-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Speak Trifecta, Long Way to Go

EXECUTIVE SUMMARY

- MNI FED: Daly 'Long Way To Go' on Rate Increases

- MNI FED: Evans Sees 50-75BP September Rate Increase

- MNI FED: Hawkish Mester Drives Further Increases In Hike Pricing

- CHINA FOREIGN MINISTRY: PELOSI'S VISIT TO TAIWAN SEVERELY IMPACTS 'POLITICAL FOUNDATION' OF SINO-U.S. RELATIONS, Rtrs

US

FED: Federal Reserve Bank of San Francisco President Mary Daly said Tuesday the Fed is "nowhere near almost done" in fighting inflation that's far too high, and dismissed market anticipation of interest-rate cuts next year.

- "Our work is far from done, so we are still resolute and completely united on achieving price stability, which doesn't mean 9.1% inflation. It means something closer to 2% inflation, so a long way to go," she said in a LinkedIn interview. Fighting high inflation requires "raising and leaving the interest rate for a while" on hold.

- She added the size of the September hike will depend on data. "We have a couple more inflation releases before the next FOMC meeting. We have a couple more labor market reports including one this Friday, and I really am looking to seeing what those data tell us about whether we can downshift a little bit the pace of rate hikes or if we need to continue."

FED: Chicago Fed President Charles Evans told reporters Tuesday that policymakers could slow the pace of rate increases to 50 basis points at the next meeting in September and move to quarter-point hikes after that.

- “Fifty is a reasonable assessment, but 75 could also be okay. I doubt that more would be called for,” in September, he said. While recent inflation data have been stronger than expected and there may be a few more of those kinds of reports coming, Evans prefers a smoother rate path to guard against any surprise economic setback.

- Quarter-point hikes at the last few meetings this year and the first two or three in 2023 could also be enough to bring down inflation, Evans said, adding that's remained his thinking since submitting June dot plot estimates. “In spite of less favorable inflation reports than I expected in June, I’m still hopeful that that rate path is a reasonable one,” he said.

- With questions over the reliability of a technical recession in US GDP after the Q2 contraction, she notes that domestic demand only cooled in Q2 whilst the labor market certainly right now remains very healthy and there's no broad-based pullback in activity across sectors. Similarly, her forecast of below trend growth this year and into next year wouldn't be considered a bad outcome or stagflation; it's necessary for price stability with healthy labor markets.

US TSYS: Fed's Work Far From Done

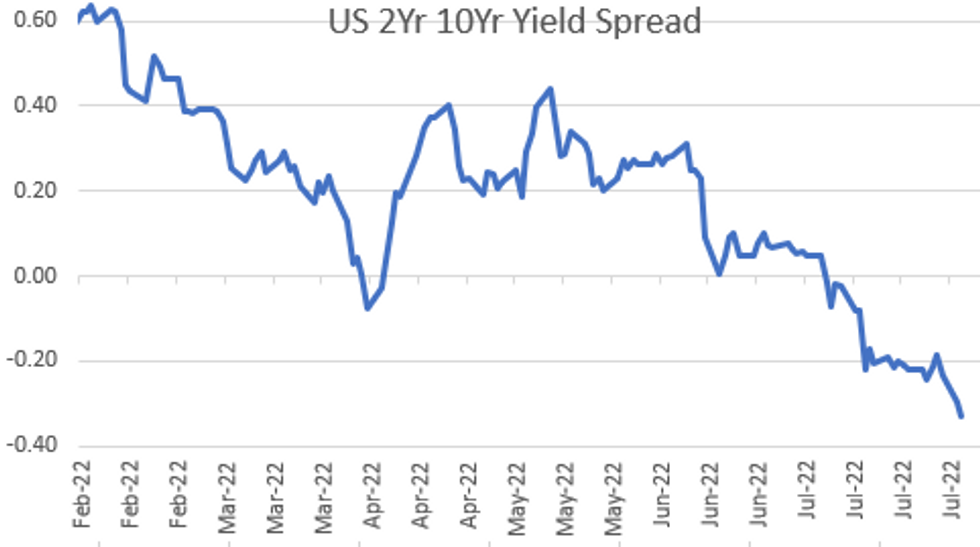

Treasury futures trading session lows after the bell, curves bear flattening with heavy selling in short end (TUU2>600k, FVU>1.13M, TYU>1.78M), 2YY back over 3.0% to 3.0814% high vs. 2.8154% early low, 2s10s hits inverted low of -35.531.

- Rates reversed early support/stocks gained on relief rally after House Speaker Pelosi's safe landing in Taiwan. Brief negative correlation to rates evaporated in the second half as trifecta of Fed speakers (Daly, Mester, Evans) reminded markets inflation is too high and 75bp hike in Sep not off the table.

- SF Fed Pres Daly stating the Fed's "work is far from done, so we are still resolute and completely united on achieving price stability"; Chicago Fed Evans: "Fifty is a reasonable assessment, but 75 could also be okay" for Sep FOMC; Cleveland Fed Mester: prices are only cooling down "if you squint" and in some pockets.

- Earlier Data: Job openings fall by more than expected in June to 10.698M (cons 11.0M) after a marginally upward revised 11.3M in May. Pushes the ratio of job openings to unemployed down to 1.81, the lowest since Feb off the March high of 1.99.

- Pick-up in data for Wednesday: S&P Global US Services/Composite PMIs (47.0, 47.5 respective ests), Durable Goods Orders (1.9% est), Factory Orders (1.2%), ISM Services (53.5 est)

- Current cross assets: spot Gold reversed direction -9.50 at 1762.67, Crude mild gain: WTI +0.37 at 94.26, stocks marginally lower ESU2 -13.5 at 4107.0

- Currently, 2-Yr yield is up 11bps at 2.9796%, 5-Yr is up 10.2bps at 2.7365%, 10-Yr is up 7.9bps at 2.6522%, and 30-Yr is up 2.8bps at 2.9421%

OVERNIGHT DATA

- US REDBOOK: JUL STORE SALES +14.1% V YR AGO MO

- US REDBOOK: STORE SALES +15.5% WK ENDED JUL 30 V YR AGO WK

- US BLS: JOLTS QUITS RATE 2.8% IN JUN

- US BLS: JOLTS OPENINGS RATE 10.698M IN JUN

- Data pushes the ratio of job openings to unemployed down to 1.81, the lowest since Feb off the March high of 1.99, but still obviously considerably higher than the 1:1 of the late teens seen as “a good number” by Powell.

- The quits rate meanwhile was unchanged on the month for both total and private sectors, at 2.8% and 3.1%, down from respective highs of 3.0% in Nov/Dec and 3.4% in Nov.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 295.42 points (-0.9%) at 32504.88

- S&P E-Mini Future down 12.25 points (-0.3%) at 4108.5

- Nasdaq up 27.5 points (0.2%) at 12396.35

- US 10-Yr yield is up 16.4 bps at 2.7374%

- US Sep 10Y are down 38/32 at 120-5.5

- EURUSD down 0.0087 (-0.85%) at 1.0175

- USDJPY up 1.21 (0.92%) at 132.82

- WTI Crude Oil (front-month) up $0.5 (0.53%) at $94.40

- Gold is down $6.33 (-0.36%) at $1765.91

- EuroStoxx 50 down 21.99 points (-0.59%) at 3684.63

- FTSE 100 down 4.31 points (-0.06%) at 7409.11

- German DAX down 30.43 points (-0.23%) at 13449.2

- French CAC 40 down 27.06 points (-0.42%) at 6409.8

US TSY FUTURES CLOSE

- 3M10Y -2.59, 19.479 (L: -0.608 / H: 21.374)

- 2Y10Y -3.27, -33.565 (L: -35.531 / H: -29.379)

- 2Y30Y -12.226, -8.492 (L: -10.479 / H: 5.314)

- 5Y30Y -13.78, 13.659 (L: 11.73 / H: 29.074)

- Current futures levels:

- Sep 2Y down 9.25/32 at 104-29.25 (L: 104-28.25 / H: 105-12.375)

- Sep 5Y down 28.75/32 at 112-29.25 (L: 112-26.25 / H: 114-07.75)

- Sep 10Y down 1-05.5/32 at 120-6 (L: 120-01.5 / H: 122-02)

- Sep 30Y down 1-26/32 at 142-28 (L: 142-23 / H: 145-31)

- Sep Ultra 30Y down 2-02/32 at 157-28 (L: 157-23 / H: 162-02)

US 10Y FUTURES TECH: (U2) Rally Stalls For Now

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-17+ 2.0% 10-dma envelope

- RES 1: 122-02 High Aug 02

- PRICE: 121-16 @ 14:51 BST Aug 02

- SUP 1: 119-19+/118-23+ Low Jul 27 / 50-day EMA

- SUP 2: 117-14+ Low Jul 21 and key near-term support

- SUP 3: 116-11 Low Jun 28

- SUP 4: 115-20 Low Jun 17

Treasuries traded higher to begin the week and printed a higher high on Tuesday. This puts prices clear of resistance at 120-16+ and keeps the outlook bullish. The break higher has confirmed a resumption of the current bull cycle and targets 122-17+ initially, ahead of levels last seen on Mar 31 at 122-29+. On the downside, the 50-day EMA, at 118-23+, is a firm support. Key support is at 117-14+, the Jul 21 low.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.050 at 96.640

- Dec 22 -0.120 at 96.235

- Mar 23 -0.170 at 96.345

- Jun 23 -0.20 at 96.515

- Red Pack (Sep 23-Jun 24) -0.24 to -0.205

- Green Pack (Sep 24-Jun 25) -0.245 to -0.24

- Blue Pack (Sep 25-Jun 26) -0.22 to -0.17

- Gold Pack (Sep 26-Jun 27) -0.16 to -0.115

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00443 to 2.30714% (-0.01443/wk)

- 1M -0.00957 to 2.35729% (-0.00500/wk)

- 3M +0.00486 to 2.80700% (+0.01871/wk) * / **

- 6M -0.06271 to 3.31343% (-0.01643/wk)

- 12M -0.03443 to 3.70771% (+0.00042/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $93B

- Daily Overnight Bank Funding Rate: 2.32% volume: $270B

- Secured Overnight Financing Rate (SOFR): 2.28%, $1.035T

- Broad General Collateral Rate (BGCR): 2.25%, $401B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $378B

- (rate, volume levels reflect prior session)

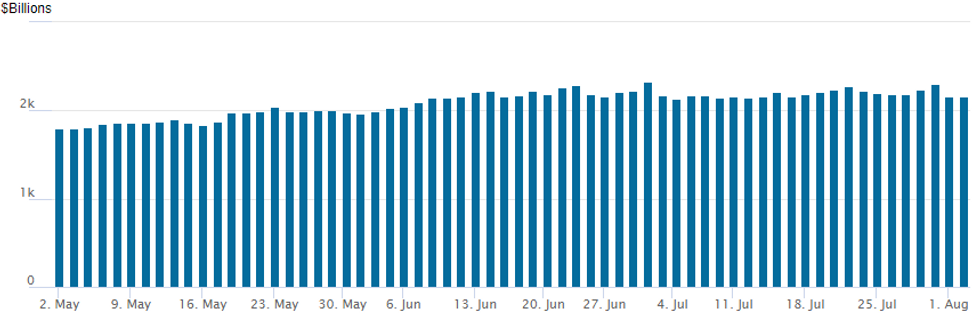

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,156.013B w/ 105 counterparties vs. $2,161.885B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $6B Intel 5Pt Leads Day's $17.2B Total Issuance

- $17.2B To Price Tuesday

- 08/02 $6B #Intel $1.25B 5Y +90, $850M 7Y +120, $1.25B 10Y +140, $1.75B 30Y +185, $900M 40Y +200 (last time Intel issued: $5B in September 2021)

- 08/02 $4.25B #Barclays $1.5B 4NC3 +230, $1.75B 6NC5 +265, $1B 11NC10 +300

- 08/02 $1.65B #Macquarie Bank $800M 4NC3 +210, $850M 11.25NC10.25 +275

- 08/02 $1.5B #Canadian National Railway $800M 10Y +115, $700M 30Y +140

- 08/02 $1.5B NextEra Energy WNG 2Y +125a

- 08/02 $800M #Brooklyn Union Gas $400M each 5Y +177, 10Y +212

- 08/02 $500M #ANZ Bank10NC5 +270

- 08/02 $500M #Moody's WNG 10Y +158

- 08/02 $500M KT Corp 3Y +125a

FOREX: USD Index Snaps Losing Streak As US Yields Reverse Course

- The greenback has been significantly boosted on Tuesday in conjunction with a substantial move higher across US yields. Notable comments from Mary Daly on the Fed being "nowhere near done" on curbing inflation and subsequent Fed speak were largely responsible for the turnaround and subsequent pressure on US treasuries. The price action supported the USD index (+0.80%), which is set to snap a four-day losing streak.

- Equity markets shrugged off the ongoing tensions surrounding Speaker Pelosi’s trip to Taiwan and following her safe landing, major benchmarks staged a strong recovery, rallying to the best levels of the session. In sharp contrast to the APAC session, firmer risk sentiment proved enough to place downward pressure on the Japanese Yen, prompting USDJPY to stage a significant recovery. Even with the latest renewal of pressure in equity markets the USD remains firmly on the front foot with USDJPY extending its recovery to 250 pips.

- USDJPY’s 130.41 low came within close proximity of key support at 130.24, the 100-day MA, a level last crossed in September 2021.

- AUD remains the worst performer in G10 following the RBA delivering the widely expected and largely priced 50bp hike at the end of it August meeting. However, the formal introduction of some well-used phrases to the post-meeting statement left a dovish tinge to the post-meeting takeaway.

- Wednesday's data focus will be on US ISM Services PMI. Later this week, the Bank of England’s monetary policy decision on Thursday precedes Friday’s US employment data.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/08/2022 | 0130/1130 | *** |  | AU | Retail trade quarterly |

| 03/08/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 03/08/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/08/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/08/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 03/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/08/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/08/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/08/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/08/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/08/2022 | 1430/1030 |  | US | Philadelphia Fed's Patrick Harker | |

| 03/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 03/08/2022 | 1545/1145 |  | US | Richmond Fed's Tom Barkin | |

| 03/08/2022 | 1830/1430 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.