-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yield Curves Resume Off Lows

EXECUTIVE SUMMARY

- US DATA: PPI Inflation Cools More Than Expected

- Oil output halted at three U.S. Gulf platforms on pipeline outage, Shell says, Rtrs

US

US DATA: PPI final demand inflation surprisingly fell -0.5% M/M (cons +0.2%), pushing the annual rate down from 11.3% to 9.8% Y/Y (cons 10.4%).

- Core measures of PPI (ex food & energy or ex food, energy & trade) also missed by two tenths at 0.2% M/M but that was more in line with yesterday's core CPI miss with the Bloomberg survey not materially updated.

- That said and very much at the margin, it's potentially a faster decline than it looks vs the core CPI miss seeing its version of airfares increased +1.1% M/M vs the -8% M/M decline in CPI.

- Initial claims meanwhile tick up 14k to 262k but were below consensus of 265k, from a downward revised 248k the prior week and outside of a payrolls reference week so likely to be downplayed.

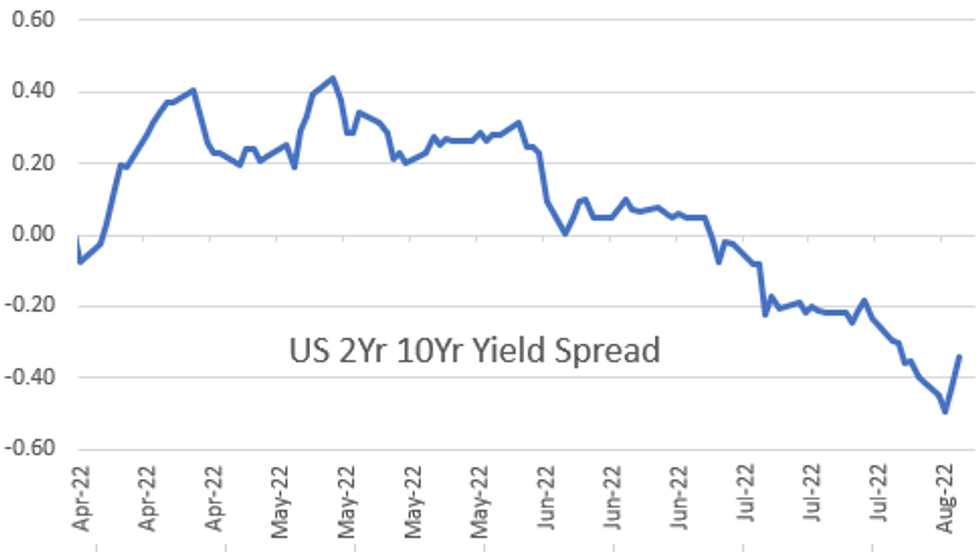

- Little immediate impact on 2Y Tsy yields before selling off 2.5bps and then giving most of it back over a space of 15 minutes to leaves yields -6.5bps on the day. 2s10s still sit at circa -40bps having been closer to -50bps prior to CPI yesterday at fresh post-2000 flats although still only back to late Fri/early Mon levels of inversion.

US TSYS: PPI Lower Than Expected, 30Y Bond Sale Tails

Yield curves continue to steepen off 22 year inverted lows (2s10s tapping -33.863 high, at -35.089 +8.642 after the bell) w/ carry-over selling in long as 30YY tapped 3.1877 high. Chunky block sales in 5s, 30s and 30Y Ultras adding to weaker tone ahead next week sees Tsy 20Y bond supply, retail sales anticipated to be strong- Short end holding onto cooler inflation (50bp hike over 75bp in Sep) after lower than expected PPI today, final demand inflation surprisingly fell -0.5% M/M (cons +0.2%), pushing the annual rate down from 11.3% to 9.8% Y/Y (cons 10.4%).

- Tys extend lows after $21B 30Y auction (912810TJ7) tails: 3.106% high yield vs. 3.092% WI; 2.31x bid-to-cover vs. 2.44x the prior month. Indirect take-up recedes to 70.65% vs. 73.20% in Jul; direct bidder take-up climbs to 18.51% vs. 16.34% prior; primary dealer take-up 10.84% vs.14.46%.

- Cross asset update: Stocks have trimmed gains, rotating around steady: SPX eminis currently trades -0.75 (-0.02%) at 4209.25; DJIA +19.59 (0.06%) at 33328.18; Nasdaq -72.2 (-0.6%) at 12782.35. Spot Gold little weaker at 1785.53 -6.85; Crude firmer (WTI +2.02 at 93.95) after reports of a leak at Fourchon forced Shell and Chevron to shut off near half dozen fields.

- Data on tap for Friday: Import/Export prices, University of Michigan Sentiment (52.5 est vs. 51.5 prior).

- Currently, 2-Yr yield is up 0.7bps at 3.2206%, 5-Yr is up 6bps at 2.9816%, 10-Yr is up 9.8bps at 2.8785%, and 30-Yr is up 13.3bps at 3.1656%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +14K TO 262K IN AUG 06 WK

- US PREV JOBLESS CLAIMS REVISED TO 248K IN JUL 30 WK

- US CONTINUING CLAIMS +0.008M to 1.428M IN JUL 30 WK

- US JULY PRODUCER PRICES FALL 0.5% M/M; EST. 0.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 36.6 points (0.11%) at 33343.52

- S&P E-Mini Future up 2.75 points (0.07%) at 4211.75

- Nasdaq down 62.4 points (-0.5%) at 12790.04

- US 10-Yr yield is up 9.8 bps at 2.8785%

- US Sep 10Y are down 19.5/32 at 119-4.5

- EURUSD up 0.0024 (0.23%) at 1.0323

- USDJPY up 0.07 (0.05%) at 132.96

- WTI Crude Oil (front-month) up $2.1 (2.28%) at $94.01

- Gold is down $4.15 (-0.23%) at $1788.22

- EuroStoxx 50 up 7.7 points (0.21%) at 3757.05

- FTSE 100 down 41.2 points (-0.55%) at 7465.91

- German DAX down 6.42 points (-0.05%) at 13694.51

- French CAC 40 up 21.23 points (0.33%) at 6544.67

US TSY FUTURES CLOSE

- 3M10Y +12.596, 31.24 (L: 12.618 / H: 32.772)

- 2Y10Y +9.106, -34.625 (L: -44.771 / H: -33.863)

- 2Y30Y +12.653, -5.908 (L: -17.98 / H: -5.249)

- 5Y30Y +7.644, 18.234 (L: 10.956 / H: 18.994)

- Current futures levels:

- Sep 2Y down 0.875/32 at 104-21.375 (L: 104-20.375 / H: 104-27.875)

- Sep 5Y down 7.75/32 at 112-10 (L: 112-07.5 / H: 112-30)

- Sep 10Y down 19.5/32 at 119-04.5 (L: 118-31 / H: 120-07.5)

- Sep 30Y down 1-28/32 at 140-02 (L: 139-24 / H: 142-27)

- Sep Ultra 30Y down 3-19/32 at 152-24 (L: 152-09 / H: 157-16)

US 10Y FUTURES TECH: (U2) Support Is Still Intact

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-22+ 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-27+ @ 11:33 BST Aug 11

- SUP 1: 119-16 Trendline support drawn from the Jun 16 low

- SUP 2: 119-07+ 50-day EMA

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries continue to trade closer to recent lows. The trend direction remains up and the latest move lower is still considered corrective. Importantly for bulls, the contract is trading above support at the 50-day EMA, which intersects at 119-07+. There is also a trendline support at 119-16. A break of this support zone would threaten the uptrend. A reversal higher would strengthen bullish conditions and refocus attention on 122-02.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.005 at 96.640

- Dec 22 -0.005 at 96.10

- Mar 23 -0.030 at 96.110

- Jun 23 -0.040 at 96.230

- Red Pack (Sep 23-Jun 24) -0.06 to -0.05

- Green Pack (Sep 24-Jun 25) -0.07 to -0.05

- Blue Pack (Sep 25-Jun 26) -0.105 to -0.08

- Gold Pack (Sep 26-Jun 27) -0.135 to -0.11

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00771 to 2.32400% (+0.01200/wk)

- 1M -0.00943 to 2.39100% (+0.02157/wk)

- 3M -0.01757 to 2.90514% (+0.03843/wk) * / **

- 6M -0.05786 to 3.48871% (+0.06314/wk)

- 12M -0.07000 to 3.92814% (+0.06828/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.92271% on 8/10/22

- Daily Effective Fed Funds Rate: 2.33% volume: $93B

- Daily Overnight Bank Funding Rate: 2.32% volume: $281B

- Secured Overnight Financing Rate (SOFR): 2.28%, $970B

- Broad General Collateral Rate (BGCR): 2.26%, $390B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $377B

- (rate, volume levels reflect prior session)

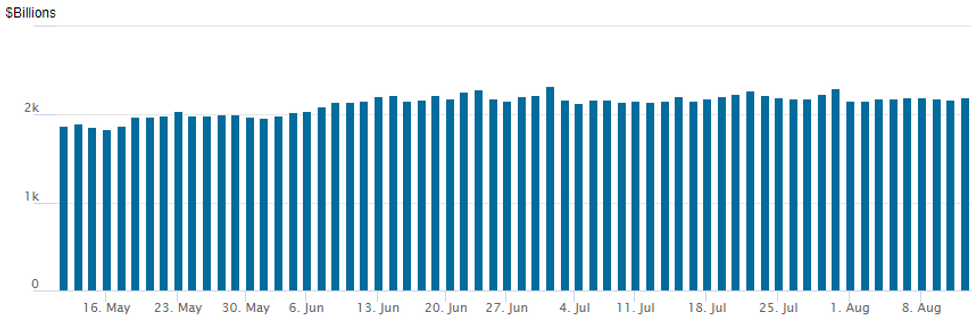

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,199.247B w/ 103 counterparties vs. $2,177.646B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $3.5B Santander 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/11 $3.5B #Santander $1.75B 3Y +195, $1.75B 5Y +230

- 08/11 $Benchmark Fairfax Financial 10Y +275a

EGBs-GILTS CASH CLOSE: 10Y Yields Hit August Highs

The German and UK curves bear steepened Thursday as some of the prior session's post-US CPI dovishness was reconsidered.

- The second weak US inflation print in as many days (PPI) saw limited immediate reaction, and the follow-through was actually bearish with Bund and Gilt yields reversing higher from session lows and steepening accelerating.

- Gilts underperformed Bunds, though 10Y yields on both curves hit their highest levels of the month - with the recent caveat that trading volumes today were very limited in typical August trade.

- Periphery spreads compressed despite a fairly soft tone in overall risk appetite (equities were flat/lower on the day).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2bps at 0.566%, 5-Yr is up 5.6bps at 0.712%, 10-Yr is up 8.3bps at 0.971%, and 30-Yr is up 10.2bps at 1.229%.

- UK: The 2-Yr yield is up 5.5bps at 2.002%, 5-Yr is up 8.2bps at 1.882%, 10-Yr is up 10.8bps at 2.059%, and 30-Yr is up 11.3bps at 2.449%.

- Italian BTP spread down 5.4bps at 205.9bps / Greek down 4.2bps at 226.6bps

FOREX: USD Index Matches Wednesday Low And Bounces

- The first half of Thursday’s session in currency markets saw general dollar weakness as markets continued to ponder the latest dip in US CPI data. As such, the USD index gravitated slowly towards Wednesday’s low print but momentum to the downside abruptly halted, and the greenback found firm support at this level.

- Fed rhetoric since the data points to officials being closely aligned that victory should not be declared and that the path for monetary policy in the short-term does not necessarily change. In similar price action to late yesterday, market participants were happy to sell rallies in US rates and the bear steepening of the yield curve appeared to support the US Dollar during the second half of the session.

- USDJPY once again traded in a volatile manner and was able to trade down to 131.74 amid the initial greenback weakness. However, the turnaround prompted a significant 125 pip rally back to the 133 mark as we approach the APAC crossover.

- EURUSD price action was considerably more subdued and the pair was unable to make a new high above 1.0368. A slow grind lower to 1.0315 as of writing indicates the pair may once again close below the channel top intersection (1.0344) and the notable breakdown pivot at 1.0341 dating back to Jan 2017. Note that a deeper pullback would be a bearish development and suggests a reversal lower inside the channel. Watch support at 1.0123, the Aug 3 low.

- Overall, daily adjustments for majors have remained subtle with NZD (+0.41%) outperforming and CNH (-0.31%) the laggard.

- First estimate of Q2 GDP from the UK highlights Friday’s European data calendar before Eurozone Industrial Output figures. In the US, UMich Consumer Sentiment data rounds off the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/08/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/08/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/08/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/08/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/08/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/08/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/08/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/08/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/08/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/08/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.