-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Curves Bull Flatten Ahead Wed CPI

EXECUTIVE SUMMARY

- MNI FED: Fed’s Williams Sees Rates Rising ‘Expeditiously’ In 2022

- MNI FED: Fed's Waller Bullish On Housing

- EU-RUSSIA: EU Considers 'Financial Compensation' To Hungary Over Oil Sanctions

- US-CHINA: Biden Says White House 'Discussing' Removing China Tariffs

- FED MESTER: BACKS HIKING RATES BY 50 BPS AT NEXT TWO FED MEETINGS, Bbg

- FED MESTER: NEED TO MOVE RATES UP AT PACE TO GET INFLATION TURNING DOWN--YAHOO FINANCE INTERVIEW, Rtrs

MNI CPI Preview: Strong Core On Smaller Autos Drag

- CPI inflation for April is released May 11 at 0830ET.

- Consensus has core inflation firming to +0.4% M/M from the +0.32% M/M in March, driven by a smaller decline or possibly a rise in used autos after sliding nearly 4%.

- Headline is seen weaker at +0.2% M/M as large declines in gasoline weigh on energy whilst food inflation maintains its recent strong pace.

- FOMC consensus appears increasingly set on 2x50bp hikes in Jun/Jul but implications further along the rate path will depend on the usual breadth of inflationary pressure and what happens to stickier rent components.

US

FED: The Federal Reserve will raise interest rates quickly this year to tamp down brisk consumer demand and combat the highest inflation in 40 years, New York Fed President John Williams said Tuesday.

- “I expect the FOMC will move expeditiously in bringing the federal funds rate back to more normal levels this year,” he said in prepared remarks to the Bundesbank. “Our monetary policy actions will cool the demand side of the equation.”

- Still, he emphasized monetary policy is not on a preset course, a point emphasized by Richmond Fed Thomas Barkin in an interview last week with MNI’s FedSpeak podcast.

- “The ongoing pandemic and war in Ukraine bring a tremendous amount of complexity and uncertainty. We will need to be data dependent and adjust our policy actions as circumstances warrant,” Williams said.

EUROPE

EU/RUSSIA: Politico has reported that 'EU officials are considering offering financial compensation to Hungary in an attempt to persuade Prime Minister Viktor Orban to sign up to the bloc's proposed sanctions on Russian oil.'

- Politico cites three EU officials in their report, suggesting that a diplomatic assault from EU Commission resident Ursula Von Der Leyen yesterday evening and today has failed to convince Orban of the merits of sanctioning Russian oil.

- According to the Elyse Palace French President Emmanuel Macron also spoke to Orban this morning to 'finalise in a spirit of solidarity the guarantees which are necessary for oil supply conditions.'

US TSYS: Expeditious Policy and Normal Fed Funds Rates

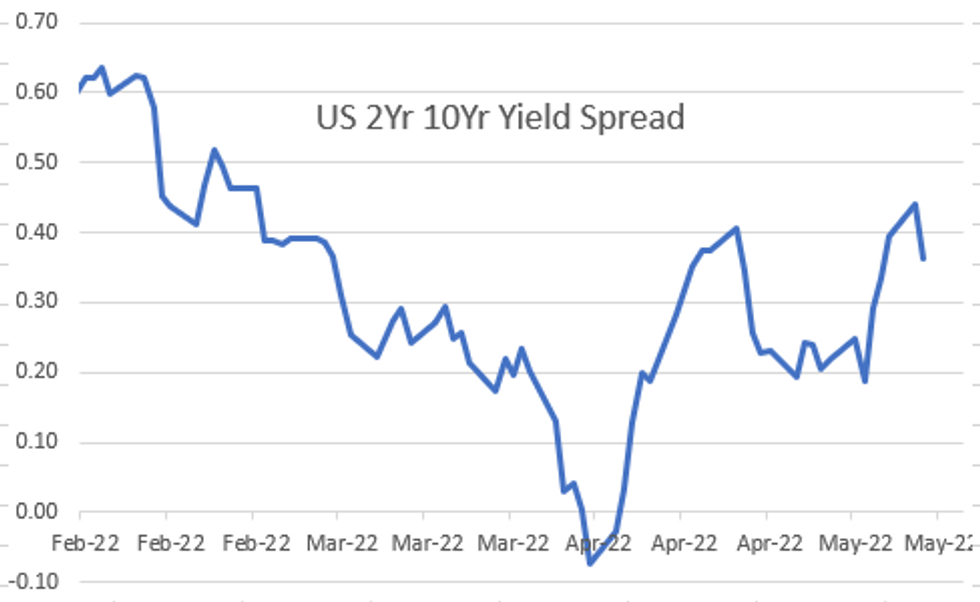

Rates trade firmer after the bell, Bonds off midday highs to near midmorning levels while yield curves hold flatter profiles as latest round of Fed speak anchors the front end.

- “I expect the FOMC will move expeditiously in bringing the federal funds rate back to more normal levels this year,” New York Fed President John Williams said Tuesday in prepared remarks to the Bundesbank. “Our monetary policy actions will cool the demand side of the equation.”

- Cleveland Fed Mester said 50bp rate increase base case "makes sense" over the next couple meetings. Richmond Fed Barkin said US doesn't "need a recession to contain inflation", adds Fed can reassess once rates are "into range of neutral".

- Treasury futures gradually receded off highs after $45B 3Y note auction (91282CEQ0) trades through: 2.809% high yield vs. 2.812% WI; 2.59x bid-to-cover vs. 2.48x last month.

- Focus turns to Wed' CPI data for April: MoM (1.2%, 0.2%; YoY (8.5%, 8.1%); CPI Ex Food and Energy MoM (0.3%, 0.4%); YoY (6.5%, 6.0%). Next leg Treasury supply: $36B 10Y note auction.

OVERNIGHT DATA

No significant data Tuesday, focus on FED speakers:

- NY Fed Williams, NABE/Bundesbank, moderated Q&A, at 0740ET

- Richmond Fed Barkin on inflation , Q&A, 0915ET

- MN Fed Kashkari and Fed Gov Waller moderated discussion, 1300ET

- Cleveland Fed Mester mon-pol panel discussion, text, Q&A, 1500ET

- Atlanta Fed Bostic mon-pol discussion, text, Q&A, 1900ET

- Economic resumes Wed w/ focus on CPI at 0830ET:

- CPI MoM (1.2%, 0.2%; YoY (8.5%, 8.1%)

- CPI Ex Food and Energy MoM (0.3%, 0.4%); YoY (6.5%, 6.0%)

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 151.02 points (-0.47%) at 32110.35

- S&P E-Mini Future up 1.75 points (0.04%) at 3990.75

- Nasdaq up 101.8 points (0.9%) at 11730.94

- US 10-Yr yield is down 4.5 bps at 2.9889%

- US Jun 10Y are up 19/32 at 118-25

- EURUSD down 0.0032 (-0.3%) at 1.0529

- USDJPY up 0.13 (0.1%) at 130.42

- WTI Crude Oil (front-month) down $3.37 (-3.27%) at $99.70

- Gold is down $14.59 (-0.79%) at $1839.66

- EuroStoxx 50 up 27.94 points (0.79%) at 3554.8

- FTSE 100 up 26.64 points (0.37%) at 7243.22

- German DAX up 154.07 points (1.15%) at 13534.74

- French CAC 40 up 30.89 points (0.51%) at 6116.91

US TSY FUTURES CLOSE

- 3M10Y -10.87, 207.679 (L: 201.216 / H: 219.567)

- 2Y10Y -7.578, 36.215 (L: 31.526 / H: 44.306)

- 2Y30Y -6.639, 48.728 (L: 43.519 / H: 57.418)

- 5Y30Y -1.092, 19.067 (L: 16.492 / H: 23.731)

- Current futures levels:

- Jun 2Y down 0.125/32 at 105-19.625 (L: 105-18.5 / H: 105-23.875)

- Jun 5Y up 7.5/32 at 112-25 (L: 112-17.5 / H: 113-03.25)

- Jun 10Y up 19/32 at 118-25 (L: 118-08 / H: 119-06)

- Jun 30Y up 1-20/32 at 138-18 (L: 137-04 / H: 139-15)

- Jun Ultra 30Y up 2-24/32 at 154-26 (L: 152-17 / H: 156-07)

US 10Y FUTURES TECH: (M2) Corrective Bounce

- RES 4: 122-12+ High Apr 4

- RES 3: 121-19+ 50-day EMA

- RES 2: 121-09 High Apr 14

- RES 1: 119-13/120-18+ 20-day EMA / High Apr 27

- PRICE: 119-00 @ 1115ET May 10

- SUP 1: 117-08+ Low May 9

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-15 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

Treasuries remain bearish and traded to a fresh trend low Monday. The move lower confirms a resumption of the primary downtrend and an extension of the price sequence of lower lows and lower highs. Recent corrections have tended to be shallow and this also highlights bearish sentiment. Sights are on 116-28 next, a Fibonacci projection. Key resistance is 120-18+, Apr 27 high. Short-term gains are considered corrective.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.020 at 98.170

- Sep 22 -0.040 at 97.410

- Dec 22 -0.025 at 96.930

- Mar 23 +0.010 at 96.730

- Red Pack (Jun 23-Mar 24) +0.025 to +0.035

- Green Pack (Jun 24-Mar 25) +0.035 to +0.065

- Blue Pack (Jun 25-Mar 26) +0.075 to +0.105

- Gold Pack (Jun 26-Mar 27) +0.115 to +0.120

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00129 to 0.82371% (+0.00514/wk)

- 1M -0.00129 to 0.84314% (+0.00100/wk)

- 3M +0.00129 to 1.39986% (-0.00200/wk) * / **

- 6M -0.04814 to 1.93200% (-0.03257/wk)

- 12M -0.08657 to 2.58829% (-0.10642/wk)

- * Record Low 0.11413% on 9/12/21; ** 2Y high 1.40614% on 5/4/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $75B

- Daily Overnight Bank Funding Rate: 0.82% volume: $270B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $931B

- Broad General Collateral Rate (BGCR): 0.80%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $343B

- (rate, volume levels reflect prior session)

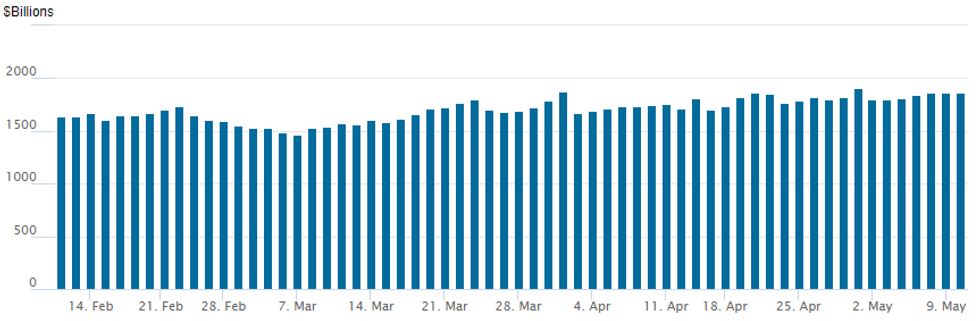

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,864.225B w/ 87 counterparties vs. prior session's 1,858.995B (all-time high of $1,906.802B on Friday, March 29, 2022).

PIPELINE: $3.5B CADES 3Y Leads Tuesday Supply

- Date $MM Issuer (Priced *, Launch #)

- 05/10 $3.5B #CADES 3Y SOFR+30

- 05/10 $1.75B #Caterpillar Fncl 1.5y SOFR+45, 3Y +65, 3Y SOFR

- 05/10 $750M #KKR Grp 10Y +190

- 05/10 $700M #Public Service Co of Colorado $300M 10Y +120, $400M 30Y +145

- 05/10 $500M #Deutsche Bank 3Y +155a

- 05/10 $500M #State Street 11NC10 +143

- 05/10 $500M #Ameriprise WNG 10Y +153

- 05/10 $Benchmark Amcor Flexibles 3Y +140a

EGBs-GILTS CASH CLOSE: BTPs Gain As Risk Appetite Stabilises

Core bond yields continued to fall Tuesday but closed a bit off session lows. The UK and German curves bull flattened, but BTPs led the charge, with 10Y yields falling as much as 21bp as risk appetite stabilised following Monday's broader market rout.

- Bundesbank chief Nagel said he supported a July rate hike, while saying he was skeptical of addressing eurozone fragmentation with a new tool.

- Periphery EGBs did little on those typically hawkish Nagel comments, with 10Y BTP spreads having already bounced higher from session lows below 200bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 6.4bps at 0.165%, 5-Yr is down 7.7bps at 0.691%, 10-Yr is down 9.3bps at 1.002%, and 30-Yr is down 9.2bps at 1.142%.

- UK: The 2-Yr yield is down 6.4bps at 1.329%, 5-Yr is down 9.5bps at 1.484%, 10-Yr is down 10.8bps at 1.848%, and 30-Yr is down 10.3bps at 2.056%.

- Italian BTP spread down 5.5bps at 200bps / Greek down 2.4bps at 250.8bps

FOREX: USD, JPY Hold Recent Strength as Equities Show at a New Low

- Risk aversion remained the theme for currency markets Tuesday, with another downtick in equity markets resulting in a fresh low print for the e-mini S&P. This helped both the JPY and greenback hold recent strength, leaving the two currencies close to the top of the G10 table.

- SEK was the strongest, however, with markets watching comments from Riksbank's Ingves, who stated that a 'systematically' weaker SEK would be undesirable from a policy perspective. EUR/SEK reversed off a multi-month high printed in overnight trade at 10.6793.

- Gold also sold off alongside energy products, putting commodity-tied currencies at a disadvantage and resulting in AUD, NZD and CAD undperforming most others.

- Chinese inflation data crosses during the Wednesday Asia-Pac session, with markets expecting CPI to creep higher to touch 1.8%, while PPI moderates to 7.8%. US CPI then takes focus.

- Consensus has core inflation firming to +0.4% M/M from the +0.32% M/M in March, driven by a smaller decline or possibly a rise in used autos after sliding nearly 4%. Meanwhile headline is seen weaker at +0.2% M/M as large declines in gasoline weigh on energy whilst food inflation maintains its recent strong pace.

- Outside of macro data, a slew of ECB speakers are due throughout the day, with the highlights including Lagarde, Nagel, Makhlouf, Schnabel and Knot among many others.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2022 | 0030/1030 |  | AU | Westpac-MI Consumer Sentiment | |

| 11/05/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/05/2022 | 0600/0800 |  | EU | ECB Elderson Fireside Chat with Sonja Gibbs | |

| 11/05/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at 30th anniversary of Banka Slovenije | |

| 11/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/05/2022 | 1220/1420 |  | EU | ECB Schnabel Keynote Speech at Austrian National Bank | |

| 11/05/2022 | 1230/0830 | *** |  | US | CPI |

| 11/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/05/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.