-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-On, Tsys Consolidate

EXECUTIVE SUMMARY

- MNI BRIEF: Fed’s Powell Seeks ‘Convincing’ Inflation Drop

- Powell On NAIRU Probably Well Above 3.6%

- MN FED KASHKARI: NOT CLEAR YET IF FED NEEDS TO DO EVEN MORE ON RATES, Bbg

US

FED: Federal Reserve Chairman Jerome Powell said Tuesday the Fed needs to see inflation coming down consistently before it can think about pausing or slowing the pace of its monetary tightening, set for 50 basis point increases at the next two meetings.

- "What we need to see is inflation coming down in a clear and convincing way," Powell told the WSJ in a webcast. "We're going to keep pushing until we see that."

- "We don't know with any confidence what neutral is, we don't know where tight is," he said.

- Richmond Fed President Thomas Barkin told MNI's FedSpeak podcast: https://marketnews.com/mni-fed-s-barkin-says-rates... this month he would not rule out larger 75 basis point moves.

- Paraphrasing: It should shift down as this highly unusual time in our economy and labour market goes on. We should see that settling down and see the natural rate declining and that itself could reduce wage and inflation pressures. Vacancies and quits are at an all-time high. Would like to see vacancies come down so that supply and demand get back to together.

US TSYS: Fed Firmly Focused on Inflation

US FI markets hold weaker levels after the bell -- off mid-morning lows when 30YY climbed to 3.1711%, and holding narrow band through the second half.- Brief dip in Tsy futures after Fed Chairman Powell comment on WSJ interview that the Fed "won't hesitate to raise rates above neutral if needed" to bring inflation down. Levels recovered just as quickly as Chair Powell stuck to the dual mandate boiler plate comments for the most part.

- "What we need to see is inflation coming down in a clear and convincing way," Powell told the WSJ in a webcast. "We're going to keep pushing until we see that. We don't know with any confidence what neutral is, we don't know where tight is," he said.

- Rates traded weaker post-data, retail sales excl autos better than est at 0.6% (0.4% est), control group +1.0% vs. 0.8% est. Yield curves bear flattened: 2s10s -4.454 at 26.172, 5s30s -4.277 at 1.138%.

- StL Fed Bullard comments at EIC conf: 50bp hikes "at coming meetings"; market vol "reflects policy outlook repricing". While Bullard says the Fed has a good plan in place to address inflation -- has yet to mention recession risk for US (did say doesn't think Europe will go into recession). Last week, Bullard stated recession is "not that high for the US" while the "current strong jobs market is not consistent with recession risk.

- Rather large (certainly unexpected by the broader market) corporate issuance with $6B each between United Health Care and Citigroup multi-tranche jumbos later in the second half.

OVERNIGHT DATA

- US APR RETAIL SALES +0.9%; EX-MOTOR VEH +0.6%

- US MAR RETAIL SALES REVISED +1.4%; EX-MV +2.1%

- US APR RET SALES EX GAS & MTR VEH & PARTS DEALERS +1.0% V MAR +1.2%

- US APR RET SALES EX MTR VEH & PARTS DEALERS +0.6% V US APR +2.1%

- US APR RET SALES EX AUTO, BLDG MATL & GAS +1.2% V MAR +1.2%

- US APR INDUSTRIAL PROD +1.1%; CAP UTIL 79.0%

- US MAR IP REV TO +0.9%; CAP UTIL REV 78.2%

- US APR MFG OUTPUT +0.8%

- FOREIGN HOLDINGS OF CANADA SECURITIES +46.9B CAD IN MAR

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -24.0B CAD IN MAR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 365.1 points (1.13%) at 32591.43

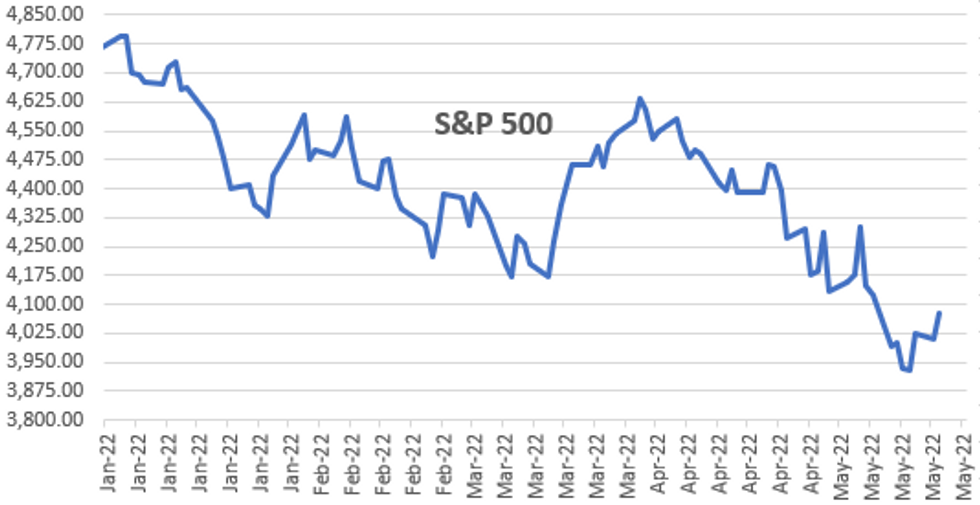

- S&P E-Mini Future up 70.25 points (1.75%) at 4074.75

- Nasdaq up 287.3 points (2.5%) at 11951.9

- US 10-Yr yield is up 9.5 bps at 2.9769%

- US Jun 10Y are down 28.5/32 at 118-25

- EURUSD up 0.0113 (1.08%) at 1.0547

- USDJPY up 0.23 (0.18%) at 129.4

- WTI Crude Oil (front-month) down $1.84 (-1.61%) at $112.36

- Gold is down $8.22 (-0.45%) at $1815.89

- EuroStoxx 50 up 56.17 points (1.52%) at 3741.51

- FTSE 100 up 53.55 points (0.72%) at 7518.35

- German DAX up 221.56 points (1.59%) at 14185.94

- French CAC 40 up 82.42 points (1.3%) at 6430.19

US TSY FUTURES CLOSE

- 3M10Y +4.859, 189.413 (L: 181.105 / H: 190.942)

- 2Y10Y -3.175, 27.451 (L: 25.525 / H: 31.803)

- 2Y30Y -5.287, 46.958 (L: 44.446 / H: 53.533)

- 5Y30Y -5.658, 21.376 (L: 20.117 / H: 28.185)

- Current futures levels:

- Jun 2Y down 7.375/32 at 105-16.375 (L: 105-15.625 / H: 105-24.875)

- Jun 5Y down 21.25/32 at 112-19.75 (L: 112-19 / H: 113-11.25)

- Jun 10Y down 28/32 at 118-25.5 (L: 118-24 / H: 119-24)

- Jun 30Y down 1-13/32 at 138-16 (L: 138-06 / H: 139-26)

- Jun Ultra 30Y down 2-13/32 at 153-4 (L: 152-30 / H: 155-09)

US 10Y FUTURES TECH: (M2) Trading Below Its Recent Highs

- RES 4: 122-12+ High Apr 4

- RES 3: 121-09 High Apr 14

- RES 2: 121-06+ 50-day EMA

- RES 1: 120-01/120-18+ High Apr 28 / High Apr 27

- PRICE: 118-27+ @ 19:56 BST May 17

- SUP 1: 118-03+/117-08+ Low May 11 / Low May 9 and a bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-15+ 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

Treasuries remain below its recent high. The primary downtrend is intact, and short-term gains are considered corrective - a pause in the downtrend. Further gains would open 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and the bear trigger is unchanged at 117-08+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.003 at 98.175

- Sep 22 -0.070 at 97.320

- Dec 22 -0.125 at 96.790

- Mar 23 -0.165 at 96.615

- Red Pack (Jun 23-Mar 24) -0.19 to -0.185

- Green Pack (Jun 24-Mar 25) -0.18 to -0.155

- Blue Pack (Jun 25-Mar 26) -0.14 to -0.11

- Gold Pack (Jun 26-Mar 27) -0.10 to -0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00215 to 0.82014% (-0.00557/wk)

- 1M -0.00714 to 0.92843% (+0.04172/wk)

- 3M -0.00743 to 1.44757% (+0.00386/wk) * / **

- 6M -0.01186 to 2.00514% (+0.01014/wk)

- 12M +0.02085 to 2.67771% (+0.02557wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.45500% on 5/16/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $84B

- Daily Overnight Bank Funding Rate: 0.82% volume: $271B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.80%, $1.013T

- Broad General Collateral Rate (BGCR): 0.80%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $356B

- (rate, volume levels reflect prior session)

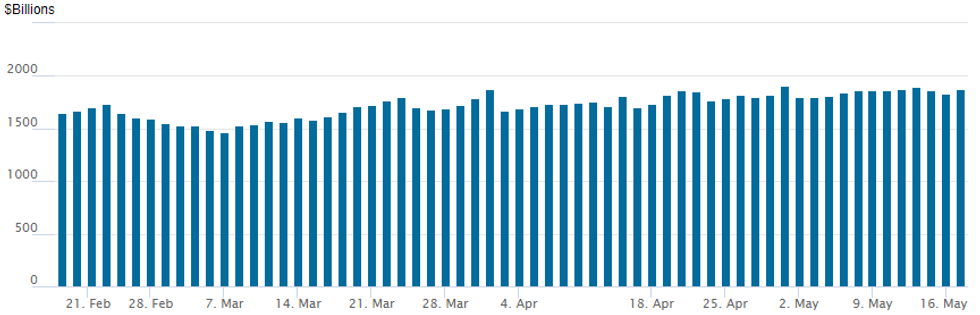

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage currently 1,877.483B w/ 90 counterparties vs. prior session's 1,833.152B (all-time high of $1,906.802B on Friday, March 29, 2022).

PIPELINE: Unexpectedly Large: $6B UNH, $6B Citigroup

Heavy -- unexpectedly so for some issuance likely had an effect on rates around time Fed Chairman Powell discussed "won't hesitate" to raise rates above neutral if needed.- Date $MM Issuer (Priced *, Launch #)

- 05/17 $6B #United Health $600M 5Y +75, $900M 7Y +105, $1.5B 10Y +125, $2B 30Y +160, $1B 40Y +180

- 05/17 $6B #Citigroup $1.5B 3NC2 +145, $500M 3NNC2 SOFR, $1.5B 6NC5 +170, $2.5B 11NC10 +195

- 05/17 $2.75B *Export Development Canada 5Y SOFR +34

- 05/17 $1B #HSBC 2Y +105, 2Y SOFR+105

- 05/17 $1B OKB 3Y SOFR+25

- 05/17 $800M #Oncor Electric Delivery $400M 10Y +122, $400M 30Y +147

- 05/17 $600M Motorola 10Y +265

- 05/17 $500M RELX Capital 10Y +190

- 05/17 $500M CNH Industrial Capital 3Y +125

- 05/17 $Benchmark Japan Int Cooperation Agcy (JICA) 5Y SOFR+63a

EGBs-GILTS CASH CLOSE: 50bp On ECB's Agenda For July?

ECB's Knot sparked a bearish repricing at the front of European curves Tuesday with his comment that he would be open to a 50bp hike at the bank's July meeting.

- Although Knot's comments could be discounted on account of his pre-existing hawkish leanings, ECB rate hike pricing for 2022 hit a cycle high, with over 100bp in hikes priced for the year (though a 25bp raise in July remains the market's base case).

- UK yields also rose sharply, both following the EGB move and strong March wage data. 2Y Gilts sold off 20+bp.

- Periphery EGB spreads widened but not as much as might be expected given tighter ECB policy expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 12bps at 0.3551%, 5-Yr is up 12.8bps at 0.734%, 10-Yr is up 10.9bps at 1.046%, and 30-Yr is up 7.2bps at 1.176%.

- UK: The 2-Yr yield is up 20.8bps at 1.445%, 5-Yr is up 20.2bps at 1.565%, 10-Yr is up 15.1bps at 1.881%, and 30-Yr is up 11.5bps at 2.092%.

- Italian BTP spread up 1bps at 191.6bps / Spanish up 1bps at 107.2bps

FOREX: Greenback Slides As Risk Catches A Bid, Euro and GBP Bounce

- Renewed optimism for risk sentiment weighed on the US Dollar on Tuesday. The USD Index is down 0.82% approaching the APAC crossover, extending the week’s losses to over 1%. The majority of greenback pressure was felt during the early European session, with price largely in consolidation mode throughout US trade.

- Exacerbating the USD descent was a surging Euro, which was significantly bolstered by comments from ECB’s Knot that a bigger increase than 25bp cannot be excluded. EURUSD extended gains through 1.0450 and spent little time before breaching back above the 1.05 mark to print a 1.0556 high.

- GBP was among the best performers in G10 FX on Tuesday, closely matched by the Euro, SEK and NOK. This follows the stronger than expected UK labour market data, contributing to both sides of the GBPUSD trade amid the weaker dollar. Cable has gained around 1.3% and has consolidated just shy of 1.2500. Next resistance seen at 1.2512 High May 9.

- Equity gains have also lent support to the likes of AUD (+0.70%) and NZD (+0.75%), however, an underwhelming day for oil saw CAD relatively underperform ahead of Canadian inflation data due tomorrow.

- The USD picked up a small bid as Fed Chair Powell commented on not hesitating to raise rates above neutral, however, the greenback was only able to slightly trim losses.

- Aussie wage price index data overnight before inflation data from both the UK and Canada is scheduled for Wednesday’s session.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 18/05/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 18/05/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 18/05/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 18/05/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.