

- SUP 3: 121-02 Low Jan 18 2019 (cont)

- SUP 4: 120.28 Low Dec 26 2018 (cont)

Treasuries extended the move lower and cleared Wednesday’s low of 122-12 on Friday. The break reinforces bearish conditions and confirms a resumption of the current downtrend. Furthermore, the move maintains the bearish price sequence of lower lows and lower highs that clearly highlights current sentiment. Moving average conditions are bearish too. The focus shifts to 121-15+ next, the Mar 4 2019 low (cont). Initial resistance is at 123-12, Mar 23 high.

US EURODOLLAR FUTURES CLOSE

Lead quarterly EDM2 started off modestly weaker Friday: 98.425 (-0.010) after latest 3M LIBOR settle climbs +0.01729 to new 2Y high of 0.98286%, +0.04886 total on week.- Balance of Whites (EDU2-EDH3) trade -0.005-0.020 lower as market resumes pricing in increased chances of 50bp hikes over the next couple policy meetings, while Reds through Golds (EDM3-EDH7) trading -0.025-0.045 lower.

- Uncertainty over pricing in forward policy (or confidence in Fed managing a soft landing) evident as longer expirys continue to outperform. First price inversion holding at Red Jun'23 (97.020) vs. Red Sep'23 (97.035). Inversion flattens out in Blue Mar'26 through Golds (EDM6-EDH7) trading around 97.535.

- Friday settles:

- Jun 22 -0.050 at 98.385

- Sep 22 -0.125 at 97.715

- Dec 22 -0.160 at 97.255

- Mar 23 -0.180 at 96.995

- Red Pack (Jun 23-Mar 24) -0.21 to -0.19

- Green Pack (Jun 24-Mar 25) -0.235 to -0.225

- Blue Pack (Jun 25-Mar 26) -0.235 to -0.215

- Gold Pack (Jun 26-Mar 27) -0.205 to -0.175

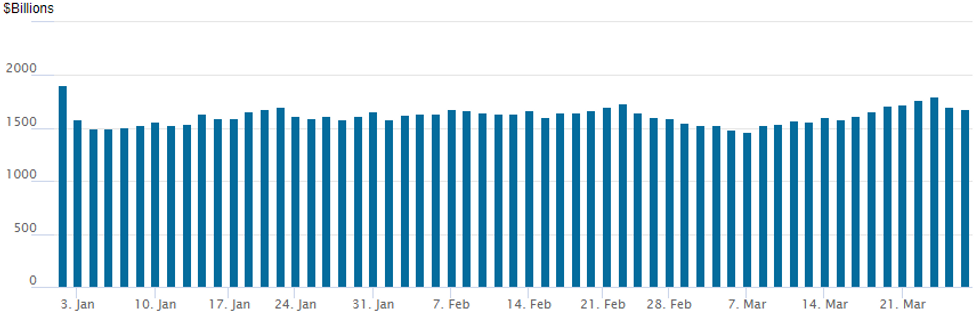

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,676.974B w/ 86 counterparties vs. prior session's $1,707.655B. Compares to Wednesday's year-to-date high of $1,803.186B and still well off all-time high of $1,904.582B on Friday, December 31.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00129 at 0.32657% (-0.00214/wk)

- 1 Month -0.00200 to 0.44514% (-0.00143/wk)

- 3 Month +0.01729 to 0.98286% (+0.04886/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02528 to 1.45114% (+0.16357/wk)

- 1 Year +0.03085 to 2.08871% (+0.30228/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $246B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $900B

- Broad General Collateral Rate (BGCR): 0.30%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $339B

- (rate, volume levels reflect prior session)

EGBs-GILTS CASH CLOSE: Another Day, Another Selloff

Bond weakness saw little respite to end the week, with the short-end/bellies of the UK and German curves selling off sharply.

- Multiple potential factors weighed, including an increasingly hawkish sell-side outlook for near-term Fed hikes, and optimism that Russia may have limited its ambitions in the Ukraine conflict.

- Both the UK and German curves bear flattened. 10Y Bund yields hit highest since 2018 and closed on the highs.

- Periphery EGB spreads narrowed on core weakness: GGBs outperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.4bps at -0.135%, 5-Yr is up 8.5bps at 0.355%, 10-Yr is up 5.5bps at 0.587%, and 30-Yr is up 3.5bps at 0.7%.

- UK: The 2-Yr yield is up 6.8bps at 1.416%, 5-Yr is up 5.8bps at 1.473%, 10-Yr is up 4.9bps at 1.695%, and 30-Yr is up 4bps at 1.881%.

- Italian BTP spread down 2.5bps at 149.6bps / Greek down 4.3bps at 222.8bps

FOREX: More Muted Friday After Volatile Week

- Currency markets were more muted Friday, consolidating after several sessions of acute volatility - mainly led by JPY crosses. Both USD/JPY and EUR/JPY this week printed fresh cycle and multi-year highs, sending upside targets north and prompting mild verbal intervention from Japanese ministers. Both currencies showed technical signs of being overbought, prompting a session of consolidation Friday in which the JPY regained a very small part of the recent lost ground.

- NOK was the strongest performer Friday, benefiting from both a higher oil price as well as the Norges Bank decision on Thursday, which showed a far sharper, steeper rate path projection relative to the past forecast round in December. USD/NOK and EUR/NOK hold close to recent YTD lows.

- The oil saw support into the Friday close, as an attack on a Saudi Aramco facility in Jeddah erased any downside pressure that followed reports that the US are considering another wave of oil reserve releases as gas prices remain sticky.

- Focus in the coming week turns to the latest US jobs release, with markets expecting job gains of 480k and another downtick in the unemployment rate to 3.7%. Personal income/spending data is also due, while markets will also contend with month-end flows.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2022 | 1100/1200 |  | UK | BOE Bailey in Conversation w. Guntram Wolff | |

| 28/03/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/03/2022 | 1430/1530 |  | UK | DMO Consultation Gilt Issuance 2022/23 | |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.