-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: German Firms Expanding R&D In China

MNI: PBOC Sets Yuan Parity Lower At 7.1027 Mon; +2.85% Y/Y

MNI ASIA OPEN: 5Y, 10Y, 30Y Yields Over 3%

EXECUTIVE SUMMARY

MNI BRIEF: Conservative Lawmakers Ready For PM Confidence Vote

MNI INTERVIEW: BOC Heading To Restrictive Policy-Ex Researcher

UK

UK: Conservative MPs will vote later Monday on the leadership of current party leader and Prime Minister Boris Johnson. The vote will start at 1800BST, having been triggered by at least 15% of the Conservative's sitting Members of Parliament having sent a letter of no confidence in the the PM.

- The threshold was hit over the weekend, with at least 54 letters being posted. The confidence vote will be in secret but, as of 1500BST, betting firms make Johnson a favorite to win the vote.

- In a straw poll of Conservative Party members, not a constituency for the confidence vote, 53% said they wanted Johnson to remain as Prime Minister, with 42% looking for an ouster.

CANADA

BOC: The Bank of Canada is clearly taking monetary policy into restrictive territory to bring inflation back to target, a top outside research adviser told MNI, while also arguing it's unfair to attack policymakers for a slow pivot away from stimulus that was vital when Covid struck.

- “This is going to involve some restrictive monetary policy,” said Francisco Ruge-Murcia, who in 2017 won a five-year Fellowship award from the Bank and teaches at McGill University. “The Bank has been very clear in signaling that.”

- Investors are less sure where rates are going. Markets see the Bank making a third straight 50bp hike to 2% at its July 13 meeting, with some chance it will raise by 75bps, and there's much less conviction of what happens afterwards. For more see MNI Policy main wire at 1223ET.

US TSYS: UK PM Hat in Hand; Musk Twitter Tiff

Tsy/Eurodollar futures continue to extend session lows after the close, overall volumes still rather light (TYU2<945k) despite yields grinding to the highest levels since early May (all over 3%: 5YY 3.0368%, 10YY 3.0380%, 30YY 3.1908%). Yield curves bear steepen: 2s10s north of 30.0 again at 30.387 high (+2.921). Tsy 30YY at 3.1798 high (+.0936).

- No data to start the week (no Fed-speak either w/ Fed in Blackout through June 16). Markets pre-occupied with Elon Musk threat to pull out of Twitter bid due to lack of spam/bot documentation, and UK PM Boris Johnson confidence vote in late trade. Main focus on public Jan 6 insurrection hearing that start June 9.

- Limited data Tue: Trade Balance (-$89.4B est) and Wholesale Inventories MoM (2.1% est).

- CPI for May on Friday (0.7% est vs. 0.3% prior). Credit Suisse see core CPI slowing slightly to +0.4% M/M in May (cons. 0.5%) after the reacceleration to 0.6% in April, which should lead to a continued decline in the year-ago rate from 6.2% to 5.8% Y/Y. Risks could be skewed to the upside from goods inflation as we haven't seen the pass-through from supply chain disruptions from China lockdowns.

OVERNIGHT DATA

No economic data released Monday.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 35.29 points (-0.11%) at 32860.02

- S&P E-Mini Future up 7.5 points (0.18%) at 4113.5

- Nasdaq up 20.8 points (0.2%) at 12031.73

- US 10-Yr yield is up 10.5 bps at 3.038%

- US Sep 10Y are down 20.5/32 at 117-29

- EURUSD down 0.0027 (-0.25%) at 1.0692

- USDJPY up 1 (0.76%) at 131.88

- WTI Crude Oil (front-month) down $0.55 (-0.46%) at $118.34

- Gold is down $9.34 (-0.5%) at $1841.77

- EuroStoxx 50 up 54.76 points (1.45%) at 3838.42

- FTSE 100 up 75.27 points (1%) at 7608.22

- German DAX up 193.72 points (1.34%) at 14653.81

- French CAC 40 up 63.48 points (0.98%) at 6548.78

US TSY FUTURES CLOSE

- 3M10Y +10.74, 182.552 (L: 172.565 / H: 183.272)

- 2Y10Y +2.902, 30.368 (L: 25.771 / H: 31.614)

- 2Y30Y +2.543, 45.308 (L: 40.797 / H: 47.248)

- 5Y30Y +0.153, 15.064 (L: 14.121 / H: 17.877)

- Current futures levels:

- Sep 2Y down 4.25/32 at 105-6.25 (L: 105-05.875 / H: 105-11.5)

- Sep 5Y down 12.75/32 at 111-27.75 (L: 111-27 / H: 112-11.5)

- Sep 10Y down 20/32 at 117-29.5 (L: 117-28 / H: 118-23.5)

- Sep 30Y down 1-16/32 at 136-20 (L: 136-19 / H: 138-15)

- Sep Ultra 30Y down 2-01/32 at 152-7 (L: 152-03 / H: 154-31)

(U2) Remains Below The 50-Day EMA

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 120-07+/19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 118-16+ @ 11:20 BST Jun 6

- SUP 1: 118-01+ Low May 18 and a key short-term support

- SUP 2: 117-18 Low May 11

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

Treasuries are trading at recent lows and remain below the 50-day EMA - at 120-07+. This average represents a key resistance and a clear break would pave the way for a stronger recovery towards 122-00. The recent move away from the 50-day EMA however suggests that the recent corrective cycle that started May 9, is over. An extension lower would open key support and a bear trigger at 116-21, May 9 low. Initial firm support is 118-01+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.008 at 98.230

- Sep 22 -0.015 at 97.335

- Dec 22 -0.035 at 96.740

- Mar 23 -0.045 at 96.525

- Red Pack (Jun 23-Mar 24) -0.11 to -0.07

- Green Pack (Jun 24-Mar 25) -0.12 to -0.115

- Blue Pack (Jun 25-Mar 26) -0.115 to -0.11

- Gold Pack (Jun 26-Mar 27) -0.11 to -0.105

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00229 to 0.82143% (-0.00643 total last wk)

- 1M +0.04000 to 1.15971% (+0.05800 total last wk)

- 3M +0.03900 to 1.66500% (+0.02814 total last wk) * / **

- 6M +0.07871 to 2.18800% (+0.02315 total last wk)

- 12M +0.07686 to 2.85229% (+0.07972 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.62600% on 6/1/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $954B

- Broad General Collateral Rate (BGCR): 0.79%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $354B

- (rate, volume levels reflect prior session)

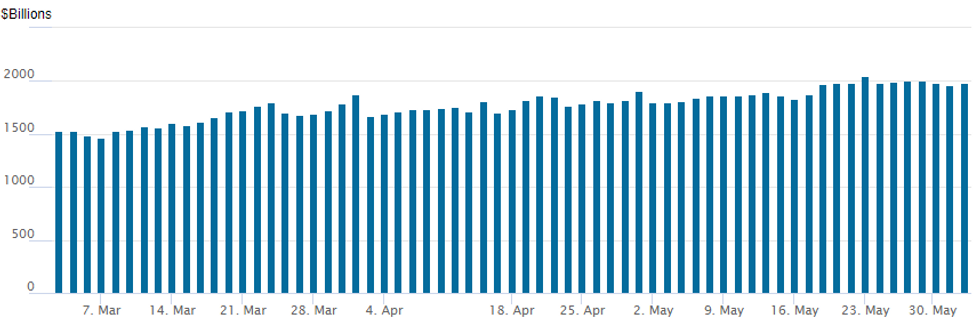

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 2,040.093B w/ 98 counterparties vs. 2,031.228B prior session, shy of Monday, May 23 record high $2,044.658B.

$12.15B High-Grade Corporate Debt To Price Monday

Flurry of high-grade debt launched in the second half, just over $12B:

- Date $MM Issuer (Priced *, Launch #)

- 06/06 $3.6B #Parker-Hannifin $1.4B 2Y +95, $1.2B 5Y +125, $1B 7Y +145

- 06/06 $2B #Hewlett Packard $900M +5Y +175, $1.1B +10Y +250

- 06/06 $1.5B #PG&E $450M 3Y +205, $450M 5Y +245, $600M 10Y +290

- 06/06 $1.25B #GM Financial, 5Y +200, 5Y SOFR dropped

- 06/06 $850M #O'Reilly Automotive 10Y +170

- 06/06 $750M #Ally Financial 5Y +195, upsized from $500M

- 06/06 $700M #Goldman Sachs WNG 5NC4 +135

- 06/06 $500M Tokyo Metro Govt WNG 3Y SOFR+57

- 06/06 $500M #Santander Holdings, 3NC2 +153

- 06/06 $500M #PACCAR Financial 2Y +43

- 06/06 $Benchmark Kommunivest +2Y investor calls

- 06/06 $Benchmark ASB Bank 10NC5 investor calls

EGBs-GILTS CASH CLOSE: Gilts Underperform As PM's Future Hangs In Balance

Gilts underperformed as both UK and German yields hit multi-year highs Monday.

- UK focus was on a confidence vote in PM Johnson (results set for 2100BST), with EGB traders eyeing this week's ECB meeting. The German curve bear steepened, with the UK a little flatter in the return from a 4-day weekend. 10Y yields hit post-2014 highs in both cases.

- Italy 10Y spreads narrowed by over 9bp shortly after the open as markets digested multiple reports that the ECB was eyeing anti-fragmentation tool plans.

- Greece went in the opposite direction, with spreads widening as much as 18bp with little apparent explanation, though some desks pointing to both a retracement of last week's rally, as well as low liquidity.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.1bps at 0.693%, 5-Yr is up 3.5bps at 1.05%, 10-Yr is up 4.9bps at 1.322%, and 30-Yr is up 5.3bps at 1.575%.

- UK: The 2-Yr yield is up 9.5bps at 1.78%, 5-Yr is up 10.2bps at 1.869%, 10-Yr is up 9.2bps at 2.247%, and 30-Yr is up 6.5bps at 2.481%.

- Italian BTP spread down 3.7bps at 209.4bps / Greek up 11bps at 256bps

FOREX: USDJPY Firms To Fresh 20-Year Highs Above 131.50

- Initial greenback strength on Monday saw the USD index trade within close proximity of key support at the 50-dma, which today sits at 101.71. However, a grinding recovery throughout late European hours then led to the index surging to session highs, looking likely to post a 0.25% daily gain as we approach the APAC crossover.

- The key victims of the US dollar advance were CHF (-0.80%) and JPY (-0.67%), while GBP (+0.41%) bucked the trend, holding on to the majority of gains made earlier in the session.

- USDJPY extended on recent strength, rallying firmly into the London close and taking out the bull trigger at 131.35 - the May 9 high. The pair has now made fresh highs of 131.78 as of writing - the highest rate since 2002. Today's break higher confirms a resumption of the primary uptrend, narrowing the gap with initial resistance at 131.96, a Fibonacci projection. Support remains at 128.63, the 20-day EMA.

- GBP had been the focal point for G10 FX markets to start the week, with PM Boris Johnson facing a no confidence vote. Johnson is expected to win the vote, which requires 180 of his lawmakers voting against him to be upheld. This would make the PM immune from further no confidence votes for the next 12 months - potentially removing an element of political uncertainty and explaining the supportive GBP price action ahead of the vote.

- Lastly, commodity-tied currencies are trading well, putting CAD and NOK near the top of the G10 pile amid the Bloomberg commodity index rising 1.94% from Friday’s close, led by higher NatGas prices.

- Tuesday’s APAC session will be headlined by the June RBA meeting. The RBA is set to hike the cash rate target for the second consecutive month, however, the key question is whether or not this move will come in a 25bp or 40bp step. Sell-side forecasts remain close, with 10 of the 24 surveyed by Bloomberg looking for a 25bp hike and 11 looking for a 40bp move. The remaining 3 look for a bolder 50bp adjustment.

- Thursday’s ECB meeting remains in focus this week before Friday’s release of US CPI.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.