-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yield Curve Inversion Anticipates Hot CPI?

EXECUTIVE SUMMARY

- MNI US CPI Preview: Buckle Up

- MNI BRIEF: Scant Evidence Covid-19 Shook Up US Workforce-Paper

US

US: Consensus has headline CPI slowing to just 0.2% M/M from an unwind in energy prices, whilst core CPI is seen easing from 0.7% to 0.5% M/M but after three sizeable beats.

- Analysts see various driving forces for the moderation in core CPI but only a limited easing in shelter after once again surprisingly to the upside in June at multi-decade M/M highs.

- The market reaction to Friday’s payrolls beat shows the potential for large moves, with significant two-sided risk to this release.

US: There is little evidence to support claims the Covid-19 pandemic prompted U.S. workers to switch jobs en masse, a Working Paper published by the ECB argues, with no clear increase in occupational or sectoral switch and few signs of mismatch pushing up unemployment.

- Overall, reallocation shock has played only a relatively minor role in explaining labour market patterns in the pandemic, relative to its importance in earlier episodes, the authors conclude, in contrast to earlier findings from the U.S, although they cautioned that it may be too early to provide a definitive verdict.

US TSYS: Tsys Hold Weaker/Narrow Range Ahead Wed's July CPI

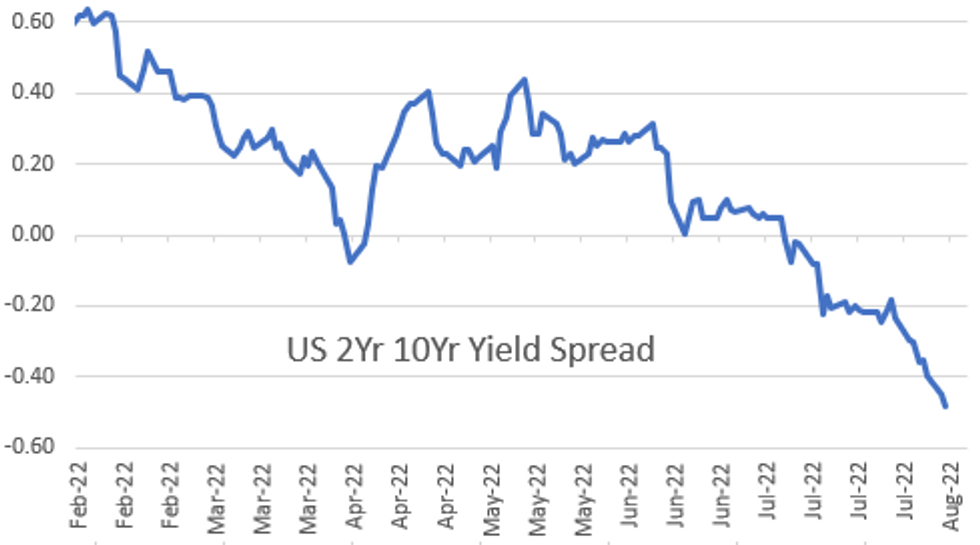

Treasury futures hold modestly weaker after the bell, near middle of session range on light summer volumes (TYU2<815k) - thin participation ahead of Wednesday's key CPI data: 0.2% est, 1.3% prior; YoY 8.7% est, 9.1% prior. Yield curves mostly flatter after the bell, 2s10s nearly tapped -50.0, new 22 year low of -49.264.

- Morning data spurred buying in intermediates to long end:

- Nonfarm labour productivity was roughly as expected in the preliminary Q2 release, falling -4.6% Q/Q saar after -7.4% as output fell -2.1%

- With hourly compensation jumping 5.7% (but -4.4% in real terms), ULCs saw a smaller moderation than expected from 12.7% to 10.8% (cons 9.5%).

- Tsy Auction: Muted react after $42B 3Y note auction (91282CFE6) small stop-through: 3.202% high yield vs. 3.205% WI; 2.50x bid-to-cover vs. 2.43x last month.

- Indirect take-up climbed to 63.08% vs. 60.37% prior; direct bidder take-up at 17.28 vs. last month's 19.35%; primary dealer take-up 19.64% vs. 20.28%.

- Cross asset update: Stocks off modest lows (SPX eminis at 4126.75 -15.00); Spot Gold firmer +6.58 at 1795.54; Crude near steady (WTI +0.04 at 90.80).

- Currently, 2-Yr yield is up 7.9bps at 3.2841%, 5-Yr is up 7.4bps at 2.9797%, 10-Yr is up 4bps at 2.7974%, and 30-Yr is up 2.1bps at 3.0057%.

OVERNIGHT DATA

- US Q2 PREL UNIT LABOR COSTS +10.8% VS Q1 +12.7%; Y/Y +9.5%

- US Q2 PREL NONFARM PRODUCTIVITY -4.6% VS Q1 -7.4%; Y/Y -2.5%

- US REDBOOK: AUG STORE SALES +10.4% V YR AGO MO

- US REDBOOK: STORE SALES +10.4% WK ENDED AUG 06 V YR AGO WK

Rampant ULC Growth But Some Respite In Manufacturing

- Nonfarm labour productivity was roughly as expected in the preliminary Q2 release, falling -4.6% Q/Q saar after -7.4% as output fell -2.1% and aggregate hours worked rose 2.6% in a release that can be used to argue that both GDP should be revised up and/or payrolls revised down.

- With hourly compensation jumping 5.7% (but -4.4% in real terms), ULCs saw a smaller moderation than expected from 12.7% to 10.8% (cons 9.5%).

- There are clear differences by industry though, supporting the view of a rotation towards services. Manufacturing labour productivity jumped 5.5% which outside of immediate pandemic distortions pushed the first, admittedly small, decline in mfg ULCs since 2Q18 (-0.5% Q/Q) with Y/Y growth at 4.4% vs 9.5% for all nonfarm business.

- The data have helped drive a pause in the belly-led sell-off in Treasuries, with larger rallies in the belly and long-end on the release leaving the curve with a bear flattening with 2YY +4.2bps and 10YY +2.4bps on the day.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 79.9 points (-0.24%) at 32753

- S&P E-Mini Future down 21.75 points (-0.53%) at 4120.25

- Nasdaq down 160.4 points (-1.3%) at 12484.47

- US 10-Yr yield is up 4 bps at 2.7974%

- US Sep 10Y are down 12.5/32 at 119-15

- EURUSD up 0.0006 (0.06%) at 1.0203

- USDJPY up 0.25 (0.19%) at 135.2

- WTI Crude Oil (front-month) down $0.17 (-0.19%) at $90.57

- Gold is up $5.68 (0.32%) at $1794.64

- EuroStoxx 50 down 41.85 points (-1.11%) at 3715.37

- FTSE 100 up 5.78 points (0.08%) at 7488.15

- German DAX down 152.72 points (-1.12%) at 13534.97

- French CAC 40 down 34.44 points (-0.53%) at 6490

US TSY FUTURES CLOSE

- 3M10Y -5.843, 15.653 (L: 10.973 / H: 18.161)

- 2Y10Y -3.442, -48.873 (L: -49.264 / H: -43.383)

- 2Y30Y -5.358, -28.042 (L: -28.493 / H: -21.012)

- 5Y30Y -4.91, 2.438 (L: 2.185 / H: 8.123)

- Current futures levels:

- Sep 2Y down 3.625/32 at 104-17.375 (L: 104-17 / H: 104-22.75)

- Sep 5Y down 11.5/32 at 112-6.75 (L: 112-06.25 / H: 112-20.75)

- Sep 10Y down 13/32 at 119-14.5 (L: 119-12.5 / H: 119-31)

- Sep 30Y down 8/32 at 142-10 (L: 141-26 / H: 142-27)

- Sep Ultra 30Y down 11/32 at 157-18 (L: 156-29 / H: 158-15)

US 10Y FUTURES TECH: (U2) Trendline Support Still Intact

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-25+ 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-14 @ 15:10 BST Aug 09

- SUP 1: 119-07+ Trendline support drawn from the Jun 16 low

- SUP 2: 119-06+ 50-day EMA

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries traded lower late last week and in the process cleared a number of support levels. The trend direction remains up and recent weakness is still considered corrective. The contract has remained above support at the 50-day EMA, which intersects at 119-06+. Just above this level is a trendline support at 119-07+. A break of this zone would threaten the uptrend. A reversal higher would refocus attention on the bull trigger at 122-02.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.010 at 96.555

- Dec 22 -0.035 at 96.020

- Mar 23 -0.045 at 96.065

- Jun 23 -0.070 at 96.210

- Red Pack (Sep 23-Jun 24) -0.11 to -0.095

- Green Pack (Sep 24-Jun 25) -0.11 to -0.09

- Blue Pack (Sep 25-Jun 26) -0.08 to -0.045

- Gold Pack (Sep 26-Jun 27) -0.04 to -0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00071 to 2.31800% (+0.00600/wk)

- 1M -0.00843 to 2.38014% (+0.01071/wk)

- 3M +0.00943 to 2.92100% (+0.05429/wk) * / **

- 6M -0.01843 to 3.55043% (+0.12486/wk)

- 12M -0.00385 to 3.99086% (+0.13100/wk)

- * Record Low 0.11413% on 9/12/21; ** New 24Y high: 2.91157% on 8/8/22

- Daily Effective Fed Funds Rate: 2.33% volume: $89B

- Daily Overnight Bank Funding Rate: 2.32% volume: $279B

- Secured Overnight Financing Rate (SOFR): 2.28%, $950B

- Broad General Collateral Rate (BGCR): 2.26%, $387B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

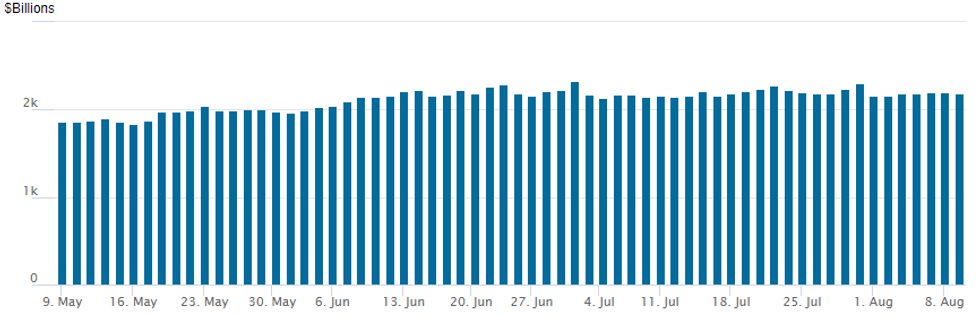

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,186.568B w/ 95 counterparties vs. $2,195.692B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $500M M&T Bank Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/09 $1B Dominion Energy 10Y +170, 30Y +195

- 08/09 $500M *AIIB 5Y SOFR+62

- 08/09 $500M #M&T Bank 6NC5 +158

- 08/09 $Benchmark Alabama Power 5Y +80a, 10Y +115a

EGBs-GILTS CASH CLOSE: Greece Underperforms Again

Gilts and Bunds weakened Tuesday, with the German curve bear steepening and the belly underperforming in the UK.

- No major data or ECB speakers Tuesday, with the most notable morning event being BoE's Ramsden telling Reuters that the BoE would sell Gilts even if it were to cut rates in future.

- Gilts briefly gained in late afternoon on a Bloomberg sources piece pointing to UK gov't plans for potential power cuts in January in a "reasonable worst-case scenario", but the move quickly faded and Gilts reversed to session lows.

- GGBs underperformed yet again, with a wiretap scandal continuing to pose political uncertainty.

- Otherwise very thin trading volumes, with all attention on Wednesday's US inflation report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 5-Yr yield is up 1.9bps at 0.688%, 10-Yr is up 2.2bps at 0.921%, and 30-Yr is up 3.6bps at 1.154%.

- UK: The 2-Yr yield is up 2.9bps at 1.927%, 5-Yr is up 3.9bps at 1.82%, 10-Yr is up 1.9bps at 1.971%, and 30-Yr is down 0.7bps at 2.345%.

- Italian BTP spread down 0.5bps at 214bps / Greek up 10.1bps at 228.3bps

FOREX: Initial Euro Strength Reverses, G10 Ranges Contained

- Currency markets traded in a subdued manner on Tuesday, with major pairs contained to narrow ranges ahead of the US inflation data tomorrow.

- There was some early Euro strength throughout the European session which saw EURUSD rise around 50 pips from 1.02 to a 1.0247 high and notably back above pre-NFP levels ~1.0230. The single currency bid helped the likes of EURAUD reverse a solid portion of the prior day’s retreat.

- This price action initially kept the USD index on the back foot for much of the session, however, a slow grind lower across major equity indices bolstered the greenback, with the DXY eventually turning positive nearing the APAC crossover. This led EURUSD back to levels just above the 1.0200 mark with the pair settling in the middle of its 1.0100-1.0300 range which it has respected for the past 16 trading days.

- AUDUSD (-0.49%) is the notable laggard, however, price action remains well within the bounds of Monday’s range. Very tentative price action in USDJPY, trading blows either side of the 135.00 mark and registering a significantly smaller 52-pip range on the day.

- The obvious potential catalyst for renewed currency volatility on Wednesday lies in the form of US inflation data at 1330BST/0830ET. Consensus shows headline CPI easing to +0.2% M/m from an unwind in energy prices, whilst core CPI is seen slowing from 0.7% to 0.5% M/m following three sizeable consecutive beats.

- There will also be Chinese CPI/PPI data released during the APAC session overnight.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/08/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/08/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 10/08/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 10/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/08/2022 | 1230/0830 | *** |  | US | CPI |

| 10/08/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 10/08/2022 | 1500/1100 |  | US | Chicago Fed's Charles Evans | |

| 10/08/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/08/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/08/2022 | 1800/1400 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.