-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Core Inflation Print Weaker Than Expected

EXECUTIVE SUMMARY

- MNI BRIEF: Resilient Job Mkt While Hiking To Neutral-Brainard

- FED: Brainard Rows Back On Potential QT Start

- NATO: US Does Not Object To MiG-29 Transfer

US

FED: Federal Reserve Governor Lael Brainard said Tuesday the central bank raising the fed funds rate to a neutral range can bring inflation down while sustaining job market growth.

- "I'd expect to see labor demand coming down and that should take place in large measure through reduction in the current very elevated level of vacancies," she said in Q&A at a WSJ event. "As we go forward on this path of moving monetary policy to a more neutral level, I really see that as being consistent with both bringing inflation down and sustaining the recovery."

- Speaking a few hours after the BLS showed core goods prices were down 0.4% in March from the previous month, Brainard said "it's very welcome to see the moderation" but "inflation is too high and getting inflation down is going to be our most important task."

FED: Fed Gov Lael Brainard "We'll decide as soon as May to start reducing the size of the balance sheet in which case those reductions could come as soon as June".

- Her comments from Apr 4: FED TO SHRINK BAL. SHEET AT RAPID PACE AS SOON AS MAY - bbg

- Technically still consistent with the section from the FOMC minutes published Apr 6: "All participants agreed that elevated inflation and tight labor market conditions warranted commencement of balance sheet runoff at a coming meeting, with a faster pace of decline in securities holdings than over the 2017-19 period."

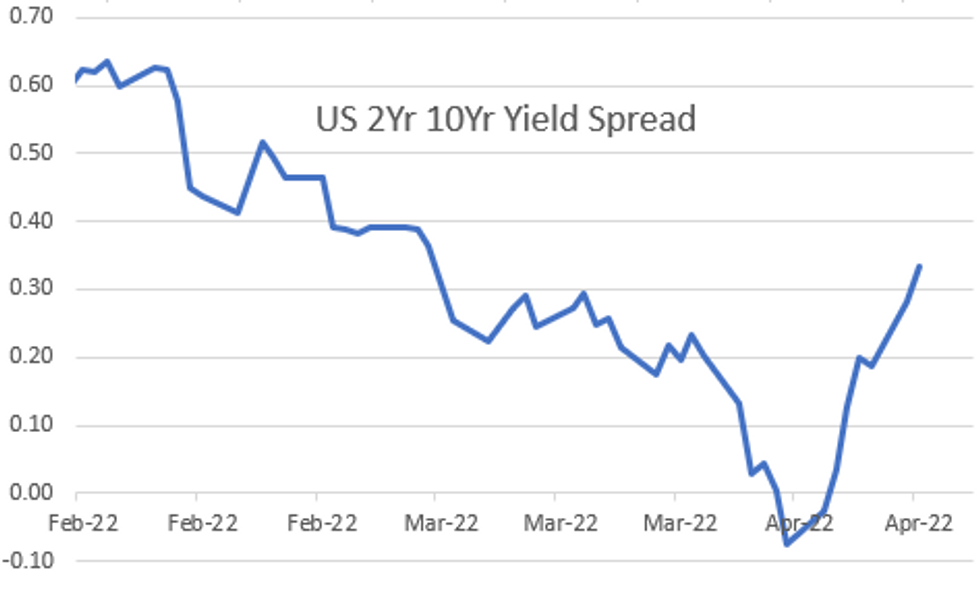

- Hikes implied by Fed Funds futures down at 208bps to year-end (near enough unchanged 48bps for May). Tsy curves steeper with 2s10s at 30bbps, 5s30s at 14bps.

NATO: US Does Not Object To MiG-29 Transfer Jack Detsch of Foreign Policy has reported that the US will no long object to the transfer of Soviet era MiG-29 fighter planes from NATO states to Ukraine.

- Detsch: 'US "does not object" to the provision of fixed-wing fighters to Ukraine, such as Soviet-era MiG-29 jets after Slovakia floated a transfer: senior U.S. defense official.'

- The US nixed a Polish deal to transfer MiGs to Ukraine via the American Rammstein military base in Germany in March as a dangerous escalation of NATO's role in the conflict.

- It is likely that the US would be expected to backfill the Slovakian planes with comparable American planes in return. Last week Bratislava transferred a S-300 missile system to Kyiv and was compensated with a US Patriot missile defence system.

- Samuel Ramani: 'This is a major contrast from U.S. opposition to Poland's MiG transfer. By moving S-300s to Ukraine, Slovakia has bucked domestic polarizations to moving sophisticated arms with Ukraine, and might take this green-light seriously.'

US TSYS: March Inflation CPI Measure Less Than Feared

Tsy futures gradually extended early session highs after weaker than exp March CPI, MoM 1.2% in-line w/est., 8.5% YoY edges past 8.4% est. Core YoY 6.5% slightly weaker than est, used car prices cited.

- Support ebbed back to midmorning levels after $34B 10Y note auction re-open (91282CDY4) tailed again: 2.720% high yield vs. 2.690% WI; 2.43x bid-to-cover off last month's 2.47x.

- Yield curves bull steepened vs bear steepening for a change - underpinned by another (Mon's Bloocked print of 2s vs. 5s and ultra-bond) massive steepener package Block at 1344:06ET

- +41,733 TUM2 105-28 buy through 105-26.5 post-time offer vs.

- -3,000 USM2 142-21, sell through 142-26 post-time bid

- -3,189 WNM2 165-00, sell through 165-08 post-time bid

- Stocks trade weaker after the FI close, reversing off midday highs after London close while some traders attribute late sell interest to headlines that US has credible intel Russia proposes use of chemical weapons in Ukraine.

- Markets have been taking geopol headline risk with more than a grain of salt of late. Weakness may be more attributed to start of earnings cycle with slew of banks (trading weaker) reporting: JP Morgan and BlackRock due Wed, before Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo follow.

- Data on tap for Wednesday at 0830ET:

- PPI Final Demand MoM (0.8%, 1.1%); YoY (10.0%, 10.6%)

- PPI Ex Food and Energy MoM (0.2%, 0.5%); YoY (8.4%, 8.4%)

- PPI Ex Food, Energy, Trade MoM (0.2%, 0.5%); YoY (6.6%, 6.6%)

- Last leg of the week's Tsy supply: US Tsy $20B 30Y Bond auction re-open (912810TD0) at 1300ET.

OVERNIGHT DATA

- US MAR CPI 1.2%, CORE 0.3%; CPI Y/Y 8.5%, CORE Y/Y 6.5%

- Unrounded CPI Data Confirms Big Headline Beat, Core Miss:

- Unrounded % M/M figures: Headline 1.241%; Core: 0.324%

- Unrounded % Y/Y figures: Headline 8.542%; Core: 6.474%

CPI Brief: U.S. inflation measured by the consumer price index rose 8.5% over the last year in March and 1.2% from February, both at the higher end of expectations, the Bureau of Labor Statistics said Tuesday, with the data showing one of the firmest headline month-on-month changes since September 2005. The strength in prices largely attributable to ripping increases in energy prices.

- Core CPI rose 6.5% over the year and 0.3% over the month, with core monthly figure below market expectations. Shelter prices rose 0.5% in March and 5.0% over the year, accounting for nearly two-thirds of the increase in core CPI, the BLS said, with owners' equivalent rent up 0.4% and rents up 0.4% over the month.

- New vehicles were up 0.2%, and used cars and truck prices again retreated, down 3.8% over the month, after rising sharply over the pandemic, one of the few categories to decline in the month.

- The gasoline index rose 18.3% in March and accounted for over half of the all items monthly increase. The food index rose 1.0% and the food at home index rose 1.5%.

- US REDBOOK: APR STORE SALES +13.4% V YR AGO MO

- US REDBOOK: STORE SALES +13.4% WK ENDED APR 09 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 118.93 points (-0.35%) at 34190.24

- S&P E-Mini Future down 23.25 points (-0.53%) at 4385.75

- Nasdaq down 76.8 points (-0.6%) at 13335.2

- US 10-Yr yield is down 6.6 bps at 2.7137%

- US Jun 10Y are up 25.5/32 at 120-17.5

- EURUSD down 0.0053 (-0.49%) at 1.0831

- USDJPY down 0.08 (-0.06%) at 125.29

- WTI Crude Oil (front-month) up $6.24 (6.62%) at $100.55

- Gold is up $15.08 (0.77%) at $1968.59

- EuroStoxx 50 down 8.15 points (-0.21%) at 3831.47

- FTSE 100 down 41.65 points (-0.55%) at 7576.66

- German DAX down 67.83 points (-0.48%) at 14124.95

- French CAC 40 down 18.4 points (-0.28%) at 6537.41

US TSY FUTURES CLOSE

- 3M10Y -12.754, 193.654 (L: 188.15 / H: 209.542)

- 2Y10Y +5.648, 33.085 (L: 22.418 / H: 34.034)

- 2Y30Y +13.38, 43.646 (L: 24.857 / H: 44.907)

- 5Y30Y +13.857, 15.374 (L: -1.505 / H: 16.466)

- Current futures levels:

- Jun 2Y up 8.75/32 at 105-27.125 (L: 105-15.5 / H: 105-27.875)

- Jun 5Y up 20/32 at 113-24 (L: 112-27.25 / H: 113-28.5)

- Jun 10Y up 25.5/32 at 120-17.5 (L: 119-10.5 / H: 120-26)

- Jun 30Y up 16/32 at 142-18 (L: 141-06 / H: 143-08)

- Jun Ultra 30Y down 6/32 at 164-22 (L: 163-17 / H: 166-18)

US 10Y FUTURES TECH: (M2) Bear Trend Extends

- RES 4: 124–21+ 50-day EMA

- RES 3: 124-18 High Mar 21

- RES 2: 123-04 High Mar 31 and a key resistance

- RES 1: 121-06+/22-19 High Apr 7 / 20-day EMA

- PRICE: 120-17 @ 1433ET Apr 12

- SUP 1: 119-10+ Intraday low

- SUP 2: 119-04+ Low Dec 3 2018 (cont)

- SUP 3: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 4: 117-22+ Low Nov 8 2018 (cont)

Treasuries have traded to a fresh cycle low of 119-10+ today. The break lower once again confirms a resumption of the primary downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies are also pointing south and scope is seen for a move towards 119-04+ next, the Dec 3 2018 low (cont). Key short-term trend resistance has been defined at 123-04, the Mar 31 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.040 at 98.375

- Sep 22 +0.085 at 97.715

- Dec 22 +0.130 at 97.220

- Mar 23 +0.165 at 96.945

- Red Pack (Jun 23-Mar 24) +0.190 to +0.205

- Green Pack (Jun 24-Mar 25) +0.145 to +0.185

- Blue Pack (Jun 25-Mar 26) +0.10 to +0.135

- Gold Pack (Jun 26-Mar 27) +0.070 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00171 at 0.32586% (-0.00171/wk)

- 1 Month +0.01057 to 0.52457% (+0.01057/wk)

- 3 Month +0.01700 to 1.03843% (+0.02772/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01300 to 1.55343% (+0.01300/wk)

- 1 Year +0.00886 to 2.28043% (+0.00886/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $80B

- Daily Overnight Bank Funding Rate: 0.32% volume: $266B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $886B

- Broad General Collateral Rate (BGCR): 0.30%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

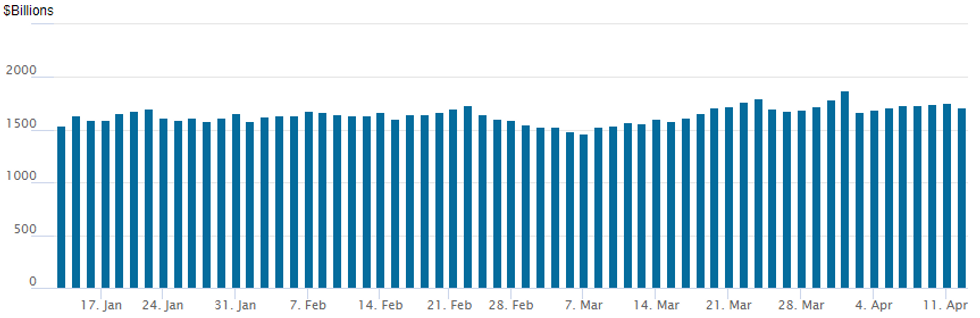

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to 1,710.414B w/ 85 counterparties from prior session 1,758.958B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: John Deere, Ferguson Finance Launched

Well off Monday's pace after $12.75B Amazon 7pt jumbo pushed week opener issuance to $23.5B. IDB rolled to Wednesday, suspect balance of week to be thin ahead early Easter holiday close Thu, no trade Friday.- Date $MM Issuer (Priced *, Launch #)

- 04/12 $600M #John Deere Capital 7Y +65

- 04/12 $1B #Ferguson Finance $300M 5Y +165, $700M 10Y +200

- Expected Wednesday:

- 04/13 $Benchmark IDB 3Y SOFR+35a

EGBS-GILTS CASH CLOSE: Soft US Inflation Report Cements Rally

A weaker-than-expected US core inflation print Tuesday afternoon cemented a reversal lower in yields from multi-year highs.

- The downside surprise helped ECB and BOE hike pricing fade slightly, and this led the German and UK curves bull flatten.

- Earlier, yields had peaked in late morning (10Y Bunds and Gilts hitting 7-yr highs).

- Periphery spreads tightened, with Italy leading the way as the the CPI release forced reconsideration of central bank hawkishness ahead of Thursday's ECB decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.8bps at 0.075%, 5-Yr is down 5.3bps at 0.573%, 10-Yr is down 2.6bps at 0.79%, and 30-Yr is down 0.1bps at 0.927%.

- UK: The 2-Yr yield is down 5bps at 1.508%, 5-Yr is down 4.9bps at 1.564%, 10-Yr is down 4.4bps at 1.803%, and 30-Yr is down 3.4bps at 1.95%.

- Italian BTP spread down 3bps at 161.9bps / Spanish down 1.5bps at 92.2bps

FOREX: Greenback Recovers Following Post-CPI Sell-Off

- March US inflation data showed the weakest M/M core print since September 2021 and the biggest core goods drop since April 2020. With the data putting a small spanner in the works for a 50bp May hike, the dollar was seen sharply lower across the board.

- USDJPY had a fairly aggressive move lower following the data. Having failed earlier in the session, just below the 2015 highs of 125.86, the pair fell around 75 pips to print fresh daily lows at 124.77. In similar vein, EURUSD received a solid boost to regain the 1.09 handle, albeit very briefly.

- Overall, greenback weakness was short-lived and the dollar index slowly edged its way back above the 100 mark and is trading at the best levels of the day approaching the APAC crossover.

- Interestingly, USDJPY was unable to retrace all the post-CPI losses, however, EURUSD went on to extend below last week’s lows and narrow the gap with the March low of 1.0806.

- Indeed, Euro crosses came under particular pressure today with EURAUD the hardest hit, down 1.25% on Tuesday. AUD remains the strongest currency on the day across G10, with AUD/USD bouncing off overnight lows of $0.7400 in a move that coincided with a late recovery in Asia-Pacific equities.

- The relative and notable Euro weakness comes ahead of Thursday’s ECB decision. The consensus expects no material change in policy at the April ECB meeting, however, MNI believe that it is a close call and that markets should be prepared for a hawkish surprise.

- Major central bank decisions in focus tomorrow. First up the RBNZ appear to have a close call on whether to raise the OCR by 25bp or 50bp. Secondly, the Bank of Canada is widely expected to hike its overnight rate by 50bp and end the reinvestment phase.

- On the data front, UK CPI and US PPI headline the docket.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 13/04/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 13/04/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 13/04/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/04/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 13/04/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bon |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.