-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Recessionary Policy?

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed May Need To Raise Rates To 5% -Lacker

- MNI INTERVIEW: Inflation Worries Threaten U.S. Expansion–UMich

- CDC TO LIFT TEST REQUIREMENT FOR TRAVELERS ENTERING US: CNN

- US TREASURY REFRAINS FROM DESIGNATING ANY CURRENCY MANIPULATORS, Bbg

2Y Yield

Bloomberg/MNI

US

FED: The Federal Reserve may have to push interest rates much higher than markets expect in order to contain an inflation problem that it allowed to get out of hand, former Richmond Fed President Jeffrey Lacker told MNI.

- Fighting inflation from behind means the Fed will need to do more than it would have otherwise to ensure policy is actually restrictive enough to tamp down demand.

- “My sense is they have to go to 5% before they can really think they’re at neutral,” said Lacker in an interview with MNI’s FedSpeak podcast. Even at the aggressive current pace of 50 bps per meeting, “they’re not going to hit that until the middle of next year.” For more see MNI Policy main wire at 0949ET.

US: U.S. consumer spending is likely to slow down substantially as surging inflation drives worries about things like personal finances to levels consistent with past recessions, University of Michigan survey chief Joanne Hsu told MNI.

- “The other times we’ve been in situations like this it’s been in the middle of a recession,” said Hsu, also a former economist at the Federal Reserve’s board of governors.

- The school's consumer sentiment index plunged more than 8 points to 50.2 in May, the weakest on record, even including the height of the pandemic or the depths of the 2008 financial crisis.

- “It is very likely that this will drive down spending going forward,” Hsu said. “It’s an open question how soon that shift will occur but in general when we see sentiment this low it’s during an economic contraction.” For more see MNI Policy main wire at 1726ET.

US TSYS: Hot CPI, 2Y Yld Over 3% First Time Since 2008

Rates extend lows after May CPI came out higher than est at 1.0% vs. 0.7% est, unrounded 0.974%, core 0.631%. Heavy short end selling on inflation surge has market expecting Fed to hike US into a recession.- Notably, 2Y yield surged to 3.0611% - the highest level since 2008, while curves bull flattened after some initial volatility in the long end: 2s10s at 9.858 (-12.786) vs. 9.421 low, 5s10s inverted, flattening -7.273 at -9.761 vs. -10.722 low, while 5s30s slipped to inverted low of -6.661.

- Reaction spurred several dealers to up their rate hikes estimates with Barclays now sees a 75bp Fed hike next week. They have also raised their forecast for the terminal rate by 25bp to 3.00-3.25% in early 2023, implying 150bp of hikes after June's meeting. That's the most aggressive June FOMC hiking call that we are aware of, but markets are pricing in a modest chance of such a surprise (15-20% probability per futures).

- GS upped they're hike forecast to 50bp in June, July and September (from 50bp in Jun/Jul and 25bp in Sep).

OVERNIGHT DATA

- US MAY CPI 1.0%, CORE 0.6%; CPI Y/Y 8.6%, CORE Y/Y 6.0%

- Headline CPI was boosted by energy and food prices. The energy index rose 3.9% from April as gasoline spiked 4.1%. The food index rose 1.2%, with food at home increasing 1.4%. The Core CPI was led by shelter costs, rising 0.6%, the most since March 2004, with owners' equivalent rent rising 0.6%. Airfares continued to rise by 12.6% in the month, slightly slower than in April. Used cars and trucks rebounded by 1.8% after falling in the previous three months.

- The report will likely stoke inflation concerns at the Federal Reserve. Former Fed Governor Randall Kroszner told MNI the central bank will likely raise interest rates by a half point in the next three meetings to tame prices.

- MICHIGAN CONSUMER EXPECTATIONS INDEX DROPS TO 46.8 FROM 55.2

- MICHIGAN 5-YR INFLATION EXPECTATIONS HIGHEST SINCE 2008

- CANADA: INDUSTRIAL CAPACITY USE RATE UNCHANGED AT 82.0% IN Q1

- CANADA: FACTORY CAPACITY UTILIZATION RATE 76.3%

- CANADA: MAY EMPLOYMENT +39.8K; JOBLESS RATE 5.1%

- CANADA: MAY FULL-TIME JOBS +135.4K; PART-TIME -95.8K

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 654.72 points (-2.03%) at 31607.89

- S&P E-Mini Future down 88.25 points (-2.2%) at 3925.75

- Nasdaq down 341.1 points (-2.9%) at 11405.04

- US 10-Yr yield is up 11.2 bps at 3.1536%

- US Sep 10Y are down 35.5/32 at 116-26

- EURUSD down 0.0093 (-0.88%) at 1.0523

- USDJPY up 0.01 (0.01%) at 134.37

- WTI Crude Oil (front-month) down $0.96 (-0.79%) at $120.53

- Gold is up $25.26 (1.37%) at $1873.63

- EuroStoxx 50 down 125.25 points (-3.36%) at 3599.2

- FTSE 100 down 158.69 points (-2.12%) at 7317.52

- German DAX down 436.97 points (-3.08%) at 13761.83

- French CAC 40 down 171.23 points (-2.69%) at 6187.23

US TSY FUTURES CLOSE

- 3M10Y +1.755, 178.55 (L: 167.638 / H: 184.438)

- 2Y10Y -12.765, 9.879 (L: 9.421 / H: 22.87)

- 2Y30Y -20.811, 13.947 (L: 13.57 / H: 34.874)

- 5Y30Y -15.518, -5.892 (L: -6.661 / H: 10.216)

- Current futures levels:

- Sep 2Y down 15.625/32 at 104-16.375 (L: 104-16.25 / H: 105-00.5)

- Sep 5Y down 29.5/32 at 110-26.75 (L: 110-26 / H: 111-26.25)

- Sep 10Y down 1-04/32 at 116-25.5 (L: 116-22.5 / H: 118-06)

- Sep 30Y down 1-11/32 at 135-22 (L: 135-05 / H: 138-09)

- Sep Ultra 30Y down 26/32 at 152-07 (L: 151-03 / H: 155-08)

US 10Y Futures Tech: (U2) Resolutely Bearish

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 119-29/120-19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 117-06+ @ 14:54 BST Jun 10

- SUP 1: 117-03 Low Jun 10

- SUP 2: 116-29 Low Apr 29 2010

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

Short-term conditions in Treasuries have deteriorated following the US CPI release, with prices plunging to new June lows and keeping the outlook resolutely negative. This keeps attention the May 9 low at 116-21, which holds as the bear trigger. Price remains well below the 50-day EMA at 119-29. This EMA still represents a key resistance and a clear break would allow for a stronger recovery towards 122-00.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.038 at 98.188

- Sep 22 -0.225 at 97.070

- Dec 22 -0.290 at 96.375

- Mar 23 -0.305 at 96.110

- Red Pack (Jun 23-Mar 24) -0.275 to -0.235

- Green Pack (Jun 24-Mar 25) -0.22 to -0.16

- Blue Pack (Jun 25-Mar 26) -0.145 to -0.10

- Gold Pack (Jun 26-Mar 27) -0.09 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00071 to 0.81929% (+0.00015/wk)

- 1M +0.02743 to 1.28214% (+0.16243/wk)

- 3M +0.02342 to 1.74471% (+0.11871/wk) * / **

- 6M +0.01728 to 2.31157% (+0.20228/wk)

- 12M +0.04686 to 3.00543% (+0.23000/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.72129% on 6/9/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $79B

- Daily Overnight Bank Funding Rate: 0.82% volume: $247B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.75%, $985B

- Broad General Collateral Rate (BGCR): 0.77%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.77%, $360B

- (rate, volume levels reflect prior session)

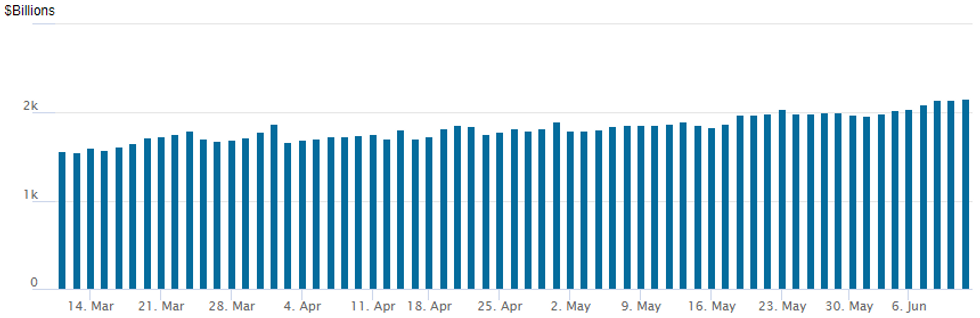

FED Reverse Repo Operation, New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of 2,162.885B w/ 99 counterparties vs. Thursday's prior record of 2,142.318B.

EGBs-GILTS CASH CLOSE: US CPI Crushes European Front End

European short-end bonds sold off sharply Friday afternoon, on a higher-than-expected US CPI reading that boosted near-term global rate hike expectations.

- The UK and German curves bear flattened: markets are now pricing in 160bp in ECB hikes the rest of the year (+11bp on the session) and 179bp from the BoE (+10bp).

- UK 2Y yields now have a 2-handle for the first time since 2008, while Schatz neared 1%.

- Periphery spreads continued to sell off post-ECB, 10 BTP reaching a fresh post-May 2018 wide.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 13.6bps at 0.971%, 5-Yr is up 13.4bps at 1.329%, 10-Yr is up 8.6bps at 1.516%, and 30-Yr is up 3.3bps at 1.659%.

- UK: The 2-Yr yield is up 19.1bps at 2.046%, 5-Yr is up 18.1bps at 2.144%, 10-Yr is up 12.4bps at 2.447%, and 30-Yr is up 7.9bps at 2.57%.

- Italian BTP spread up 7.4bps at 224.7bps / Greek up 18.8bps at 288.1bps

FOREX: US Dollar Is King Amid Surging Yields Post Above-Estimate CPI

- Following the above estimate US CPI data, the greenback has extended its weekly gains with the USD index looking set to post +2% gains since last Friday’s close.

- Two- and five-year US Treasury yields climbed to the highest since 2008 with swaps now pricing at least 50bps hikes for the next three Fed meetings and showing greater than 50% odds of a 75bps increase in July.

- EURUSD continued its downward trajectory following Thursday’s ECB meeting. The move lower also means channel resistance at 1.0733 remains intact. For bears, the extension lower has seen a breach of 1.0533, the May 20 low, opening up 1.0461 (previous lows) and 1.0350, low May 13 and bear trigger.

- The weakness across major equity benchmarks naturally weighed on the likes of AUD, NZD, CAD and CHF, however GBP was the main G10 victim of the price action on Friday.

- GBPUSD sold off close to 1.5% following a clean break of the key short-term support point at 1.2431, Tuesday’s low. The primary trend direction remains down and today’s resumption of bearish activity has breached initial support at 1.2317, the May 17 low. The key technical bear trigger resides at 1.2156, May 13 low.

- Similarly, global stagflationary concerns weighed substantially on the emerging market FX basket. In particular, the South African Rand dropped 2.25% and was closely followed by the majority of LatAm currencies. USDMXN rose back above the 50-day EMA at 19.9702, a technically bullish development.

- UK growth data headlines a quiet start to next week. Central banks remain in focus with the Fed, SNB and BOE all meeting next week.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 13/06/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/06/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 13/06/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/06/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/06/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2022 | 1100/1300 |  | EU | ECB de Guindos at Arab Central Banks & Monetary Authorities' Meeting | |

| 13/06/2022 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/06/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.