-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: To Be Resolute, Or Not To Be

EXECUTIVE SUMMARY

- MNI: BOC Shifts To Say It's More Likely To Hike Above Neutral

- MNI: St. Louis Fed Model Predicts May Employment Gain Slowed

- MNI: Mester Urges Fed 'Be Resolute' On Controlling Inflation

- MNI BRIEF: Fed’s Brainard: Hard To See Case For Pause -CNBC

- OPEC+ JMMC Recommends A 648K BPD Output Increase For July

US

FED: Inflation is still far to high for Federal Reserve officials to consider a pause or reduction in the pace of interest rate hikes, Fed Vice Chair Lael Brainard told CNBC Thursday.

- "Right now it's still very hard to see the case for a pause," Brainard said. "On inflation, I'm going to be looking to see a consistent string of decelerating monthly prints on core inflation before I feel more confident we're getting to the kind of inflation trajectory that's going to get us back to our 2% goal."

- The deceleration in inflation the Fed is hoping to see in the fall may not materialize current and former Fed economists told MNI. Minneapolis Fed Research Director Mark Wright also said in an interview last week policymakers might consider slowing the pace of rate increases as the fed funds rate approaches neutral.

- She also reiterated her support for two more 50bp interest rate hikes at the upcoming meetings this month and next and said the funds rate will probably need to go above its longer-run neutral level to rein in inflation.

- The Coincident Employment Index, using weekly data from time-tracker software provider Homebase, shows "an improvement in employment, as measured by the household survey," in May, Dvorkin said. Homebase users tend to be smaller firms concentrated in retail and food and accommodation services.

- The index suggested a seasonally adjusted gain of close to 800,000 in April, though official figures from BLS showed a decline of 115,000 for the month. "The large forecast error may be due, in part, to the religious holiday in April and the timing in which the CPS data is collected relative to the Homebase data," Dvorkin said.

CANADA

BOC: The Bank of Canada is more likely to lift interest rates above neutral to prevent entrenched high inflation that would require a much more forceful response, Deputy Governor Paul Beaudry said Thursday.

- Discussing deliberations for Wednesday's hike to 1.5% from 1% he reiterated the Bank can "act more forcefully if needed," a phrase investors take to mean a 75bp hike is possible at July's meeting.

- "Price pressures are broadening and inflation is much higher than we expected and likely to go higher still before easing. This raises the likelihood that we may need to raise the policy rate to the top end or above the neutral range," Beaudry said in the text of a speech that will be followed by audience questions and a press conference.

US TSYS: ADP Miss Ahead May NFP; Stocks, Oil, Gold Bounce

Rates trade mildly higher after the bell, near middle of session range on light volumes (TYU2 appr 900k) w/ London out on two-day holiday.

- No LIBOR settles today and tomorrow w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325. Moderating market repricing chances of additional rate hikes out the curve (odds of additional 50bp in Fall gaining).

- Random volatility/thin liquidity continues. Tsys had bounced back near post-ADP highs (+128k vs. +300k est), reversed course as 30Y Bonds gapped lower/extend session lows (30YY tapped 3.1110%) reportedly in sympathy w/ selling in EGBs. Yield curves bear steepened off lows, 2s10s climbed to 28.921 high.

- Wide range for Crude (Brent 115.5 low/121.5 high), initially weaker on assumption Saudi and UAE were going to make up for Russian lost capacity (down 1mn bpd since invasion). Instead, Russia remains joint biggest contributor based on quota but market knows they can't make up that number - neither can Nigeria, Iraq etc. Crude reversed/legged higher after headlines annc EU approves "partial Russian oil ban, sanctions on Sberbank", Bbg.

- Fri data focus on May Employ Report (+325k vs. +428k prior), Fed Speak: Cleveland Fed Mester on CNBCs The Exchange to discuss employ report at 1340ET.

OVERNIGHT DATA

- ADP RESEARCH INSTITUTE SAYS U.S. ADDED 128,000 JOBS IN MAY

- ADP May US Private Sector Jobs Expected +299,000

- US JOBLESS CLAIMS -11K TO 200K IN MAY 28 WK

- US PREV JOBLESS CLAIMS REVISED TO 211K IN MAY 21 WK

- US CONTINUING CLAIMS -0.034M to 1.309M IN MAY 21 WK

- US APRIL FACTORY ORDERS RISE 0.3% FROM MONTH AGO

- US APRIL DURABLE GOODS ORDERS INCREASE 0.5%; EST. 0.4% - bbg

- US APRIL CAPITAL GOODS NEW ORDERS NONDEFENSE EX-AIR RISE 0.4%

- US APRIL FACTORY ORDERS RISE 0.3% FROM MONTH AGO

- US Q1 REV NONFARM PRODUCTIVITY -7.3%; Y/Y -0.6%

- US Q1 UNIT LABOR COSTS +12.6%; Y/Y +8.2%

- CANADIAN APR BUILDING PERMITS -0.6% MOM

- CANADA RESIDENTIAL BUILDING PERMITS -3.3%; NON-RESIDENTIAL +5.0%

MARKETS SNAPSHOT

Key late session market levels:

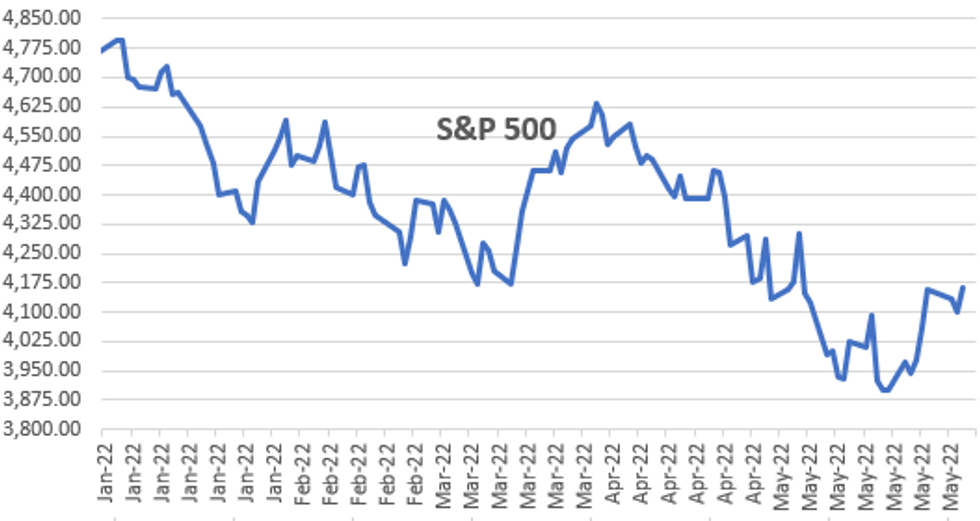

- DJIA up 290.07 points (0.88%) at 33103.14

- S&P E-Mini Future up 59.5 points (1.45%) at 4158

- Nasdaq up 269 points (2.2%) at 12262.85

- US 10-Yr yield is up 1.5 bps at 2.9204%

- US Sep 10Y are up 4.5/32 at 118-25

- EURUSD up 0.0094 (0.88%) at 1.0744

- USDJPY down 0.26 (-0.2%) at 129.87

- WTI Crude Oil (front-month) up $1.85 (1.61%) at $117.14

- Gold is up $23.45 (1.27%) at $1869.99

- EuroStoxx 50 up 35.59 points (0.95%) at 3795.13

- German DAX up 144.7 points (1.01%) at 14485.17

- French CAC 40 up 81.55 points (1.27%) at 6500.44

US TSY FUTURES CLOSE

- 3M10Y +1.207, 177.402 (L: 174.196 / H: 180.504)

- 2Y10Y +1.645, 27.46 (L: 23.711 / H: 28.921)

- 2Y30Y +2.652, 43.542 (L: 38.31 / H: 46.069)

- 5Y30Y +2.282, 16.165 (L: 11.256 / H: 17.958)

- Current futures levels:

- Sep 2Y up 1.25/32 at 105-11.25 (L: 105-09.625 / H: 105-12.625)

- Sep 5Y up 2.75/32 at 112-12.75 (L: 112-07.75 / H: 112-16.25)

- Sep 10Y up 5/32 at 118-25.5 (L: 118-18.5 / H: 118-31)

- Sep 30Y up 1/32 at 138-20 (L: 138-04 / H: 139-11)

- Sep Ultra 30Y down 5/32 at 155-3 (L: 154-04 / H: 156-05)

US 10Y FUTURES TECH: (U2) Trading At This Week’s Lows

- RES 4: 122-00 Round number resistance

- RES 3: 121-27+ High Apr 5

- RES 2: 120-27+ High Apr 7

- RES 1: 120-11+/19+ 50-day EMA / High May 26 and bull trigger

- PRICE: 118-24+ @ 11:28 BST Jun 2

- SUP 1: 118-16+ Low May 23

- SUP 2: 118-01+ Low May 18 and a key short-term support

- SUP 3: 117-18 Low May 11

- SUP 4: 116-21 Low May 9 and a bear trigger

Treasuries are trading at this week's lows having faded off recent highs. Resistance at the 50-day EMA, at 120-11+ today, remains intact. A clear breach of this EMA is required to pave the way for a stronger recovery towards the 122-00 handle. Recent gains are considered corrective and the primary trend direction remains down. Key support and the bear trigger is 116-21, May 9 low. Initial firm support to watch is 118-01+, May 18 low

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.00 at 98.2375

- Sep 22 -0.010 at 97.355

- Dec 22 -0.020 at 96.795

- Mar 23 -0.015 at 96.610

- Red Pack (Jun 23-Mar 24) -0.005 to +0.020

- Green Pack (Jun 24-Mar 25) +0.020 to +0.025

- Blue Pack (Jun 25-Mar 26) +0.025 to +0.025

- Gold Pack (Jun 26-Mar 27) +0.030 to +0.035

SHORT TERM RATES

US DOLLAR LIBOR: No LIBOR settles today and tomorrow w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325.

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $255B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.80%, $994B

- Broad General Collateral Rate (BGCR): 0.80%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $355B

- (rate, volume levels reflect prior session)

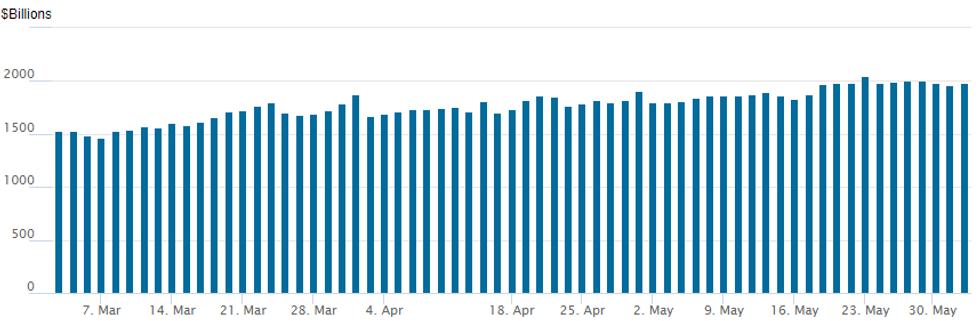

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to 1,985.239B w/ 97 counterparties vs. 1,965.015B prior session, compares to Monday's record high $2,044.658B.

PIPELINE: $750M Norfolk Southern Launched; Updated Guidance

- Date $MM Issuer (Priced *, Launch #)

- 06/02 $1B *Province of Saskatchewan 5Y SOFR+55

- 06/02 $750M #Norfolk Southern 31Y +145

- 06/02 $750M #Jackson Financial 5Y +225, 10Y +275

- 06/02 $750M #Penske Trucking 5Y +155

- 06/02 $Benchmark National Bank of Canada 3NC2 +115a, 3MN2 SOFR

USDCAD Beyond A Hawkish BoC

- At sub-1.26, USDCAD has now slipped -3.7% from the May 12 high of 1.3077 from a combination of a rolling over in USD strength and strong CAD factors including surprisingly strong inflation.

- The latest slide in the pair following recent BOC hawkishness (latest being Dep Gov Beaudry on increasing chance of rates north of 3%) and USD weakness sees the pair sitting just above support at 1.2562 (61.8% retrace of the Apr 5 – May 12 bull run).

- As noted in the MNI BoC Review, there is a wide range in some analyst expectations for the pair: TD view CAD as the most overbought on their dashboard and sees a high frequency fair value of 1.27-1.28 whilst ING sees a supportive CAD backdrop supporting both in the short-term by offsetting USD appreciation and longer-term with USDCAD eyed at 1.22 year-end.

- Some of this uncertainty comes from a real effective exchange rate sitting very close to long-run averages (offering little bias) and CFTC net spec positioning has shifted to a net short position but isn’t particularly large historically which could move either way.

- In addition, the pair remains heavily led by risk sentiment, with greater risk-off flows easily having potential to unwind recent moves.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/06/2022 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 03/06/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/06/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 03/06/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/06/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/06/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/06/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/06/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 03/06/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/06/2022 | 1230/0830 | *** |  | US | Employment Report |

| 03/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/06/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/06/2022 | 1430/1030 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.