-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Off Lows Ahead Wed's Retail Sales, FOMC Min's

EXECUTIVE SUMMARY

MNI INTERVIEW: Fed To Hike More Than Markets Expect–Goodhart

MNI BRIEF: US Rents Seen Spiking To Mid-2023 Peak-Dallas Fed

MNI: US President Joe Biden is shortly due to sign the Inflation Reduction Act into law.

US

FED: The Federal Reserve will likely raise interest rates substantially more than markets are pricing in because inflation will prove stubborn even amid slowing economic activity, former long-time Bank of England member and adviser Charles Goodhart told MNI.

- Wall Street is betting the fed funds rate will peak around 3.6%, while Fed officials have signaled rates will end the cycle around 3.8%.

- “The problem is that you won’t get inflation back to target unless you get wage growth back to a consistent level,” Goodhart said in an interview. “And it will take quite a lot more to get wage growth down, which is one of the reasons that a recession is likely to be deeper than the Fed indicates.” Fore more see MNI Policy main wire at 1232ET Tuesday.

- Year-over-year OER inflation is expected: https://www.dallasfed.org/research/economics/2022/... to continue rising from 5.4% in June 2022 to 7.7% in May 2023 before easing and rent inflation is expected to increase from 5.8% in June 2022 to 8.4% in May 2023, rent and owners' equivalent rent inflation was expected to accelerate to 7% by early next year.

- The Inflation Reduction Act is a major legislative achievement of the Biden administration and a event will be held at the White House on Sept. 6 after lawmakers return from the summer Congressional recess.

- The primary problem for the White House is striking upon an effective strategy to sell the legislation to the electorate when the positive effectives of the legislation will not manifest until long after the midterm elections in November. Biden will host a cabinet meeting on the implementation of the legislation in the coming days and then, according to White House Chief of Staff Ron Klain, members of Biden's cabinet will travel to 23 states over 35 trips this month to tout the legislation.

US TSYS: Off Lows Ahead Wed's Retail Sales, July FOMC Minutes

Tsys remain weaker, but well off midmorning lows after mixed data: Housing starts weaker for third consecutive month (1.446M), Building Permits down 1.3% on the month still better than expected for second consecutive month (1.674M).

- Bonds extended lows yet again (30YY tapping 3.1703% high) after Industrial Production (+0.6% vs. 0.3% est), Capacity Utilization (80.3% vs. 80.2% est) both stronger than expected.

- Rates spent the rest of the session gradually scaling back from lows amid two-way flow session data out of the way, participants migrating to the sidelines ahead Wed's Retail Sales (0.1% est vs. 1.0% prior) not to mention July FOMC minutes release later in the session.

- Technicals for TYU2 currently trading 119-13 (-9.5) sustained losses through midmorning as prices fail to make any headway on 120-00 handle and 120-22 post-CPI high. Weakness at tail-end of last wk put contract through trendline support: 119-16 (Jun 16 low). Sales still considered corrective, however, the trendline break suggests a deeper retracement is likely near-term. This has opened 118-05, a Fibonacci retracement. Initial resistance to watch is 120-22, the Aug 10 high. A break would signal a possible bullish reversal.

- Additional trade tied to corporate debt issuance ($4.5B ADB 5Y SOFR+40 priced, several others including $3B KFW WNG 2Y SOFR and Goldman Sachs) generating two-way hedging/unwinds. Gradual pick-up in Sep/Dec roll volume as well.

OVERNIGHT DATA

- US JUL HOUSING STARTS 1.446M; PERMITS 1.674M

- US JUN STARTS REVISED TO 1.599M; PERMITS 1.696M

- US JUL HOUSING COMPLETIONS 1.424M; JUN 1.409M (REV)

- US JUL INDUSTRIAL PROD +0.6%; CAP UTIL 80.3%

- US JUN IP REV TO +0.0%; CAP UTIL REV 79.9%

- US JUL MFG OUTPUT +0.7%

- US REDBOOK: AUG STORE SALES +11.6% V YR AGO MO

- US REDBOOK: STORE SALES +12.7% WK ENDED AUG 13 V YR AGO WK

- CANADA JUL CPI INFLATION +0.1% M/M, +7.6% YY

- FOREIGN HOLDINGS OF CANADA SECURITIES -17.5B CAD IN JUN

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -12.3B CAD IN JUN

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 216.27 points (0.64%) at 34124.73

- S&P E-Mini Future up 5.25 points (0.12%) at 4303

- Nasdaq down 45.5 points (-0.3%) at 13080.64

- US 10-Yr yield is up 2.9 bps at 2.8168%

- US Sep 10Y are down 9.5/32 at 119-13

- EURUSD up 0.0004 (0.04%) at 1.0164

- USDJPY up 0.9 (0.68%) at 134.21

- WTI Crude Oil (front-month) down $3.22 (-3.6%) at $86.15

- Gold is down $2.89 (-0.16%) at $1776.80

- EuroStoxx 50 up 15.6 points (0.41%) at 3805.22

- FTSE 100 up 26.91 points (0.36%) at 7536.06

- German DAX up 93.51 points (0.68%) at 13910.12

- French CAC 40 up 22.63 points (0.34%) at 6592.58

US TSY FUTURES CLOSE

- 3M10Y -3.897, 14.503 (L: 9.017 / H: 19.661)

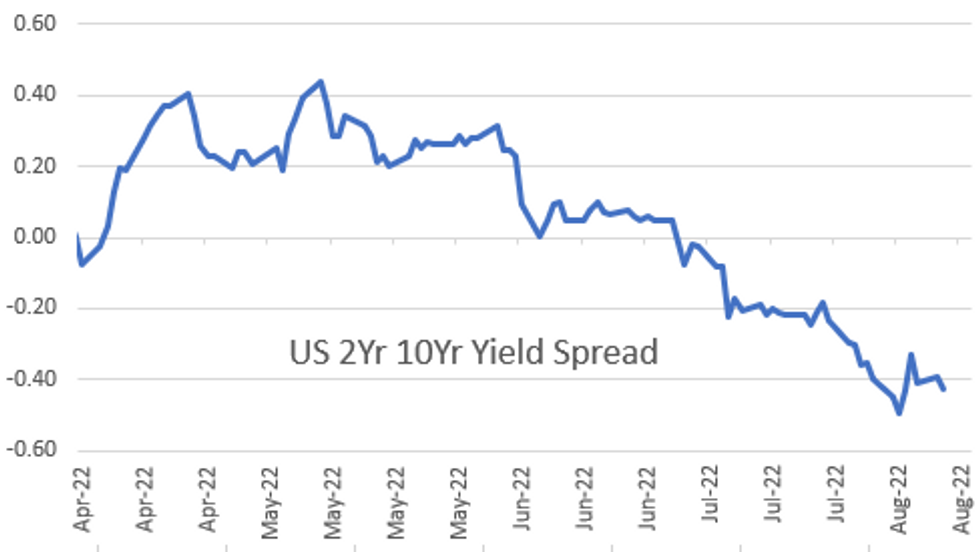

- 2Y10Y -2.964, -43.017 (L: -43.879 / H: -36.839)

- 2Y30Y -5.531, -14.237 (L: -15.443 / H: -6.655)

- 5Y30Y -4.821, 15.163 (L: 14.142 / H: 20.465)

- Current futures levels:

- Sep 2Y down 2.5/32 at 104-20.375 (L: 104-19.25 / H: 104-25.25)

- Sep 5Y down 6.75/32 at 112-11.25 (L: 112-07.75 / H: 112-22.75)

- Sep 10Y down 9/32 at 119-13.5 (L: 119-04 / H: 119-28.5)

- Sep 30Y down 9/32 at 141-8 (L: 140-03 / H: 141-27)

- Sep Ultra 30Y down 7/32 at 154-6 (L: 152-10 / H: 154-28)

US 10YR FUTURES TECHS: (U2) Bounce Falters Ahead of 120-00

- RES 4: 122-29+ High Mar 31

- RES 3: 122-16 2.0% 10-dma envelope

- RES 2: 120-29/122-02 High Aug 4 / High Aug 02

- RES 1: 120-22 High Aug 10

- PRICE: 119-06+ @ 15:25 BST Aug 16

- SUP 1: 118-30+/30 Low Aug 12 / Jul 22

- SUP 2: 118-05 50.0% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

Treasuries bounced through late Monday hours, but sustained losses through the Tuesday open. This sees prices fail to make any headway on the 120-00 handle and the 120-22 post-CPI high. Weakness at the tail-end of last week put the contract through trendline support at 119-16. The trendline is drawn from the Jun 16 low. The recent move lower is still considered corrective, however, the trendline break suggests a deeper retracement is likely near-term. This has opened 118-05, a Fibonacci retracement. Initial resistance to watch is 120-22, the Aug 10 high. A break would signal a possible bullish reversal.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.003 at 96.650

- Dec 22 -0.015 at 96.10

- Mar 23 -0.020 at 96.105

- Jun 23 -0.020 at 96.205

- Red Pack (Sep 23-Jun 24) -0.08 to -0.035

- Green Pack (Sep 24-Jun 25) -0.08 to -0.05

- Blue Pack (Sep 25-Jun 26) -0.04 to -0.01

- Gold Pack (Sep 26-Jun 27) -0.005 to +0.010

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00343 to 2.32229% (+0.00743/wk)

- 1M -0.00271 to 2.37700% (-0.00986/wk)

- 3M +0.01871 to 2.96057% (+0.03900/wk) * / **

- 6M -0.02700 to 3.50600% (-0.00329/wk)

- 12M -0.04386 to 3.95071% (-0.00829/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.96057% on 8/16/22

- Daily Effective Fed Funds Rate: 2.33% volume: $97B

- Daily Overnight Bank Funding Rate: 2.32% volume: $294B

- Secured Overnight Financing Rate (SOFR): 2.29%, $1.014T

- Broad General Collateral Rate (BGCR): 2.26%, $394B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $388B

- (rate, volume levels reflect prior session)

PIPELINE: $2B Goldman Sachs, $1.75B Ford Launch Late

$16.25B to price Tuesday:

- Date $MM Issuer (Priced *, Launch #)

- 08/16 $4.5B *ADB 5Y SOFR+40

- 08/16 $3B *KFW WNG 2Y SOFR+13

- 08/16 $2.5B #Goldman Sachs 6NC5 +152

- 08/16 $2B #Eaton Corp $1.3B +10Y +135, $700M 30Y +162.5

- 08/16 $1.75B #Ford 10Y Green 6.1%

- 08/16 $1.25B #CCDJ $750M 3Y +125, $500M 5Y +160

- 08/16 $1.25B #PNC Financial PerpNC5 6.2%

- Expected Wednesday:

- 08/17 $1B BNG Bank WNG 2Y SOFR+25a

- 08/17 $1B MuniFin WNG 5Y SOFR+52a

- 08/17 $Benchmark Export Development Bank of Canada 3Y SOFR+34a

EGBs-GILTS CASH CLOSE: BTPs Blow Out While UK Short End Underperforms

BTPs underperformed the European space as a whole Tuesday, while Gilts weakened vs Bunds.

- Widening BTP spreads (10Y yields rose the most since Jun 14, up 20+bp at session highs) couldn't be pinned to any particular catalyst but political risk ahead of September elections and thin trading volumes contributed.

- The Gilt curve bear flattened with 2Y yields briefly hitting 2-month highs; some desks cited strong wage pressures in this morning's employment report potentially encouraging more BoE hikes.

- Supply consisted of Bobl and Gilt, little reaction. The only remaining auction this week is France (Thurs).

- UK July CPI takes centre stage Wednesday, with Eurozone GDP up later in the morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.7bps at 0.577%, 5-Yr is up 6.6bps at 0.744%, 10-Yr is up 7.1bps at 0.971%, and 30-Yr is up 7.5bps at 1.23%.

- UK: The 2-Yr yield is up 12.3bps at 2.155%, 5-Yr is up 11bps at 1.965%, 10-Yr is up 10.8bps at 2.125%, and 30-Yr is up 8bps at 2.515%.

- Italian BTP spread up 8.8bps at 216.3bps / Greek up 7.6bps at 236.5bps

FOREX: JPY Under Pressure As Core Yields Reverse Monday Price Action

- The Japanese Yen was the poorest performer in G10 FX on Tuesday as global fixed income markets reversed Monday’s price action and core yields took a leg higher.

- USDJPY (+0.68%) took out the Monday highs in early Europe and the rally gained momentum as we broke back above 134, narrowing the gap with the pre-US CPI levels for the pair around the 135 mark. Firm short-term resistance has been defined at 135.58, the Aug 8 high.

- USDJPY’s ascent lent overall support to the dollar index, which extended north of the Monday highs and briefly made a new high for August at 106.94. However, greenback momentum from this point waned and after the DXY had reversed to unchanged levels on the day, FX markets were happy to consolidate ahead of tomorrow’s data.

- Both EUR and GBP traded higher as a result of the greenback’s turnaround, however they both remain comfortably below the week’s opening levels as the European energy crisis continues to loom in the backdrop.

- The Chinese offshore Yuan saw a moderate pullback after Monday’s significant drop. USDCNH (-0.30%) dropped back to 6.7908 and looks set to close around yesterday’s breakout point around 6.7950.

- Focus overnight will be on the RBNZ rate decision. With a 50bp OCR hike seen as a done deal this week, the focus will fall on the Reserve Bank's forward-looking comments, with particular emphasis on the OCR track. The tone of this MPS will be set by the combination of hints on how policymakers are planning to handle the inflation/growth dilemma further down the road.

- Elsewhere, Australia wage price index data will precede the Uk’s release of July CPI and Eurozone GDP. The focus will then turn to US July Retail Sales and the release of the FOMC minutes.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/08/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/08/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 17/08/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/08/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 17/08/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 17/08/2022 | 0900/1100 | * |  | EU | Employment |

| 17/08/2022 | 0900/1100 | *** |  | EU | GDP (p) |

| 17/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/08/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/08/2022 | 1330/0930 |  | US | Fed Governor Michelle Bowman | |

| 17/08/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 17/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/08/2022 | 1820/1420 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.