-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - EURUSD Bounces Off Lows Pre-ECB

- TREASURIES RETRACE YESTERDAY'S LARGE SELL-OFF ON GROWTH CONCERNS AS OIL TUMBLES

- FED HIKE EXPECTATIONS LEANING CLOSER TO 75BPS FOR SEPTEMBER FOMC

- EURUSD SEES STRONG BOUNCE OFF LOWS AHEAD OF ECB

- 2Y GILT YIELDS DROP SHARPLY ALONGSIDE 2023 BOE HIKE PRICING

US TSYS: Treasuries Rally Back On Growth Concerns As Attention Turns To ECB, Powell

- Treasuries have seen a sizeable rally on softer growth fears, with yields helped lower early from continued China lockdowns, the latest being Chengdu extending lockdowns from tomorrow, which have coincided with oil woes. Not a direct driver but supportive of the move has been the Fed’s Beige Book more recently showing weak growth expectations over the next six to twelve months, along with at the margin a downward revision for Atlanta Fed GDPNow from 2.6% to 1.4% for Q3.

- September FOMC pricing slightly remains up on the day at 69bps after the earlier WSJ’s Timiraos piece leaning to a 75bp rather than 50bp hike but the terminal sees a modest trimming to 3.91% in Mar’23 from highs of 3.96%.

- Yields remain within yesterday’s even larger range though, with 2YY -6.2bps at 3.441, 5YY -8.8bps at 3.364%, 10YY -8.0bps at 3.269% and 30YY -8.8bps at 3.413%.

- TYZ2 trades 17 ticks higher at 116-04, pulling back after yesterday’s clearance of a bear trigger and today’s further low of 115-13+. The recent trend has been downward, but should today’s upward momentum continue, resistance is seen at 116-26 (Sep 2 high).

EGBs-GILTS CASH CLOSE: UK 2s Rally, Bunds Stronger Pre-ECB

The UK curve bull steepened violently Wednesday as BoE rate hike expectations were pared back, while EGBs were relatively steady with peripheries outperforming ahead of Thursday's ECB decision.

- 2Y UK yields were briefly poised for their biggest drop since 2009, with more than one 25bp hike priced out of the BoE hiking path at one point with senior BoE officials' TSC testimony were seen leaving a 50bp or 75bp hike next week "on a knife edge".

- Pricing is about the same now for the ECB (preview here) and BoE Sept meetings, at 65-66bp.

- The German curve bull flattened, while periphery EGB spreads fell ahead of the ECB, led by BTPs.

- Thursday is shaping up as very busy, both with the ECB meeting, and potentially more info on the UK fiscal package to be unveiled (which would impact BoE pricing).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.3bps at 1.105%, 5-Yr is down 4bps at 1.374%, 10-Yr is down 6.1bps at 1.577%, and 30-Yr is down 7.8bps at 1.681%.

- UK: The 2-Yr yield is down 20.2bps at 3.001%, 5-Yr is down 11bps at 2.917%, 10-Yr is down 6.7bps at 3.034%, and 30-Yr is down 4.4bps at 3.369%.

- Italian BTP spread down 7.1bps at 229.1bps / Greek down 2.1bps at 257.9bps

FOREX: EURUSD Strong Bounce Off Lows, EURJPY Approaches Cluster Resistance

- Lower energy prices on the continent (notably European natgas futures falling around 11%) have bolstered risk sentiment on Wednesday, strengthening equity markets and providing firm support for the Euro.

- EURUSD has recovered around 125 pips from the lows to trade back at parity amid the more positive backdrop with a potential position squaring dynamic also in play ahead of tomorrow’s ECB meeting.

- Interestingly, there are 2.2B of expiries at 1.0000 for tomorrow’s NY cut, which has the potential to be magnetic in the immediate aftermath of the ECB’s decision and press conference.

- The USD index looks set to post 0.5% losses with a relatively dovish Fed’s Brainard providing a further boost to equities and weighing further on the greenback in late trade ahead of the APAC crossover.

- Despite this USD turnaround, coinciding with 145.00 capping the USDJPY price action, EURJPY continues to hug session highs and it is worth noting the pair is approaching strong cluster resistance, with four daily highs between 144.18-28. This week’s impulsive gains reinforce current bullish conditions for the pair and the move higher maintains a positive price sequence of higher highs and higher lows.

- The next two levels of note on the topside would be 145.00 (psychological round number) and then 145.48, Jan 1, 2015 high.

JAPAN: How Has Japan's FX Language Changed Amid the USD/JPY Rally?

- With USD/JPY's incline accelerating not just in September, but across the entirety of 2022, the authorities' approach to currency has evolved. Despite the step-up in language, however, authorities look unlikely to intervene while yield spreads and FX rates remain coupled.

- Today's missive in Jiji from finance minister Suzuki was a notable step-up in communication, with the phrase 'one-sided' appearing for the first time since 2018: "moves in JPY are one-sided, I am concerned".

- Asakawa, former senior FX policy bureaucrat, and Aso, former finance minister, were the last to use the phrase, but were addressing USD/JPY's decline from Y112 to Y106. That phase of JPY strength concluded with no official intervention.

- The language tweak has so far failed to reverse the tide for USD/JPY, with markets focusing instead on the presence of a number of phrases that are becoming more routine: "weak JPY has merits and demerits", "sudden moves are undesirable", "closely watching negative impacts of weak JPY".

- Similarly, Suzuki's comment as of end-August that FX moves were "basically inline with fundamentals" feeds into the view that as long as US-Japan yield differentials are coupled with the exchange rate, the authorities will learn to live with a higher exchange rate as an indirect consequence of the BoJ's YCC.

- Another convening of the BoJ, MoF and FSA, however, would raise speculation of near-term action. The three authorities last met in June, but only a material breakdown in the yield/FX correlation will likely trigger action now.

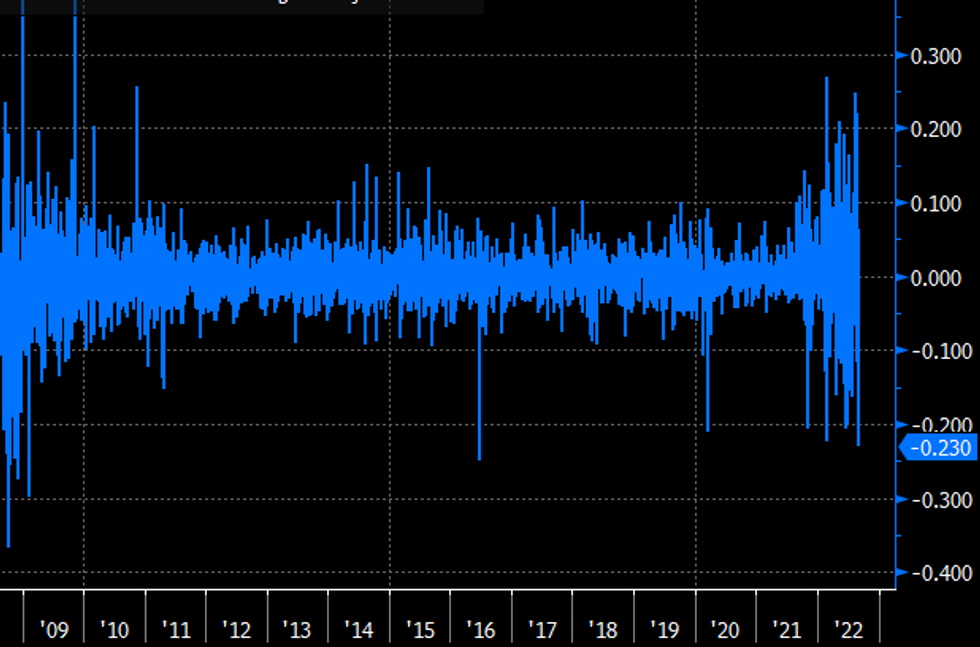

GILTS: 2Y Yields Drop Sharply Alongside 2023 BoE Hike Pricing

The 2Y UK bond yield has fallen as much as 25.2bp today following commentary by key BoE officials that has left a 50bp or 75bp hike next week "on a knife edge".

- That has cratered BoE pricing - while the September decision remains a close call, further out the strip we've seen more dramatic moves: June 2023 implied was 4.45% this morning, but It has dropped as far as 4.10%.

- Today's 2Y yield drop is being compared to the 25bp drop by the close on June 24, 2016 (post Brexit referendum). Before that you'd have to go to Feb 2009 for a bigger drop (just under 30bp).

- 2Y yields are now off 30bp from the post-2008 high set yesterday. To put this into perspective though, 2Y yields are still up 78bp vs a month ago, and traded with a 1-handle as recently as August 11th.

- And put into the context of broader short-end volatility (August saw two 20+bp daily moves) , today's drop looks more of a retracement after a sharp move higher than a fundamental change of direction.

COMMODITIES: WTI Hits Eight-Month Low On Demand Concerns

- Crude oil has tumbled today on expectations of softer demand, with China oil imports falling 1mbpd and further regions being put into lockdown, most recently Chengdu from Sep 8, coming at the end of the US driving season, seeing WTI hit an eight-month low.

- WTI is -5.6% at $82.01, which having cleared the key support at $85.37 (Aug 16 low) is homing in on support at $81.88 (Feb 25 low).

- The current most active strikes for the session for CLV2 has been $75/bbl puts.

- Brent is -5.2% at $87.99, clearing the key bear trigger of $89.06 (Jul 14 low) and next eyeing $87.50 (Mar 15 low).

- Gold meanwhile is +0.8% at $1715.36 as it finds respite from a weaker dollar and lower Tsy yields. It remains within yesterday’s range though with resistance at the intraday high of $1726.7 after which sits $1735.5 (20-day EMA).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/09/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 08/09/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/09/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 08/09/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/09/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 08/09/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 08/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 08/09/2022 | 1245/1445 |  | EU | ECB Post-Meeting Press Conference | |

| 08/09/2022 | 1310/0910 |  | US | Fed Chair Jerome Powell | |

| 08/09/2022 | 1400/1000 | * |  | US | Services Revenues |

| 08/09/2022 | 1415/1615 |  | EU | ECB President Lagarde's Podcast | |

| 08/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/09/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 08/09/2022 | 1525/1125 |  | CA | BOC Deputy Rogers "Economic Progress Report" speech | |

| 08/09/2022 | 1530/1130 |  | US | New York Fed's Patricia Zobel | |

| 08/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/09/2022 | 1600/1200 |  | US | Chicago Fed's Charles Evans | |

| 08/09/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.