-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Waiting For Fri's March Jobs Data

EXECUTIVE SUMMARY

- MNI INTERVIEW: KC Fed Index Implies Jobless Rate Nearing 3%

- MNI FED: Richmond Fed Barkin Still Open To Hiking 50bps In May If Needed

- MNI FED: KC Fed's George Prefers Steady Hikes, Faster Runoff

- MNI BRIEF: St Louis Fed Model Signals 300k Gain For March Jobs

- MNI: US Imposes New Sanctions On Iran

US

FED: Kansas City Federal Reserve President Esther George said Wednesday it is clear that removing accommodation is required and laid out a more cautions stance on raising the federal funds rate, paired with a desire to roll assets off of the central bank's balance sheet faster.

- "Given the state of the economy, with inflation at a 40-year high and the unemployment rate near record lows, moving expeditiously to a neutral stance of policy is appropriate," she said, characterizing recent inflation as a result of supply constraints in the face of strong demand. For more see MNI Policy main wire at 1300ET.

FED: Adjusting the unemployment rate to incorporate information from the Kansas City Federal Reserve's Labor Market Conditions Indicators measure suggests the labor market is tighter than the unemployment rate alone implies and is consistent with a 3.1% unemployment rate, KC Fed senior economist Andrew Glover told MNI.

- The LMCI-implied unemployment rate is below the Bureau of Labor Statistics' official 3.8% rate and "certainly could" go under 3%, said Glover about updated analysis for February data, adding that it is likely to continue to fall reflecting that activity has increased. "The LMCI essentially says labor markets are stronger than the unemployment rate alone would tell you." For more see MNI Policy main wire at 1155ET.

- Headlines from Barkin (2024 voter) so far largely repeating comments from Mar 18 when he said the Fed could do 50bp hikes as it has in the past, if we start to believe that is necessary to prevent inflation expectations from unanchoring.

- FED'S BARKIN SAYS OPEN TO HIKING BY 50 BPS IN MAY IF NEEDED - bbg

- BARKIN: UKRAINE WAR IMPACTING INFLATION, DEMAND NOT HURT SO FAR - bbg

- BARKIN: STILL SEE A LOT OF EXCESS DEMAND FOR LABOR - bbg

- At the time of speaking, Fed Funds futures price a 43bp hike for the May meeting and 85.5bps for June, the latter implying a 61% chance of 100bp of hikes over the two meetings.

- The announcement of fresh Iran sanctions comes in the wake of US Secretary of State Antony Blinken's MENA tour where he was pressured by representatives of the UAE and Israel to respond to Iranian regional hostility.

- Blinken told Israeli Prime Minister Naftali Bennett: 'Deal or no deal, we will continue to work together and with other partners to counter Iran's destabilizing behavior in the region.'

US TSYS: Waiting For Fri's March Jobs Data

FI markets traded higher by the closing bell, inside range on robust volumes (TYM2>1.5M). Yield curves gradually scaled back early steepening, mixed after the bell. After briefly inverting Tuesday, 5s30s hit +5.122 high and finished around 3.33 +3.28.- Aside from mixed geopol headlines re: Russia/Ukraine, KC Fed George generated some interest after midday after mentioning "FED BALANCE SHEET SIZE NEEDS TO DECLINE SIGNIFICANTLY ... while "ROLLING OFF FED ASSET HOLDINGS COULD HELP STEEPEN CURVE" Bbg.

- George said it's clear that removing accommodation is required and laid out a more cautions stance on raising the federal funds rate, paired with a desire to roll assets off of the central bank's balance sheet faster.

- "Given the state of the economy, with inflation at a 40-year high and the unemployment rate near record lows, moving expeditiously to a neutral stance of policy is appropriate," she said, characterizing recent inflation as a result of supply constraints in the face of strong demand.

- Little/no react to March ADP +455 vs. +450 est, +6.9%. Thursday data focus on weekly claims (+196k est), Personal income/spending at 0830ET; Chicago PMI (57.0 vs. 56.3 prior) at 0945ET.

- The 2-Yr yield is down 4.4bps at 2.3204%, 5-Yr is down 5.8bps at 2.4399%, 10-Yr is down 4.6bps at 2.3488%, and 30-Yr is down 2.8bps at 2.4735%.

OVERNIGHT DATA

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 455,000 JOBS IN MARCH

- US Q4 GDP +6.9%

- 4Q Final PCE Price Index +6.4% Vs Prelim +6.3%

- 4Q Final Core PCE Price Index +5.0% Vs Prelim +5.0%

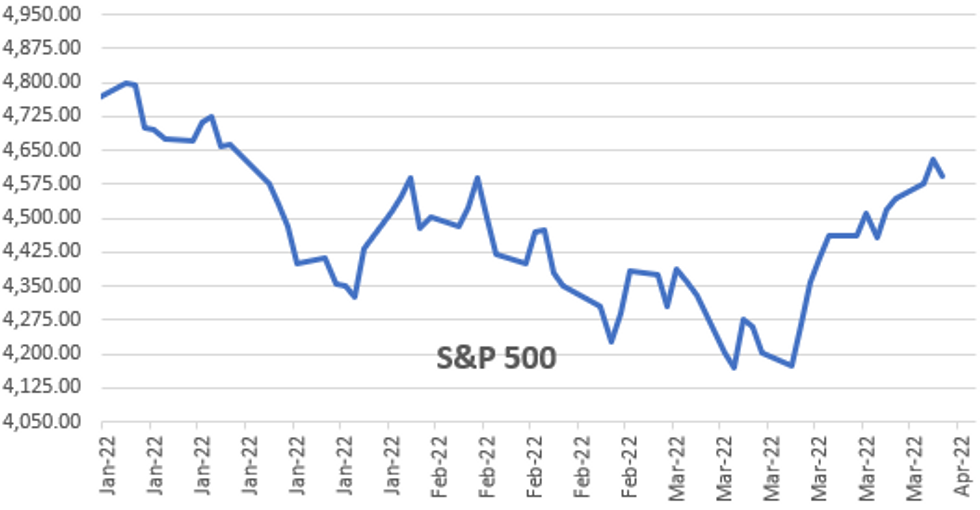

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 181.9 points (-0.52%) at 35114.25

- S&P E-Mini Future down 41.75 points (-0.9%) at 4583.75

- Nasdaq down 196.3 points (-1.3%) at 14423.52

- US 10-Yr yield is down 4.4 bps at 2.3506%

- US Jun 10Y are up 11.5/32 at 122-22

- EURUSD up 0.0073 (0.66%) at 1.1159

- USDJPY down 1.03 (-0.84%) at 121.85

- WTI Crude Oil (front-month) up $3.24 (3.11%) at $107.47

- Gold is up $13.85 (0.72%) at $1933.29

- EuroStoxx 50 down 43.04 points (-1.08%) at 3959.14

- FTSE 100 up 41.5 points (0.55%) at 7578.75

- German DAX down 214.28 points (-1.45%) at 14606.05

- French CAC 40 down 50.57 points (-074%) at 6741.59

US TSY FUTURES CLOSE

- 3M10Y -1.253, 180.561 (L: 176.112 / H: 186.516)

- 2Y10Y +0.475, 2.842 (L: 1.089 / H: 8.46)

- 2Y30Y +2.268, 15.319 (L: 12.522 / H: 20.812)

- 5Y30Y +3.245, 3.197 (L: 0.007 / H: 5.122)

- Current futures levels:

- Jun 2Y up 2/32 at 105-28.625 (L: 105-24.5 / H: 105-30)

- Jun 5Y up 6.5/32 at 114-18.75 (L: 114-06.25 / H: 114-21.5)

- Jun 10Y up 12/32 at 122-22.5 (L: 122-00.5 / H: 122-26.5)

- Jun 30Y up 19/32 at 149-17 (L: 148-06 / H: 150-01)

- Jun Ultra 30Y up 1-11/32 at 176-8 (L: 174-03 / H: 177-02)

US 10Y FUTURES TECH: (M2) Resistance Remains Intact

- RES 4: 126-04 High Mar 14RES 3: 124-06+ 20-day EMA

- RES 2: 123-25+ Low Mar 16 and a recent breakout level

- RES 1: 122-26+/123-12 Intraday high / Mar 23

- PRICE: 122-0+ @ 11:08 GMT Mar 30

- SUP 1: 120-30+ Low Mar 28 and the bear trigger

- SUP 2: 120.28 Low Dec 26 2018 (cont)

- SUP 3: 120-04+ Low Dec 12/13 2018 (cont)

- SUP 4: 120.00 Low Dec 6 2018 (cont) and psychological support

The trend direction in Treasuries is bearish and short-term gains are considered corrective. A bearish price sequence of lower lows and lower highs continues to dominate and moving average conditions are in a bear mode. The recent break lower signals scope for weakness towards 120-28 next ahead of the psychological 120-00 handle. Resistance is seen at 123-12, the Mar 23 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.050 at 98.465

- Sep 22 +0.050 at 97.795

- Dec 22 +0.040 at 97.315

- Mar 23 +0.035 at 97.005

- Red Pack (Jun 23-Mar 24) +0.040 to +0.055

- Green Pack (Jun 24-Mar 25) +0.035 to +0.045

- Blue Pack (Jun 25-Mar 26) +0.055 to +0.085

- Gold Pack (Jun 26-Mar 27) +0.080 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 at 0.32814% (+0.00157/wk)

- 1 Month -0.00229 to 0.45514% (+0.01000/wk)

- 3 Month -0.03914 to 0.96686% (-0.01600/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02771 to 1.47200% (+0.02086/wk)

- 1 Year -0.07714 to 2.12586% (+0.03715/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $83B

- Daily Overnight Bank Funding Rate: 0.32% volume: $255B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $874B

- Broad General Collateral Rate (BGCR): 0.30%, $332B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $320B

- (rate, volume levels reflect prior session)

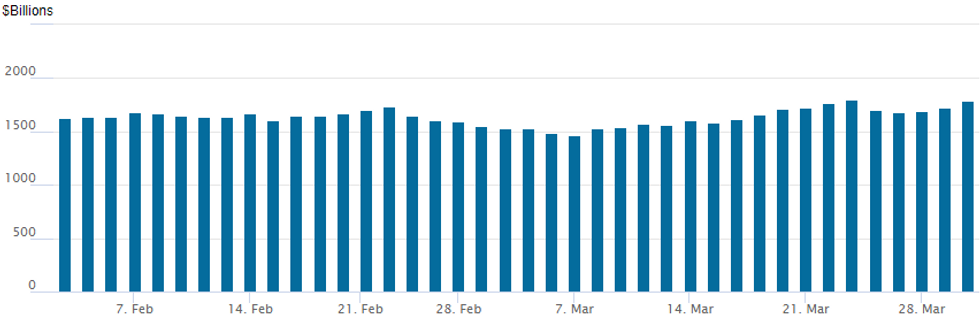

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,785.939B w/ 86 counterparties vs. prior session's $1,718.870B. Compares to Wed, March 23 year-to-date high of $1,803.186B and all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $2.25B Rabobank Launched, Drops SOFR Leg

$12.35B to price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 03/30 $4B #CIBC $1.35B 3Y +85, $650M 3Y SOFR+94, $1B 5Y +105, $1B 10Y +130

- 03/30 $3B #Workday $1B 5Y +107, $750M 7K +127, $1.25B 10Y +147

- 03/30 $2.25B #Rabobank $1.25B 6NC5 +122, $1B 11NC10 +142

- 03/30 $1.25B #National Bank of Canada 5Y +65

- 03/30 $1.25B *ADB 5Y SOFR+28

- 03/30 $600M *DT Midstream 10Y +195

EGBs-GILTS CASH CLOSE: Negative Yields Disappearing

German FI underperformed UK counterparts Wednesday with sharp bear flattening in the curve as ECB rate hike expectations edged higher.

- Higher-than-expected Spanish and German inflation data spurred a sell-off at the short end, more than offsetting weak economic sentiment data.

- As end-2022 ECB rate expectations rose into positive territory for the first time, likewise Schatz yields closed above 0% for the first time since 2014.

- Greece outperformed, with 10Y GGB spreads narrowing 10bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.5bps at 0.002%, 5-Yr is up 5.2bps at 0.484%, 10-Yr is up 1.3bps at 0.646%, and 30-Yr is up 0.7bps at 0.732%.

- UK: The 2-Yr yield is up 2.7bps at 1.382%, 5-Yr is up 2.6bps at 1.443%, 10-Yr is up 2.4bps at 1.666%, and 30-Yr is up 2.4bps at 1.813%.

- Italian BTP spread unchanged at 148.2bps / Greek down 10.3bps at 212.6bps

FOREX: Greenback Declines For Second Day, DXY Lowest Print Since March 3

- The dollar index retreated for a second consecutive session and briefly hit a near four-week low as the greenback unwinds a good portion of the March gains for the index.

- USD losses were broad based with the Japanese Yen and the Swiss France the main beneficiaries.

- The JPY has risen 0.82%, extending the bounce off the multi-year cycle lows printed earlier in the week. This places USD/JPY back below the Y122.00 handle approaching the APAC crossover. The move is considered corrective and is beginning to allow a recent extreme overbought condition to unwind. Any extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle.

- In similar vein, the Euro continued to grind higher amid the dollar weakness and in the process breached the key near-term resistance of 1.1137, Mar 17 high. A break of this hurdle eases recent bearish threats and instead highlights a developing bullish theme. Note too that the 50-day EMA intersects at 1.1150, an equally important resistance. A breach of this zone opens 1.1232 as a target.

- A slightly more muted session for equities/oil prices leaves the likes of AUD and CAD hovering around unchanged for Wednesday and underperforming their G10 counterparts.

- Chinese PMI’s on the data docket overnight before a flurry of minor European data points including German/Eurozone unemployment.

- US Core PCE Price Index headlines the US schedule as well as Canadian GDP for January being released. Later on Thursday, we will publish the MNI Chicago Business Barometer.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2022 | 2350/0850 | ** |  | JP | Industrial production |

| 31/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 31/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 31/03/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2022 | 0630/0730 |  | UK | DMO Gilt Operations Calendar April-June | |

| 31/03/2022 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2022 | 0755/0955 | ** |  | DE | unemployment |

| 31/03/2022 | 0800/1000 |  | EU | ECB Lane Lecture at Paris School of Economics | |

| 31/03/2022 | 0900/1100 | ** |  | EU | unemployment |

| 31/03/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2022 | 1000/1200 |  | EU | ECB de Guindos at Discussion at University of Amsterdam | |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.