-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Strong 20Y Auction Re-Open

EXECUTIVE SUMMARY

- MNI BRIEF: EU: Putin No Pretext For Not Resuming NS1 Supplies

- MNI BRIEF: Italy Govt Nears Collapse As Draghi Support Ebbs

- EU APPROVES BAN ON RUSSIAN GOLD, OTHER SANCTIONS TWEAKS, Bbg

EUROPE

ITALY: Italian Prime Minister Mario Draghi's Unity coalition government looks set to collapse Wednesday, as major parties across the Italian political spectrum have declined, at a late hour, to back him in a crucial confidence vote.

- Forza Italia, the League and the 5Star Movement have all said they are not prepared to lend their confidence to the current government. The decision will almost certainly prompt Draghi's resignation, perhaps as soon as this evening, with signs that current a quorum can't be reached to hold a confidence vote in the Senate.

RUSSIA: Russia has no pretext for not resuming gas supplies to Germany via the Nordstream 1 pipeline in coming days, EU Commission President Ursula von der Leyen said Wednesday.

- The Commission chief said that maintenance on the NS1 turbine, the original Russian excuse for the shutdown, is now ‘in transit’ back from Siemens Canada where the work was bring done. Russia shutdown the pipeline on July 11 for 10 days of annual maintenance and is expected to reopen with limited supplies on Thursday.

US TSYS: Early Headline Driven Moves Evaporate

Rates mildly weaker for the most part after the close, 30Y Bonds outperforming after strong $14B 20Y bond auction (912810TH1) re-open traded through: 3.420% high yield vs. 3.447% WI; 2.65x bid-to-cover vs. last month's 2.60x.- Early risk-on bid spurred by Russia foreign affairs minister Lavrov headlines: "If the West delivers long-range weapons to Kyiv, geographical objectives in Ukraine will be advanced even further .. from just the Donetsk and Luhansk People's Republics to a number of other territories". Brief rally saw 30YY fall 3.1066% low just tapped 3.1856%.

- Markets gradually reversed course through the first half, however, as Russia's Nord Stream 1 pipeline drew attn for the second day. Russia has no pretext for not resuming gas supplies to Germany via the Nord Stream 1 pipeline in coming days, EU Commission President Ursula von der Leyen said Wed as maintenance on the NS1 turbine, the original Russian excuse for the shutdown, is now ‘in transit’ back from Siemens Canada where the work was bring done.

- Limited react to early sales of U.S. existing homes: down for a fifth straight month in June, declining 5.4% from May to a 5.12M seasonally adjusted annual rate and below market expectations of 5.4M.

- Thursday focus: weekly claims (240k est), Continuing Claims (1.340M est) and Philadelphia Fed Business Outlook (0.8) at 0830ET, Leading Index (-0.6%) at 1000ET.

OVERNIGHT DATA

- US JUNE EXISTING HOME SALES -5.4% MOM TO 5.12M SAAR; -14% YOY

- US NAR: MEDIAN HOME SALE PRICE HITS RECORD $416,000, +13% YOY

- NAR'S YUN: HOME PRICE GROWTH SLOWING BUT NO DECLINE THIS YEAR

- US MBA: MARKET COMPOSITE -6.3% SA THRU JUL 15 WK

- US MBA: REFIS -4% SA; PURCH INDEX -7% SA THRU JULY 15 WK

- US MBA: UNADJ PURCHASE INDEX -19% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.82% VS 5.74% PREV

- CANADA JUN INDUSTRIAL PRICES -1.1% MOM; EX-ENERGY -1.6%

- CANADA JUN RAW MATERIALS PRICES -0.1% MOM; EX-ENERGY -3.1%

- CANADA JUN CPI INFLATION +0.7% M/M, +8.1% YY

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 71.11 points (0.22%) at 31896.39

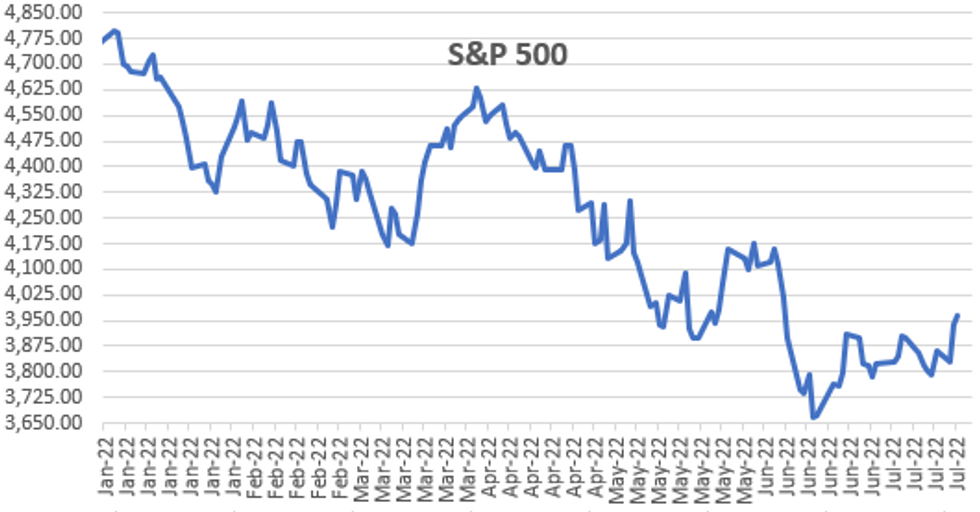

- S&P E-Mini Future up 31.25 points (0.79%) at 3968.5

- Nasdaq up 205.2 points (1.8%) at 11917.86

- US 10-Yr yield is up 1.3 bps at 3.034%

- US Sep 10Y are down 6.5/32 at 117-24.5

- EURUSD down 0.0048 (-0.47%) at 1.018

- USDJPY up 0.08 (0.06%) at 138.27

- WTI Crude Oil (front-month) down $1.96 (-1.88%) at $102.26

- Gold is down $11.37 (-0.66%) at $1700.33

- EuroStoxx 50 down 2.2 points (-0.06%) at 3585.24

- FTSE 100 down 31.97 points (-0.44%) at 7264.31

- German DAX down 26.43 points (-0.2%) at 13281.98

- French CAC 40 down 16.56 points (-0.27%) at 6184.66

US TSY FUTURES CLOSE

- 3M10Y +6.716, 55.758 (L: 42.547 / H: 56.388)

- 2Y10Y +0.439, -22.046 (L: -23.39 / H: -19.763)

- 2Y30Y -1.629, -8.749 (L: -9.046 / H: -2.806)

- 5Y30Y -3.156, -1.221 (L: -1.559 / H: 4.574)

- Current futures levels:

- Sep 2Y down 1/32 at 104-16.125 (L: 104-16 / H: 104-21.75)

- Sep 5Y down 3.75/32 at 111-14.75 (L: 111-14.5 / H: 111-31.25)

- Sep 10Y down 6.5/32 at 117-24.5 (L: 117-24 / H: 118-17.5)

- Sep 30Y steady at at 138-18 (L: 138-09 / H: 139-25)

- Sep Ultra 30Y up 5/32 at 152-28 (L: 152-10 / H: 154-19)

US 10YR FUTURES TECHS: (U2) Recovering Off Lows

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 118-09+ @ 12:12 BST Jul 20

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries slipped into the Tuesday close, but are rebounding ahead of the NY crossover, with the support at 117-18 intact for now. The short-term trend outlook remains bullish and the recent pullback is considered corrective. Key short-term support is at 116-11, Jun 28 low where a break would strengthen a bearish threat and signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break resumes the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.010 at 96.520

- Dec 22 -0.015 at 96.070

- Mar 23 -0.035 at 96.20

- Jun 23 -0.030 at 96.350

- Red Pack (Sep 23-Jun 24) -0.015 to -0.01

- Green Pack (Sep 24-Jun 25) -0.03 to -0.015

- Blue Pack (Sep 25-Jun 26) -0.055 to -0.04

- Gold Pack (Sep 26-Jun 27) -0.055 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00700 to 1.56914% (+0.00400/wk)

- 1M +0.05200 to 2.21357% (+0.09328/wk)

- 3M +0.02729 to 2.75900% (+0.02143/wk) * / **

- 6M +0.03500 to 3.33386% (+0.02257/wk)

- 12M +0.02343 to 3.89300% (-0.00343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.75900% on 7/20/22

- Daily Effective Fed Funds Rate: 1.58% volume: $90B

- Daily Overnight Bank Funding Rate: 1.57% volume: $274B

- Secured Overnight Financing Rate (SOFR): 1.54%, $933B

- Broad General Collateral Rate (BGCR): 1.51%, $372B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $360B

- (rate, volume levels reflect prior session)

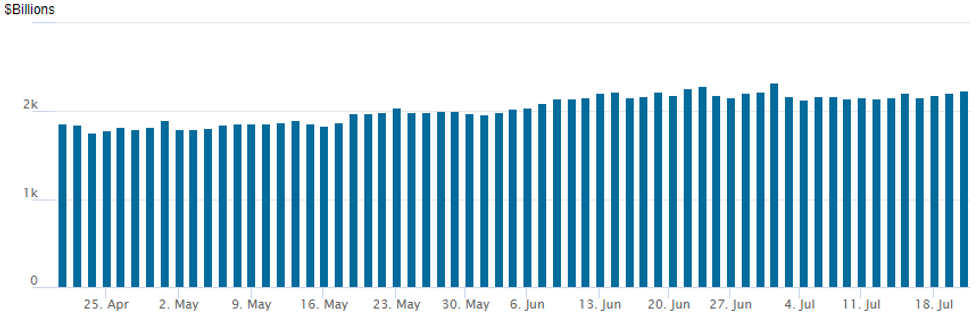

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,240.204B w/ 100 counterparties vs. $2,211.821B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $3.25B IBM 4Pt Launched

$9.05B total issuance on the day, $48.35B total on the week- Date $MM Issuer (Priced *, Launch #)

- 07/20 $3.25B #IBM $1B 3Y +75, $750M 5Y +100, $750M 10Y +145, $750M 30Y +180 (adds to $1.8B issued in early Feb w/ $650M 5Y +60, $500M 10Y +95, $650M 30Y +132)

- 07/20 $1.5B #NTT Finance $500M Each: 2Y +90, 3Y +100, 5Y +120

- 07/20 $1.25B #Lenovo $625M each: 5.5Y +265, 10Y +350

- 07/20 $1B #Imperial Brands 5Y +320

- 07/20 $850M #Nationwide BS 5Y +170

- 07/20 $700M *Korea Hydro 5Y +123

- 07/20 $500M #Bank Leumi 5Y +210

EGBs-GILTS CASH CLOSE: BTPs Steal The Show Pre-ECB

BTP spreads finished sharply wider Wednesday, reversing earlier tightening as the fate of the Draghi gov't was set to be decided after market close.

- 10Y BTP/Bund spreads hit a high of 218.6bp (up 8+bp on the day) after falling to under 194bp at one point early as it appeared PM Draghi would stay on. The confidence vote is due around 1845CET.

- Bunds outperformed Gilts through the 5Y segment; but vice-versa further down.

- The ECB decision will take focus Thursday: markets pulled back 50bp hike pricing slightly as the events in Rome developed, but show about a 60/40% split between 25bp/50bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3bps at 0.607%, 5-Yr is down 0.4bps at 1.011%, 10-Yr is down 2bps at 1.257%, and 30-Yr is down 1.5bps at 1.454%.

- UK: The 2-Yr yield is up 2.8bps at 2.069%, 5-Yr is up 0.9bps at 1.916%, 10-Yr is down 4.1bps at 2.139%, and 30-Yr is down 2.7bps at 2.66%.

- Italian BTP spread up 8.3bps at 213.4bps / Spanish up 2.3bps at 122.7bps

FOREX: Euro Headwinds Re-Emerge Amid Italian Political Turmoil

- Renewed Euro positivity, largely stemming from the likely return of Nordstream 1 gas flows and a potentially more hawkish ECB, was dealt a blow on Wednesday. Fresh headwinds have emerged relating to developments in Italy and the probable collapse of the current government.

- Despite EURUSD sitting marginally in the red for much of the US session, late weakness saw gradual but consistent selling through the intra-day lows of 1.0174. While there has not been significant follow through, the pair continues to trade with an offered tone around the 1.0160 mark.

- Overnight vols are very high for EURUSD, the highest since the depths of the covid crash, pointing to a potentially turbulent session on Thursday. Initial tech support resides at 1.0120, Tuesday’s intra-day low.

- The late single currency weakness has naturally lent support to the USD index (+0.5%), which has reversed the majority of yesterday’s downtick. With key central bank event risk upcoming, other G10 major currencies held much narrower ranges on Wednesday with USDJPY registering a notable 47 point range, well below the most recent average.

- The Bank of Japan takes focus for the upcoming APAC session. The BoJ will leave policy settings unchanged at its July meeting, however, markets should expect a markup in the Bank’s immediate CPI forecast and a moderation in its immediate GDP growth forecast.

- The ECB decision will be the focus for global markets on Thursday: markets pulled back 50bp hike pricing slightly as Italian political noise developed, but show about a 60/40% split between 25bp/50bp.

- Jobless Claims and Philly Fed Manufacturing data highlight the US docket.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/07/2022 | 0800/0900 |  | UK | BOE Pill Intro at BOE & ECB Conference | |

| 21/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 21/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 21/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/07/2022 | 1245/1445 |  | EU | ECB Press Conference | |

| 21/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/07/2022 | 1515/1715 |  | EU | ECB Lagarde Presents Policy Decision via Podcast | |

| 21/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.