-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FOMC Restrictive Policy for Some Time

EXECUTIVE SUMMARY

- MNI: Fed Hikes Rates By 75BPS, Sees 4.6% Peak Rate

- MNI BRIEF: Powell-Need Restrictive Policy For Some Time

- MNI BRIEF: Powell Says MBS Sales Not Under Consideration

US

FED: The Federal Reserve on Wednesday raised interest rates by another aggressive 75 basis points, the third such increase in as many meetings and part of the most accelerated rate hike campaign since the Volcker era, while charting a more aggressive path for how high rates need to go to control inflation.

- The increase brought the federal funds rate to a range between 3% and 3.25%. The Fed also sharply boosted its forecast for where interest rates are likely to peak next year to 4.6% from its June forecast of 3.8%. “Recent indicators point to modest growth in spending and production,” the FOMC said in a statement.

- The Fed’s view of PCE inflation was revised higher to 5.4% at the end of 2022 from 5.2% in June while officials now see the measure closing 2023 at 2.8%, up from 2.6% in the last SEP. For more see MNI Policy main wire at 1401ET.

FED: Federal Reserve Chair Jerome Powell says officials are looking for compelling evidence that inflation is moving back down to target before easing off from its aggressive monetary tightening stance. “We'll need to bring our funds rate to a restrictive level and to keep it there for some time,” Powell told reporters.

- “Reducing inflation is likely to require a sustained period of below-trend growth and will likely require some softening in the labor market.” Ahead of the FOMC meeting, MNI reported that the Fed would likely raise its terminal fed funds rate substantially, and the committee delivered just such a decision.

FED: The Federal Reserve is not currently considering sales of MBS in order to speed up its balance sheet runoff, Fed Chair Jerome Powell said Wednesday. "We're not considering that and I don't expect that we will anytime soon," he told reporters.

- Cleveland Fed President Loretta Mester told an MNI webcast this month that MBS sales should be on the table as a policy option.

US TSYS: Digesting Hawkish Forward Guidance

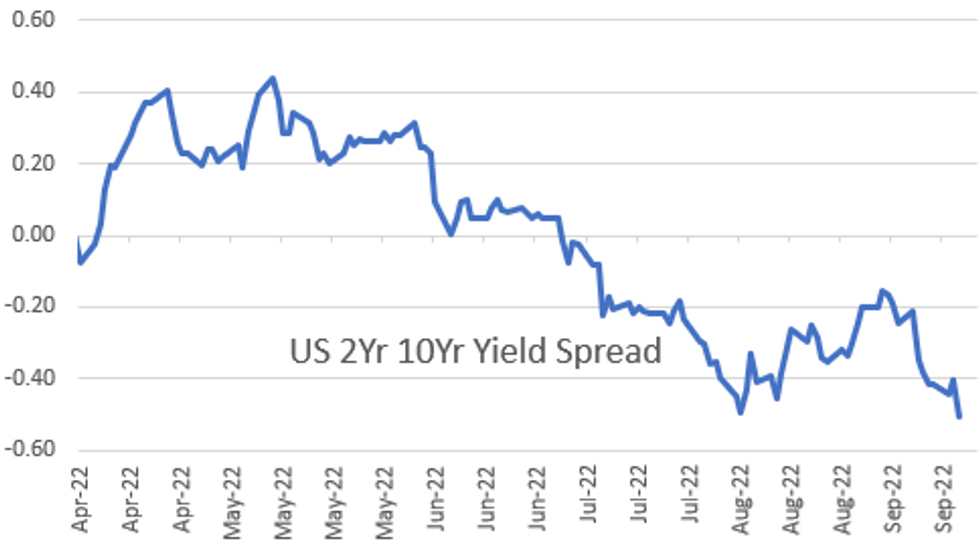

Markets still reacting to FOMC's expected 75bp hike but digesting forward guidance as bonds mark new highs, curves extending inversion w/2YY back over 4.0% to 4.0378% at the moment, stocks extending lows after bouncing to new session highs following initial FOMC react.

- Stocks made new lows (3802.25) after initial selling sent SPX to 3836.75 low. Hawkish forward guidance weighed on equities and helped push 2YY to new 15 year highs of 4.1168%, yield curves extending inversion (2s10s -53.757 low).

- The Fed also sharply boosted its forecast for where interest rates are likely to peak next year to 4.6% from its June forecast of 3.8%. “Recent indicators point to modest growth in spending and production,” the FOMC said in a statement.

- Flipside to hiking to is prospect of cutting rates as price stability and inflation comes back to 2.0% target helping current rebound with SPX tapping 3918.75 high.

- Timing of Chair Powell comment on recession risk: "no one knows whether this process will lead to a recession or if so, how significant that recession would be," coincided with dip in stocks to 3890.0. Late risk-off on question regarding economic pain and potential "difficult correction" to get housing fundamentals back in balance.

- Smaller than expected August existing home sale -0.4% decline to 4.80M, helped buoyed 2Y yields as pace slowed abruptly from the -5.7% in July and an average monthly decline of almost -5% through 1H22.

- The 2-Yr yield is up 6.7bps at 4.0335%, 5-Yr is down 0.2bps at 3.7449%, 10-Yr is down 4.5bps at 3.5181%, and 30-Yr is down 7.3bps at 3.4978%.

OVERNIGHT DATA

- MNI: US AUG EXISTING HOME SALES -0.4% TO 4.80M SAAR

- NAR: AUG SALES WEAKEST SINCE MAY'20 OR NOV'15 PRE-PANDEMIC

- NAR'S YUN: RECENT HOME PRICE DECLINES LARGER THAN USUAL

- US EIA: CRUDE OIL STOCKS EX SPR +1.14M TO 430.8M SEP 16 WK

- US EIA: DISTILLATE STOCKS +1.23M TO 117.2M IN SEP 16 WK

- US EIA: GASOLINE STOCKS +1.57M TO 214.6M IN SEP 16 WK

- US EIA: CUSHING STOCKS +0.34M TO 25.0M BARRELS IN SEP 16 WK

A Pause In The Existing Home Sales Slide

- Existing home sales help 2Y Tsy yields rise to cycle highs with a smaller than expected decline in August of -0.4% M/M (cons. -2.3%) as the pace slowed abruptly from the -5.7% in July and an average monthly decline of almost -5% through 1H22.

- That's despite price growth continuing to cool, with NAR’s Yun noting recent declines are larger than usual. Median price growth slowed to 7.7% Y/Y from a most recent peak of 15% in May’22 and cycle peak of 25% May’21.

- Levels of inventory held at 3.2 months of current sales after strong increases, which despite being a sizeable increase in supply compared to post-pandemic levels, remains tight compared to the 2019 average of 3.9.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 419.38 points (-1.37%) at 30288.65

- S&P E-Mini Future down 53.5 points (-1.38%) at 3819.75

- Nasdaq down 157.1 points (-1.4%) at 11269.64

- US 10-Yr yield is down 4.5 bps at 3.5181%

- US Dec 10Y are up 6.5/32 at 114-1.5

- EURUSD down 0.012 (-1.2%) at 0.9851

- USDJPY up 0.19 (0.13%) at 143.95

- Gold is up $7.21 (0.43%) at $1672.05

- EuroStoxx 50 up 24.78 points (0.71%) at 3491.87

- FTSE 100 up 44.98 points (0.63%) at 7237.64

- German DAX up 96.32 points (0.76%) at 12767.15

- French CAC 40 up 51.86 points (0.87%) at 6031.33

US TSY FUTURES CLOSE

- 3M10Y -2.655, 21.89 (L: 15.343 / H: 27.85)

- 2Y10Y -11.408, -51.962 (L: -53.757 / H: -39.425)

- 2Y30Y -14.114, -53.903 (L: -55.941 / H: -38.22)

- 5Y30Y -7.404, -25.152 (L: -28.456 / H: -16.207)

- Current futures levels:

- Dec 2Y down 5.25/32 at 103-0.5 (L: 102-27.25 / H: 103-08.875)

- Dec 5Y down 1.5/32 at 108-21.5 (L: 108-05.75 / H: 108-31.5)

- Dec 10Y up 6/32 at 114-1 (L: 113-09.5 / H: 114-10)

- Dec 30Y up 29/32 at 130-24 (L: 129-09 / H: 130-31)

- Dec Ultra 30Y up 2-10/32 at 143-27 (L: 141-13 / H: 143-31)

US 10YR FUTURE TECHS: (Z2) Trend Needle Still Points South

- RES 4: 118-00 High Aug 26

- RES 3: 117-08 50 day EMA values

- RES 2: 115-29+/116-26 20-day EMA / High Sep 2

- RES 1: 115-01 High Sep 15

- PRICE: 114-02 @ 11:07 BST Sep 21

- SUP 1: 113-20+ Low Sep 20

- SUP 2: 113-19 Low Jun 19 2009 (cont)

- SUP 3: 113-06 2.236 proj of the Mar ‘20 - Apr ‘21 - Aug ‘21 swing

- SUP 4: 112-25+ Low Jun 11 2009

Treasuries remain soft and the contract traded lower Tuesday. Importantly for bears, price has breached key support at 114-06, the Jun 14 low. This confirms a resumption of the broader downtrend and strengthens the underlying bearish condition. The 114.00 handle has been cleared, the focus is on 113-19, the Jun 19 2009 low (cont). Initial firm resistance is at 115-29+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.10 at 95.330

- Mar 23 -0.130 at 95.190

- Jun 23 -0.150 at 95.225

- Sep 23 -0.140 at 95.395

- Red Pack (Dec 23-Sep 24) -0.12 to -0.045

- Green Pack (Dec 24-Sep 25) -0.015 to +0.040

- Blue Pack (Dec 25-Sep 26) +0.050 to +0.085

- Gold Pack (Dec 26-Sep 27) +0.085 to +0.10

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume:

- O/N +0.00428 to 2.31971% (+0.00414/wk)

- 1M +0.00714 to 3.05900% (+0.04514/wk)

- 3M +0.00215 to 3.60386% (+0.03857/wk) * / **

- 6M -0.05114 to 4.12400% (+0.00071/wk)

- 12M -0.01700 to 4.68243% (+0.01029/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.60171% on 9/20/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $301B

- Secured Overnight Financing Rate (SOFR): 2.26%, $967B

- Broad General Collateral Rate (BGCR): 2.25%, $390B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $374B

- (rate, volume levels reflect prior session)

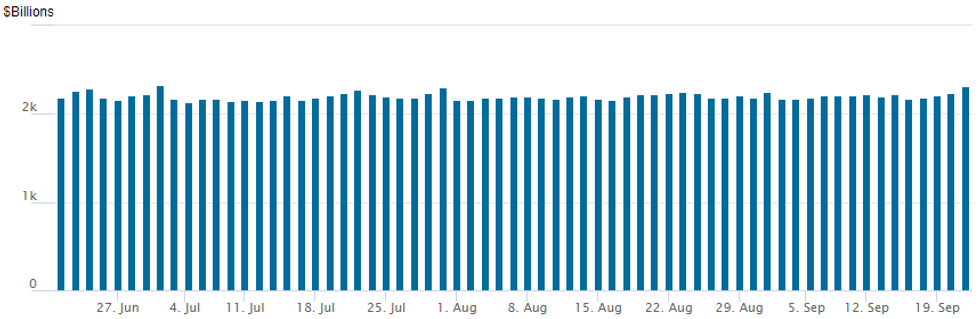

FED Reverse Repo Operation: Second Highest on Record

NY Federal Reserve/MNI

NY Fed reverse repo usages climbs to $2,238.840B w/ 102 counterparties vs. $2,238.840B prior session. Nearing record high that still stands at $2,329.743B from Thursday June 30.

PIPELINE: $1.25B Rentenbank 5Y SOFR Priced

Aside from Rentenbank issuance (telegraphed earlier in the week), corporate bond issuers absent ahead the FOMC policy annc at 1400ET.- Date $MM Issuer (Priced *, Launch #)

- 09/21 $1.25B *Rentenbank 5Y SOFR+37

- $9B Priced Tuesday

- 09/20 $4B *ADB $2.75B 2Y SOFR+8, $1.25B 10Y SOFR+51

- 09/20 $4B *Citrix 6.5NC3 Sec notes 10% said to have launched

- 09/20 $1B *EQT Corp $500M 3NC1 +175, $500M +5Y +205

EGBs-GILTS CASH CLOSE: Gilts Underperform As Short-End Weakens Pre-Fed

European curves twist flattened Wednesday with the short end underperforming ahead of the Federal Reserve decision later in the evening.

- After core instruments gained early on a safe-haven bid with Russia-Ukraine tensions in focus, short-end yields / STIR implied rates rose for the rest of the session, exacerbated by higher US terminal rate pricing going into the much-anticipated Fed meeting.

- Some segments of the German and UK curves reached multi-year flats, with German 5s30s inverting for the first time since 2008.

- Most of the UK curve underperformed, with the government's energy price support scheme for businesses coming in largely in line with expectations, and focus turning to Fed/BoE Thursday/fiscal announcements Friday.

- Periphery EGBs traded mixed, with BTP spreads narrowing as broader equities gained.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.6bps at 1.759%, 5-Yr is up 1.5bps at 1.839%, 10-Yr is down 3.3bps at 1.893%, and 30-Yr is down 8.3bps at 1.838%.

- UK: The 2-Yr yield is up 6.4bps at 3.39%, 5-Yr is up 7.4bps at 3.38%, 10-Yr is up 2.1bps at 3.311%, and 30-Yr is down 0.1bps at 3.589%.

- Italian BTP spread down 2.3bps at 224.2bps / Greek up 2.9bps at 256.9bps

FOREX: Kneejerk Surge For Greenback Reverses, Still Holding Solid Daily Advance

- Broad greenback strength emanated overnight following comments from Russian President Vladimir Putin on the partial mobilisation effective today across Russia. These gains sharply extended following the release of the FOMC decision/statement, with the USD Index soaring to fresh cycle highs above 111.50.

- Despite the hawkish initial reaction to the Fed seeing a 4.6% peak rate, markets reversed all the moves throughout the press conference, with most asset classes trading back to pre-announcement levels. With that said, the USD Index is holding onto 0.8% gains on the day and is set to close at its best levels since June, 2002.

- EURUSD is holding onto losses over 1% on Wednesday as trend conditions are being highlighted by a break of the bear trigger at 0.9864, the Sep 6 low. The next immediate levels of note on the downside are:

- SUP 1: 0.9800 Round number support

- SUP 2: 0.9785 2.00 projection of the Jun 9 - 15 - 27 price swing

- Similarly, GBPUSD has moved sharply lower and has broken through the 1.13 mark. Nearest support levels are:

- SUP 1: 1.1200 Round number support

- SUP 2: 1.1153 1.764 proj of the Jun 16 - Jul 14 - Aug 1 price swing

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/09/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 22/09/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 22/09/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 22/09/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/09/2022 | - | *** |  | JP | BOJ policy announcement |

| 22/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/09/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 22/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/09/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/09/2022 | 1400/1000 |  | US | Leading Index | |

| 22/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/09/2022 | 1500/1100 |  | US | Kansas City Fed Manufacturing Activity | |

| 22/09/2022 | 1500/1700 |  | EU | ECB Schnabel Keynote at Network Luxemburg | |

| 22/09/2022 | 1500/1600 |  | UK | BOE Tenreyro on Climate | |

| 22/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 22/09/2022 | 1830/1930 |  | UK | BOE Haskel Panellist at Lecture |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.