-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: New ADP Wed, Improved Signal for NFP?

EXECUTIVE SUMMARY

US

FED: If economic data start to show a clear slowing in inflation, it might give the Federal Reserve room to slow the pace of hikes from supersized 75 basis point moves, Atlanta Fed President Raphael Bostic said Tuesday.

- Most Fed officials have yet to clearly endorse either a 50 basis point hike or 75 at the September meeting, but some are offering more explanation of their reaction function. Futures markets are currently pricing in a 75% chance of a third 75 basis point move.

- "Even though it will take time to see the full effect of the policy adjustments we have made to date, I don't think we are done tightening," he said in a message published on the Atlanta Fed's website: "Inflation remains too high, and our policy stance will need to move into restrictive territory if inflation is to come down expeditiously.

- That said, incoming data - if they clearly show that inflation has begun slowing - might give us reason to dial back from the hikes of 75 basis points that the Committee implemented in recent meetings. We will have to see how those data come in," said Bostic, who is not a FOMC voter this year, noting that this summer's data showed "glimmers" of good news on the fight against inflation.

FED: he Federal Reserve needs to get inflation-adjusted rates above zero in order to weaken demand in the economy enough to bring down inflation toward the Fed's target, New York Fed President John Williams said Tuesday, adding he has still not decided whether a 50 bps or 75 bps rate hike will be appropriate at the September meeting.

- "We do need to get real interest rates, that's the interest rate adjusted for inflation, above zero. We need to have a somewhat restrictive policy to slow demand," Williams said in a live interview with The Wall Street Journal. "So if you think next year inflation is say somewhere 2.5% to 3% -- that's a lot lower than it is now but that's a forecast that I think is reasonable, then you're thinking about having interest rates well above that."

- ADP and the "Stanford Digital Economy Lab (the Lab) have developed a new methodology for the ADP National Employment Report (NER) that will provide a more robust, high-frequency view of the labor market with a focus on both jobs and pay. Using fine-grained data, this new measure will deliver a richer labor market analysis that will help answer key economic and business questions and offer insights relevant to a broader audience."

- JPM analysts think "the most important aspects of the report will be an estimate of the monthly nonfarm private employment change ahead of the related BLS reading (similar to what was included in the prior ADP reports) and an estimate of the median annual pay growth (a new feature of the ADP report)."

US TSYS: Policy Heads, Data, Geopol Risk Triggers Early Volatility

Tsys weaker after the bell, near middle of session range after volatile first half. Whippy price action after extending past overnight lows in early NY trade from nearly testing highs and now extending lows w/ 30YY tapping 3.2577% high. Several factors at play include policy headlines, geopol risk and data both domestic and foreign:

- Tsys pared early gains as Richmond Fed Barkin discussed economic outlook, "RECESSION IS RISK IN GETTING INFLATION UNDER CONTROL .. DOESN'T EXPECT INFLATION TO COME DOWN IMMEDIATELY, Bbg.

- Additional selling across the board on ECB'S KNOT comments/headlines: NOT CONVINCED THAT GOING BACK TO NEUTRAL ENOUGH .. MARKET PRICING OF RATE HIKE IN SEPT NOT UNWISE .. LEANING TOWARDS 75 BPS BUT OPEN TO DISCUSSION, Bbg.

- Meanwhile, UK Gilt yields climbing to mid-2014 levels, 10Y 2.75%, 30Y 3.03% as Goldman Sachs analysts warn "UK inflation could top 22% next year if natural gas prices remain elevated in the coming months", Bbg.

- Fast risk-off bid (that also spurred lows in stocks at the time on uptick in China/Taiwan tensions for risk-off move: headlines re: Taiwan fired warning shots at China drone spotted near an offshore island.

- Midmorning JOLTs number surprised by 864k to the upside - that's the fourth largest upside surprise of the past decade (only beaten in April 2021, May 2020 and July 2021). Data likely to give the Fed confidence at their upcoming policy meeting for a large move, particularly if backed up by strong Aug employment read this Friday (+300k est vs. +528k prior).

- Reminder, ADP will release it's retooled private-sector employment report early Wednesday (0815ET) after pausing the report back on June 30

OVERNIGHT DATA

- US JUN FHFA HPI SA +0.1% V +1.3% MAY; +16.2% Y/Y

- US Q2 FHFA HPI Q/Q SA +4.0% V +17.7% Q2 2021

- US AUG. CONSUMER CONFIDENCE AT 103.2; EST. 98.0

- US REDBOOK: AUG STORE SALES +12.7% V YR AGO MO

- US REDBOOK: STORE SALES +14.2% WK ENDED AUG 27 V YR AGO WK

MARKETS SNAPSHOT

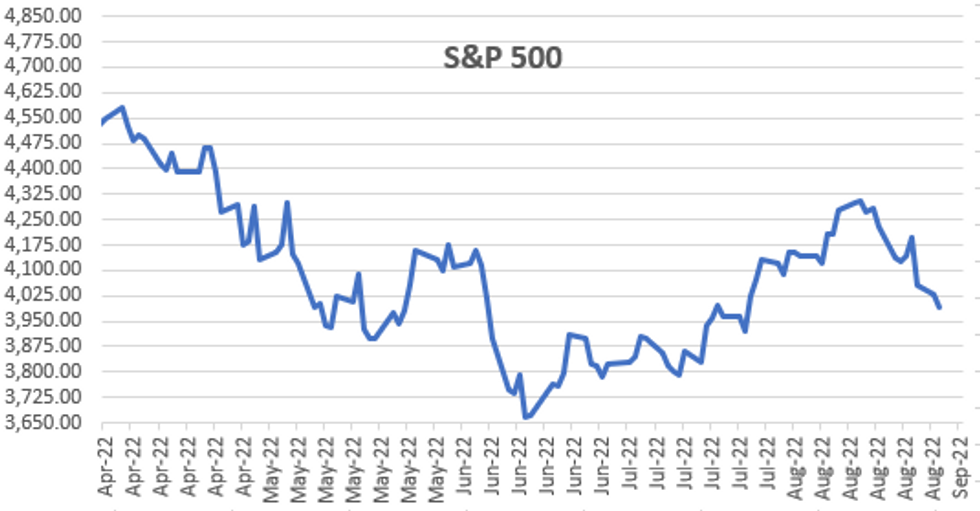

Key late session market levels:- DJIA down 303.16 points (-0.94%) at 31796.56

- Nasdaq down 147.8 points (-1.2%) at 11870

- US 10-Yr yield is up 0.2 bps at 3.1043%

- US Sep 10Y are down 0.5/32 at 117-0.5

- EURUSD up 0.0031 (0.31%) at 1.0028

- USDJPY down 0.08 (-0.06%) at 138.64

- WTI Crude Oil (front-month) down $5.19 (-5.35%) at $91.75

- Gold is down $11.46 (-0.66%) at $1725.65

European bourses closing levels:

- EuroStoxx 50 down 8.59 points (-0.24%) at 3561.92

- FTSE 100 down 65.68 points (-0.88%) at 7361.63

- German DAX up 68.15 points (0.53%) at 12961.14

- French CAC 40 down 12.06 points (-0.19%) at 6210.22

US TSY FUTURES CLOSE

- 3M10Y -4.808, 14.981 (L: 7.102 / H: 20.248)

- 2Y10Y -3.687, -36.176 (L: -38.842 / H: -31.941)

- 2Y30Y -6.118, -25.06 (L: -25.757 / H: -18.214)

- 5Y30Y -4.58, -5.971 (L: -6.058 / H: -0.431)

- Current futures levels:

- Sep 2Y down 2.5/32 at 104-7.75 (L: 104-05.5 / H: 104-12.375)

- Sep 5Y down 1.75/32 at 110-25.5 (L: 110-20.25 / H: 111-04)

- Sep 10Y down 0.5/32 at 117-0.5 (L: 116-22.5 / H: 117-14.5)

- Sep 30Y up 8/32 at 136-26 (L: 136-03 / H: 137-14)

- Sep Ultra 30Y up 28/32 at 150-22 (L: 149-14 / H: 151-11)

US 10YR FUTURE TECHS: (Z2) Remains Vulnerable

- RES 4: 120-02+ High Aug 15

- RES 3: 119-18 High Aug 17

- RES 2: 118-25+ 50-day EMA

- RES 1: 118-00/17+ High Aug 26 / 20-day EMA

- PRICE: 117-02+ @ 16:47 BST Aug 30

- SUP 1: 116-24 Low Aug 30

- SUP 2: 116-08 Low Jun 28

- SUP 3: 116-01+ 76.4% retracement of the Jun 14 - Aug 2 bull run

- SUP 4: 114-26 Low Jun 16

The outlook for Treasuries remains bearish and the contract traded lower again Tuesday, slipping further below last week’s low of 117-06 on Aug 24/25. This highlights a resumption of the current bear cycle and opens 116-08 next, the Jun 28 low. Further out, attention is on 116-01+, a Fibonacci retracement. Initial resistance has been defined at 118-00, Friday’s high. The 50-day EMA, at 118-25+ marks a firmer resistance.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.008 at 96.598

- Dec 22 -0.015 at 95.90

- Mar 23 -0.040 at 95.860

- Jun 23 -0.055 at 95.890

- Red Pack (Sep 23-Jun 24) -0.06 to -0.03

- Green Pack (Sep 24-Jun 25) -0.015 to steady

- Blue Pack (Sep 25-Jun 26) +0.005 to +0.015

- Gold Pack (Sep 26-Jun 27) +0.015 to +0.025

SHOR TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N -0.00085 to 2.30829% (-0.01200 total last wk)

- 1M +0.04014 to 2.56400% (+0.09858 total lastwk)

- 3M +0.01257 to 3.08214% (+0.11186 total lastwk) * / **

- 6M +0.02900 to 3.59543% (+0.01886 total lastwk)

- 12M +0.03657 to 4.15986% (+0.10473 total lastwk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.08214% on 8/30/22

- Daily Effective Fed Funds Rate: 2.33% volume: $89B

- Daily Overnight Bank Funding Rate: 2.32% volume: $265B

- Secured Overnight Financing Rate (SOFR): 2.28%, $963B

- Broad General Collateral Rate (BGCR): 2.26%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $383B

- (rate, volume levels reflect prior session)

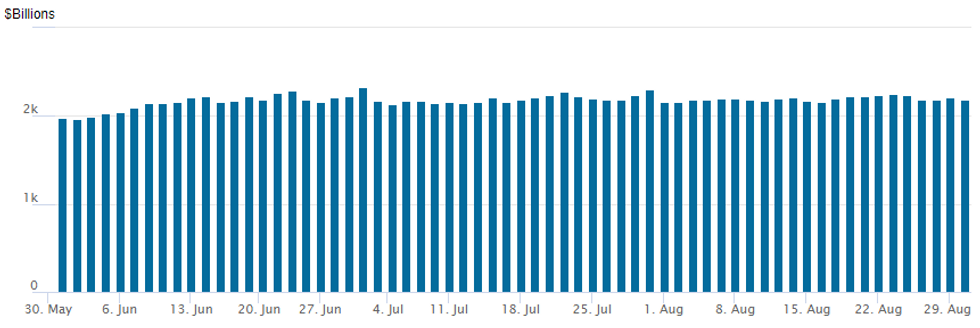

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages recedes to $2,188.975B w/ 101 counterparties vs. $2,205.188B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: Korean Development Bank US$/EUR Denominated Register

Quiet end to August after strong $165.7B total high grade issuance for the month

- Date $MM Issuer (Priced *, Launch #)

- 08/30 $Benchmark Korea Development Bank (KDB) looking into US$/EUR 3Y fix/FRN, 10Y issuance

- 08/29 No new issuance Monday

FOREX: Greenback Claws Back Losses As Equities Sink, EUR Outperforms

- Further relief for gas futures in Europe set a positive early tone for risk in the first half of Tuesday’s session which placed initial pressure on the greenback. However, a sharp turnaround for major equity benchmarks and a set of stronger US data (above estimate consumer confidence and JOLTS figures) altered market sentiment which allowed the USD to trade back to flat for the day.

- The weaker risk sentiment along with sharp moves to the downside for crude futures weighed on the likes of AUD, CAD and NOK. CHF was also among the poorest performers on the day, with EUR/CHF printing a higher high for a sixth consecutive session and putting the cross on track to test the 0.9819 50-dma.

- Outperforming on Tuesday was the Euro amid several more ECB governing board members hinting at the inevitable discussion of increasing the hiking pace at next week’s meeting. While this has already been alluded to since Friday, the ongoing rhetoric continues to bolster the single currency, alongside the retreating gas prices.

- In turn, Euro crosses continue their bounce with EURAUD now an impressive 2.3% higher than Friday’s lows.

- In emerging markets, the Hungarian Forint rallied 1.5% following the NBH rate decision and its commitment to a “decisive continuation” of its monetary tightening cycle. On the contrary, a weaker risk backdrop weighed on LatAm FX with USDMXN bouncing close to 1.5% from intra-day lows back to ~20.20.

- Chinese Manufacturing PMI data is due overnight before the Eurozone HICP Flash Estimate for August, expected to rise to 9.0%. New methodology for US ADP will be released tomorrow before the MNI Chicago Business Barometer. The focus remains on Friday’s US employment report for August.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 31/08/2022 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 31/08/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/08/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/08/2022 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/08/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/08/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 31/08/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/08/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/08/2022 | 1200/0800 |  | US | Cleveland Fed's Loretta Mester | |

| 31/08/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 31/08/2022 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/08/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 31/08/2022 | 2200/1800 |  | US | Dallas Fed's Lorie Logan | |

| 31/08/2022 | 2230/1830 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.