-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Don't Fight The Fed, Tsys Reverse Course

EXECUTIVE SUMMARY

- MNI: Recession Could Force Fed To End QT Early - Ex Officials

- MNI INTERVIEW: Services Less Confident In Growth In Fall - ISM

- MNI BRIEF: US Announces Another Reduction In Debt Sales

- MNI FED: SF Daly Markets Ahead Of Themselves Expecting Cuts Next Year

- MNI BRIEF: Daly Says Fed's Rate Remains Below Neutral

- MNI BRIEF: Kashkari Says Mkt Bets on Rate Cut Very Unlikely

US

FED: A recession next year would force the Federal Reserve to consider slowing or stopping the run-down of its massive asset portfolio long before bank reserves approach their equilibrium level, though any decision to alter course would not be made lightly, former Fed officials and ex-staffers told MNI.

- "Conceivably sometime in 2023 they'll need to cut rates, so it’s quite plausible that economic circumstances could also raise questions about what to do with the QT program," former Atlanta Fed President Dennis Lockhart said in an interview.

- "They’re reluctant to pause that normalization process or reverse it prematurely if that can be avoided," he said. "The first principle for rates and balance sheet policy is to avoid inconsistency." For more see MNI Policy main wire at 1008ET.

- "The comments show how these companies are feeling and thinking and they are feeling the economy is weakening," he said. "But I would point to the index itself because that is empirical information measuring change month over month."

- The ISM services survey increased 1.4ppts to 56.7, increasing more than anticipated in July to a three-month high on firmer business activity and orders. A reading below 50 suggests a contraction.

US TSY: The U.S. Treasury on Wednesday announced its fourth consecutive reduction in its quarterly sales of longer-term debt as borrowing needs diminished and signaled a pause going forward.

- The department said it will issue USD98 billion of securities at next week's quarterly refunding, raising USD43.9 billion in new cash.

- Officials say they plan to sell USD42 billion in 3-year notes on Aug. 9, USD35 billion in 10-year notes on Aug. 10, and USD21 billion in 30-year bonds on Aug. 11.

- Over the next three months, changes in nominal coupon auction sizes announced Wednesday will result in a USD51 billion reduction of issuance. "Treasury believes these reductions announced today leave Treasury well-positioned to address potential changes to the fiscal outlook," the agency said in a statement.

- "We're not even up to neutral right now," she said on a Twitter talk with Reuters, saying the short-run neutral rate is different from the FOMC's views on the long-run rate around 2.5%. Further hikes needed to pull down inflation aren't necessarily restrictive, she said, adding that the pace of the September move depends on new economic data. The June SEP showing about another 100bps of hikes by year-end remains a reasonable view, she said.

- "The more likely scenario is we would continue raising and then we would sit there, until we have a lot of confidence that inflation is well on its way back down to 2% before we would start to cut," he said during a talk at Columbia University. It could take several years for inflation to come back down, he said.

US TSYS: Rates Quietly Rebound, Yld Curves Hold 22 Year Inverted Lows

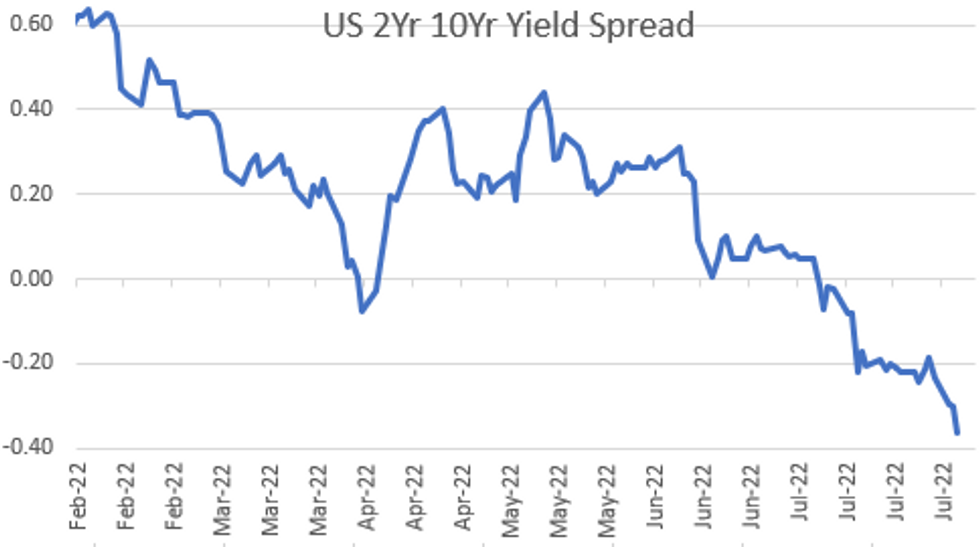

Tsy futures drifting near modest session highs after the bell - wide range on decent volume (TYU2>1.6M) after rebounding steadily off midmorning lows. Yield curves still near inverted lows not seen since late 2000: 2s10s currently -6.205 ast -36.662 vs. -37.202 low.

- Hawkish Fed messaging continues: StL Fed Bullard on CNBC earlier echoing Daly and Mester's messaging: Fed job "nowhere near" complete in reining in inflation while needing months of "convincing evidence" that infl has peaked.

- That said, SF Fed Daly clarified/softened her view slightly saying 50bp hike in Sep a "reasonable thing to do." Mkts appeared to ignore MN Fed Kashkari comments after the close: inflation fight a bigger priority than recession, while market bets on rate cuts are very unlikely.

- Meanwhile, US Tsy annc fourth consecutive reduction in its quarterly sales of longer-term debt as borrowing needs diminished and signaled a pause going forward. Reductions in short-end auction sizes was not widely expected (2s, 3s), the rest was more or less in line by the looks of it.

- Data on tap for Thursday: Challenger Job Cuts YoY, Initial Jobless Claims (260k est), Continuing Claims (1.383M est). Larger focus on Friday's July employment report (+250k est vs. +372K prior).

- Current cross assets: spot Gold rebounds +$5.39 (0.31%) at $1765.35, Crude weaker: WTI -$3.57 (-3.78%) at $90.81, stocks near recent session highs ESU2 +72.5 points (1.77%) at 4160.75.

- Currently, 2-Yr yield is up 4.3bps at 3.0937%, 5-Yr is up 0.7bps at 2.8599%, 10-Yr is down 1.6bps at 2.7319%, and 30-Yr is down 4.8bps at 2.9581%.

OVERNIGHT DATA

- US ISM JUL SERVICES COMPOSITE INDEX 56.7

- US ISM JUL SERVICES BUSINESS INDEX 59.9

- US ISM JUL SERVICES PRICES 72.3

- US ISM JUL SERVICES EMPLOYMENT INDEX 49.1

- US ISM JUL SERVICES NEW ORDERS 59.9

- US JUL FINAL SERVICES PMI 47.3 (FLSH 47.0); JUN 52.7

- US S&P GLOBAL JULY COMPOSITE PMI AT 47.7 VS 52.3 PRIOR

- US S&P GLOBAL JULY SERVICES PMI AT 47.3 VS 52.7 LAST MONTH

- US JUN FACTORY ORDERS +2.0%; EX-TRANSPORT NEW ORDERS +1.4%

- US JUN DURABLE ORDERS +2.0%

- US JUN NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.7%

- US MBA: MARKET COMPOSITE +1.2% SA THRU JULY 29 WK

- US MBA: REFIS +2% SA; PURCH INDEX +1% SA THRU JULY 29 WK

- US MBA: UNADJ PURCHASE INDEX -16% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.43% VS 5.74% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 464.47 points (1.43%) at 32860.58

- S&P E-Mini Future up 69 points (1.69%) at 4162.75

- Nasdaq up 325.8 points (2.6%) at 12673.99

- US 10-Yr yield is down 2 bps at 2.7282%

- US Sep 10Y are up 2.5/32 at 120-6.5

- EURUSD down 0.0002 (-0.02%) at 1.0165

- USDJPY up 0.89 (0.67%) at 134.06

- WTI Crude Oil (front-month) down $3.54 (-3.75%) at $90.86

- Gold is up $4.62 (0.26%) at $1765.04

- EuroStoxx 50 up 47.91 points (1.3%) at 3732.54

- FTSE 100 up 36.57 points (0.49%) at 7445.68

- German DAX up 138.36 points (1.03%) at 13587.56

- French CAC 40 up 62.26 points (0.97%) at 6472.06

US TSY FUTURES CLOSE

- 3M10Y +2.301, 23.824 (L: 16.48 / H: 30.869)

- 2Y10Y -6.113, -36.57 (L: -37.202 / H: -30.671)

- 2Y30Y -9.288, -13.923 (L: -14.172 / H: -2.72)

- 5Y30Y -5.261, 9.662 (L: 9.403 / H: 18.649)

- Current futures levels:

- Sep 2Y down 1.125/32 at 104-27.5 (L: 104-20.75 / H: 105-00.75)

- Sep 5Y down 0.5/32 at 112-27.5 (L: 112-09.75 / H: 113-04.5)

- Sep 10Y up 2/32 at 120-6 (L: 119-10.5 / H: 120-16)

- Sep 30Y up 5/32 at 143-4 (L: 141-05 / H: 143-10)

- Sep Ultra 30Y up 20/32 at 158-25 (L: 155-13 / H: 158-31)

US 10Y FUTURES TECH: (U2) Rally Stalls, Hits Reverse

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-17+ 2.0% 10-dma envelope

- RES 1: 122-02 High Aug 02

- PRICE: 119-19+ @ 16:08 BST Aug 03

- SUP 1: 119-10+/118-23+ Low Aug 3 / 50-day EMA

- SUP 2: 117-14+ Low Jul 21 and key near-term support

- SUP 3: 116-11 Low Jun 28

- SUP 4: 115-20 Low Jun 17

Treasuries traded higher to begin the week, putting prices clear of resistance at 120-16+. This soon reversed, however, breaking the run of higher highs and higher lows that defined the recent uptrend. The 50-day EMA, at 118-23+, is a firm support for now. A break below here opens support at 117-14+, the Jul 21 low. Any return higher targets 122-17+ initially, ahead of levels last seen on Mar 31 at 122-29+.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.010 at 96.630

- Dec 22 -0.015 at 96.215

- Mar 23 -0.045 at 96.290

- Jun 23 -0.055 at 96.450

- Red Pack (Sep 23-Jun 24) -0.05 to -0.015

- Green Pack (Sep 24-Jun 25) -0.02 to +0.005

- Blue Pack (Sep 25-Jun 26) +0.015 to +0.030

- Gold Pack (Sep 26-Jun 27) +0.030 to +0.035

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00315 to 2.31029% (-0.01128/wk)

- 1M +0.01900 to 2.37629% (+0.01400/wk)

- 3M +0.02529 to 2.83229% (+0.04400/wk) * / **

- 6M +0.07557 to 3.38900% (+0.05914/wk)

- 12M +0.13543 to 3.84314% (+0.13585/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $95B

- Daily Overnight Bank Funding Rate: 2.32% volume: $278B

- Secured Overnight Financing Rate (SOFR): 2.30%, $1.015T

- Broad General Collateral Rate (BGCR): 2.27%, $399B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $381B

- (rate, volume levels reflect prior session)

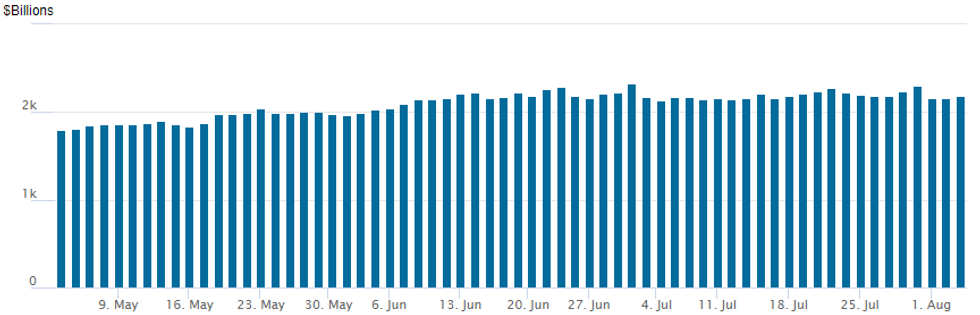

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,182.238B w/ 105 counterparties vs. $2,156.013B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $2B KeyBank 2Pt Rounds Out Total Day's Issuance of $6.55B

- Date $MM Issuer (Priced *, Launch #)

- 08/03 $2B #KeyBank $1.25B 3Y +112.5, $750M 10Y +220

- 08/03 $1.75B #Williams Co $1B 10Y +195, $750M 30Y +235

- 08/03 $1.3B #DTE Energy WNG 2Y +112.5

- 08/03 $1B #Westpac 11NC10 +268

- 08/03 $500M #Guatemala 7Y 5.45%

- 08/03 $Benchmark Meta Platforms investor calls

FOREX: Greenback Supported By Firmer US Services PMI, USDJPY Extends Recovery

- A stronger-than-expected US Services PMI print further weighed on the front-end of the TSY curve, bolstering the US Dollar on Wednesday. The greenback index had largely been consolidating before the data after yesterday’s strong recovery, however, there was a notable uptick following the above consensus reading. Despite a 30 tik retreat off the intra-day highs, the USD Index (+0.25%) has marginally extended on yesterday’s rebound.

- A consolidation of hawkish Fed rhetoric over the past 24 hours continues to fuel the renewed optimism for the greenback keeping the USD underpinned as we approach Friday’s important jobs report.

- Bottom of the G10 pile on Wednesday is the Japanese Yen with USDJPY posting another huge daily range. The 134 handle initially capped the rally overnight in Asia and evidence of the significant volatility, the pair pulled back as much as 150 pips to 132.40 before consolidating above 133 for much of the European session. Price action continued to look perky into the US session and the ISM data prompted another spike in price to a daily high of 134.55, over 400 pips above yesterday’s low.

- Mixed price action across the rest of G10 with no clear theme driving the price action. A decent rally in global equity benchmarks has benefitted the likes of AUD and CAD, filtering through to a boost for crosses such as AUDJPY and CADJPY which have both risen over 1%.

- In similar vein in emerging markets, bolstered risk sentiment in equities helped the Mexican Peso rise 1.6%, however, the move largely reflects a reversal of the steep rally in USDMXN on Tuesday, with the pair just marginally above yesterday’s close.

- The Bank of England is the headline risk event on Thursday. The median surveyed estimate looks for a 50bp hike to bank rate, however, some analysts are predicting a smaller 25bp increase.

- A relatively light docket in the US (jobless claims and trade balance data) paves the way for Friday’s release of US Non-Farm payrolls.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 04/08/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/08/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 04/08/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/08/2022 | 0800/1000 |  | EU | ECB August Economic Bulletin | |

| 04/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/08/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 04/08/2022 | 1130/1230 |  | UK | BOE Press Conference | |

| 04/08/2022 | 1230/0830 | * |  | CA | Building Permits |

| 04/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/08/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/08/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 04/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/08/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.