-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Reverse Strong Jobs Move

EXECUTIVE SUMMARY

- MNI INTERVIEW: High Bar For Fed To Back Off Big Hikes- Athreya

- MNI: Fed's George Downplays Need For Supersized Rate Hikes

US

FED: The Federal Reserve should raise interest rates aggressively until there are clear signs of a slowdown in inflation, and not only in inflation expectations, Richmond Fed Research Director Kartik Athreya told MNI.

- Fed officials have said getting U.S. inflation, now at 40-year highs, under control is their top priority, and Athreya said they should avoid sending conflicting policy signals. “Inflation expectations — TIPS breakevens — are heading in the right direction, but current inflation remains above where the committee would be at all comfortable,” he said in an interview.

- “Policy works when it is communicated and believed. For it to be believed there has to be routine follow through. And right now policy is not likely restrictive. All of this raises the bar for reaction to any given piece of incoming data.” For more, see MNI Policy main wire at 0955ET

FED: Kansas City Fed President Esther George Monday said the case for the Fed to continue to remove policy accommodation is clear but pushed back against supersized hikes, citing recession risks, unpredictable impacts from tightening financial conditions and market volatility.

- "With the policy rate still relatively low and a $9 trillion dollar balance sheet in the early stages of shrinking, the case for continuing to remove policy accommodation is clear-cut. The speed at which interest rates should rise, however, is an open question," she said. For more, see MNI Policy main wire at 1015ET

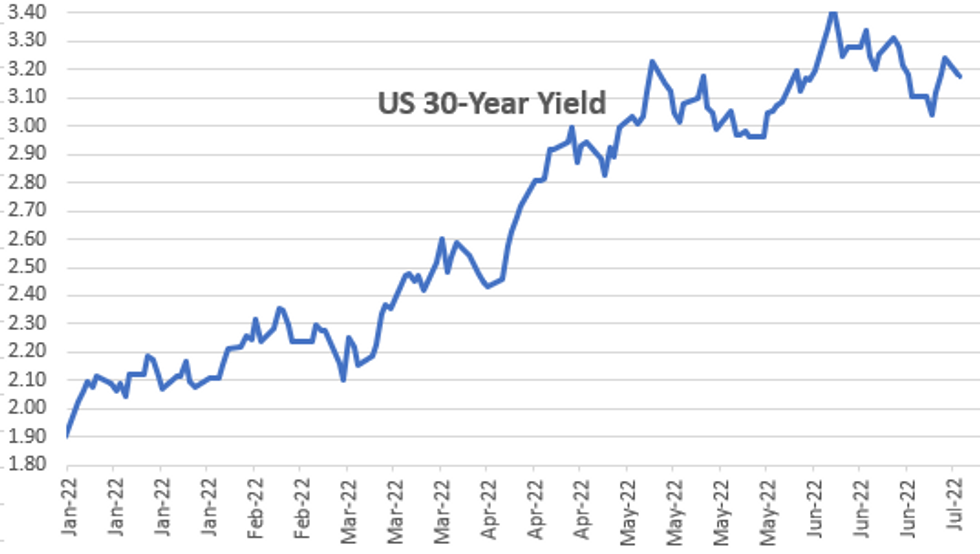

US TSYS: Rates Reverse Post Jobs Move, 30YY Slips Below 3.15%

Rates trade strong after the bell, futures more than make up for Fri's sell-off on stronger than exp June employ report (+372k vs. +268k est).- Strong moves on light summer volumes, however, many accts near the sidelines to await Wed's CPI data: MoM (1.0% prior, 1.1% est); YoY (8.6%, 8.8%).

- Treasury futures held near highs, little react after $43B 3Y note auction's (91282CEY3) modest stop through: 3.093% high yield vs. 3.095% WI; 2.43x bid-to-cover vs. 2.45x last month.

- Yield curves extended bull flattening for the most part: 5s30s +1.091 at the moment at 12.770, while 2s10s extends inversion to -8.229 (-5.171), 2s5s at -2.431 (-3.680).

- Short end trades strong, however, after KC Fed George pushed back against need for "supersized" rate hikes, citing recession risks, unpredictable impacts from tightening financial conditions and market volatility. Markets had briefly started pricing in small chance of 100bps hike after Fri's data.

- Cross asset: Crude and Gold prices remain weaker: WTI at 103.74 -1.05, Gold -8.60 at 1733.82; Equities near lows: SPX emini futures ESU2 -45.25 at 3856.0.

- Reminder: Earnings season kicks off this week, with financials and banks the early focus. Just over 5% of the S&P 500 by market cap are due to report, with the releases in focus including JP Morgan, Morgan Stanley, BNY Mellon, BlackRock, Citigroup, State Street, UnitedHealth and Wells Fargo.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 187.97 points (-0.6%) at 31150.35

- S&P E-Mini Future down 46.5 points (-1.19%) at 3854.25

- Nasdaq down 257.9 points (-2.2%) at 11377.8

- US 10-Yr yield is down 8.9 bps at 2.9909%

- US Sep 10Y are up 24/32 at 118-12

- EURUSD down 0.0131 (-1.29%) at 1.0054

- USDJPY up 1.25 (0.92%) at 137.35

- WTI Crude Oil (front-month) down $1 (-0.95%) at $103.80

- Gold is down $8.73 (-0.5%) at $1733.76

- EuroStoxx 50 down 34.86 points (-0.99%) at 3471.69

- FTSE 100 up 0.35 points (0%) at 7196.59

- German DAX down 182.79 points (-1.4%) at 12832.44

- French CAC 40 down 36.83 points (-0.61%) at 5996.3

US TSY FUTURES CLOSE

- 3M10Y -21.464, 92.27 (L: 90.249 / H: 116.648)

- 2Y10Y -4.821, -7.879 (L: -8.806 / H: -1.239)

- 2Y30Y -2.336, 10.726 (L: 9.411 / H: 16.667)

- 5Y30Y +1.005, 12.684 (L: 10.927 / H: 14.646)

- Current futures levels:

- Sep 2Y up 4.25/32 at 104-25.75 (L: 104-20.75 / H: 104-29)

- Sep 5Y up 13/32 at 112-2.25 (L: 111-19.25 / H: 112-08)

- Sep 10Y up 24/32 at 118-12 (L: 117-18.5 / H: 118-19)

- Sep 30Y up 1-27/32 at 138-22 (L: 136-24 / H: 138-29)

- Sep Ultra 30Y up 2-20/32 at 152-20 (L: 150-03 / H: 153-11)

US 10YR FUTURES TECHS: (U2) Watching Support

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-05/120-16+ High Jul 7 / High Jul 6 and the bull trigger

- PRICE: 118-16 @ 1545ET Jul 11

- SUP 1: 117-12 50.0% retracement of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries maintain a softer tone following last week’s pullback from 120-16+, the Jul 6 high. The latest retracement lower is still considered corrective, as long as price remains above support at 116-11, Jun 28 low. A break is required to strengthen a bearish threat and this would signal scope for a deeper retracement. On the upside, a reversal higher would refocus attention on the short-term bull trigger at 120-16+.

US EURODOLLAR FUTURES CLOSE

- Sep 22 steady at 96.675

- Dec 22 +0.060 at 96.205

- Mar 23 +0.115 at 96.30

- Jun 23 +0.125 at 96.480

- Red Pack (Sep 23-Jun 24) +0.080 to +0.115

- Green Pack (Sep 24-Jun 25) +0.085 to +0.110

- Blue Pack (Sep 25-Jun 26) +0.120 to +0.140

- Gold Pack (Sep 26-Jun 27) +0.145 to +0.150

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00329 to 1.56386% (-0.00672 total last wk)

- 1M +0.06472 to 1.96443% (+0.10214 total last wk)

- 3M +0.03214 to 2.45514% (+0.13014 total last wk) * / **

- 6M -0.02200 to 3.07043% (+.14914 total last wk)

- 12M +0.07714 to 3.72200% (+0.08057 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.45514% on 7/10/22

- Daily Effective Fed Funds Rate: 1.58% volume: $99B

- Daily Overnight Bank Funding Rate: 1.57% volume: $258B

- Secured Overnight Financing Rate (SOFR): 1.53%, $942B

- Broad General Collateral Rate (BGCR): 1.51%, $368B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $345B

- (rate, volume levels reflect prior session)

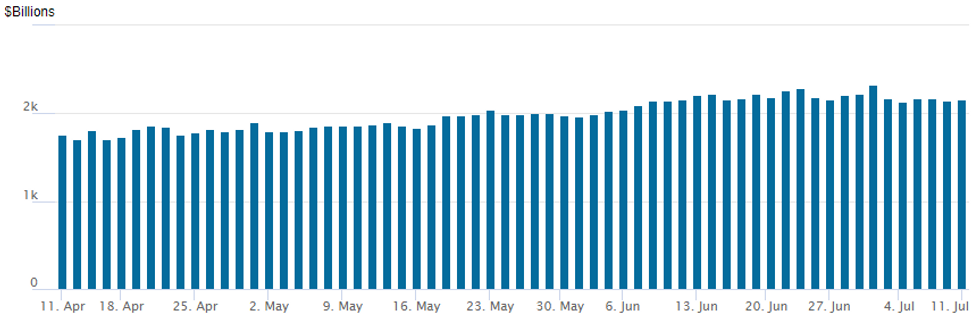

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,164.266B w/ 96 counterparties vs. $2,144.921B prior session. Record high stands at $2,329.743B from Thursday June 30.

PIPELINE: $4.5B MUFG 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/11 $4.5B #MUFG $1.4B 3NC2 +170, $350M 3NC2 SOFR+165, $1.25B 6NC5 +195, $1.5B 11NC10 +212.5

- 07/11 $1.75B #BPCE $750M 5Y +177, $1B 11NC10 +277

- 07/11 $500M #Bermuda 10Y +210

- Expected Tuesday:

- 07/12 $Benchmark World Bank5Y SOFR+42a

EGBs-GILTS CASH CLOSE: Recession Trade Resumes

Bund and Gilt yields fell to start the week, as the familiar themes of recession fears (and US dollar strength) were prevalent.

- Monday's strength was enough to largely reverse Friday's sell-off following the US jobs report, with concerns over global recession resuming (China Covid lockdowns and Russia-Eurozone gas dispute the proximate causes).

- Otherwise, it was a relatively quiet session for European fixed income despite the advance, with EUR/USD nearing parity taking the headlines, and little in the way of speakers or impactful data.

- Bobl outperformed on the German curve, with the UK belly also outperforming.

- Periphery EGB spreads tightened intraday but finished a little wider.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 8.5bps at 0.442%, 5-Yr is down 10.1bps at 0.865%, 10-Yr is down 9.9bps at 1.246%, and 30-Yr is down 7.2bps at 1.537%.

- UK: The 2-Yr yield is down 5bps at 1.88%, 5-Yr is down 5.6bps at 1.856%, 10-Yr is down 5.5bps at 2.178%, and 30-Yr is down 3.3bps at 2.602%.

- Italian BTP spread up 2.2bps at 196.6bps / Spanish up 1.7bps at 108.9bps

FOREX: Greenback Rally Extends, AUD Plummets To Fresh Two-Year Low

- A volatile start to the week for FX markets has been underpinned by continued US Dollar demand as a sense of risk-off permeates across global markets.

- The USD Index has advanced just shy of 1% from Friday’s close, rising to fresh multi-decade highs above the 108.00 mark.

- With risk under pressure once more, AUDUSD finds itself at the bottom of the G10 pile, having plummeted 1.6%. The notably strong sell-off today has resulted in a breach of support at 0.6762, the Jul 5 / 6 low and 0.6759, 50.0% of the Mar ‘20 - Feb ‘21 bull cycle. The break lower confirms a resumption of the technical downtrend and sets the scene for a move towards 0.6685, the Mar 9, 2020 high. On the upside, initial firm resistance is now seen at 0.6874, the 20-day EMA.

- Similarly, NZD and GBP are registering losses greater than 1%, along with the single currency, which now finds itself within striking distance of parity against the greenback as anxieties surrounding European gas supplies continue to mount.

- EURUSD printed a fresh cycle low of 1.0053 and overall trend conditions remain bearish. Weakness last week resulted in a break of 1.0350, May 13 low, to confirm a resumption of the primary downtrend. The move lower also highlights an acceleration of the bear cycle. The technical focus is on 1.0009, the base of a channel drawn from the Feb 10 high, just ahead of parity.

- Additionally, the Japanese Yen showed few signs of halting its steep downtrend as USDJPY surged above 137 to peak at 137.75, continuing to reach the highest levels seen since 1998.

- Another light day for economic data on Tuesday with German ZEW Economic Sentiment highlighting the European docket. Wednesday remains in focus with rate decisions from both the RBNZ and BOC but also US June inflation readings.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/07/2022 | 0800/0900 |  | UK | BOE Cunliffe on Crypto Markets | |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2022 | 0900/1000 |  | UK | BOE Bailey Speaks at OMFIF | |

| 12/07/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/07/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 12/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/07/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 12/07/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.