-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI ASIA OPEN: Soft-Landing Really Challenging

EXECUTIVE SUMMARY

- RICHMOND FED Barkin: Soft-Landing Really Challenging

- FED BARKIN: EXPECTS ANOTHER ELEVATED READING FROM JUNE CPI, Bbg

- MNI: Fed Patient On SOFR, Seen Boosting Reverse Repo- Ex-Staff

- MNI BRIEF: One Fed Bank Wanted June 75bp Discount Hike-Minutes

US

FED: The Federal Reserve should not overreact to recent weakness in some money market rates and will leave the rates it pays on bank reserves and reverse repos steady, but could increase its overnight reverse repo facility per counterparty limit as soon as this month, former central bank staff told MNI.

- The benchmark fed funds rate is rock steady at 8 bps, well within the target range of 1.5% to 1.75%, but there has been weakness in the secured overnight financing rate (SOFR) and other repo reference rates in recent weeks, driven by an underlying cash and collateral imbalance. Fed liquidity has increased USD2.5 trillion and Treasury and other money market issuers have slashed supply by almost USD1.5 trillion since mid-2020.

- Weakness has appeared in money market rates since the Fed started raising rates from zero. But the leaks of overnight rates printing below ON RRP grew during June and the the first percentile of SOFR transactions recently printed 75bp below the target band. For more see MNI Policy main wire at 1053ET.

- The directors of the Federal Reserve Banks of Boston, New York, Philadelphia, Chicago, St. Louis, San Francisco, Richmond, Cleveland, Atlanta, Kansas City, and Dallas voted before June 15 for a 50bp increase to establish a primary credit rate of 1.5%, according to minutes from meetings of the regional Bank boards.

- At the June 15 meeting, there was consensus for a 75-basis-point increase, and the board approved an increase in the primary credit rate from 1% to 1.75%, the minutes showed.

- EXPECTS ANOTHER ELEVATED READING FROM JUNE CPI, Bbg

- SIGNS ECONOMY SOFTENING, JUNE JOBS DATA A STRONG REPORT

- BUSINESSES GETTING MORE CONFIDENT THEY CAN FIND WORKERS

- BACKS RAISING RATES TO NEUTRAL 'EXPEDITIOUSLY AS WE CAN'

- LIKELY NEED TO RAISE RATES INTO RESTRICTIVE TERRITORY

US TSYS: Back Where We Started

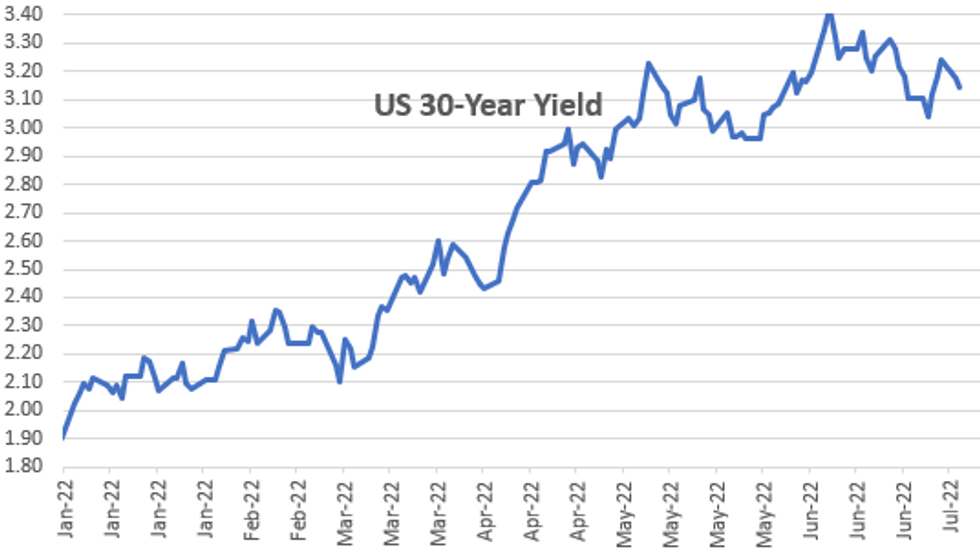

Tsys currently trading firmer, are well off first half highs after the bell. Rate support evaporated after the $33B 10Y note auction reopen tailed, the high yield of 2.960% vs. 2.937% WI -- actually matched the high yield for the $34B 1Y bill sale earlier in the session. Rates pared gains/extended session lows while yield curves finished flatter but well off lows as accts square up ahead Wed's CPI MoM (1.0%, 1.1%); YoY (8.6%, 8.8%).- Early rate bid: US rates took cues from German Bunds in early London trade, rallied on weak ZEW current Conditions -45.8. Tsy futures traded back to last week's pre-FOMC minutes levels: 30YY falling to 3.0833% in the first half.

- Large Block buys in 2s (37.5k) and 5s (15.1k) earlier. Pre-auction short sets ahead US Tsy $33B 10Y Note auction re-open (91282CEP2) at 1300ET.

- Earlier comments from Richmond Fed's Barkin ('24 voter) appears to see increased difficulty at managing a soft-landing in the economy when updating remarks from a Jun 21 speech called the Recession Question.

- Reminder: Earnings season kicks off this week, with financials and banks the early focus. Just over 5% of the S&P 500 by market cap are due to report, with the releases in focus including JP Morgan, Morgan Stanley, BNY Mellon, BlackRock, Citigroup, State Street, UnitedHealth and Wells Fargo.

OVERNIGHT DATA

- US REDBOOK: JUL STORE SALES +13.0% V YR AGO MO

- US REDBOOK: STORE SALES +13.0% WK ENDED JUL 09 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 192.51 points (-0.62%) at 30981.33

- S&P E-Mini Future down 36.25 points (-0.94%) at 3818.75

- Nasdaq down 107.9 points (-0.9%) at 11264.73

- US 10-Yr yield is down 3.2 bps at 2.9613%

- US Sep 10Y are up 9/32 at 118-21

- EURUSD down 0.0004 (-0.04%) at 1.0038

- USDJPY down 0.62 (-0.45%) at 136.82

- WTI Crude Oil (front-month) down $8.48 (-8.15%) at $95.64

- Gold is down $8.39 (-0.48%) at $1725.53

- EuroStoxx 50 up 15.36 points (0.44%) at 3487.05

- FTSE 100 up 13.27 points (0.18%) at 7209.86

- German DAX up 73.04 points (0.57%) at 12905.48

- French CAC 40 up 47.9 points (0.8%) at 6044.2

US TSY FUTURES CLOSE

- 3M10Y -16.61, 76.613 (L: 70.414 / H: 93.576)

- 2Y10Y +0.541, -7.978 (L: -12.408 / H: -6.803)

- 2Y30Y +0.639, 10.285 (L: 5.526 / H: 12.807)

- 5Y30Y +1.729, 13.31 (L: 9.99 / H: 15.722)

- Current futures levels:

- Sep 2Y up 2.125/32 at 104-27.75 (L: 104-25.25 / H: 104-31.75)

- Sep 5Y up 5.5/32 at 112-7.75 (L: 112-00 / H: 112-16.75)

- Sep 10Y up 9/32 at 118-21 (L: 118-09.5 / H: 119-03)

- Sep 30Y up 14/32 at 139-5 (L: 138-18 / H: 140-12)

- Sep Ultra 30Y up 28/32 at 153-16 (L: 152-15 / H: 155-06)

US 10YR FUTURES TECHS: (U2) Watching Support

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-05/120-16+ High Jul 7 / High Jul 6 and the bull trigger

- PRICE: 118-29+ @ 11:24 BST Jul 12

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries have found support at 117-18, Friday’s low and the contract is trading higher. The short-term trend condition remains bullish and recent weakness is considered corrective. Key short-term support is at 116-11, the Jun 28 low. A break is required to strengthen a bearish threat and this would signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.010 at 96.685

- Dec 22 +0.055 at 96.255

- Mar 23 +0.085 at 96.385

- Jun 23 +0.085 at 96.565

- Red Pack (Sep 23-Jun 24) +0.035 to +0.075

- Green Pack (Sep 24-Jun 25) +0.045 to +0.055

- Blue Pack (Sep 25-Jun 26) +0.045 to +0.050

- Gold Pack (Sep 26-Jun 27) +0.045 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00443 to 1.56829% (+0.00772/wk)

- 1M +0.00700 to 1.97143% (+0.07172/wk)

- 3M +0.02786 to 2.48300% (+0.06000/wk) * / **

- 6M -0.00600 to 3.06443% (+.01600/wk)

- 12M -0.03529 to 3.68671% (+0.04185/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.48300% on 7/12/22

- Daily Effective Fed Funds Rate: 1.58% volume: $93B

- Daily Overnight Bank Funding Rate: 1.57% volume: $269B

- Secured Overnight Financing Rate (SOFR): 1.53%, $930B

- Broad General Collateral Rate (BGCR): 1.51%, $359B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $353B

- (rate, volume levels reflect prior session)

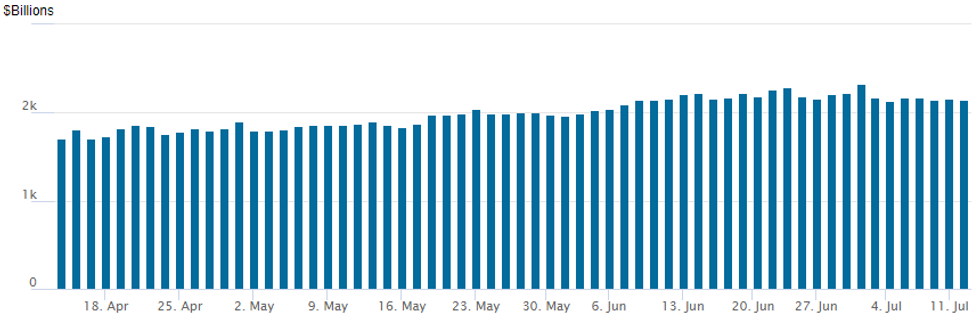

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,146.132B w/ 96 counterparties vs. $2,164.266B prior session. Record high stands at $2,329.743B from Thursday June 30.

PIPELINE: $1.3B Deutsche Bank 4NC3 Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/12 $4B *World Bank 5Y (IBRD) SOFR+40

- 07/12 $1.3B #Deutsche Bank 4NC3 +305

EGBs-GILTS CASH CLOSE: Recession Drumbeat Continues

Tuesday saw another strong rally across the UK and German curves as the euro touched parity with the US dollar.

- Most of the session's rally took place over the morning, punctuated by a miss in the German ZEW data, with falling commodity prices helping moderate inflation expectations as well.

- There was a bit of retracement higher in yields in the afternoon as traders began eyeing Wednesday's key US inflation report.

- In contrast to bull steepening moves in prior sessions, outperformance Tuesday was further along the curve (German Buxl yields fell 13+bp, UK 10Y down 10+).

- Periphery spreads widened but ended well off session's widest levels.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 8.7bps at 0.355%, 5-Yr is down 9.2bps at 0.773%, 10-Yr is down 11.4bps at 1.132%, and 30-Yr is down 13.1bps at 1.406%.

- UK: The 2-Yr yield is down 8.8bps at 1.792%, 5-Yr is down 10bps at 1.756%, 10-Yr is down 10.3bps at 2.075%, and 30-Yr is down 3.2bps at 2.57%.

- Italian BTP spread up 1.6bps at 198.2bps / Spanish up 0.6bps at 109.5bps

FOREX: EURUSD Parity Holds As Early Greenback Strength Reverses

- Having started the Tuesday session as the best performer, the dollar was knocked off its perch by fierce defence of parity in EUR/USD, which marked not just a key psychological level but also the base of the bear channel drawn off the February highs.

- Currency futures markets showed considerable spikes in activity that coincided with the EUR/USD approach to 1.00 - suggesting sizeable defence of the level and helped a recovery back above 1.0050 ahead of the London close.

- As a result, the USD became one of the weakest currencies of the session into the close, partially reversing the week's 1.00% rally in the USD Index.

- Meanwhile, an extension of the downleg in commodity prices worked against oil-tied FX, with NOK underperformance persisting and putting the currency at new multi-year lows against the USD. The NOK weakness posted since Monday continues to put the currency below the Norges Bank's projections outlined at the June policy meeting - adding more pressure to the board to tighten policy and contain any imported inflationary pressures.

- USD weakness was further reflected in the USD/JPY pullback to Y136.50, however the outlook remains bullish following the break of key resistance at 137.00 earlier in the week. This confirmed the resumption of the primary uptrend and highlights that corrections remain shallow, reinforcing underlying bullish conditions.

- Final German CPI data crosses Wednesday, as well as UK industrial and manufacturing production data and the US CPI reading for June. Markets expect core CPI Y/Y to decelerate to 5.7% from the 6.0% posted in May. The Bank of Canada also decide on rates, with analysts expecting a 75bps rate rise to 2.25%. The full MNI Preview can be found here: https://marketnews.com/mni-boc-preview-jul-22-eyei...

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/07/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2022 | 0900/1100 | ** |  | EU | industrial production |

| 13/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/07/2022 | - | *** |  | CN | Trade |

| 13/07/2022 | 1230/0830 | *** |  | US | CPI |

| 13/07/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/07/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/07/2022 | 1500/1100 |  | CA | BOC press conference | |

| 13/07/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2022 | 1800/1400 |  | US | Federal Reserve Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.