-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Tempers Tone Slightly

EXECUTIVE SUMMARY

- MNI INTERVIEW: Tantrum Risk Rises As Fed Resets- Ex-Researcher

- MNI: Fed's Mester Sees Rate Peak Over 4% By June, Pause After

US

FED: The Federal Reserve will face a greater risk of sparking market volatility as it continues to tighten policy to fight inflation even as the economy slows, former Fed visiting scholar and MIT professor Ricardo Caballero told MNI.

- That danger runs against recent clarity from policymakers playing catch-up against big price gains according to Caballero, who has done research at the Fed's main board and the Boston branch of the central bank.

- "Tantrum risk will rise substantially once the tradeoff between activity and inflation becomes more balanced," Caballero said. "Stay tuned." For more see MNI Policy main wire at 0838ET.

- "I would pencil in going a bit above 4% as being appropriate," Mester said. "That trajectory is what I have in mind. Interest rates continue to rise this year and into next year for the first half, and maybe by then we pause," she added. "When we get up to a sufficiently high level where we've seen that compelling evidence (that inflation is coming down), we hold them there for a while, and then we can bring them back down as we get inflation closer to goal."

- Compared to when the Fed met in June, Mester said she was inclined to "frontload" the hikes more even if the end point doesn't change. For the next move in September, "it's not unreasonable to think that we might have to do a 75 but I can imagine it could be a 50," she said.

US TSYS: Short End Gains Late, Yld Curves Off Lows

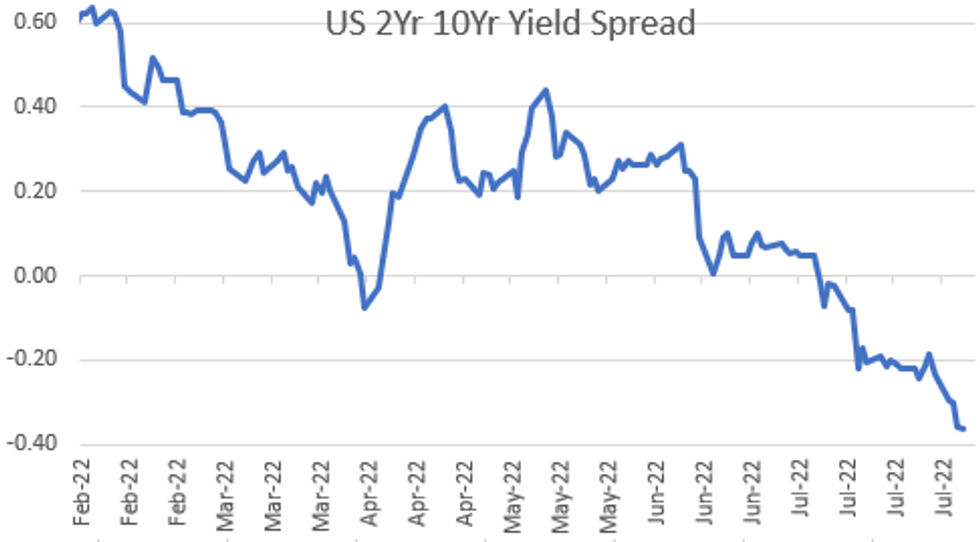

Treasury futures currently trading firmer, upper half relatively narrow range. Modest volumes, TYU2 just over 1M with active accts staying close to sidelines ahead Fri's headline jobs data. Short end gaining momentum in late trade, yield curves well off early inverted lows: 2s10s currently +0.249 at -36.414 vs. -39.611 (lvl not seen since Sep 2000).

- After initial post-BOE rate annc bounce, Bonds extended highs with desks citing mix of higher than expected continuing claims (1.416M vs 1.383M est) as well as geopolitical risk as tensions in APAC region. Tension high after China launched multiple rockets over Taiwan, five of which landed inside Japan's EEZ region. Def Dept asst sec Kirby said he hopes China is not trying to engineer a conflict in region after House Sp Pelosi visit Tuesday.

- Data on tap for Friday: Change in Nonfarm Payrolls (250k est), Change in Private Payrolls (230k est), Unemployment Rate (3.6%), Average Hourly Earnings MoM (0.3%), Labor Force Participation Rate (62.2%), Consumer Credit ($26.0B).

- Cross asset update: Stocks near steady (SPX eminis at 4156.0), DJIA -82.53 (-0.25%) at 32731.34; Nasdaq +35 (0.3%) at 12703.56; Spot Gold surge continued +28.15 at 1793.44; Crude continues to fall (WTI -2.25 at 88.41).

- Currently, 2-Yr yield is down 3.5bps at 3.0305%, 5-Yr is down 5.6bps at 2.7702%, 10-Yr is down 3.4bps at 2.6702%, and 30-Yr is up 1.2bps at 2.9573%

OVERNIGHT DATA

US JOBLESS CLAIMS +6K TO 260K IN JUL 30 WK

US PREV JOBLESS CLAIMS REVISED TO 254K IN JUL 23 WK

US CONTINUING CLAIMS +0.048M to 1.416M IN JUL 23 WK

US JUN TRADE GAP -$79.6B VS MAY -$84.9B

CANADIAN JUN TRADE BALANCE CAD +5.0 BILLION

CANADA JUN EXPORTS CAD 69.9 BLN, IMPORTS CAD 64.9 BLN

CANADA REVISED MAY MERCHANDISE TRADE BALANCE CAD +4.8 BLN

CANADIAN JUN BUILDING PERMITS -1.5% MOM

CANADA RESIDENTIAL BUILDING PERMITS +3.1%; NON-RESIDENTIAL -10.4%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 76.21 points (-0.23%) at 32737.41

- S&P E-Mini Future down 1.5 points (-0.04%) at 4155.25

- Nasdaq up 43.5 points (0.3%) at 12712.69

- US 10-Yr yield is down 2.5 bps at 2.6792%

- US Sep 10Y are up 19.5/32 at 120-22.5

- EURUSD up 0.0084 (0.83%) at 1.0249

- USDJPY down 0.96 (-0.72%) at 132.92

- WTI Crude Oil (front-month) down $2.33 (-2.57%) at $88.38

- Gold is up $29.12 (1.65%) at $1794.46

- EuroStoxx 50 up 22.06 points (0.59%) at 3754.6

- FTSE 100 up 2.38 points (0.03%) at 7448.06

- German DAX up 75.12 points (0.55%) at 13662.68

- French CAC 40 up 41.33 points (0.64%) at 6513.39

US TSY FUTURES CLOSE

- 3M10Y +2.533, 20.222 (L: 17.084 / H: 25.826)

- 2Y10Y +0.903, -35.76 (L: -39.611 / H: -35.644)

- 2Y30Y +5.988, -6.605 (L: -14.862 / H: -6.146)

- 5Y30Y +7.38, 19.143 (L: 10.415 / H: 19.932)

- Current futures levels:

- Sep 2Y up 4.5/32 at 104-31.25 (L: 104-26 / H: 105-00.125)

- Sep 5Y up 14/32 at 113-7.75 (L: 112-25.25 / H: 113-10)

- Sep 10Y up 19.5/32 at 120-22.5 (L: 120-03 / H: 120-26.5)

- Sep 30Y up 23/32 at 143-18 (L: 142-29 / H: 144-08)

- Sep Ultra 30Y up 9/32 at 158-18 (L: 158-06 / H: 159-30)

US 10Y FUTURES TECH:: (U2) Trading Above The 50-Day EMA

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-21 2.0% 10-dma envelope

- RES 1: 122-02 High Aug 02

- PRICE: 120-22 @ 1515ET Aug 04

- SUP 1: 119-10+/119-03 Low Aug 3 / 50-day EMA

- SUP 2: 117-14+ Low Jul 21 and key near-term support

- SUP 3: 116-11 Low Jun 28

- SUP 4: 115-20 Low Jun 17

Treasuries traded higher to begin the week before finding resistance and retracing. The contract remains below 122-02, Aug 02 high. Short-term trend conditions are bullish though and the 50-day EMA, at 119-03, represents a key support. A resumption of strength would refocus attention on 112-02 where a break would resume the uptrend and open 122-29+, the Mar 31 high. A break of the 50-day EMA would concern bulls.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.025 at 96.650

- Dec 22 +0.035 at 96.230

- Mar 23 +0.055 at 96.330

- Jun 23 +0.075 at 96.510

- Red Pack (Sep 23-Jun 24) +0.10 to +0.135

- Green Pack (Sep 24-Jun 25) +0.115 to +0.135

- Blue Pack (Sep 25-Jun 26) +0.095 to +0.115

- Gold Pack (Sep 26-Jun 27) +0.080 to +0.090

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00072 to 2.30957% (-0.01200/wk)

- 1M -0.00358 to 2.37271% (+0.01042/wk)

- 3M +0.03100 to 2.86329% (+0.07500/wk) * / **

- 6M +0.00371 to 3.39271% (+0.06285/wk)

- 12M +0.03586 to 3.87900% (+0.17171/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $92B

- Daily Overnight Bank Funding Rate: 2.32% volume: $274B

- Secured Overnight Financing Rate (SOFR): 2.29%, $984B

- Broad General Collateral Rate (BGCR): 2.27%, $379B

- Tri-Party General Collateral Rate (TGCR): 2.27%, $373B

- (rate, volume levels reflect prior session)

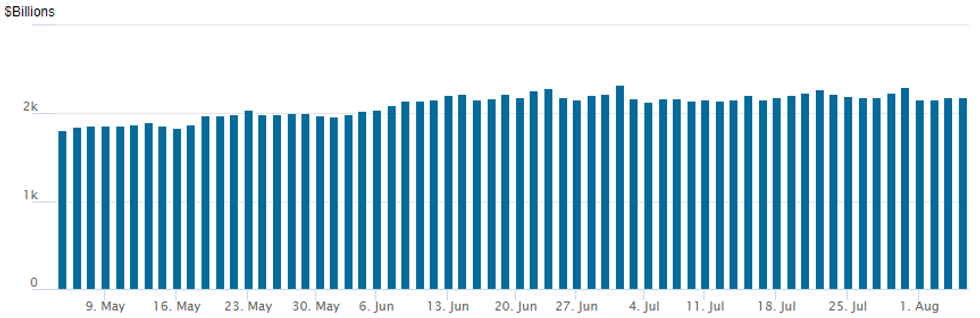

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,191.546B w/ 101 counterparties vs. $2,182.238B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $10B Meta Platform 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/04 $10B #Meta Platforms $2.75B 5Y +75, $3B 10Y +115, $2.75B 30Y +145, $1.5B 40Y +165

- 08/04 $4.75B #HSBC $2.25B 6NC5 +245, $2.5B 11NC10 +275

- 08/04 $2.5B #Lloyds Banking Grp $1.25B each: 4NC3 +175, 11NC10 +230

- 08/04 $1.25B Benchmark Standard Chartered perpNC5.5 7.75%

- 08/04 $1B Charter 7NC3

- 08/04 $800M #Citizens Bank 6NC5 +180

- 08/04 $750M *Waste Connections +10Y +153 upsized from $500M

- 08/04 $750M #Ashtead 10Y +295

FOREX: Greenback Continues To Fade Approaching APAC Crossover

- The greenback spent the latter half of Thursday’s session drifting lower as bullish short-term price action following the sharp recovery from Tuesday’s lows has reversed course.

- Downside USD momentum picked up a little around the WMR fix, with EURUSD (+0.77) popping above Wednesday’s highs at 1.0210 with the pair now trading in marginally positive territory ahead of tomorrow’s payrolls report. Similar price action being conversely reflected in the Dollar Index which has fallen -0.69%.

- In similar vein, USDJPY briefly made fresh late session lows below the 133 handle. The Japanese Yen has once again traded in a volatile manner on Thursday, continuing the currency’s significant intra-day volatility throughout the week. Despite multiple 100+ pip swings throughout today’s session in USDJPY, the pair remained within the bounds of Wednesday’s range.

- The nearest technical resistance point lies at 135.32, the 20-day EMA, however, given the fact that the short-term gains have been considered technically corrective, renewed weakness would place focus back on a sustained break of 131.50 and then 130.41, Tuesday’s low.

- GBP the major move throughout the session following the Bank of England decision. Despite hiking by a slightly above-consensus 50bps, the rather bleak set of attached economic forecasts put immediate pressure on sterling. GBPUSD fell from 1.22 all the way to 1.2066 during the press conference, however, the most recent greenback weakness has seen cable pare losses to 1.2170 as of writing. GBP weakness does still exude through the cross with EURGBP rising 0.6% to a one-week high back above 0.8400.

- Looking ahead to tomorrow, consensus sees US non-farm payrolls growth moderating to 250k in July in a resumption of a downward trend after four remarkably steady months as the gap on pre-pandemic employment levels is almost completely shut.

- Particular focus will be on the strength of jobs growth plus any differences between establishment and household surveys, with FOMC speakers putting weight on labour market strength as evidence against the economy already being in recession.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/08/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 05/08/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 05/08/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 05/08/2022 | 0645/0845 | * |  | FR | Current Account |

| 05/08/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.