-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weaker Data Underpins Stocks, FI

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Jobless Rate Masks Slack -Blanchflower Paper

- MNI JUL CHICAGO BUSINESS BAROMETER 52.1 VS 56.0 JUN

- MNI SOURCES: Majority Sufficient For ECB's New TPI Tool

US

US: The U.S. job market is weaker than Federal Reserve policymakers believe because officials are focused on historically-low unemployment and a high vacancy rate, but neither is correlated with wage growth, according to forthcoming research ex-Bank of England MPC member David Blanchflower shared with MNI.

- Fed Chair Jerome Powell told reporters this week that the labor market is “extremely tight,” pointing to rapid employment growth, a 3.6% jobless rate and a large number of job openings. He and other officials say this strength suggests the economy can avoid a recession despite rapidly rising interest rates.

- “The labor market is not tight. The vacancy to unemployment ratio is negatively correlated with wage growth,” said Blanchflower, now a professor of economics at Dartmouth College and also a former visiting scholar at the Boston Fed. For more see MNI Policy main wire at 1145ET.

US DATA: The Chicago Business BarometerTM, produced with MNI, slid further in July, extending June's decline. The indicator fell 3.9-points to 52.1, the lowest level since August 2020

- Production fell 7.0 points to 48.2 in July, a two-year low. Close to a fifth of firms saw lower production.

- New Orders slid a further 5.4 points to 44.5, the lowest in 25 months. Overall demand waned in July.

- Order Backlogs slumped 6.8 points in July to 48.4. As new order levels softened, a quarter of businesses saw backlogs decline as they worked through postponed production.

- Employment grew 5.4 points to a current year high of 56.1 as the labor market continued to tighten.

- Supplier Deliveries ticked down 2.0 points to 67.1. This was the lowest since October 2020 as deliveries remained slow and lead times lengthened. Both the war in Ukraine and knock-on effects of Chinese lockdowns continued to hamper supply chains.

- Inventories saw the largest decrease this month, plunging 16.2 points, a stark contrast to May's near 50-year high.

- Prices Paid rose 2.3 points to 81.9 as price pressures intensified. Transparency issues regarding grounds for supplier price increases were flagged. The survey ran from July 1 to 19.

US TSYS: Rates Off Highs Into Month End

Tsys futures remain mixed by the bell, curves flatter with short end underperforming: 2s10s -4.966 at 24.198, 5s10s -2.275 at -4.803.

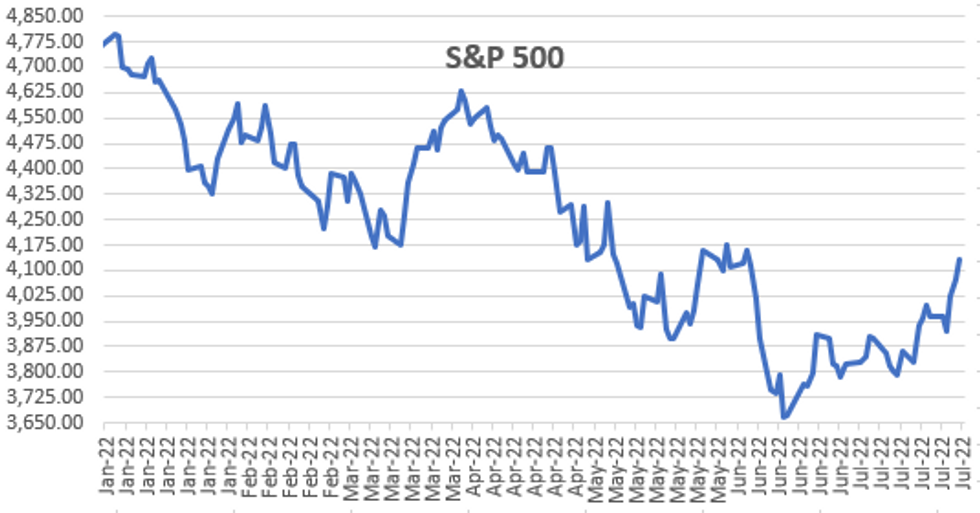

- Weaker data in-line w/ more moderate rate hikes later in the year: Little initial reaction after slight gain in June reading of Personal Income is +0.6% MoM vs. +0.5 est, PCE Deflator is +1.0% MoM vs. +0.9% est, and ECI +1.3% vs. +1.2% est. Rates and stocks moved higher after the Chicago Business BarometerTM, produced with MNI, slid further in July, extending June's decline. The indicator fell 3.9-points to 52.1, the lowest level since August 2020.

- Exogenous factors: Tsys had come under pressure in early London hours after higher than expected French, Italian and Spanish GDP economic data triggered selling in EGBs w/ brief pause after weaker than expected German GDP.

- Meanwhile, Fed speakers out of media blackout: Atlanta Fed Bostic broke the seal earlier, reiterating Chair Powell's talking point: we are not in a recession, but inflation needs to be addressed w/ "more work needs to be done on bringing demand and supply into balance".

- Next Monday data: S&P Global Mfg data (52.4 est), ISMs (mfg 52.0 est; prices paid 73.5 est), JOLTS job openings (10.994M).

- Current cross assets: spot Gold +5.35 at 1761.19, Crude firmer but off early highs WTI +2.18 at 98.60, stocks on high ESU2 +64.50 at 4138.00 -- highest level sine June 9..

- Currently, 2-Yr yield is up 4.1bps at 2.9027%, 5-Yr is up 1bps at 2.7079%, 10-Yr is down 1.1bps at 2.665%, and 30-Yr is down 1.7bps at 3.0057%.

OVERNIGHT DATA

- US JUN PERSONAL INCOME +0.6%; NOM PCE +1.1%

- US JUN PCE PRICE INDEX +1.0%; +6.8% Y/Y

- US JUN CORE PCE PRICE INDEX +0.6%; +4.8% Y/Y

- US JUN UNROUNDED PCE PRICE INDEX +0.951%; CORE +0.595%

- US Q2 EMPL COST INDEX 1.3% V Q1 1.4%

- US Q2 EMPL COST INDEX Y/Y 5.1% V Q1 4.5%

- MNI JUL CHICAGO BUSINESS BAROMETER 52.1 VS 56.0 JUN

- MNI CHICAGO: JUL PRICES PAID HIGHER AT 81.9 VS 79.6 JUN

- MNI CHICAGO: JUL EMPLOYMENT AT 56.1 VS 50.7 JUN

- MNI CHICAGO: JUL PRODUCTION 48.2 VS 55.2 JUN

- MNI CHICAGO SURVEY PERIOD JUL 1 TO JUL 19

- MICHIGAN FINAL JULY CONSUMER SENTIMENT AT 51.5; EST. 51.1

- MICHIGAN JULY CURRENT CONDITIONS AT 58.1 FROM 53.8

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 325.46 points (1%) at 32856.4

- S&P E-Mini Future up 60.25 points (1.48%) at 4133.75

- Nasdaq up 223.1 points (1.8%) at 12386.67

- US 10-Yr yield is down 2.5 bps at 2.6505%

- US Sep 10Y are up 3.5/32 at 121-3

- EURUSD up 0.0023 (0.23%) at 1.022

- USDJPY down 0.91 (-0.68%) at 133.36

- WTI Crude Oil (front-month) up $2.49 (2.58%) at $98.93

- Gold is up $8.62 (0.49%) at $1764.46

- EuroStoxx 50 up 55.9 points (1.53%) at 3708.1

- FTSE 100 up 78.18 points (1.06%) at 7423.43

- German DAX up 201.94 points (1.52%) at 13484.05

- French CAC 40 up 109.29 points (1.72%) at 6448.5

US TSY FUTURES CLOSE

- 3M10Y -3.777, 24.145 (L: 20.469 / H: 32.921)

- 2Y10Y -5.578, -24.81 (L: -27.038 / H: -15.032)

- 2Y30Y -6.359, 9.087 (L: 6.721 / H: 20.858)

- 5Y30Y -2.987, 29.163 (L: 27.205 / H: 35.769)

- Current futures levels:

- Sep 2Y down 1.75/32 at 105-7.25 (L: 105-03.625 / H: 105-12)

- Sep 5Y down 0.25/32 at 113-22.75 (L: 113-12 / H: 113-29)

- Sep 10Y up 3.5/32 at 121-3 (L: 120-17 / H: 121-12.5)

- Sep 30Y up 20/32 at 143-25 (L: 142-10 / H: 144-12)

- Sep Ultra 30Y up 1-09/32 at 157-28 (L: 155-11 / H: 158-31)

US 10Y FUTURES TECH: (U2) Key Resistance Cleared

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 1: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- PRICE: 121-03 @ 1500ET Jul 29

- SUP 1: 119-19+/118-23+ Low Jul 27 / 50-day EMA

- SUP 2: 117-14+ Low Jul 21 and key near-term support

- SUP 3: 116-11 Low Jun 28

- SUP 4: 115-20 Low Jun 17

Treasuries have traded higher this week and cleared resistance at 120-16+, the Jul 6 high and bull trigger. The outlook is bullish and the break higher has confirmed a resumption of the current bull cycle. The contract has also established a bullish price sequence of higher highs and higher lows. This opens 121-10 next, a Fibonacci retracement. On the downside, the 50-day EMA, at 118-23+, is a firm support. Key support is at 117-14+, the Jul 21 low.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.010 at 96.70

- Dec 22 -0.040 at 96.350

- Mar 23 -0.065 at 96.525

- Jun 23 -0.045 at 96.735

- Red Pack (Sep 23-Jun 24) -0.03 to +0.015

- Green Pack (Sep 24-Jun 25) +0.020 to +0.025

- Blue Pack (Sep 25-Jun 26) +0.020 to +0.025

- Gold Pack (Sep 26-Jun 27) +0.035 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.01814 to 2.32157% (+0.75700/wk)

- 1M -0.01085 to 2.36229% (+0.11000/wk)

- 3M +0.00600 to 2.78829% (+0.02200/wk) * / **

- 6M -0.01085 to 3.32986% (+0.00700/wk)

- 12M -0.05485 to 3.70729% (-0.10700/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $90B

- Daily Overnight Bank Funding Rate: 2.32% volume: $287B

- Secured Overnight Financing Rate (SOFR): 2.28%, $965B

- Broad General Collateral Rate (BGCR): 2.25%, $382B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $372B

- (rate, volume levels reflect prior session)

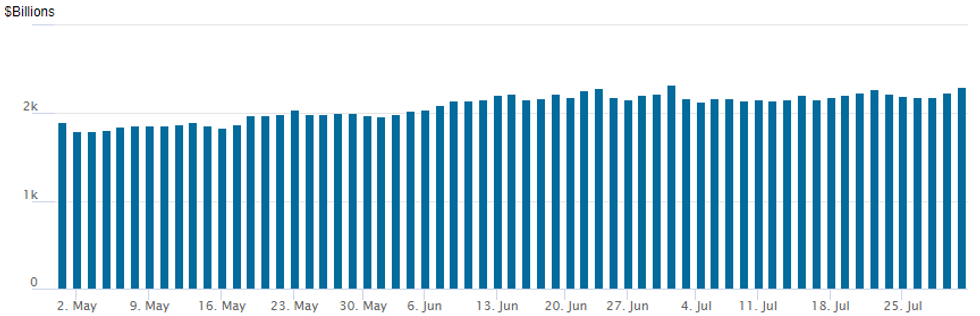

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,300.200B w/ 111 counterparties vs. $2,239.883B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: Total July Issuance $100.6B

July closes out month with just over $100B high-grade corporate issuance, compares to $124.885B for July 2021.

- Date $MM Issuer (Priced *, Launch #)

- 07/29 No new US$ issuance Friday after $19.4B total priced on wk

- $5.1B Priced Thursday

- 07/28 $2.25B *General Motors $1B 7Y +270, $1.25B 10Y +295

- 07/28 $1.35B *CIBC 3Y +115 (drops 3Y SOFR)

- 07/28 $1B *Posco $700M 3Y +160, $300M 5Y +185

- 07/28 $500M *Appalachian Power 10Y +185

EGB/Gilts - Govies recover from their lows

EGBs and Bund have recovered from the session lows, as EU desks start to likely cover as we head towards the later part of the session.

- Month End could also be at play, but more would be expected towards 16.15BST.

- Most notable extensions are in the UK, a huge +0.20yr, while EU and the US sees smaller/average extensions.

- A decent turn around for the BTP, and good continuation following this morning's headline:

- "Meloni Would Stick To EU Budget Rules If She Becomes PM-Officials"

- Italy is now 12.8bps tighter against the German 10yr, and all peripheral are tighter, besides Greece that sits 2.3bps wider.

- Looking ahead, attention turns to the BoE and US NFP next week.

Notable data for next week:

- Manufacturing PMIs (mostly final readings for core), US ISM/Price paid (Mon), Swiss CPI, Turkey CPI, Global Services PMIs (mostly final for core), US ISM Services Index (Wed), German, French, Italian IP, Canadian Employment, US NFP (Fri).

FOREX: Significant FX Volatility, Greenback Pares Gains Into Month-End

- G10 currencies remained highly volatile on Friday and despite a closing snapshot indicating no sizeable daily adjustments, most majors exhibited significant intra-day ranges to finish the week.

- USDJPY looks set to post 2% losses for the week and is the weakest pair on Friday (-0.75%). However, multiple whipsaws were experienced throughout the volatile trading day. In an extension of yesterday’s weakness and as a product of the softer US growth data and lower yields, USDJPY initially traded down as much as 1.3% overnight, printing a six-week low at 132.51 as Europe sat down.

- However, strong reversals across the currency space amid possible profit taking, combined with potential month-end dynamics, led to a sharp reversal higher. Some slightly firmer US data exacerbated the greenback relief rally, prompting USDJPY to print a 134.59 high, over 200 pips off the lows and closely matching the overnight highs.

- The broad dollar strength saw similar moves across the FX space, although the rally lost steam and once again reversed course approaching the month-end WMR fix. The USD index fell back into negative territory and looks set to extend its losing streak to three consecutive sessions.

- Similarly, GBPUSD saw initial support amid the early greenback weakness, reaching a one-month high of 1.2239. However, the rally met stiff resistance with weaker domestic data fuelling the turnaround. Despite the resulting 180-pip move to the downside, GBP had a notable bounce ahead of the month-end fix, rising over 100 pips to trade close to unchanged at 1.2170 approaching the close. Technically, initial firm support to watch lies at 1.1890, the Jul 21 low. A break of which would signal a resumption of bearish activity.

- US ISM Manufacturing PMI highlights Monday’s data docket, however, markets will remain more concerned over Friday’s release of non-farm payrolls following the Fed’s increased importance on the upcoming data. There will be central Bank decisions from both the RBA and the BOE.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/07/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/07/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 01/08/2022 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/08/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/08/2022 | 0600/0800 | ** |  | DE | retail sales |

| 01/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/08/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/08/2022 | 1900/1500 |  | US | Treasury Marketable Borrowing Estimates |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.