-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on Friday CPI

EXECUTIVE SUMMARY

- MNI BRIEF: Senate Committee Supports Fed Nominee Barr

- MNI: Canada Should End Stimulus Symmetrically- Ex Cabinet Czar

- TSY SEC YELLEN: I SEE NO WAY IN WHICH INFLATION IS A DECADE-LONG MATTER, Bbg

- UAE OIL MINISTER SAYS CRUDE PRICES `NOWHERE' NEAR PEAK YET, Bbg

US

FED: Fed Vice Chair for Supervision nominee Michael Barr garnered bipartisan support and enough votes Wednesday in the Senate Banking Committee to advance his nomination.

- With a Senate Banking Committee vote of 17 to 7, Barr's nomination will move forward to full Senate consideration. Senators Wednesday did not give any indication as to when Barr would receive that final confirmation vote.

- Barr appears likely to join the Fed as it debates how far to raise interest rates to combat inflation that is at a four decade high.

CANADA

BOC: Canada's fiscal and monetary policy should be tightened as fast as rate cuts and extra deficit spending were introduced when Covid hit to give the public a clear message inflation will remain under control, a former top federal cabinet adviser told MNI.

- The Bank of Canada and Prime Minister Justin Trudeau's government have been too slow pulling back stimulus after several quarters of evidence the economy was returning to normal and pushing full employment, said Kevin Lynch, whose public service career included leading the branch of government that organized cabinet meetings, deputy minister of finance and industry departments and Canada's top official at the IMF. For more see MNI Policy main wire at 1427ET.

UK

BOE: Estimates of monetary policy multipliers suggest that the Bank of England might need to raise interest rates by much less than markets expect to bring inflation back to target, though the extent of eventual tightening will depend on whether the current spike in energy and food prices flattens out without driving second-round effects as BOE officials assume.

- The BOE does not publish its view of the multiplier effect of monetary tightening on inflation, but the National Institute of Economic and Social Research has made similar calculations. Using the central bank’s assumption that inflation will head back towards 3% even if rates are left unchanged, NIESR estimates indicate that the tightening necessary to return to the 2% target would be around half the 150 basis points factored in by the market.

- Interest rates may only have to increase by about 80 basis points from the current 1% to achieve the BOE’s aims, according to a simulation on the NIESR model run by NIESR Deputy Director Stephen Millard, formerly a senior research manager at the Bank. For more see MNI Policy main wire at 1120ET.

US TSYS: Rates Back on the Downswing

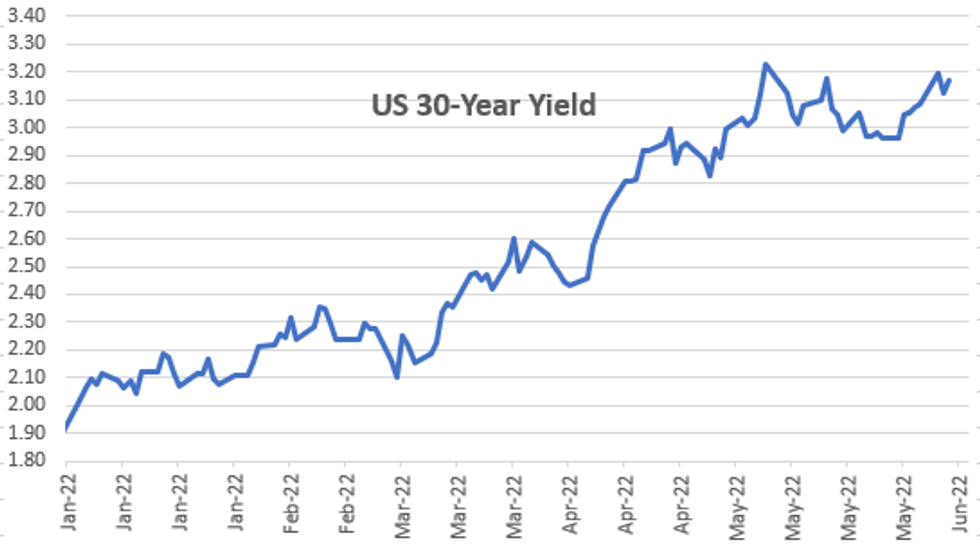

Rates swung back to weaker levels Wednesday, near late session lows to around mid-range for the week, curves rebound from prior session flattening (2s10s +1.191 at 25.288; 5s10s +.534 at -.823. Current 10YY back over 3% at 3.0289% +.0553; 30YY at 3.1782 +.0537.

- It appears as if markets are trying to anticipate "either runaway inflation (stagflation) or a train wreck of a recession, with nothing in between," one desk quipped. "That puts 10yr forecasts in a range of 4+% and 2%," they jokingly estimated.

- Focus on Friday's May CPI (0.7% est vs. 0.3% prior), while futures traded lower (still off early session lows) after $33B 10Y note auction (91282CEP2) reopen tails yet again: 3.030% high yield vs. 3.017% WI; 2.41x bid-to-cover off last month's 2.49x.

- No react to Tsy Sec Yellen testimony again: "I SEE NO WAY IN WHICH INFLATION IS A DECADE-LONG MATTER" Bbg.

- SEC head Gary Gensler targeting payment for order flow as he speaks remotely for Piper Sandler conference: "Outlines Other Possible Changes to Stock-Market Rules" WSJ.

OVERNIGHT DATA

- April Wholesale Inventories +2.2% vs. +2.1 est

- April Wholesale Trade Sales +0.7% vs. +1.7% in May

- US MBA: MARKET COMPOSITE -6.5% SA THRU JUN 03 WK

- US MBA: REFIS -6% SA; PURCH INDEX -7% SA THRU JUNE 3 WK

- US MBA: UNADJ PURCHASE INDEX -21% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.40% VS 5.33% PREV

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 285.42 points (-0.86%) at 32891.62

- S&P E-Mini Future down 42.5 points (-1.02%) at 4115

- Nasdaq down 90.7 points (-0.7%) at 12083.71

- US 10-Yr yield is up 4.8 bps at 3.0215%

- US Sep 10Y are down 10/32 at 118-3.5

- EURUSD up 0.0013 (0.12%) at 1.0716

- USDJPY up 1.55 (1.17%) at 134.14

- WTI Crude Oil (front-month) up $2.94 (2.46%) at $122.35

- Gold is up $0.97 (0.05%) at $1853.35

- EuroStoxx 50 down 17.81 points (-0.47%) at 3788.93

- FTSE 100 down 5.93 points (-0.08%) at 7593

- German DAX down 110.63 points (-0.76%) at 14445.99

- French CAC 40 down 51.72 points (-0.8%) at 6448.63

US TSY FUTURES CLOSE

- 3M10Y +3.774, 175.01 (L: 170.511 / H: 177.508)

- 2Y10Y +1.274, 25.371 (L: 23.1 / H: 26.93)

- 2Y30Y +1.35, 40.447 (L: 37.868 / H: 41.993)

- 5Y30Y +0.722, 14.365 (L: 12.613 / H: 15.811)

- Current futures levels:

- Sep 2Y down 2.375/32 at 105-3.625 (L: 105-03.25 / H: 105-06.5)

- Sep 5Y down 5.75/32 at 111-30 (L: 111-26 / H: 112-04)

- Sep 10Y down 10/32 at 118-3.5 (L: 117-29 / H: 118-13)

- Sep 30Y down 30/32 at 137-0 (L: 136-24 / H: 137-25)

- Sep Ultra 30Y down 1-10/32 at 152-30 (L: 152-16 / H: 154-05)

US 10Y FUTURES TECH: : (U2) Bearish Outlook

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 120-02+/19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 118-06 @ 15:37 BST Jun 8

- SUP 1: 117-22+ Low Jun 7

- SUP 2: 117-18 Low May 11 07

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

The near-term outlook in Treasuries remains bearish following recent weakness. Futures continue to trade below the 50-day EMA - at 120-02+. The EMA represents a key resistance and a clear break is required to allow for a stronger recovery towards 122-00. The recent move away from the average however suggests the correction since May 9, is over. An extension lower would open key support and a bear trigger at 116-21, May 9 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.005 at 98.233

- Sep 22 -0.025 at 97.325

- Dec 22 -0.035 at 96.725

- Mar 23 -0.040 at 96.505

- Red Pack (Jun 23-Mar 24) -0.04 to -0.03

- Green Pack (Jun 24-Mar 25) -0.035 to -0.03

- Blue Pack (Jun 25-Mar 26) -0.04 to -0.035

- Gold Pack (Jun 26-Mar 27) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00700 to 0.81957% (+0.00043/wk)

- 1M +0.00942 to 1.19971% (+0.08000/wk)

- 3M -0.00272 to 1.68771% (+0.06171/wk) * / **

- 6M +0.02800 to 2.26643% (+0.15714/wk)

- 12M +0.02257 to 2.91214% (+0.13671/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.69043% on 6/7/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.77%, $947B

- Broad General Collateral Rate (BGCR): 0.78%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $349B

- (rate, volume levels reflect prior session)

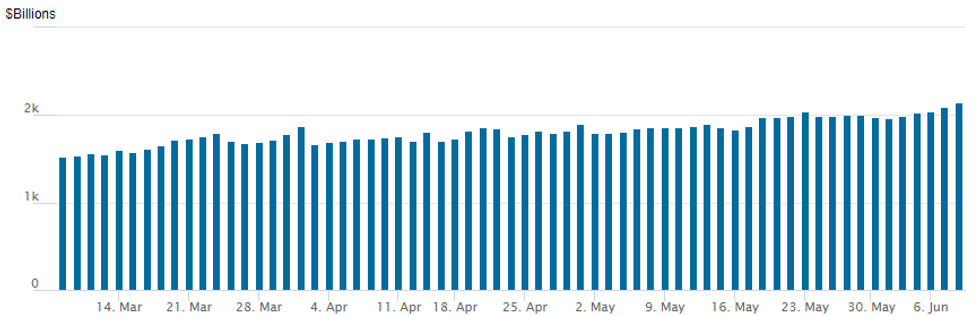

FED Reverse Repo Operation, Second Consecutive Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of 2,140.277B w/ 98 counterparties vs. Tuesday session record high of 2,091.395B, prior record of $2,044.658B from Monday, May 23.

PIPELINE: SocGen Launched, Waiting on Hungary, AAIB

- Date $MM Issuer (Priced *, Launch #)

- 06/08 $3.5B #Enel Finance $750M 3Y +145, $750M 5Y +165, $1B 10Y +215, $1B 30Y +240

- 06/08 $3B Hungary $1.75B 7Y +240, $1.25B 12Y +280

- 06/08 $2.65B #SocGen $600M 3Y +140, $800M 5Y +165, $1.25B 11NC10 +320

- 06/08 $1.95B #Bank of NY Mellon $700M 3NC2 +65, $500M 6NC5 +95, $750M 11NC10 +125

- 06/08 $1.5B *CPPIB Capital 5Y SOFR+52

- 06/08 $1B #Council of Europe Development Bank (CoE) 3Y SOFR+21

- 06/08 $750M *Bangkok Bank 5Y +130

- 06/08 $650M #Jordan +5Y 7.95%

- 06/08 $600M #ASB Bank 10NC5 +225

- 06/08 $500M Synchrony Financial 3Y +195a

- 06/08 $Benchmark Asian Infrastructure Inv Bank (AAIB) 3Y investor calls

EGBs-GILTS CASH CLOSE: Rate Hike Pricing Hits Cycle High Pre-ECB

The ongoing rise in European yields resumed Wednesday after a day's pause. The German curve bear steepened while the UK belly underperformed, with Thursday's ECB meeting coming into focus.

- 2Y yields reached the highest in over a decade, with 5Y highest since 2013. 10Y hit a fresh post-2014 high.

- Despite a slow session in terms of news and data, hawkish central bank speculation continued. End-2022 hike pricing hit a fresh cycle high (ECB 134bp of tightening priced, UK 155bp).

- Pre-ECB peripheral EGB volatility continued; Greek 10Y spreads rose by over 9bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.2bps at 0.701%, 5-Yr is up 4.8bps at 1.077%, 10-Yr is up 6.1bps at 1.354%, and 30-Yr is up 6.6bps at 1.592%.

- UK: The 2-Yr yield is up 3.3bps at 1.78%, 5-Yr is up 3.7bps at 1.881%, 10-Yr is up 3.2bps at 2.246%, and 30-Yr is up 3.3bps at 2.458%.

- Italian BTP spread up 1.9bps at 202.1bps / Greek up 9.6bps at 261.9bps

FOREX: Yen Weakness Sees EURJPY Surge To 7-Year High Ahead of ECB

- The latest leg lower for JPY comes as the BoJ governor acknowledged some of the outcry around the weaker currency, but pledged that the BoJ will firmly support the economy with the current monetary easing strategy. He also added that "stable" JPY weakness is a positive for the Japanese economy.

- EUR/JPY was the notable climber today amid the broad JPY downtrend. The cross traded on four different big figures today, extending its winning sequence to ten trading days and eventually peaking at Y144.25, levels last seen in January 2015.

- Nearest resistance stands at 144.58 which is the 0.764 projection of the Mar 7 - 28 - Apr 5 price swing. Further out, the 2014 highs, closer to the 150.00 mark appear a potential target for the move.

- USDJPY (+1.17%) continues to climb following pair resuming its primary uptrend, after the break of 131.35, May 9 high. The focus today was on 134.48, a Fibonacci projection which has held at the first time of asking. Despite a sharp pullback to 133.61, the pair has resumed its supportive price action and looks set to close above the 134.00 mark.

- Weaker equities and higher US yields lent support to the greenback which saw the USD index advance a quarter of a percent. In similar vein, the likes of GBP, AUD, NZD and CAD all came under pressure, retreating around 0.5%.

- EURUSD sits marginally in the green ahead of tomorrow’s ECB meeting/statement. The ECB is now clear that the APP will end in early July, policy rate lift-off will occur in the same month and policy rates will reach zero by September. A 50bp hike in July is a low, but increasing, risk. However, the probability is rising of a one-off 50bp hike or a series of such hikes from September onward.

- US CPI data and Canadian Employment will be released on Friday.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 09/06/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.