-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Sec Yellen Confident of Soft Landing?

EXECUTIVE SUMMARY

- MNI: Fed QT May Have Deeper Tightening Effect - Ex-Officials

- MNI BRIEF: Yellen Says Fed Has Path To Hike Without Recession

- EU STARTS TO MULL DELAY IN OIL SANCTIONS AS HUNGARY DIGS IN, Bbg

- JEROME POWELL SECURES ENOUGH VOTES IN SENATE FOR CONFIRMATION AS FED CHAIR; VOTING CONTINUES, Rtrs

US

FED: The Federal Reserve's unprecedented effort to whittle down a record USD9 trillion balance sheet could have a much larger than expected impact on financial conditions if markets become disorderly, ex-Fed officials told MNI, casting doubt on the chances that the asset reduction plans will run quietly in the background as current policymakers hope.

- The Fed's second go at shrinking its balance sheet, which it calculates will be equivalent in impact to just one rate hike a year, is expected by officials to proceed more smoothly than its first attempt in 2018 when key lessons were learned about banking system reserve requirements. But pandemic-era QT is twice as aggressive and comes at a time of rapidly rising yields. If markets turn bumpy, ex-officials fear the tightening effect from the Fed’s bond runoffs could be multiplied several times over.

- “There certainly is potential for financial market tumult,” former Richmond Fed President Jeffrey Lacker said in an interview. “This is another looming possibility for the Fed to have to face, which is a scenario in which the inflation fight has not yet been won and yet financial markets exhibit some volatility, some asset price declines, some credit spreads widening, which is what you’d expect if growth slows down."

- "The Fed has a path to bring down inflation, without causing a recession and I know that it will be their objective to try to accomplish that," she said at a hearing before Congress when asked about risks of stagflation. "We have a really good, strong labor market. We have household balance sheets that are in good shape," the former Fed chair said, while also expressing confidence in businesses' ability to handle increased debt costs.

US TSYS: Rate Hike Path Without Recession

Rates trading stronger after the bell, but trimming gains back to midmorning levels. Notably, yield curves recovered from early flattening to steeper (2s10s +2.024 at 29.763 vs. 22.474 low) as the short end unwinds Wednesday's more aggressive rate hikes from additional three to four 50bps hikes by year end to two over the next two FOMC meetings.- Chances of additional hikes in the second half of the year receded Thursday. Cumulative hikes for July (9.5bps) are not far off when the US came in but there have been larger slides on the day further out. Both Sep (133bp) and Dec (181bp) are ~5bp lower than prior to US CPI.

- Treasury Secretary Janet Yellen told lawmakers the Federal Reserve has a path to increase interest rates without setting off a recession. "The Fed has a path to bring down inflation, without causing a recession and I know that it will be their objective to try to accomplish that," she said at a hearing before Congress when asked about risks of stagflation.

- Tys gained briefly after $22B 30Y auction (912810TG3) stops through: 2.997% high yield vs. 3.002% WI; 2.38x bid-to-cover vs. 2.30x last month. Indirect take-up climbs to 69.66% vs. 65.23% in Apr; direct bidder take-up slips to 16.60% vs. 18.91% prior; primary dealer take-up 13.74% vs. 15.87%.

- Friday focus: Import/Export Price Indexes, UMich Sentiment while MN Fed Kashkari speaks on energy and inflation at 1100ET, Cleveland Fed Mester on monetary policy at 1200ET. Sidebar: Fed Chairman Powell confirmed by Senate for a second term today.

OVERNIGHT DATA

- U.S. WEEKLY JOBLESS CLAIMS AT 203,000 LAST WEEK; EST. 193,000

- U.S. CONTINUING CLAIMS FELL TO 1,343K LAST WEEK; EST. 1,372K

- U.S. APRIL PRODUCER PRICES RISE 0.5% M/M; EST. 0.5%

- U.S. APRIL PRODUCER PRICES EX-FOOD, ENERGY, TRADE RISE 0.6% M/M; 6.9% Y/Y

- U.S. APRIL PRODUCER PRICES RISE 11.0% Y/Y; EST. 10.7%

- U.S. APRIL PRODUCER PRICES EX-FOOD, ENERGY RISE 0.4% ON MONTH

- U.S. APRIL PPI EX-FOOD, FUEL RISE 8.8% Y/Y; EST. 8.9%

MARKETS SNAPSHOT

Key late session market levels

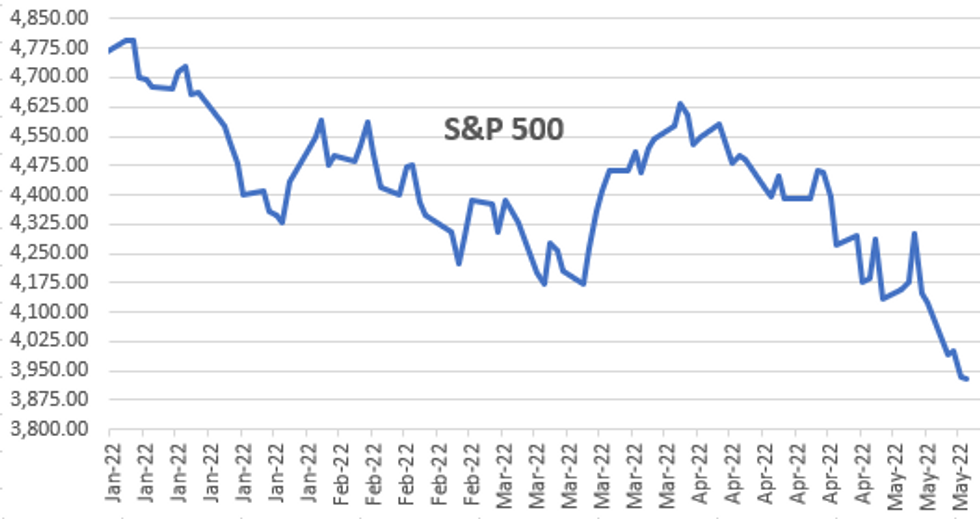

- DJIA down 103.81 points (-0.33%) at 31730.3

- S&P E-Mini Future down 8 points (-0.2%) at 3922.25

- Nasdaq up 6.7 points (0.1%) at 11370.96

- US 10-Yr yield is down 6 bps at 2.8605%

- US Jun 10Y are up 12/32 at 119-20.5

- EURUSD down 0.0138 (-1.31%) at 1.0375

- USDJPY down 1.61 (-1.24%) at 128.36

- WTI Crude Oil (front-month) up $1.02 (0.96%) at $106.72

- Gold is down $29.34 (-1.58%) at $1822.88

- EuroStoxx 50 down 34.44 points (-0.94%) at 3613.43

- FTSE 100 down 114.32 points (-1.56%) at 7233.34

- French CAC 40 down 63.47 points (-1.01%) at 6206.26

US TSY FUTURES CLOSE

- 3M10Y -10.777, 189.323 (L: 186.196 / H: 198.947)

- 2Y10Y +0.98, 28.719 (L: 22.474 / H: 32.536)

- 2Y30Y +5.666, 45.897 (L: 36.867 / H: 48.489)

- 5Y30Y +5.472, 20.084 (L: 13.713 / H: 21.318)

- Current futures levels:

- Jun 2Y up 4.125/32 at 105-23.125 (L: 105-16.75 / H: 105-26.625)

- Jun 5Y up 7.75/32 at 113-6.25 (L: 112-27.25 / H: 113-14.25)

- Jun 10Y up 12.5/32 at 119-21 (L: 119-04.5 / H: 120-00.5)

- Jun 30Y up 21/32 at 140-9 (L: 139-14 / H: 141-03)

- Jun Ultra 30Y up 21/32 at 157-20 (L: 156-20 / H: 159-17)

US 10Y FUTURES TECH: (M2) Corrective Bounce Extends

- RES 4: 122-12+ High Apr 4

- RES 3: 121-16 50-day EMA

- RES 2: 121-09 High Apr 14

- RES 1: 120-01/120-18+ High Apr 28 / High Apr 27

- PRICE: 119-21.5 @ 1615ET May 12

- SUP 1: 118-03+/117-08+ Low May 11 / Low May 9 and a bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-09+ 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

The primary downtrend in Treasuries remains intact, however a corrective (bullish) cycle has been established and this suggests potential for gains near-term. The contract has traded above the 20-day EMA, at 119-10+, and this opens 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and the bear trigger is at 117-08+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.005 at 98.170

- Sep 22 +0.030 at 97.410

- Dec 22 +0.045 at 96.945

- Mar 23 +0.085 at 96.805

- Red Pack (Jun 23-Mar 24) +0.090 to +0.105

- Green Pack (Jun 24-Mar 25) +0.055 to +0.085

- Blue Pack (Jun 25-Mar 26) +0.020 to +0.050

- Gold Pack (Jun 26-Mar 27) +0.015 to +0.020

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00086 to 0.82686% (+0.00829/wk)

- 1M +0.02057 to 0.87471% (+0.03257/wk)

- 3M -0.01057 to 1.41129% (+0.00943/wk) * / **

- 6M +0.00385 to 1.95886% (-0.00571/wk)

- 12M +0.01315 to 2.62986% (-0.06485/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.42186% on 5/11/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $78B

- Daily Overnight Bank Funding Rate: 0.82% volume: $256B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $925B

- Broad General Collateral Rate (BGCR): 0.80%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $344B

- (rate, volume levels reflect prior session)

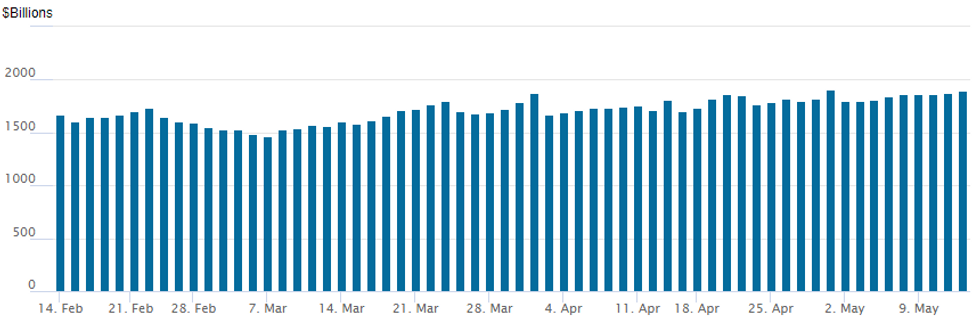

FED: Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage nears late March all-time high, currently 1,900.069B w/ 85 counterparties vs. prior session's 1,876.119B (all-time high of $1,906.802B on Friday, March 29, 2022).

PIPELINE: Surprise $8B Intercontinental Exchange 6Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/12 $8B #Intercontinental Exchange $1.25B 3Y +95, $1.5B 5Y +125a, $1.25B 7Y +150, $1.5B 10Y +175, 1.5B 30Y +200, $1B 40Y +200

- 05/12 $2.25B *Province of Ontario 5Y SOFR+51

- 05/12 $750M #Willis NA 5Y +185

- 05/12 $500M #Nederlandse Financierings-Maatschappij (FMO) 3Y SOFR+28

- 05/12 $1.5B #NXP Semiconductors $500M 5Y +165, $1B +10Y +220

EGBs-GILTS CASH CLOSE: Yields Close Near Lows Despite Equity Rebound

Yields closed near session lows Thursday despite a bounce in equities in the afternoon.

- Both the German and UK curves bull flattened, but UK instruments outperformed. 10Y yields dropped over 16bp, as real yields fell 27bp (implied inflation breakevens rose 10bp).

- BTP spreads vs Bunds continued to narrow from levels above 200bp.

- They continue to mirror ECB policy rate expectations, which fell to a May low of 19bp at end-2022 (77bp of hikes) from above 35bp last week. That's despite several ECB officials seemingly endorsing a July hike this week, including Makhlouf today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 8.8bps at 0.052%, 5-Yr is down 14bps at 0.519%, 10-Yr is down 14bps at 0.846%, and 30-Yr is down 11.5bps at 1.024%.

- UK: The 2-Yr yield is down 10.8bps at 1.179%, 5-Yr is down 14.6bps at 1.305%, 10-Yr is down 16.1bps at 1.665%, and 30-Yr is down 13.9bps at 1.926%.

- Italian BTP spread down 3.9bps at 187bps / Greek up 4.8bps at 251.5bps

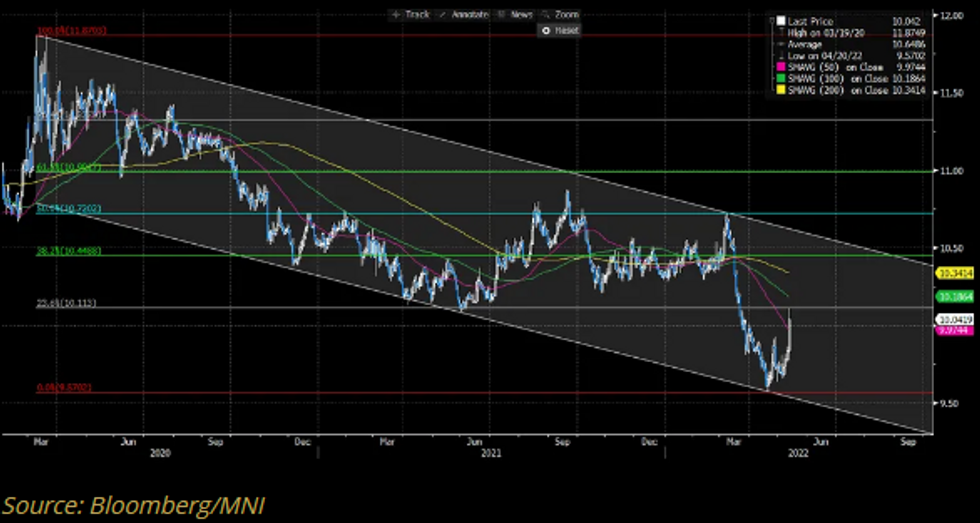

FOREX: JPYKRW Consolidates Back Above 10 Amid Global Risk off

- We have seen that the sharp CNY depreciation in recent weeks has been weighing on EM FX, including KRW, which is approaching the 1,300 level (2009 highs vs. USD).

- In addition, JPY has been appreciating sharply this week as global risk off environment has led to a significant consolidation in LT bond yields.

- JPYKRW, which has historically been very sensitive to a sudden rise in price volatility, has been consolidating higher after reaching a local low at 9.57 in the end of April.

- The pair found resistance at 10.1130 earlier today, which corresponds to the 23.6% Fibo retracement of the 9.57 – 11.87 range.

- Next level to watch on the topside stands at 10.1860 (100DMA).

Friday Data Calendar

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.